Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | ASX to Rise, Dow Jones Hits Record High, Bitcoin Jumps to US$50k

Market close update

The ASX 200 bucked analyst expectations of a gain today after the second day of heavy losses by biotech titan CSL, which fell 2.5% today, wiping around $10 billion off its market cap in the past two days.

Its shares have declined over 7% since Monday, when the company announced plans to abandon its regulatory approval process for its heart attack treatment after disappointing phase 3 results.

Seven West Media fell 11.8% today after reporting a 53% drop in TV advertising revenue, a huge blow to the company’s revenue streams as it competes with new media and lower consumer spending.

Building materials company James Hardie also fell 8.6% after reporting disappointing margins in its most recent earnings report, despite similar volume expectations.

Strike Energy was the worst hit today, falling over -20% as the company announced the failure of the initial tests at its new SE-3 well in the Perth Basin. The early indications point to the well potentially hitting water, although further testing is still needed.

Macquarie Group fell by -1.24% today as the bank warned that its FY24 profit was ‘substantially lower‘ in the year to today when compared to 2023. The bank did say that 2023 included an exceptional result in 3Q23 and that underlying client franchises were still resilient despite uncertain conditions.

On the other end of the market, the retirement products company Challenger jumped by over 8% after reporting a 16% jump in its half-year profits.

James Hardie shares drop

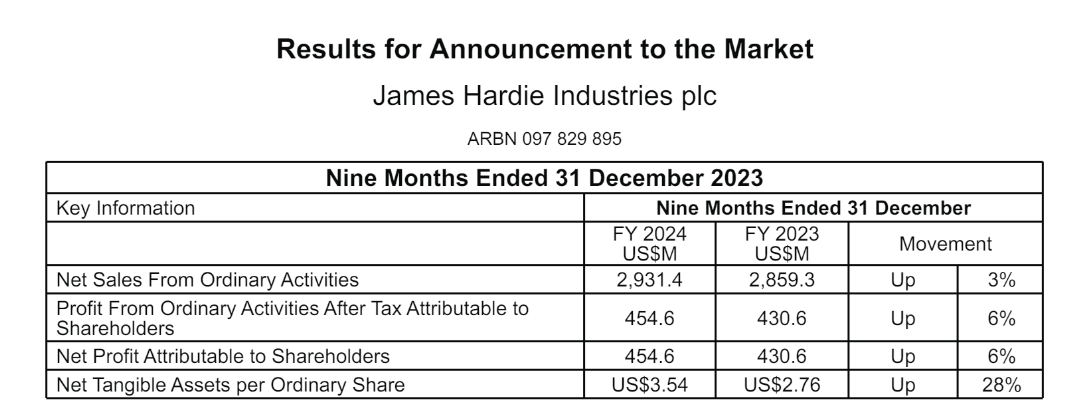

James Hardie [ASX:JHX] has fallen nearly 6% after reporting earnings of Us$280.4 million in the third quarter of FY24, with a margin of 28.7%.

Source: James Hardie

The CEO of the building products group, Aaron Erter said today that the effects of sharp interest rate rises in the past 18 months were underestimated for the renovations segment of its major markets in North America, Europe and Australia.

He continued that he thinks the renovation market will remain soft and will likely strengthen when interest rate cuts come through and consumer confidence returns.

Regarding the results today, he said:

‘Our last four quarterly results have demonstrated that we are accelerating through this cycle and taking share. We have a superior value proposition that helps our customers grow and be successful.’

For the company’s FY24 outlook, the company said adjusted net income would be in the range of US$165-185 million.

Midday market update

The ASX 200 is trading near open at 7,612.7 after falling in the late morning as biotech giant CSL extended its losses today.

Health Care (-1.97%) is once again the worst-performing sector thanks to CSL, which has lost 8% and $10 billion in market cap in the past two days so far.

Big losses were also seen by Seek which is down by nearly 10% in trading so far today. The online job site saw its profits fall as job volumes fell back to pre-pandemic levels.

Appliance maker Breville also fell over 12% despite a 6.7% increase in profits as investors showed concern for consumer spending.

One of today’s biggest losses was Strike Energy, which is down by over 26% on news its Perth Basin site, South Erregulla-3, is having flow issues.

On the positive side of the market, Utilities (+0.59%) and Financials (+0.58%) are both the biggest gainers so far today.

The biggest individual stock gainer on the ASX 200 today so far is Challenger, up by +7.37% after strong 1H24 results showed net profits up 16% to $290 million.

Temple & Webster Half year results

Furniture and homeware retailer Temple & Webster [ASX:TPW] is bucking the trend of tight consumer spending by retaining existing customers and attracting new ones.

The company reported a strong second half so far, with revenue surging 35% year-on-year since January.

Overall, Temple & Webster raked in $254 million in revenue for the six months ending December, a 23% increase compared to the same period last year. This growth is driven by both repeat and first-time customers.

Despite facing ‘some of the toughest headwinds’ due to the current economic climate, Temple & Webster managed to turn a profit of $4.1 million, up from $3.9 million a year earlier.

CEO Mark Coulter attributes the success to their ‘amazing range, great value proposition, and incredible service,’ which has resonated with over 1 million active customers as of February this year. This milestone represents a million Australians joining the Temple & Webster community in the past year.

The company ended the half with $114 million in cash and no debt.

Shares are up by 6.69% in this morning’s trading at $10.69 per share.

CSL half year results

Biotech giant CSL’s latest earnings report wasn’t enough to stem the flow as the ASX’s largest medical company saw another day of losses.

Shares are currently down by -3.21%, as yesterday it was revealed that its new heart attack drug has failed at phase 3 trials.

The $147 billion market cap giant spent close to $1 billion on the study, which involved 18,000 patients and was one of the largest in CSL’s history.

However, after the trial concluded, the study noted that the drug CSL112 ‘did not meet its primary efficacy endpoint of MACE reduction at 90 days.’

Shares fell -5.5% yesterday on the news, and today’s half-year results weren’t enough to move the needle.

Here are the highlights from the latest report:

Morning market updat

Good morning. Charlie here

The ASX 200 opened up +0.20% to 7,632.2 this morning as the ASX earnings season continues. Today, we have reporting by Seven West Media, Temple & Webster, James Hardie, CSL, and Seek.

On Wall Street, gains continued for many of the major indices that have been left behind in recent rallies, with the small-cap Russell 2000 gaining 2.06% and the Dow Jones reaching a new record high.

While things began to ease on the tech side of the market, with the S&P 500 slowing to finish flat and the Nasdaq falling while both are still trading near their highest levels.

The US market awaits all-important January CPI inflation data due tomorrow.

Many are placing bets that it is going to show continued slowing price rises, which will stoke the market’s anticipation of earlier cuts by the Fed.

It seems that talk of recession has moved outside the national discourse. Now, only JP Morgan, one of the major investment banks, is raising concerns about a major reversal in the near term.

According to analysts at JP Morgan, the stock market could experience a downturn of approximately 20–30% following a peak in 2024.

Meanwhile, Bitcoin touched US$50,000 overnight as the Chinese New Year rally continued. BTC is now up 16.6% in the past five days.

Wall Street: Dow +0.33%, Nasdaq -0.30%, S&P 500 flat.

Overseas: FTSE flat, STOXX +0.65%, Nikkei flat, SSE +1.28%

The Aussie dollar rose +0.12% to US 65.27 cents.

US 10-year bond yields flat at 4.18%.

Australian 10-year bond yields rose +5bps to 4.17%.

Gold is down -0.26% to US$2,020.1. Silver is up 0.14% to US$22.69.

Bitcoin rose +3.77% to US$49,985, while Ethereum rose 5.78% to US$2,650.

Oil Brent eased -0.22% to US$82.01 after gaining 5.4% in a week, while WTI Crude rose +0.21% to US$77.0.

Iron ore rose +1.2% to US$128.10 a tonne.

Key Posts

-

4:15 pm — February 13, 2024

-

2:24 pm — February 13, 2024

-

12:10 pm — February 13, 2024

-

11:28 am — February 13, 2024

-

11:23 am — February 13, 2024

-

10:06 am — February 13, 2024

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2025 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988