Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | ASX to Rise as Wall Street Hits Record Highs on AI Stock Surge

Market close update

The ASX 200 closed up by +0.68% today to close at 7,821.8 as all eleven sectors closed in the green today.

Inflation-sensitive Information technology sector (+1.41%) and Financials (+0.95%) were today’s stand-out sectors as the Big Four and tech followed strong gains on Wall Street overnight.

The later part of the trading session was spurred by the announcement by the Bank of China that they would be cutting interest rates, the first G7 nation to do so.

The European Central Bank will be meeting tomorrow and are also expected to cut rates so stay tuned for that.

What happens if were last?

Looking at market bets, it appears like many European traders have already placed their bets and are expecting cuts to come tomorrow from the European Central Bank.

That begs the question, with the Bank of Canada (BoC) cutting today, Europe’s ECB (potentially) tomorrow, which Central Bank is next? and when will it be our turn?

With the mood lifted after today’s cuts, don’t be surprised if we see further green days by markets in the week ahead as further cuts could come.

In the US traders have swung to now expect two rate cuts this year, starting September (in line with my December 2023 predictions), but this could again swing wildly.

But i have two interesting charts for you to consider when looking at the RBA and when the next cuts could come.

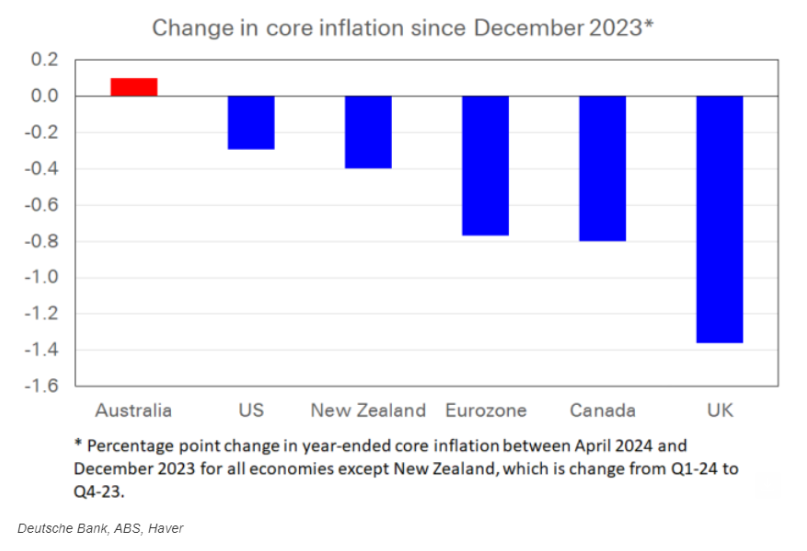

The first one is from Deutsche bank last month:

Source: Deutsche bank

Here we can see that we stand as an outlier from the other tracker economies when it comes to bringing core inflation down. Yes some of these countries had further to fall (such as the UK with sky-high prices thanks to the earlier Russian gas crisis among other issues), but it still doesn’t look great for us cutting earlier.

In fact, just last month economists were arguing about the change of potential hikes from the RBA.

Many of these discussions have been pushed aside after Wednesday’s anemic GDP data which showed Australia with a 0.1% quarterly growth and still shuffling on with a per capita recession.

The next in the chart is the US, which has surprised most economists and analysts with the strength of its economy despite the many headwinds.

This strength has many thinking that the US could be one of the later markets to cut rates.

This brings us to my second chart from the St Louis Federal Reserve in the US.

Source: St Louis Fed

If the US is late to the party cutting rates, then its bonds will be favoured by international investors who will be looking for the best returns, so they will go where interest rates remain high.

This is a simplified story of the real flows, but I’ll press on. Because of these higher US rates, they will use their local currency to buy US Treasuries, pushing the US Dollar index up.

In this environment where the US dollar is high, and currencies like Australia’s are low, we know from the past that commodities struggle as trade becomes more expensive when the US reserve currency is involved.

This could be bad news for commodity prices and Australia in the medium term until the laggards eventually cut.

This is of course one scenario and many others could happen, but its a challenge to look out for.

ASIC revokes XTrade’s licence

The Australian Securities and Investments Commission (ASIC) has taken action against online trading platform XTrade by cancelling its Australian Financial Services (AFS) licence.

The decision comes after ASIC discovered that XTrade had engaged in unconscionable conduct and encouraged vulnerable clients to make trades even when they lacked the financial means to do so.

According to the regulatory body, XTrade’s actions resulted in ‘substantial financial losses for some of its customers‘.

In late April, XTrade sought to challenge ASIC’s decision by applying for review. However, the tribunal overseeing the case denied XTrade’s application, upholding ASIC’s decision to revoke the company’s financial services licence, effectively ending the company’s future.

Droneshield place 37.9 million shares

Popular small-cap Droneshield [ASX:DRO] announced the placement of 37.9 million shares today at 80 cents after approval at the company’s general meeting three days ago.

With the current share price sitting at around $1.335 per share, the holders will sit on a tidy paper profit once issued.

Shares have fallen in this afternoon’s trading by around -1.11% but the company’s shares are still up over 450% in the past 12-months.

Midday market update

The ASX 200 is up by +0.75% to 7,827.4 around midday as the local benchmark lifts following record highs on Wall Street last night.

Also boosting today’s move is the news of the Bank of Canada’s (BoC) decision to cut interest rates, the first major economy to do so.

Many are now guessing that the European Central Bank could be the next to cut in its meeting tomorrow, the first time since 2019.

“Judging by the commentary from officials, there is no questioning of the wisdom of cutting rates on 6 June,” said Mark Wall, ECB watcher with Deutsche Bank.

“Even with the upside surprise on May HICP [harmonized index of consumer prices], the ECB can argue a cut is consistent with its reaction function. The question is, what comes after June?”

On the ASX, all sectors are up today in a broad rally that’s led by Industrials, up +1.11%, followed by Health Care, up just under 1%.

Outside of precious metals, Mining is fairly subdued today amongst the mega-caps as Iron ore future prices remain low due to signs of further weakness from China.

Leading on the ASX 200 so far today is Mercury NZ, gaining an astonishing +7.43% for a $9 billion market cap company.

While falling sharply today, IDP Education is down by nearly 5% as its latest market update finally outlined the extent of the damage to its volumes since immigration changes cut its international student volumes.

MinRes Sells 49% Stake in Iron Ore Road

Mineral Resources [ASX:MIN] has sold a 49% interest in its Onslow Iron Ore Project haul road to Morgan Stanley Infrastructure Partners for $1.3 billion.

The deal is priced at 9.4 times the road’s pro-forma earnings capacity, and the miner will retain the right to use the road for mine-to-ship delivery of iron ore.

The company said today that the proceeds would help fund new growth, saying:

‘As the first transaction of its kind in the Australian iron ore industry, it showcases the considerable value of MinRes’ portfolio of infrastructure assets and our ability to unlock significant capital.’

‘The transaction also establishes access to a new pool of capital to further accelerate our growth and continue to deliver returns for our shareholders.’

Sky City Entertainment shares plummet as it cuts guidance

It’s been a tough run for Casino operators in the past few years and today just got worse as Kiwi-operator Sky City Entertainment [ASX:SKC] has seen its shares collapse in early morning trading, falling an astounding -18.5% in the first hour of trading today.

The fall comes as the company cut its guidance and issued a troubled outlook for FY25.

Guidance has been trimmed to a Net profit between NZ$120-125 million in FY24, down from NZ$125-135 million.

The group blamed New Zealand’s recession-wracked economy for the weaker guidance, saying that while visitation numbers remained ‘strong’ consumer spending was impacted.

They also highlighted a potential increase in their duty expense for their Adelaide casino as part of the South Australian Court of Appeal’s ruling.

Importantly, they have also suspended dividend payments for 2H24 and FY25 in order to maintain debt levels as they expect to pay an A$67 million fine as part of the AUSTRAC civil penalty and a further NZ$76 million in capex to complete the NZICC.

Canada becomes first major economy to cut interest rates

The Bank of Canada (BoC) has taken the lead among major central banks by cutting interest rates for the first time since March 2020.

The decision to lower the rate by 25 basis points to 4.75% has ‘lifted the mood‘ about the possibility of the US Federal Reserve easing monetary policy, according to economists.

BoC Governor Tiff Macklem expressed growing confidence that inflation is returning to the 2% target. Saying that if this trend continues, ‘it is reasonable to expect further cuts to our policy interest rate.’

The European Central Bank (ECB) is also anticipated to reduce interest rates by 25 basis points from 4% at its upcoming meeting on Thursday.

While the Federal Open Market Committee (FOMC) is not expected to cut rates during its June 11-12 meeting, markets have priced in one or two cuts by year-end.

Morning market update

Good morning. Charlie here,

The ASX 200 opened higher this morning, up by +0.58% to 7,814.1 as it follows strong gains seen on Wall Street after a slow start to the week.

The S&P 500 was up 1.2%, and the Nasdaq jumped 2% overnight, closing at new record highs.

This is the 25th time the S&P 500 has made a new high in 2024, as AI mega-stocks pushed the index higher.

Nvidia surged another 5.2% to top a market cap of $3.01 trillion, surpassing Apple to become the second-largest publicly traded company.

Meanwhile, semiconductor equipment supplier ASML became Europe’s second-largest stock, overtaking LVMH.

Bond yields continued their decline, now falling 23 basis points in the past month as traders adjust their bets for the next cuts forward as weak economic data trickles in both here and in the US.

On the commodities front, iron ore futures continue to fall due to weakness in China, while gold, silver, and copper bounced back from their Wednesday selloff.

Wall Street: S&P 500 +1.18%, Dow +0.25%, Nasdaq +1.96%.

Overseas: FTSE +0.18%, STOXX +1.66%, Nikkei -0.89%, SSE -0.83%.

The Aussie dollar -0.06% to US 66.52 cents.

US 10-year bond yields -4bps to 4.29%.

Australian 10-year bond -3bps to 4.19%.

Gold +1.13% to US$2,355.17, while Silver +1.39% to US$29.98.

Bitcoin +0.95% to US$71,131, Ethereum +1.31% to US$3,861.

Oil Brent +1.38% to US$78.59, WTI Crude +1.43% to US$74.30.

Iron ore fell -0.3% to US$107.10 a tonne.

Key Posts

-

4:44 pm — June 6, 2024

-

4:38 pm — June 6, 2024

-

3:25 pm — June 6, 2024

-

2:53 pm — June 6, 2024

-

1:32 pm — June 6, 2024

-

11:36 am — June 6, 2024

-

11:10 am — June 6, 2024

-

10:53 am — June 6, 2024

-

10:26 am — June 6, 2024

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2025 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988