Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | ASX to Rise; Miners Key Drivers After Federal Budget

Midday market update

The ASX 200 is up by +0.46% trading at 7,762.3 around midday as the Mining sector carries the day, up by +1.40% in the session so far.

Real Estate also saw some gains after two days of losses, now up +0.90% followed closely by Health Care up +0.85%.

Strong gains on the ASX by Idp Education up +7.6% and Neuren Pharmaceuticals up +6.2% on the ASX 200, while in the wider market Renascor is the biggest gainer, up by 10% after seeing investor interest after the budget earmarked support for critical mineral miners.

In individual stock news Agricultural Company Limited is down by -1.42% today after it reported a net loss of $94.6m for the full year after a ‘challenging’ 12 months with falling cattle prices.

Building materials company CSR is sitting around -0.1% after highlighting its struggling aluminium operations due to high energy costs; this comes as the company is ready to transition to its new French owner, Saint-Gobain, who bought the company for $4.3 billion.

Wage growth slows in first quarter

Australia’s Wage Price Index rose just 0.8% in the first quarter, compared to 0.9% in the December quarter.

That was below estimates of 0.9% and was equal smallest quarterly rise since December 2022. On an annual basis, it rose 4.1% for the year, seasonally adjusted.

Wages growth has been getting a lot of attention for its big contribution to inflation. The move is in line with the RBAs hopes of slowing wages to combat inflation and get it back to their 2-3% target band.

Despite this ‘bad news is good news,’ for the Central Bank, the battle is far from over, inflation (especially services inflation) remains sticky and the job market remains tight.

Next let’s dig into some of the wage numbers:

The gap between public and private sector wage growth looks to be widening again.

Source: ABS

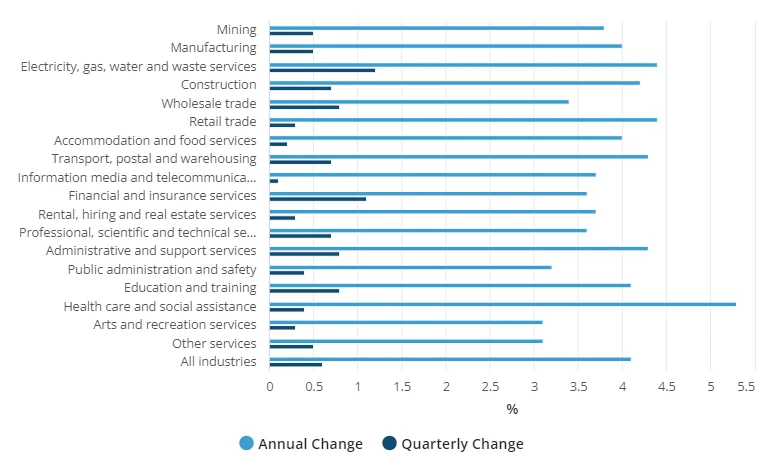

On an annual basis, Health care and social assistance have seen the biggest increase of 5.3%.

The Electricity, gas, water and waste services industry recorded the highest quarterly rise (1.2%), contributing to this industry recording its highest annual wage growth since March quarter 2013 (4.4%).

The lowest rise for the quarter was in the Information media and telecommunications industry, up 0.1%.

While arts and recreation services and other services recorded the lowest annual growth at 3.1%.

Source: ABS

On a location basis, Tasmania recorded the highest quarterly wage rise at 1.6%, and the highest annual wage movement at 4.9%.

South Australia and the Northern Territory had the lowest quarterly growth at 0.4%. The Australian Capital Territory had the lowest annual change of 3.2%.

Big miners rally on budget

BHP is leading the charge in trading this morning, with the stock up by +2.43% to $44.20 in trading this morning, holding onto its early gains while other major miners such as Fortescue Metals initially climbed above 2%, only to drop back to currently trade at near flat around +0.1%.

Similar moves were seen by Rio Tinto which has fallen back after similar gains this morning to currently sit up +1.12%, trading at $128.97 per share.

Rare earth miners are seeing strong gains in trading today, after the federal budget was released, showing around $24 billion earmarked for green and critical minerals over the next decade.

Arafura Rare Earths is up by +5.41% to trade at 19.5 cents, while WA1 Resources gained +4.75% to trade at $21.19 per share.

Click through the top of the chart below to look at the various company performance over the past 12 months.

Morning market update

Good morning. Charlie here,

The ASX 200 opened up +0.69% to 7,779.7 this morning in a solid recovery after two days of sliding.

US markets closed higher last night after a similar holding pattern on the major benchmarks. Traders are awaiting the all-important CPI data from the US, which is due out at 11:30 p.m. AEST.

From bond market movements, many traders are leaning toward the expectation that the CPI numbers tomorrow will show a reversal of the recent growth in inflation figures.

Major miners will be the major pushers of the ASX today as the federal budget was unveiled closer to home.

While the full details are still being worked out, the big takeaway from the budget is spending focusing on green energy.

The government has revealed $24 billion of long-term spending on clean energy and strategic industries as part of its Future Made in Australia plan.

Much of the support for critical minerals and green hydrogen will be delivered via production tax incentives, which will not start until 2027-28.

Another change is that small businesses will see a one-year extension of the instant asset write-off for items under $20,000 and a $325 energy bill rebate.

Other cost-of-living support measures will also be added, which UBS and S&P economists marked as ‘slightly inflationary.’

Wall Street: S&P 500 +0.48%, Dow +0.32%, Nasdaq +0.75%.

Overseas: FTSE +0.16%, STOXX flat, Nikkei +0.90%, SSE flat.

The Aussie dollar rose +0.32% to US 66.28 cents.

US 10-year bond yields -4bps to 4.44%.

Australian 10-year bond yields flat at 4.32%.

Gold rose +0.75% to US$2,356.03, while Silver rose +1.15% to US$28.60.

Bitcoin fell -2.08% to US$61,715, while Ethereum fell -2.18% to US$2,890.

Oil Brent up +0.40% to US$82.70, while WTI Crude up +0.55% to US$78.45.

Iron ore down -0.24% to US$114.60 a tonne.

Key Posts

-

12:59 pm — May 15, 2024

-

12:47 pm — May 15, 2024

-

12:28 pm — May 15, 2024

-

10:43 am — May 15, 2024

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2025 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988