Investment Ideas From the Edge of the Bell Curve

ASX NEWS LIVE | ASX to Rise as Wall St Shrugs Off Smaller Rate Cut Fears

Latest Fat Tail Daily Video

Here’s the latest from the new Fat Tail Daily video series.

Publisher James ‘Woody’ Woodburn is away, so this week, Fat Tail Daily editor Nick Hubble will join us to discuss the key trends and offer unique insights into market movements.

Today, Nick will be chatting with Diggers and Drillers and Mining Phase One editor, James Cooper.

They will be discussing all things geology and giving a bit of background to James’s rocky profession.

The careers of exploration geologists mirror the booms and busts of the mining sector.

Can you turn their professional fate into a profitable trade signal? What would that indicator tell you now?

Find out, in this video with former geo James Cooper.

Midday market update

Australian shares jumped in early trading, with broad gains mirroring a tech-led rally on Wall Street.

U.S. shares rallied overnight, boosted by the technology sector, even as investors reduced expectations for a significant interest rate cut by the Federal Reserve next week.

As a response, the Australian dollar rose to US66.77 cents, a 0.26% jump overnight.

The ASX’s upward movement this morning was led by the technology and energy sectors, as crude oil prices also bounced sharply overnight.

The ASX 200 increased +0.66% to 8,040.2, now within 120 points of its all-time high of 8148.7 set in August.

Ten out of eleven ASX sectors rebounded after the index fell 0.3% yesterday.

Uranium miners saw explosive growth, with Paladin Energy, Silex, Boss Energy and Bannerman Energy all rising around 10%.

Higher Brent crude prices, driven by concerns about Hurricane Francine in the U.S., supported Woodside, Origin, and Ampol this morning all gaining.

Brick manufacturer Brickworks fell 2.5% after warning of a $123.5 million impact on its fiscal 2024 results due to severely reduced building activity in Sydney and Brisbane, and increased operating costs.

Media outlet Nine Entertainment was among the biggest decliners, dropping 3.2% as shares traded ex-dividend and CEO Mike Sneesby announced his departure.

Uranium stocks surge as Putin threatens exports

Shares in uranium mining companies are poised for one of their strongest performances of the year.

The moves higher come after Russian President Vladimir Putin warned of potential restrictions on uranium exports as a response to Western sanctions.

Putin’s televised statement suggested that similar limitations could be imposed on other commodities.

The threats highlighted for many Russia’s significant role in producing natural gas, diamonds, and gold.

The announcement triggered a rally in uranium-related stocks, fueled by expectations of higher commodity prices amidst supply restrictions.

Silex led the charge with an impressive 11.4% gain, while Paladin Energy , Boss Energy, and Bannerman Energy each saw their shares climb by 9-10%.

Fund manager dumps ACL stake

Private fund manager Crescent Capital has sold its 30% stake in Australian Clinical Labs [ASX:ACL] in a block trade today, completely exiting the stock.

ACL shares are down by -1.7% in trading as midday approaches, as investors and shareholders consider the sale’s implications.

Does Crescent know something the market doesn’t, or was the move part of a broader shift in their investments?

Crescent’s founder and managing partner, Michael Alscher, chairs ACL’s board, so the potential for insider knowledge is large.

On the surface things seem going ok. ACL reported a 33% increase in statutory profit to $23.9 million for the year ending June 30.

However, revenue was flat at $696.4 million.

Is there something we aren’t aware of lurking in the stock?

Brickworks shares down after $125.3m hit

Major Brick manufacturer Brickworks [ASX:BKW] announced a $123.5 million impact on its fiscal 2024 financial results today.

The company faces a sharp decline in construction activity in Sydney and Brisbane, coupled with rising operational costs and a slowdown in the US market.

As a result, Austral Masonry, one of Brickworks’ divisions, is expected to report an after-tax charge of $54.7 million.

Meanwhile, Brickworks North America anticipates a $68.8 million cash impairment.

These financial setbacks reflect the broader challenges currently facing construction and building materials sectors across Australia and other high-interest nations.

While in Australia last month’s building permits showed signs of recovery, it’s still early in the recovery for the building industry.

Brickwork’s shares are down by -2.2% in early trading today at $25.47 per share.

Nine CEO Quits

Mike Sneesby, CEO of Nine Entertainment [ASX:NEC], will leave his position at the end of the month in a shock announcement.

Sneesby’s exit follows Nine’s recent challenging financial report, which showed a 3% drop in revenue to $2.6 billion and a 22% decrease in net profit to $216.4 million.

During his tenure, Nine’s share price has fallen by 57%. The departing CEO’s final months were also marked by controversy.

He faced criticism for compensating former news chief Darren Wick despite allegations of predatory behaviour and for participating in the Paris Olympic torch relay after announcing cost reductions in the publishing division.

Matt Stanton, the company’s CFO, will serve as interim CEO while a search for a permanent replacement begins.

Nine’s shares are down by nearly 4% in early trading today.

Morning Market Update

Good morning. Charlie here.

The ASX 200 opened up +0.56% to 8,032.9, as a surprising bought of positive sentiment saw Wall St gain overnight. The major US indicies shrugged off the higher US consumer price index (CPI inflation) figures to close higher.

The standout was the tech-focused Nasdaq, which closed +2.17% higher as mega-caps Nvidia gained +8.1% and Broadcom was up +6.7%.

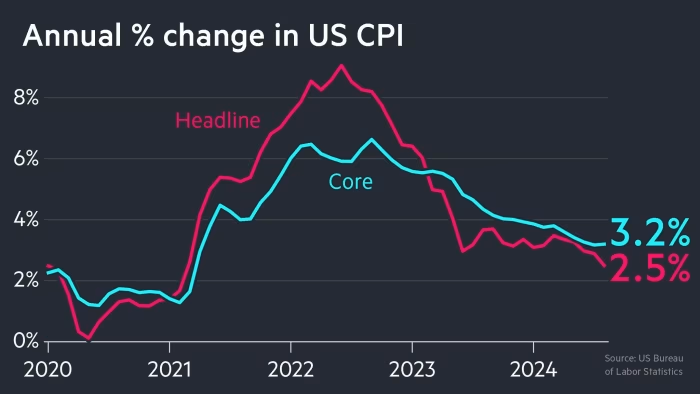

The big news overnight was the US August core CPI, up 0.3% month-on-month, above the estimates of 0.2%.

Housing-related costs largely drove this, while for headline CPI, the figures fell to 2.5% for August.

This is setting the stage for a 0.25bps point cut, with the slightly higher core figure meaning that a double cut from the Fed is unlikely.

Source: Financial Times

The CPI print was one of the last major economic data releases before the FOMC meeting on 18 September, where the Fed is almost guaranteed to cut rates.

In other news, last night’s Trump vs. Harris debate saw bitcoin prices drop, as Trump supporters saw his performance as lacklustre.

Trump, in recent months, has adopted the cryptocurrency as part of his campaign, and so its value can be seen as a proxy to feelings that Republicans will enter the Whitehouse and support crypto-positive regulation.

In other news, UK GDP was unexpectedly flat for Q3, coming in well below the consensus of 0.2% from a recent Reuters poll.

| Name | Value | % Chg | |

|---|---|---|---|

| Major Indices | |||

| S&P 500 | 5,554 | +1.07% |

| Dow Jones | 40,861 | +0.31% |

| NASDAQ Comp | 17,395 | +2.17% |

| Russell 2000 | 2,103 | +0.31% |

| Country Indices | |||

| UK | 8,193 | -0.15% |

| Germany | 18,330 | +0.35% |

| Euro | 4,763 | +0.35% |

| Japan | 35,619 | -1.49% |

| Hong Kong | 17,108 | -0.73% |

| Name | Value | % Chg | |

|---|---|---|---|

| Commodities (USD) | |||

| Gold | 2,512 | -0.27% | |

| Silver | 28.70 | +0.93% | |

| Iron Ore | 92.70 | -0.04% | |

| Copper | 4.1074 | +1.66% | |

| WTI Oil | 67.27 | +2.25% | |

| Currency | |||

| AUD/USD | 66.67¢ | +0.32% | |

| Cryptocurrency | |||

| Bitcoin (USD) | 57,377 | -0.43% | |

| Ethereum (USD) | 2,343 | -2.00% | |

Key Posts

-

2:17 pm — September 12, 2024

-

12:14 pm — September 12, 2024

-

11:50 am — September 12, 2024

-

11:25 am — September 12, 2024

-

10:59 am — September 12, 2024

-

10:35 am — September 12, 2024

-

10:22 am — September 12, 2024

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2024 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988