Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | ASX to Rise; BoE Keeps Rates Steady; Life360 and QBE Feature

Market close update

The ASX 200 closed up +0.36% to 7,749.0 as markets recovered from yesterday’s losses as signs of a slightly weakening Jobs market in the US gave some hope of earlier cuts from the Fed.

Other notable moves during today’s session was the spot gold price rising nearly 1.9% before falling slightly to close out up +0.45%.

Oil prices also had a strong day, with Brent gaining +0.72% as signs of China’s recovery spurred hopes of higher demand coming soon.

China’s April data showed improvements across its exports and imports, giving the troubled nation something to cheer as the property sector continues to look shaky.

Closer to home, seven of the eleven sectors closed up today, with Energy (+1.87%) well ahead of the rest. All of the top 20 energy stocks rose today, with Woodside gaining +1.85%, Santos +2.15% and Ampol up +1.86% on rising oil prices.

Gold miners also had a strong day, with Gold Road Resources the top performer on the ASX 200, gaining +4.52% to trade at $1.62 per share.

Next week, we have some important signs for the economy ahead which will likely move markets:

- Monday, we have NABs business confidence for Australia

- Tuesday we have PPI data for the US

- Wednesday, we have speeches from J Powell and inflation data from the US, which is likely the biggest news of next week

- Thursday, we have Australian Employment data

- Friday, we have Eurozone inflation data

Until then, have a great weekend!

QBE Confirms guidance

QBE Insurance [ASX:QBE] has recovered from a drop in its share price this morning, as the company confirmed its full-year guidance.

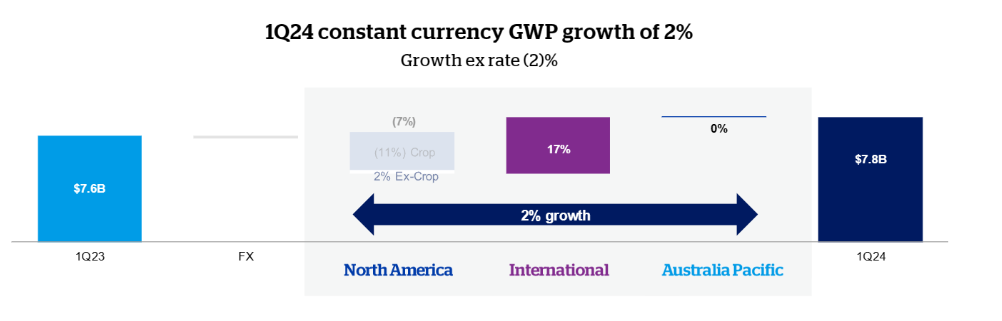

The insurance company said markets remained ‘supportive, with continued momentum in gross written premiums,‘ with this the company said it was on track for ‘growth in the mid-single digits’ for its premium rate increases.

Here’s how those gross written premiums (GWP) looked across its markets:

The company noted the increase in extreme weather events that are affecting the business, saying ‘climate change will continue to challenge us all and our ability to prepare, protect, and rebuild.’

Chairman of QBE Michael Wilkins, was positive about the results today, saying:

‘Against all that, in 2023, QBE made very good progress against its strategic priorities and our performance reflects the shifts QBE is making to be a more consistent organisation. QBE delivered a statutory net profit after tax of $1.355 billion in 2023 following a continuation of very strong premium growth of 10% and supporting our commitment to deliver improved profitability.’

‘Reflecting the Company’s performance in 2023 and our confidence in the future, the Board declared a final dividend of 48 Australian cents per share, bringing the total dividend paid in respect of the 2023 year to 62 Australian cents per share. This compares with dividends of 39 Australian cents per share for 2022 and is the highest total dividend paid by QBE for a number of years.’

The company expects to release its 1H24 results on 9 August.

Suncorp latest quarterly shows delinquency rising

Regional lender Suncorp [ASX:SUN] saw its shares drop this afternoon as the company released its latest quarterly trading update.

The company saw a notable rise of $85 million in loans that were more than 90 days past due during the March quarter, bringing the total to $510 million, an increase from the previous December quarter.

Net impairment expenses for the quarter reached $1 million, which the company classified as ‘benign’ and said it saw ‘minimal write-offs‘.

The bank’s home lending portfolio grew in the March quarter, increasing $803 million or 5.8% annualised.

Meanwhile business lending grew $69 million or 2.2% annualised.

The battle for AI and search heats up

Rumours are circulating in tech circles that OpenAI is set to unveil its next big AI product next week, an AI capable of searching and sourcing information.

The competition with Google for search has been watched closely in tech circles. Tech upstart Perplexity has been gathering attention and backing from big names in tech, including Jeff Bezos and Nvidia, for offering a similar product.

Google has maintained a near 90% dominance of search on the internet for over a decade now, so any disruption of this near monopoly will be one to watch in 2024.

OpenAI plans to announce its artificial intelligence-powered search product on Monday, according to two sources familiar with the matter, raising the stakes in its competition with search king Google. More here: https://t.co/f8lCcARH9K

— Reuters Business (@ReutersBiz) May 10, 2024

Midday market update

The ASX 200 is up by +0.47% to 7,757.7 at midday as markets bounce off yesterday’s sell-off on hopes of earlier cuts from Central Banks.

Higher than expected US weekly jobless claims hinted at signs of weakness within the US economy, which in turn raised bets of cuts coming sooner from the Fed.

This morning, the ASX saw nine of the eleven sectors up, with Energy (+1.44%) leading today as oil prices climbed.

WTI crude is up by +0.61% so far this session, trading at US$79.74 per barrel as expectations of extended cuts by OPEC in its early June meeting have boosted prices.

As a response, oil and gas explorer Beach Energy is up +4.15%.

On the benchmark gold miners, there have also been positive moves this morning, as spot gold prices jumped +1.8% to US$2,350.78 per ounce.

Top performers on the ASX 200 so far today were Gold Road Resources, up +4.68%, and Emerald Resources, up +3.85%.

Life360’s Steep First-Quarter Losses

Life360 [ASX:360], the San Francisco-based tech firm, recently released its first-quarter financial results, and investors are responding with disappointment.

The company reported a net loss of $9.8 million, causing its share price to plummet by 8.4%, now trading at $14.20.

Despite the setback, Life360’s CEO, Chris Hulls, remains optimistic about the company’s decision to list on the ASX.

In an interview with CNBC, Hulls praised Australia’s large investable capital compared to its population size, saying:

‘People think of Australia as a small little country, but in terms of investable capital, it’s massively disproportionate to their population.’

Life360 said it continues on its ‘path to profitability’ and hopes to turn a profit in the first half of 2025.

The company reported a new quarterly record of 4.9 million new monthly active users (MAUs), a metric commonly used in the tech industry. However, many of these users may only be utilizing Life360’s free services, as the release notes only 32,000 ‘net Paying Circle additions‘ in April.

The company reaffirmed its 2024 guidance of losses between (US$12-13 million) and annual revenue to be between US$365-375 million.

RBA releases meeting dates

The RBA released its board meeting dates for 2025.

For all of you industrious market watchers, it might be worth putting these in your calendar for next year.

• 17–18 February (with Statement on Monetary Policy

• 31 March–1 April

• 19–20 May (with Statement on Monetary Policy)

• 7–8 July

• 11–12 August (with Statement on Monetary Policy)

• 29–30 September

• 3–4 November (with Statement on Monetary Policy)

• 8–9 December

The Reserve Bank of Australia has also released the latest chart pack, which gives a great snapshot of the Australian economy’s health.

Morning market update

Good morning. Charlie here,

The ASX 200 opened up +0.30% to 7,744.5 this morning as US markets lifted overnight. The Dow Jones hit its seventh straight day of gains, a record for 2024 and other benchmarks were up as weekly jobless claims data in the US gave fresh hope of interest-rate cuts.

Gold reacted to the signs of potential cuts with a strong jump last night, up +1.67%.

Traders are pricing in slim odds of a rate cut at the Fed’s June 12 meeting, with a 30% probability of easing.

The most likely scenario (in my opinion) is that any moves to cut interest rates will more likely come at the September 18 meeting.

Meanwhile, last night, the Bank of England kept rates steady, with the BoE head saying:

‘Evidence suggests inflation may be less pronounced than thought.’

European stocks were up again, touching fresh record highs. This week’s been one of the strongest we’ve seen in some time for the Euro stocks, as a strong earnings season has helped spur the region.

Wall Street: S&P 500 +0.51%, Dow +0.85%, Nasdaq +0.27%.

Overseas: FTSE +0.33%, STOXX +0.32%, Nikkei –0.34%, SSE +0.83%.

The Aussie dollar rose +0.63% to US 66.19 cents.

US 10-year bond yields +5bps to 4.45%.

Australian 10-year bond yields +5bps to 4.34%.

Gold rose +1.66% to US$2,347.22, while Silver rose +1.03% to US$28.34.

Bitcoin rose +3.13% to US$63,110, while Ethereum rose +2.09% to US$3,036.

Oil Brent rose +0.26% to US$84.10, while WTI Crude rose +0.52% to US$79.67.

Iron ore rose +1.3% to US$116.20 a tonne.

Key Posts

-

4:24 pm — May 10, 2024

-

2:31 pm — May 10, 2024

-

2:22 pm — May 10, 2024

-

12:17 pm — May 10, 2024

-

12:11 pm — May 10, 2024

-

10:56 am — May 10, 2024

-

10:48 am — May 10, 2024

-

10:09 am — May 10, 2024

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2025 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988