Investment Ideas From the Edge of the Bell Curve

ASX News Live | ASX Rises; Ioneer, Tyro, PolyNovo Feature

When to buy into the market’s next bubble

The only time it makes sense to buy stocks is when they’re on sale.

Unfortunately, a bit like Australian retailers, the stock market doesn’t exactly tell you when things are actually cheap, whatever the signs may claim about the supposed markdowns. You have to be a bit more careful than just following the ‘sale’ signs.

Using the filter of only buying during a crash, my career has seen four good buying opportunities.

The 2008 financial crisis created an excellent opportunity to buy up companies that were always going to recover eventually. Of course, they were beaten down less than those which went on to barely survive…or didn’t.

But the time to buy was when a panic had infected the wider market. Any short-term loss in earnings and thereby dividends would be made up for in capital gains and future higher dividend yields.

The European sovereign debt crisis created similar opportunities. As did the chaos of 2018 and the pandemic plunge of 2020.

Heck, by this measure, stocks create plenty of surprisingly regular buying opportunities. So why not wait for them before deploying your hard-earned savings?

Of course, in the midst of all these ups and downs, buy and hold has been an option too. The UK’s FTSE 100 recently hit a four-year high. But that’s still not far from its peaks in 1999, 2007, 2015, 2017, 2018, and 2019…

The German Dax looks similar for the past seven years. The ASX 200 is close to where it was in 2007. And let’s not mention the Japanese market…

So you can see why I’m only interested in picking up good stocks during crashes…

But has the crash of 2022 created the fifth great buying opportunity of my career?

Having just bought a house and acquired two children with birthdays within two and a half months of Christmas, I’m not sure the opportunity is quite there for the taking just yet…

But what about you?

What metrics might we look for to determine whether it’s time to buy?

https://www.dailyreckoning.com.au/when-to-buy-into-the-stock-markets-next-bubble/2023/01/14/

ASX BNPL stocks spike on Monday

Beaten down buy now, pay later stocks continued their strong start to 2023 on Monday.

🔼ASX #BNPL stocks are rising on Monday 🔼

🟩 $SPT is up 19%

🟩 $ZIP is up 9.8%

🟩 $SZL is up 9%

🟩 $IOU is up 8%

🟩 $OPY is up 5.7%

🟩 $LBY is up 3.7% #ASX #ausbiz #fintech— Fat Tail Daily (@FatTailDaily) January 16, 2023

Year to date:

- Splitit is up 25%

- Humm is up 21%

- Zip is up 20%

- Sezzle is up 19%

- Laybuy is up 12%

- Openpay is up 2%

At the same time, the broad All Ords benchmark is up 2%.

WSJ Survey: economists still forecast US recession in 2023

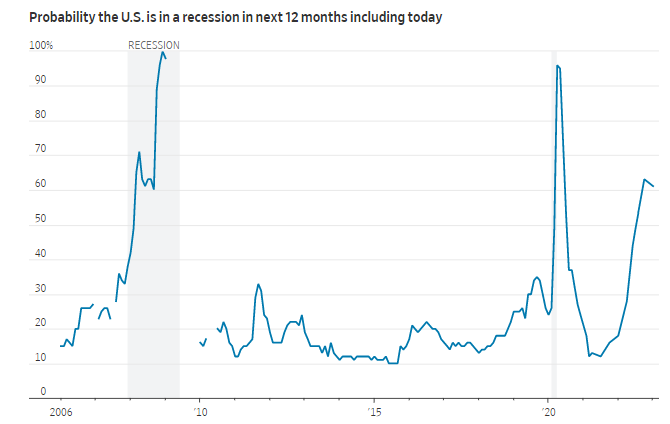

Economists surveyed by the Wall Street Journal still put 61% probability of a US recession in the next 12 months.

Despite a positive US CPI print last week, economists still think the Federal Reserve’s intent to raise interest rates — albeit at a slower pace — will push the US economy into a recession some time in 2023.

Three-quarters of survey respondents did not think the Fed will achieve a soft landing this year.

Source: Wall Street Journal

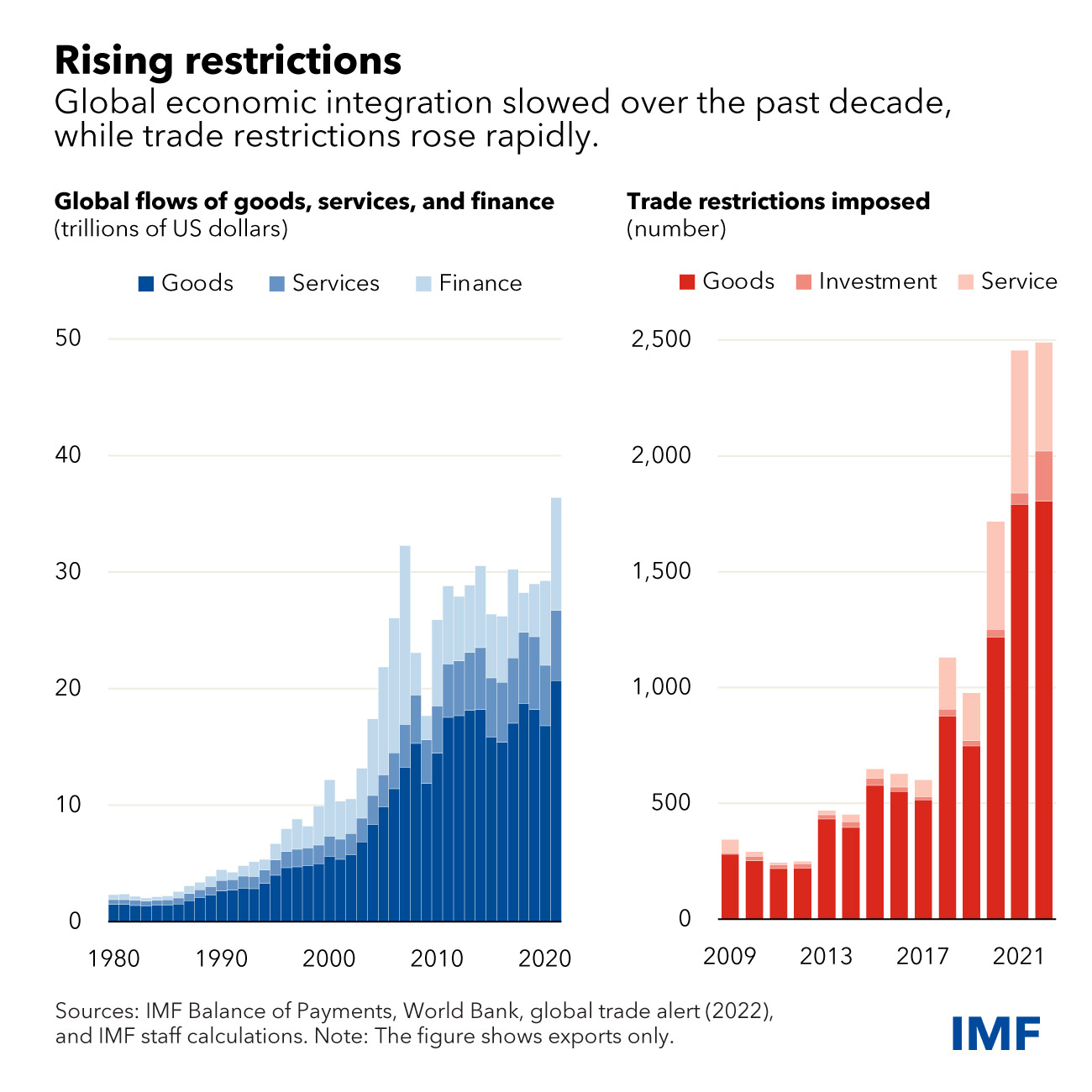

IMF: global economic integration slows, trade restrictions rise

The global village risks becoming the doomed Tower of Babel, according to the latest memo from the International Monetary Fund.

The world is becoming more fragmented — as trade restrictions and slowing economic integration pushes economic participant away.

According to the IMF report:

Since the outbreak, mentions in companies’ earnings presentations of reshoring, onshoring, and near-shoring have increased almost ten-fold. The risk is that policy interventions adopted in the name of economic or national security could have unintended consequences, or they could be used deliberately for economic gains at the expense of others. That would be a dangerous slippery slope towards runaway geoeconomic fragmentation.

In a severe fragmentation scenario, costs of economic atomisation could hit almost 7% of global output.

‘If technological decoupling is added to the mix, some countries could see losses of up to 12% of GDP,’ said the IMF report.

Yet the full impact could be even worse, depending on how much you stack on.

“In addition to trade restrictions and barriers to the spread of technology, fragmentation could be felt through restrictions on cross-border migration, reduced capital flows, and a sharp decline in international cooperation that would leave us unable to address the challenges of a more shock-prone world,” continued the IMF memo.

Copper’s story is just starting

You’ve likely heard the phrase ‘All roads lead to Rome’.

In Spain, all roads start in Madrid, specifically, in Puerta del Sol (Spanish for ‘sun gate’). Puerta del Sol is kilometre zero for all roads in the country’s road system.

It is also smack bang in the middle of the city. The plaza is a place for gatherings, near major transport and shopping…and where many Spanish choose to welcome the New Year.

Every year, hours before midnight on 31 December, people meet around the clock, which towers over the plaza, to hear the 12 bells ringing in the New Year.

Around the country, families gather around the TV to watch as the clock strikes 12.

And, it’s an old tradition that for each time the clock’s bell tolls, you eat a grape and make a wish. Each grape represents a month in the new year and is supposed to bring good luck.

But there are plenty of traditions worldwide to welcome the New Year.

Some of my Colombian friends run around the house at midnight with a suitcase in hand…to make sure they’ll have travel and adventure in the New Year. Or they take the first step of the year with their right foot, just to start the year right.

But as far as New Year’s traditions go, Brazil’s is my favourite. I spent some of my teenage years living there.

Each New Year’s Eve, hordes of people gather up at the beach wearing white, symbolising peace and good energy for the New Year. It’s also tradition to go into the sea and jump seven waves, making a request with each jump.

What all these traditions have in common is the belief that each new year we start anew. That once that clock strikes midnight, we start with a clean slate.

Markets seem to believe this too. Markets have started the year with plenty of optimism.

The Nasdaq is up close to 6% since the beginning of the year, and both the S&P 500 and the ASX 200 are up just above 4%.

Markets are focused on China’s reopening — that the Fed will stop its tightening cycle and achieve the much-desired ‘soft landing’ for the economy.

On the other hand, my colleague Vern Gowdie thinks optimism will be short-lived and that 2023 could be the year of the ‘Big Loss’.

As Vern has said recently, he’s ‘as worried as he’s ever been about the state of the markets’.

It’s why Vern is hosting a series of free strategy sessions for investors looking to protect their capital. If you want to hear more, click here.

It may be a new year, but many of the issues from last year have followed us into this year, so it could be a difficult year.

That doesn’t mean there won’t be any opportunities, though…

https://www.moneymorning.com.au/20230116/the-copper-story-is-just-starting.html

Baby Bunting tanks on 1H23 update

Maternity and baby goods retailer Baby Bunting is down 11% on Monday following the release of its 1H23 trading update.

While Baby Bunting’s first half sales rose 6.6% on 1H22 to $255 million, gross profit margin and pro forma net profit after tax both fell.

Pro forma NPAT, particularly, fell sharply. NPAT fell 59% to $5.1 million from 1H22’s $12.5 million.

Gross profit margin fell from 39.3% to 37.2%.

The actual statutory profit is likely lower, given that Baby Bunting’s pro forma figure excluded employee incentive expenses and ‘significant costs associated with business transformation projects.’

1H23 sales were hampered by a disappointing 2Q, coming in ‘below Baby Bunting’s expectations towards the end of the quarter.’

For FY23, the retailer now expects pro forma NPAT to be in the range of $21.5 million to $24 million.

Baby Bunting admitted a ‘degree of uncertainty’ in coming up with its guidance, as it struggles to read where consumer demand is heading.

This uncertainty is reflected in its outlook for comparable store sales growth — which spans both positive ‘low single digits’ for FY23 and ‘negative low single digits.’

🔻Baby Bunting $BBN fell 11% on 1H23 update 🔻

1H23 sales rose 6.6% $255m but pro forma NPAT fell 59% to $5.1m.

Statutory profit is likely lower as the pro forma NPAT excludes incentive expenses and 'significant costs associated with business transformation projects.'#ASX

— Fat Tail Daily (@FatTailDaily) January 16, 2023

ASX lithium stocks slump despite Ioneer’s US$700m news

Despite Ioneer jumping on news of a US$700 million conditional loan from the US Department of Energy, INR’s lithium peers are having another down day.

- Core Lithium is down 6%

- Ecograf is down 4.5%

- Liontown Resources is down 3.9%

- Sayona Mining is down 3.5%

- Leo Lithium is down 2.5%

- Argosy Minerals is down 2.3%

- Lake Resources is down 1.8%

Bitcoin up 30% since November 2022

Bitcoin traded below US$16,000 in November, pushed down by a broad malaise in the crypto industry worsened by the collapse of the FTX exchange.

But the crypto industry’s optimism is hard to extinguish, it seems.

Since hitting a multi-level low in November 2022, Bitcoin has rallied over 30%.

The original crypto is currently hovering at around US$20,880.

All Ords up 0.50%

In the first half-hour of trade, the All Ordinaries is up 0.50%, led by the Information Technology and Industrials sectors.

The biggest movers:

- Ioneer, up 22%

- Poseidon Nickel, up 11%

- Bigtincan, up 10.7%

- Pantoro, up 10%

- Super Retail, up 8.3%

- Baby Bunting, down 10%

- 88 Energy, down 8.3%

- Andromeda Metals, down 4.9%

- Ecograf, down 4.5%

- Macquarie Telecom, down 3.2%

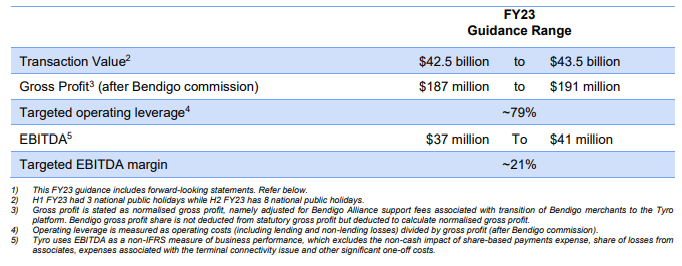

Tyro Payments jumps on record 1H23 results and improved guidance

Aussie fintech Tyro Payments (ASX:TYR) opened 9% higher on Monday after a strong first half of FY23 led to an upgraded full year guidance.

In the first half of the new financial year, TYR’s payments transaction value rose 37% on the prior relevant half to $21.7 billion. In turn, its payments normalised gross profit rose 36%.

Tyro’s banking arm saw loan originations grow 101% to $72.7 million. Banking gross profit rose 73%.

In all, Tyro’s group revenue rose 45% to $216.6 million while operating costs rose at a slower pace at 16%.

1H23 EBITDA improved 600% to $19.5 million, no doubt boosted by the low starting base of $2.8 million in 1H22.

Tyro now thinks it can be positive free cash flow ‘exiting FY23’.

The strong half-year performance has led to a revision in guidance.

TYR now expects FY23 transaction value to be between $42.5 billion and$43.5 billion (up from the previous range of $40 billion to $42 billion).

The upgraded transaction value guidance bumps Tyro’s expected gross profit to between $187 million and $191 million, with a

targeted operating leverage of 79%.

CEO Jon Davey commented on his company’s performance:

“The 37% increase in our transaction value has been driven by a 9% increase in our merchant base, growth in customer applications, and loan originations. External factors such as the absence of COVID lockdowns and inflation have also positively impacted Tyro’s transaction values, particularly in our hospitality and retail verticals. Our cost reduction program is on track to achieve an annualised $11 million reduction in our cost base. These changes have resulted in a leaner, and more efficient business. The resulting focus has facilitated the accelerated delivery of key strategic priorities including the Tyro Go reader, the Tyro Pro next generation terminal, and automated onboarding. They provide a strong foundation from which we can build new customer experiences and drive further operational efficiencies.”

ASX rises, Ioneer surges on US Department of Energy US$700m loan commitment

The ASX 200 opened 0.35% higher on Monday, boosted by US stocks finished at the highest levels in a month last Friday.

Australian shares, in turn, ended Friday at their highest level in six weeks.

Rumblings of a new bull market? Or is this the dangerous allure of a bear market rally?

The best performer at the open was US-based lithium junior Ioneer, who jumped over 25% this morning on news of a US$700 million conditional loan commitment from the US Department of Energy.

Ioneer offered conditional commitment for US$700m from US Department of Energy

Lithium explorer Ioneer — developing the Rhyolite Ridge lithium-boron project in Nevada — has been offered a conditional commitment from the US Department of Energy for a proposed loan worth up to US$700 million.

The loan has a term of 10 years at an interest rate ‘fixed from the date of each advance for the term of the loan at applicable US Treasury rates.’

The US DoE offered a conditional commitment in the expectation of supporting the Rhyolite Ridge project, subject to Ioneer satisfying the remaining legal, contractual and financial requirements.

If finalised, the loan will be the first-ever loan issued by the DoE aimed at financing a project where lithium is extracted and refined at site.

Late last year, Syrah Resources, Piedmont Lithium, and Novonix received preliminary selection for DoE grants as the United States seeks to shore up its critical metals supply chain.

US #DOE will invest US$2.8b in a "portfolio of projects that will support new and expanded commercial-scale domestic facilities to process #lithium, #graphite and other #battery materials…"

Projects include $SYR, $NVX, $PLL, and $LKE partner #Lilac Solutions. pic.twitter.com/KF85TwFj6x

— Fat Tail Daily (@FatTailDaily) October 20, 2022

Key Posts

-

3:37 pm — January 16, 2023

-

3:18 pm — January 16, 2023

-

2:59 pm — January 16, 2023

-

2:03 pm — January 16, 2023

-

1:35 pm — January 16, 2023

-

12:56 pm — January 16, 2023

-

12:30 pm — January 16, 2023

-

10:51 am — January 16, 2023

-

10:40 am — January 16, 2023

-

10:22 am — January 16, 2023

-

10:14 am — January 16, 2023

-

9:50 am — January 16, 2023

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2025 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988