Investment Ideas From the Edge of the Bell Curve

ASX News Live | ASX Rises; Nasdaq Has Best Start in Decades; Alphabet & Apple Disappoint

The dean of valuation appraises Tesla

What is a stock worth, really? Stuff the multiples comparisons and the guesstimates. What’s a stock’s intrinsic value?

The person most equipped to answer is likely Aswath Damodaran, the professor of finance at New York University and author of numerous classics on asset valuation.

He often takes readers through his valuation process via his blog.

Last week he ran the numbers on Mr Tweet’s software-as-an-EV-automaker Tesla. He took some flak so he circled the wagon and released a fuller explanation below.

His analysis is illustrative and insightful.

Importantly, Damodaran left the Tesla bulls with the following to ponder:

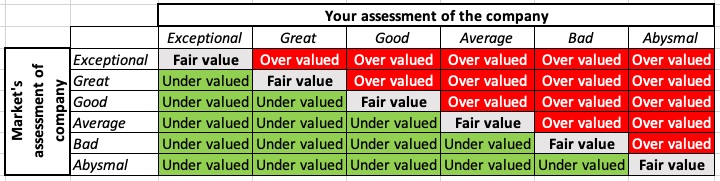

‘If … you believe Tesla is a one-of-a-kind exceptional company, it still may not be an exceptional investment. Investing is about finding mismatches between what a company is and what the market thinks it is.’

Source: Damodaran

My Tesla valuation last week got pushback, which doesn't bother me at all. My teaching side, though, decided that dissent & debate can be a forum to revisit first principles of business and valuation. So, if you are not tired of me or Tesla, here you go: https://t.co/889hzTgxJs

— Aswath Damodaran (@AswathDamodaran) February 2, 2023

Where is the rationale for the bullish start to the year?

Our editorial director Greg Canavan is finding it hard to see the basis for the recent rally in stocks.

Traders are acting like the ‘soft landing’ is a done deal but seem to ignore what a soft landing entails — elevated interest rates for a while yet.

On the other hand, if the Fed doesn’t execute a soft landing and sends the economy splatting, rates will fall and company earnings with them.

How is either scenario bullish? Is there a third scenario the markets are seeing?

If Powell is right and soft landing, rates aren’t coming down this year. If he’s wrong and hard landing, rates will fall as will company earnings. How is either scenario bullish for equities?

— Greg Canavan (@gcanavan2) February 2, 2023

A bad week for graphite stock Syrah Resources

Lithium was the hottest commodity trade in 2021/early 2022. Then it became the most crowded trade by the end of 2022.

Now punters are eyeing graphite as the next battery metal in line for a romp.

But ASX graphite producer Syrah Resources (ASX:SYR) is having a hard time of it lately, down over 15% this week.

Despite having a leg up on junior peers like Renascor Resources (ASX:RNU) and Talga Resources (ASX:TLG) by way of being a producer already, Syrah is struggling to turn the rising graphite prices into profits.

Syrah is still making losses shipping graphite from its Mozambique operation at Balama.

In the 12 months to December 2022, Syrah received US$98.2 million in customer receipts against production costs of US$118.2 million.

Free cash flow for the period was a negative US$134.8 million.

That’s the type of cash burn you’d expect from a mining developer about to enter production, not one already shipping product.

To be fair, Syrah is partly a developer still. The miner is spending big on its Vidalia Active Anode Material facility in Nevada aiming to become a vertically integrated graphite supplier to the US and the EU.

However, investors likely hoped that the Balama operation would be self-sustaining by now so the capital intensity could be focused on finishing Vidalia.

Now Syrah is fighting a two-front cost war just as its cash holdings dwindled to US$90.4 million at the end of December 2022.

Yes, Syrah signed a binding agreement to receive a US$98 million loan from the US Department of Energy to advance work on Vidalia.

Yes, Syrah was also selected for a Bipartisan Infrastructure Law Battery Materials Processing and Battery Manufacturing grant of about US$220 million from the DOE to fund some further capital costs for Vidalia.

But the latter grant in’t a done deal. And the former is a loan that must be repaid with something.

The biggest issue for Syrah is scaling its Balama operations to a profitable level.

Its weighted average sales price of natural graphite sales for the December quarter was US$716 per tonne. But its average cash costs were US$709 per tonne.

That’s not good business.

Syrah does expect the cash costs to drop significantly, stating in its latest quarterly:

“Balama C1 cash cost (FOB Nacala/Pemba) guidance is US$430–480 per tonne at a 20kt per month production rate, assuming a normalisation of diesel price below prevailing levels, the Solar Battery System is operating at full capacity and updated labour costs associated with the renewal of the Company Level Agreement (“CLA”). Balama’s cash costs are expected to reduce further as production rate increases beyond 20kt per month and as improvement initiatives continue to be embedded.”

But notice the string of conditions. It must hit a 20kt per month production rate. It must see the price of diesel fall. Its solar battery system must operate at full capacity (and bring in the intended efficiencies at full capacity). And its recent labour disputes must resolve themselves.

Syrah must do all this while operating a mine in a jurisdiction hit by recent violence and political turmoil.

Housing finance falls more than expected in December

Monetary policy is wending its way through the economy.

Household living costs are at historic levels. Mortgage interest charges are spiking. And now housing finance has fallen by more than expected in December as higher interest rates continue to bite.

Housing finance declined by more than market expectations in December as higher interest rates continued to bite. A downward trend that we expect to continue. pic.twitter.com/k0uDPqfqhs

— Alex Joiner 🇦🇺 (@IFM_Economist) February 3, 2023

Aust housing finance commitments down another 4.3%mom in Dec with investors, owner occupiers and FHBs all seeing similar falls. Consistent with ongoing home price falls and a further slowing in housing credit. pic.twitter.com/grtKNRpCiM

— Shane Oliver (@ShaneOliverAMP) February 3, 2023

Is the EV turning point finally here?

EV sales may not be strong in Australia, but in Europe they’re surging…why this trend continues to be a lucrative source for investor returns…how to find investment avenues in the EV sector beyond lithium…and why rising protectionist policy-making could benefit Aussie miners…

For years now, we’ve been hearing about how electric vehicles (EVs) are going to disrupt the automotive market.

But while the hype and hyperbole were strong, reality was a little different. EV sales have certainly been growing, but they still usually represent a fraction of total car sales.

In fact, in Australia, this is still largely the case.

Only 3.39% of all cars on Aussie roads are electric, a fact that makes us one of the slowest adopters of these new vehicles.

And that makes perfect sense, because unlike other countries, we haven’t really invested in the necessary infrastructure. On top of that, Australia is a big country with sparse communities and towns. The limited range of a single charge on some of these cars, for now, just doesn’t work for a lot of people.

But I digress…

Because while Australia may be behind the curve, Europe certainly isn’t.

For the first time ever, in the fourth quarter of 2022, electric and hybrid car sales in Europe beat their petrol-powered counterparts…

Yes, 54.8% of new cars sold in Europe during the last three months of 2022 were either battery-, electric-, or hybrid-powered. The tipping point for EV sales, in Europe at least, is finally arriving.

Granted, there’s still a long way to go before the majority of cars on our roads are run on batteries. But if Europe is any indication, it is a market that’s finally delivering on all that was touted.

As the Financial Times reports:

‘The size of the global electric vehicle market is projected to grow from $287bn in 2021 to $1.31tn in 2028, predicts data company Sustainalytics.’

The trend is well and truly underway.

For investors like yourself, this is why stocks with exposure to the EV supply chain have been such good investments of late. If you’re a regular reader of Money Morning, then I don’t need to tell you about how well lithium miners have performed lately.

Lithium was certainly one of the best investment trends of 2022, and it hasn’t slowed down yet. But it’s not the only winner, other crucial materials like rare earths are also poised to benefit from the EV boom.

https://www.moneymorning.com.au/20230203/why-the-ev-tipping-point-may-have-finally-arrived.html

A simple explanation for the market rally

There may be a simple explanation for the current rally in equities — multiple expansion.

Elon Musk’s favourite excuse for Tesla’s downhill slalom last year was the rise in the risk-free rate. He took to Twitter to explain ‘securities analysis 101’ in late December.

Securities Analysis 101

As the “risk-free” real rate of return from Treasury Bills approaches the much riskier rate of return from stocks, the value of stocks drop.

For example, if T-bills and stocks both had a 10% rate of return, everyone would just buy the former.

— Elon Musk (@elonmusk) December 17, 2022

Tesla stock is up since that tweet and up 70% year to date, despite the US Federal Reserve’s fund rate rising to between 4.5% and 4.75%.

A higher risk-free rate does depress the multiple of equities as a whole, even though Tesla’s decline was disproportionately acute and had more to do with its founder and EV competition than the Fed.

But a rising risk-free rate did help shrink the market’s multiples.

Aussie equities manager Anthony Brown of East72 explained it in his latest quarterly release:

“So over the course of 2022 as ten year bond rates in the US rose from the 1.51% level at CY2021 year end to a high of 4.25% in October, the forward earnings multiple of 21.6x (4766/221) contracted sharply to a current forecast of 16.5x (3839/232) – all of the downward momentum in US equites within the S&P500 has been caused by multiple contraction – people willing to pay lesser multiples of future year’s earnings – directly resulting from higher bond rates.”

So if the market thinks the central banks’ hike cycle is nearly over — or even about to reverse — the cap on the risk-free rate is now being discounted in a frenzy.

Investors are more willing to pay higher multiples again for future earnings betting bond rates are set to peak and fall.

In December, #Musk blamed $TSLA's downhill slalom on the Fed.

He overegged the Fed's role, but a rise in bond rates did help shrink the #SP500's multiple.

With markets betting bond rates have peaked, is the recent rally a bet on multiple expansion? https://t.co/rmwULtH4BL

— Fat Tail Daily (@FatTailDaily) February 3, 2023

Is this a bull run or a junk rally?

GMO’s Jeremy Grantham — the bearish investor with a prickly outlook perfect for calling bubbles — last week estimated that the benchmark S&P 500 could fall 20% from current levels by the end of the year.

But so far, the bulls are not listening.

The S&P 500’s 50-day moving average just moved above its 200-day moving average, what the chartists call a golden cross and a good omen.

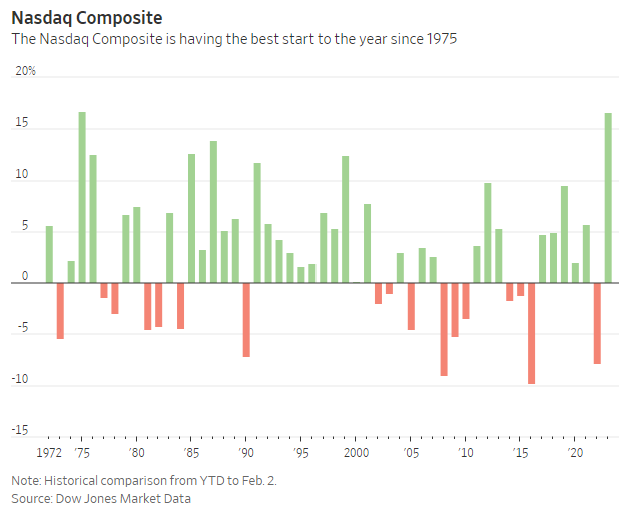

The more speculative Nasdaq Composite is having a blast, up nearly 20% since late December.

But the leadership of these gains is telling. The stocks at the forefront of the rally pulling the index higher with them is a rogue’s gallery of last year’s big losers.

Financial Times‘ Alphaville column summed it up:

“While bearish investors opine on the likelihood of recession, the market has advanced 12.8% since early October, 5.1% over the past month. However, it’s the market’s YTD leadership that’s most notable, with the most beaten up, economically-sensitive, speculative and volatile stocks leading. Many are calling this a “junk” rally; however, quality measures — such as ROE and financial leverage — are having little impact on returns. Interestingly, both price and fundamental momentum factors have rotated out of favor. This pattern of performance is typical in the aftermath of a crisis (post-dotcom period, 9/11, or GFC) or following a severe recession.”

Maybe the high anticipation of recession for months in 2022 has made markets act like it’s already happened.

But that raises a question about the rally’s sustainability. With the end of the rate cycle and easing monetary conditions seemingly already discounted, how much room does this ‘trashy rally’ have left?

Source: FT

The Nasdaq has its best start since 1975

Can you hear the bulls run?

It’s not so much a run as a stampede.

The Nasdaq Composite closed over 3% higher overnight as markets bet the US Fed is nearing the end of its rate hike cycle.

Source: Wall Street Journal

Key Posts

-

4:47 pm — February 3, 2023

-

1:50 pm — February 3, 2023

-

1:17 pm — February 3, 2023

-

12:24 pm — February 3, 2023

-

12:18 pm — February 3, 2023

-

11:52 am — February 3, 2023

-

10:19 am — February 3, 2023

-

10:07 am — February 3, 2023

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2025 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988