Investment Ideas From the Edge of the Bell Curve

ASX News Live | ASX Dips; Nick Scali Profit Jumps, Openpay Enters Receivership

Openpay’s path to profitability ends in receivership

Buy now, pay later fintech Openpay has called the receivers a week after reporting a record quarter, including a record quarterly total transaction volume of $126 million.

Last week, OPY’s chief executive Dion Appel said the December quarter showed the ‘enduring consumer demand for our differentiated offering.’

But that consumer demand is going to endure longer than Openpay.

The receivers are in. McGrathNicol are now in charge of Openpay’s assets, operations, and trading activity.

McGrathNicol said customers will no longer be able to use Openpay for new purchases but any outstanding balances must be repaid. How many of these outstanding balances will be repaid? What are the chances of a huge spike in bad debts on these news?

While Dion Appel provided commentary on Openpay’s differentiated product at last week’s quarterly, he issued no statement today.

Instead, McGrathNicol followed up its receivership announcement by noting the resignation of non-executive director Yaniv Meydan.

McLean Roche’s Grant Halverson told the Australian Financial Review Openpay’s receivership highlights a wider problem for the sector:

“This shows the frailty of the fintech model. You can’t run these businesses when interest rates go up. All these businesses run at a cashflow loss, the only reason they’ve been surviving – from Zip down – is by burning investor cash.”

$OPY in November 2022 set a goal to be profitable by June 2023.

Less than 3 months later #Openpay entered receivership. #BNPL pic.twitter.com/HvvleD541s

— Fat Tail Daily (@FatTailDaily) February 6, 2023

Openpay’s collapse casts a shadow on its peers. Can they survive where Openpay failed? Or will others follow?

https://www.moneymorning.com.au/20220802/can-bnpl-stocks-be-profitable.html

What type of investor are you? Let ChatGPT decide

Last month, Buzzfeed made others’ headlines when its stock surged on news it will use the services of ChatGPT creator OpenAI.

Buzzfeed’s plan is to use generative AI to ‘personalise and enhance’ digital content.

Quizzes are one area OpenAI could help Buzzfeed with.

So here’s a personalised quizz I prompted ChatGPT to generate, titled ‘What Type of Investor Are You?’ (The results may shock you.)

Source: OpenAI

" Any sufficiently advanced technology is indistinguishable from magic." #ChatGPT #OpenAI #Buzzfeed $BZFD pic.twitter.com/duIbhFpwJx

— Fat Tail Daily (@FatTailDaily) February 6, 2023

Meme stocks ETF up 35% YTD

In 1955, historian Cyril Northcore Parkinson made an observation that was later upgraded to a law in his name:

“It is a commonplace observation that work expands so as to fill the time available for its completion.”

Maybe some day soon there will be another law:

The number of ETFs expands to fill the themes available to the imagination.

If you can conceive a theme — or a certain configuration of stocks — there’s likely an ETF for you.

If you can conceive it, you can buy an ETF of it.

Take meme stocks. The pejorative term for stocks of questionable fundamentals but high returns on social media engagement.

Well, there is an ETF for meme stocks you can buy and sell.

The Roundhill MEME ETF is designed to ‘offer investors exposure to “meme stocks” by providing investment results that closely track the performance, before fees and expenses, of the Solactive Roundhill Meme Stock Index.’

The MEME ETF is actually the world’s first ETF explicitly designed to track the performance of meme stocks.

The $MEME ETF — tracking a basket of "meme stocks" — is up 35% YTD. $MEME's top holdings:

– $PTON

– $SOFI

– $COIN

– $SPOT

– $PLTR

– $AMC

– $MSTR

– $RKLB

– $TLSA

– $PARA pic.twitter.com/CwXhQDCEfY— Fat Tail Daily (@FatTailDaily) February 6, 2023

It’s up 35% year to date, albeit down ~60% since inception.

Does the RBA lag behind peers in fight against inflation?

The Reserve Bank is tipped to raise the official cash rate by 25 basis points tomorrow, taking the official rate to 3.35%.

At 3.35%, it would be the highest level since September 2012.

But it would still lag the official interest rates set by peers like the US Fed, the Reserve Bank of New Zealand, and the Bank of Canada.

Source: Bloomberg

Nomura’s Andrew Ticehurst told Bloomberg:

“The RBA finds itself in a tight spot, with widespread data now showing the economy is cooling, but core inflation is uncomfortably hot. The risk would be for a larger move, rather than no move, in our view.”

Oil industry notched massive profits in 2022

Western oil companies together reported over US$132 billion in annual profit in 2022, a record windfall.

The majority of that profit was distributed to shareholders. US$78 billion was handed out in dividends and buybacks.

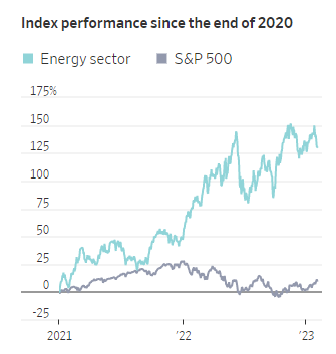

The hugely profitable 2022 saw 15 of the 20 companies with the best returns in the S&P 500 index last year belonging to the oil industry.

This has helped the energy sector to outperform the wider index in recent years.

Source: WSJ

Commodity predictions from James Cooper

Former geologist James Cooper suggests energy and small-cap explorers will be the big themes to watch in 2023.

***

In January, I shared two predictions for commodity stocks in 2023.

If you missed that article you can read it here.

The first prediction was for broad upbeat sentiment coming back to the mining industry in a big way in 2023.

While this seems to be at odds with recession fears in the US and a generally poor economic global outlook…the key point is this, with recession comes lower interest rates.

This could be a very bullish for stocks later in the year.

As absurd as it may sound right now, I think you should be ready to accept new all-time highs across juniors and majors…

This will mark a new phase in a secular bull market for the mining industry.

The second prediction from my “Part 1” article rests on the dire need for more EV battery raw materials.

We know how this played out for lithium stocks in 2022.

With around 300 gigafactories under construction, most car manufacturers are now entirely committed to EV production.

Yet, to date, lithium has been the only beneficiary of this major industry shift.

As I highlighted last week, batteries need more graphite (by weight) than any other raw material, including lithium.

However, deposits for this critical metal are scarce and held mostly within China’s borders.

To date, investment has been fixated on lithium; this has been at the expense of developing new projects for virtually all other critical minerals needed in battery production.

For EV manufacturers to have any chance of meeting global demand, investment will need to go beyond lithium stocks.

Its why I believe adding stocks leveraged to graphite production (in particular) could offer handsome rewards in 2023.

So, with that, let’s cap off this two-part series on what I believe will be the big themes for 2023…

Ryan Dinse — energy shifts make fortunes

Owning the right energy assets at the right time can make you a fortune.

The entire 20th century is a case in point.

Those oil barons of the late 1800s — historic names like JD Rockefeller and JP Getty — made dynastic wealth by investing early in the wild days of the US oil industry.

But my favourite story is probably that of Haroldson Lafayette Hunt…

Hunt was a maths whizz who worked on a cotton plantation. It was back-breaking work, and Hunt wanted more out of life.

So, in a desperate move, Hunt — with only $100 to his name — travelled to New Orleans and bet it all on a poker game.

Using his maths chops and riding his luck, Hunt turned this $100 grub stake into $100,000!

Yeah, I know, it sounds like the plot line of some cheesy Western.

But it’s what happened.

And Hunt showed that it wasn’t just dumb luck with his next move.

With his newfound wealth, he punted on the emerging oil industry, buying the East Texas Oil Field.

An investment which went on to earn him millions.

Hunt was an investor after my own heart — a calculated risk taker. Though, obviously, a bit richer than me!

Anyway, my point is…energy transitions, though rare, are incredibly profitable.

And there’s no doubt we’re living through one of those rare moments right now.

So, how can you play it?

Lithium?

Cobalt?

Hydrogen?

There are a few well-known investment ideas out there.

But today, I want to alert you to an opportunity in the energy space you might not have heard of yet.

It promises to be an important part of the puzzle…

https://www.moneymorning.com.au/20230206/energy-shifts-make-fortunes.html

Newmont eyes Aussie Newcrest Mining

“Wow.”

That’s how our gold bug Brian Chu reacted to the news the world’s largest gold producer Newmont made a new offer to acquire the largest Australian gold producer, Newcrest Mining (ASX:NCM).

If successful, the new entity would create an even larger global gold producer that will deliver annual production of almost 7 million ounces of gold.

NCM rejected an earlier Newmont offer on grounds it did not deliver ‘sufficiently compelling value to Newcrest shareholders’. Newcrest’s board is now considering whether the new offer is more compelling.

Brian was quick to ask if the acquisition offer was a signal for a gold bull market.

He thinks it sure looks like it.

Newcrest shares are currently up 10%.

Morning wrap: around the markets in 800 characters

US stocks ended lower on Friday after digesting some spectacular labour market data and some disappointing earnings releases from Amazon, Apple, and Alphabet.

The US added over half a million jobs in January as the unemployment rate fell to its lowest level since 1969.

Source: Reuters

The continued resiliency of the US economy does suggest the US Fed has a bit more to go in its rate cycle.

It is also confounding market participants and economists alike. We’ve been hounded with headlines the US economy is headed for recession. But is it? It seems healthy. Unemployment is historically low.

Imma going post this chart again, because I really think it deserves a lotta attention. pic.twitter.com/6vZKMR908y

— Justin Wolfers (@JustinWolfers) February 3, 2023

Does the labour data suggest the US Fed can pull off a soft landing? That’s the type of the questions traders are grappling with right now.

That said, markets world wide are having an amazing 2023 … so far.

The ASX 200 is about 1% shy of its all time record high. The UK’s FTSE 100 index hit its all-time high on Friday, eclipsing its previous peak in May 2018.

The mood out there is greedy.

CNN’s Fear and Greed Index is showing a reading of extreme greed, the highest such reading in months.

In other big news, our own Reserve Bank of Australia is announcing its interest rate decision tomorrow.

The bank is expected to raise rates by 25 basis points.

But the Commonwealth Bank believes there’s also a 25% chance the Reserve will raise by 40 basis points and take the cash rate to 3.5%.

And finally, to followers of the local buy now, pay later scene — Openpay just announced its entering receivership. This follows Laybuy deciding to voluntarily delist from the ASX last week.

Good morning, investors

Good morning, investors.

Here’s to another busy day making sense of the markets.

AI is all the rage at the moment, so here’s OpenAI’s DALL.E depicting the setup of a 90s trader.

Source: DALL.E

Key Posts

-

2:51 pm — February 6, 2023

-

1:46 pm — February 6, 2023

-

1:12 pm — February 6, 2023

-

12:46 pm — February 6, 2023

-

12:32 pm — February 6, 2023

-

12:07 pm — February 6, 2023

-

11:36 am — February 6, 2023

-

11:24 am — February 6, 2023

-

10:23 am — February 6, 2023

-

10:10 am — February 6, 2023

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2024 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988