Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | ASX to Rise; Hard Rock Cafe Offers Lifeline to Star, Elders Cuts Dividend

Market close update

The ASX 200 closed up by +0.63% to 7,863.7 today after a day that was largely carried by Energy and Mining stocks. The major benchmark is now within spitting distance of a new record as commodity prices help the Aussie benchmark outperform its European and Yankee cousins.

A number of metals prices are now looking very bullish, with copper leading the way its futures on the London Metal Exchange hit a new record above $US11,000 a tonne during trading yesterday.

‘Supply disruptions, strong manufacturing activity and the recent ban on Russia-origin metals – copper, aluminium and nickel – by US and UK exchanges have elevated prices for major metals,’ ANZ commodity strategist Soni Kumari said in a note yesterday.

Meanwhile, the Energy sector gained +2.23% in trading today, with the larger caps all gaining around 2%.

Woodside Energy, finished up +2.07% to $28.08 per share, while Santos closed up +2.12% at $7.71.

In the wider market, seven of the eleven sectors closed up, while Health Care was today’s laggard, falling -0.86% as Cochlear fell -2.84% to $321.01 per share.

On the benchmark 200 Paladin Energy was today’s top gainer, up by +7.57%, followed closely by Bellevue Gold gaining +7.45%.

While, today’s largest losses were seen by Wam Leaders, falling -3.90% on the ASX 200.

Fund Managers Concerned about Fiscal Spending

According to the latest Bank of America Global Fund Manager Survey, an unprecedented majority of fund managers believe that current fiscal policies around the world are excessively stimulative.

Similar sentiments have been shared at the Fat Tail Investment office, with Editorial Director Greg Canavan reminding us late last week that ‘markets are too focused on monetary policy when they should be looking at the massive spending in fiscal policy.’

The survey results reveal that over 50% of the participating fund managers share that view, saying that governments are deploying overly expansionary fiscal measures, marking a record-high level of concern regarding the potential economic implications of such policies.

This highlights growing apprehensions about the long-term consequences of excessive government spending and stimulus programs. Many fear that sustained fiscal stimulus could fuel inflationary pressures, distort market dynamics, and push already climbing federal debts to unsustainable levels.

Global Fiscal Policy Too Stimulative #chartoftheday (via @Barchart)

More than half fund managers in BofA's Global Fund Manager Survey say fiscal policy is too stimulative, the highest level on record. pic.twitter.com/po0LkFeiqs

— Smartkarma (@smartkarma) May 20, 2024

Patriot Metals Plan $44m Raise

Patriot Metals [ASX:PAT] has announced a $44 million capital raise this afternoon. This move comes less than a week after the company shelved plans to explore downstream lithium partnerships with global giant Albemarle.

The Canadian-based hard-rock lithium explorer says the funds will be used to finance Patriot Battery Metals’ exploration activities at the Corvette Property in Quebec, Canada.

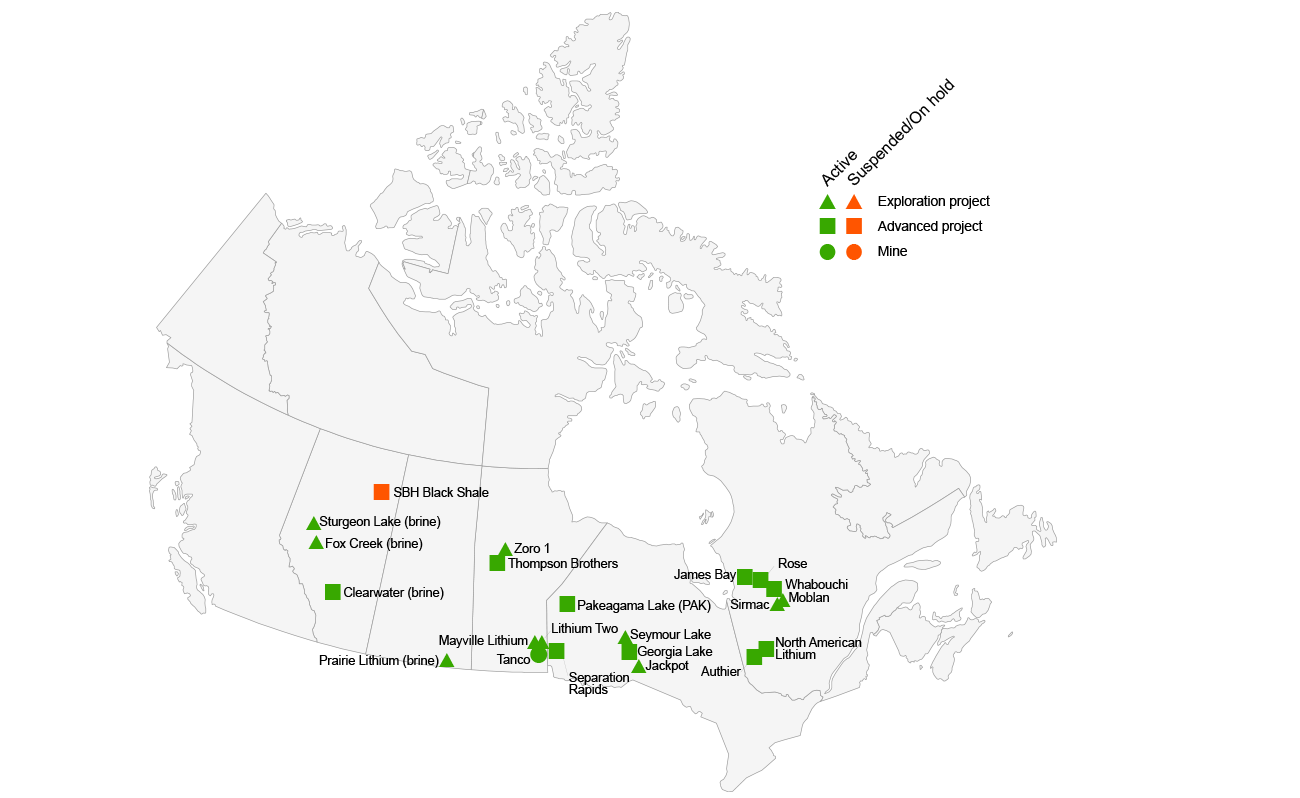

Patriot Battery Metals, chaired by Ken Brinsden, aims to bolster its exploration efforts in the strategic lithium-rich region of Quebec which is known for its large hard rock projects, Canada is considered the sixth largest lithium reserves in the world at around 930,000 tonnes.

Here are the current projects in Canada:

Source:Natural Resources Canada

Source:Natural Resources Canada

The offer price is set at 85 cents per CDI, representing a 14.6% discount to the company’s last traded price and 3.6%lower than the five-day volume-weighted average price.

The capital raise is structured as a Canadian flow-through placement, with PearTree Securities acting as the selling agent.

Iran’s President dies in helicopter crash

Iran’s hard-line president Ebrahim Raisi and foreign minister have died in a helicopter crash, state media announced in the past half hour.

The entourage were returning from a visit to the northern regions when their helicopter crashed during heavy fog and poor weather.

Source: Financial Times

Mr Raisi who was 63 was elected in 2021 and has been known by outside observers as a tough ruler who brutally shut down protests in the country and who had forged close ties with the Iranian Revolutionary Guard.

Mr Raisi was also considered to be the likely candidate to succeed Iran’s supreme leader, Ayatollah Ali Khamenei who is 85.

The news is still unfolding but markets will be keeping a close eye on oil prices as Iran’s relationship with its neighbours, especially Israel, moves into uncharted territory.

Elders Suffers Major Setback

Agribusiness giant Elders [ASX:ELD] has reported its worst financial performance in ten years, with profits plummeting 76% to $11.6 million in the six months ending March 31.

The dramatic downturn can be blamed on wayward forecasts from the Bureau of Meteorology (BoM) late last year, which predicted extended hot and dry conditions for Australia.

Reacting swiftly to the BoM’s El Niño warning, over 40,000 farmers rushed to sell off their cattle in the December quarter, anticipating drought-like conditions. However, the predicted weather event never materialized, leaving farmers unprepared and Elders bearing the brunt of the fallout.

Elders’ CEO, Mark Allison, acknowledged the significant impact of the inaccurate forecast, stating, ‘A lot of material decisions are made based on those forecasts. People sold off stock, they didn’t order farm supplies.’

While Allison expects the first-half slump to be a one-off event, with trading picking up in April, the incident highlights the far-reaching consequences of unreliable weather predictions in the agriculture sector.

Despite falling in opening trading, Elders is currently up by 2.4% to trade at $8.41 per share.

Midday market update

At noon the ASX 200 is up by +0.64%, trading at 7,864.6 as almost all sectors gain in this morning’s trading.

Only Real Estate (-0.81%) and Health Care (-0.14%) are down in trading so far today, with by far the strongest gains seen in the mining sector which is up by over 2%.

Mega-caps such as BHP are up +1.95%, Fortescue has gained 1.97% in trading so far, while Rio Tinto is up by +2.48%.

In the larger gold miners, Newmont is up by +3.15%, while Evolution Mining has gained 5.57% in trading so far today.

In individual stocks news, Star Entertainment is one to watch today as the share price is up by over 20% as the company confirms it has received a number of offers from potential buyouts, including Las Vegas major player, Hard Rock Hotels and Casinos.

Agribusiness major player Elders has cut its first-half yearly dividend by 22% after its profits plunged over 75% to $11.6 million. Shares opened down but have recovered to gain 3.5% in trading so far today.

Core Lithium has poached Hastings Technology metals CEO Paul Brown today. Mr Brown, known mainly for his role as the former Mineral Resources executive is regarded as a long-time veteran in the operational space.

Mr Brown said his first focus would be on an operational review of the Finniss Lithium Project and then the exploration program.

‘I look forward to working with the Core senior team to transform the way we work as we look to continually improve and develop a sustainable lithium project.’

Star Entertainment Jumps on Hard Rock Buyout Offer

Troubled casino operator Star Entertainment [ASX:SGR] has seen its shares jump by over 20% in trading this morning after the company confirmed rumors that it has received a buyout proposal from Hard Rock Hotel and Casinos (Hard Rock).

Star said today that ‘at this stage none of the approaches has resulted in substantive discussions,’ but that wasn’t enough to dissuade investors who have watched the company’s shares tumble over 70% in the past 12 months.

The company is in the midst of a damaging inquiry in NSW which is considering whether to take back its casino licence in Sydney.

The company could be stripped of its licences to operate gaming floors in NSW and Queensland, and faces a fine from AUSTRAC, which has accused Star of ‘serious and systemic non-compliance’ with anti-money laundering laws.

In the face of these inquiries and increased scrutiny, the company’s chief executive and chairman have resigned this year.

It’s reported that other casino owners and distressed debt funds have also considered making proposals for Star, which also operates in Brisbane and the Gold Coast.

Industrial tech metals climb

This past month we’ve seen commodities take centre stage in markets as Copper, Silver, Platinum, and Natural gas nearly all gain double digits this past month.

A combination of stimulus hopes for China, supply shortages and interest rate bets have spurred markets into a ‘risk-on’ mindset that holds equal weight of promise and risk for traders.

An interesting move that I have found no reporting on in the markets is the price of a lesser-known metal Indium, which is up over 50% since the price went vertical on 22nd of April.

Source: Trading Economics

Source: Trading Economics

Indium is a soft, silvery metal that is mostly used to make indium tin oxide (ITO), which is an important part of touch screens, flatscreen TVs and solar panels.

Indium is one of the least abundant minerals on Earth and is typically it is found associated with zinc minerals and iron, lead and copper ores.

Australian indium hopeful and minow, Iltani Resources [ASX:ILT], which holds two of Australia’s highest-grade indium deposits is up by over 70% in the past month, with speculators pouring in to try catch the change.

Will this rally be sustained? hard to know, the market for this lesser-known metal is very opaque but likely eyes will be on China’s recovery to gauge the next moves.

Iltani is up by 6.25% in trading this morning, at 34 cents per share.

Morning market upate

Good morning. Charlie here,

The ASX 200 opened up +0.57% this morning trading at 7,858.9, following a quiet close for Wall Street on Friday.

Only the last two hours of trading pushed many of the benchmarks to near flat on Friday’s US trading, while many world events are currently playing into higher commodity prices (except oil for now).

Notably, the Dow Jones closed above 40,000 for the first time ever on Friday. The index is now on a five-week winning streak. Commodity prices will be the thing to watch early this week as gold and silver gain.

Silver is now above the US$30/oz mark and has gained over 15% in the past month.

Other metals were also buoyed by the news at the end of last week, with China announcing a US$42 billion housing rescue package.

Meanwhile, Nickel has jumped over 5% as New Caledonia dissolves into chaos amid referendums of independence and reported large-scale misinformation campaigns.

In other news, hard-line Iranian President Ebrahim Raisi and Iran’s foreign minister are missing after their helicopter crashed in poor weather. Search operations are underway.

Wall Street: S&P 500 +0.12%, Dow +0.34%, Nasdaq flat.

Overseas: FTSE -0.22%, STOXX -0.16%, Nikkei +0.24%, SSE +1.01 %.

The Aussie dollar rose +0.09% to US 67.01 cents.

US 10-year bond yields +4bps to 4.41%.

Australian 10-year bond +4bps to 4.23%.

Gold rose +0.36% to US$2,423.33, while Silver rose 0.32% to US$31.54.

Bitcoin fell -0.74% to US$66,394, while Ethereum fell -1.17% to US$3,081.

Oil Brent fell -0.17% to US$83.84, while WTI Crude fell -0.27% to US$79.84.

Iron ore rose +0.39% to US$117.85 a tonne.

Key Posts

-

4:44 pm — May 20, 2024

-

4:19 pm — May 20, 2024

-

3:22 pm — May 20, 2024

-

3:11 pm — May 20, 2024

-

2:33 pm — May 20, 2024

-

12:23 pm — May 20, 2024

-

11:49 am — May 20, 2024

-

11:32 am — May 20, 2024

-

10:49 am — May 20, 2024

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2025 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988