Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | ASX to Rise as Wall St Extends Gains; RBA Minutes Due Today

Market close update

Australian shares closed with its eighth straight session of gains today.

The ASX 200 closed up 0.22%, just short of retaking the 8,000-point threshold hit during the morning.

Shares rose as much as 0.4% earlier in the session but pared gains following the release of minutes from the RBA meeting, which showed the board expected rates in Australia to remain high for ‘an extended period‘.

It marked the first time the benchmark has surpassed 8,000 since falling from a record high in a two-day sell-off at the start of August. Shares have now bounced more than 4.5% since then.

Stocks followed a similar trend to Wall Street’s gains, with 5 of the 11 sectors closing higher, with technology stocks leading today, with the sector gaining 1.29%.

Mining stocks also had a strong day, with the sector closing 0.92% higher following a rebound in the price of iron ore overnight to near US$95 per tonne. BHP rose 1.11% to $40.18 per share.

On the other end of the market, real estate stocks fell on the release of the RBA minutes, with the sector closing down by 1.55%. Goodman Group fell by 1.42%, and Stockland fell by nearly 2% at the close.

On the ASX 200, the biggest move was seen by Yancoal, which fell by an astonishing 14.5% today after suspending its 1H24 dividend to search for acquisition targets in the second half of this year.

RBA minutes hint at extended hold, but scepticism remains

The Reserve Bank of Australia continues to signal that interest rates will likely remain at their current 12-year high for an extended period to ensure inflation returns to target in 2025.

The RBA’s August meeting minutes revealed the board considered further tightening but opted to maintain the key rate at 4.35%.

They suggested that holding rates steady for longer than market expectations might suffice to control inflation.

The RBA emphasised its commitment to restrictive monetary policy until confident about inflation trends, with it noting the usual phrase that it will prioritise incoming data.

There was little new in the minutes whose language remained steady, with the usual refrain like this:

‘Monetary policy will need to be sufficiently restrictive until members are confident that inflation is moving sustainably towards the target range.’

While global counterparts begin easing cycles, Australia’s slower rate hike pace and lower benchmark rate set it as an outlier.

While the RBA aims to balance inflation control with preserving recent labour market gains it could mean we are one of the last to cut in this cycle.

But the market isn’t believing the RBA rhetoric as much these days. Expectations of a rate cut as early as December are still prevalent, while most economists anticipate rates will hold steady this year.

A good example was the RBNZ who also held their language firm but then unexpectedly cut rates this month as weakening labour data pushed them to move.

Will Australia be the same?

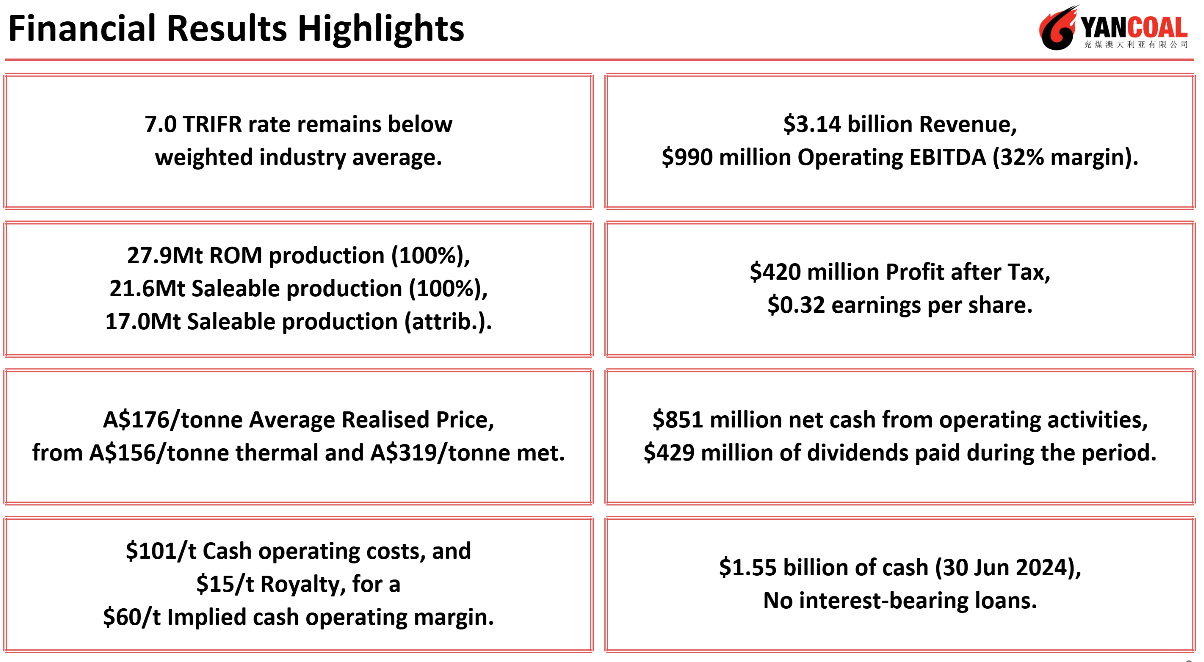

Yancoal doesnt distribute dividend, eyes acquisitions

Coal giant Yancoal [ASX:YAL] has seen its shares fall by over 15% in trading so far today after the major producer said it was not distributing a dividend.

The company which released its 1H24 results today, reported a 39% fall in its average sales price for thermal coal and 18% fall in metallurgical coal sales prices.

Some of its other major financial results are posted below:

Source: Yancoal

Cash operating costs went down by 7% to $101 per ton, while at the same time total sales increased 17%.

The major news shifting the share price was the decision to retain its $420 million half-year profit.

The company says it will instead hold around $1.55 billion in cash for ‘corporate initatives’.

What that means is it is eying up the potential acquisition of Anglo American’s Queensland coal mines.

Midday market update

Australian shares have risen to near 8000 points, as the sell-off earlier this month continues to unwind following gains in US shares overnight.

The ASX 200 sits +0.23%, higher at 7,998.9 after touching the 8,000-mark earlier in the session.

The gains today mirrored similar moves in the US overnight. At the close, the S&P 500 was 1% higher to 5,608 after eight straight sessions of gains.

On the ASX, mining stocks are leading the index higher, following a rebound in the price of iron ore overnight to steady near US$95 per tonne.

The Utilities sector leads today, up by +1.07%, as both Origin (+1.77%) and AGL Energy (+0.42%) continue to gain after their strong earnings selloff.

Meanwhile, minutes from the Reserve Bank of Australia’s meeting earlier this month confirmed the bank discussed raising the cash rate before deciding to hold at 4.35%, more on those after lunch.

The long and short was they had little effect on the market this morning as belief in the RBA’s decisions being clear from its rhetoric have diminished following the surprise cut by the RBNZ and other Central Banks.

Ansell cuts almost 10% of its staff in automation push

Ansell [ASX:ANN], a leading manufacturer of medical gloves and protective surgical attire, has reduced its global workforce by almost 10%.

In its FY24 earnings report today, the company posted an adjusted EPS of US 105.5 cents per share, which is within its guidance range.

Revenues were -5.2% lower than FY23, while the company posted a final dividend of US21.9 cents, bringing its full-year dividend to US 38.4 cents.

The company saw -2.2% lower sales overall as its healthcare segment fell, but said they were offset by its industrial segment, which appears to be its new push in a post-COVID era.

The big highlight of the release was the company’s focus on adopting automation across its manufacturing facilities.

Neil Salmon, the company’s CEO, confirmed today that the layoffs affected all 14 of Ansell’s factories.

He said that the layoffs were ‘90 percent complete,’ with 1,330 employees already made redundant.

Salmon also hinted at further cost-cutting measures on the horizon.

The news sparked a positive market reaction, with Ansell’s shares rising +7.3% to $29.28 in trading so far today.

Adding to the upbeat sentiment, Salmon reported that the oversupply of medical gloves and other personal protective equipment (PPE) – a consequence of the COVID-19 pandemic – has largely been resolved, with only minor surpluses remaining in select market segments.

With today’s gains, the company’s share price has returned 27.3% in the past 12 months.

Dexus shares fall on loss

Property giant Dexus [ASX:DXS] has reported a $1.58 billion statutory loss for FY2024, a significant downturn from the previous year’s $752.7 million loss.

Here is its full results presentation.

This result stems from large portfolio devaluations. Despite this, adjusted funds from operations reached $516.3 million, aligning with guidance but 7% below last year.

New CEO Ross Du Vernet delivered on the promised 48¢ per security distribution but forecast lower earnings for the coming year. He projects adjusted FFO per security of 44.5-45.5 cents and a 37-cent distribution for FY2025.

Du Vernet outlined a strategy favouring co-investment with partners, targeting opportunities in industrial, infrastructure, and some alternative sectors. He acknowledged current market challenges, saying:

‘Markets move in cycles and while conditions are presently challenging, we invest for the long term. The assets we own, manage and develop, the capabilities we build, and the relationships we forge with clients and customers continue to position us well to deliver superior risk-adjusted returns for Dexus Security holders and our capital partners over the long term.’

Shares in Dexus are currently down by -7.11%, trading at $7 per share. That puts its 12-month return at -9.13%.

Expectations of cuts seen through bond market

Here is an interesting chart by analyst Jim Bianco showing a record number of long positions in US 10-year bonds, as traders expect cuts coming in September.

A record amount of net long positions in US 10-year Treasury bonds often signals expectations of future interest rate cuts.

Investors buying bonds in large quantities are essentially betting that yields will fall. Because of this, they rush to lock in current yields before they potentially decrease.

This increased demand drives bond prices up and yields down as bond prices and yields move inversely.

The rationale is that if rates are cut in the future, the bonds purchased now at higher yields will become more valuable.

These expectations can be self-reinforcing to some extent. As more investors pile into bonds, driving yields lower, it can create pressure on the Fed to actually implement rate cuts to align with market expectations.

It’s worth noting that while such positioning often correctly anticipates Fed policy, it can also lead to market volatility if these expectations are not met.

If the Fed maintains higher rates than the market anticipates, or if economic data suddenly improves, it could lead to a rapid unwinding of these positions, potentially causing bond yields to spike.

record net long pic.twitter.com/nBveVJNLZ6

— Jim Bianco (@biancoresearch) August 20, 2024

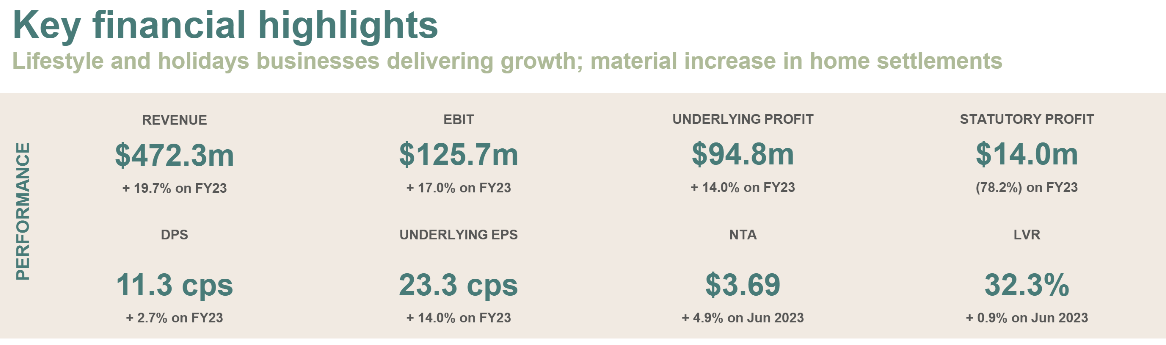

Ingenia Reports

Shares in retirement village operator Ingenia Communities [ASX:INA] are on the rise, after posting a 20% jump in revenue to $472.3 million in FY24.

In its FY24 earnings presentation, the company said it exceeded guidance after accelerating development activity and increasing average home sale prices.

Source: Ingenia

Statutory profit fell 28% to $14.0 million; however, the company noted this reflected a $96.6 million goodwill impairment relating to a 2021 acquisition.

Looking ahead, the company is targeting earnings per share of 24.4-25.6 cents for FY25 and earnings growth of 10% to 15% from FY24.

The company said it has 16 land lease communities underway and another 4 commencing development over FY25.

Shares are up by +7.5% so far today, trading at $5.47 per share.

Morning Market Update

Good morning. Charlie here.

The Australian share market looks to post another positive day as Wall Street extends its winning streak. Equities continue to rise, with their 8th straight day of gains after the massive pullback earlier this month.

The ASX 200 opened up +0.46% pushing over 8,000 to 8,017.1 this morning.

Trading volumes are around 13% lower on Wall Street, but traders are still pushing back into stocks that fell sharply just a couple of weeks ago.

The expectations of cuts seem to have pushed the bears to one side for now, as many await Jerome Powell’s speech at the US Central Bank’s key annual summit at Jackson Hole on Friday.

There, he is expected to paint his roadmap of rate cuts for the rest of the year. The speech will be on Saturday morning AEST.

On the ASX, we have earnings reports from ARB Corp, Vicinity Centres, Baby Bunting, VGI Partners, Helia Group, Deterra Royalties, Reliance Worldwide, Ansell, HUB24, Ingenia Communities, Monadelphorous Group, and Sims Ltd.

For the full list of upcoming results and a basic overview of NPAT of past earnings this season, click here for the full list.

On the commodities front, we saw a sharp drop in crude oil prices as ongoing cease-fire talks in Gaza seemed to make ground after Israeli PM Netanyahu backed the US proposal for a truce.

| Name | Value | % Chg | |

|---|---|---|---|

| Major Indices | |||

| S&P 500 | 5,608 | +0.97% |

| Dow Jones | 40,896 | +0.58% |

| NASDAQ Comp | 17,876 | +1.39% |

| Russell 2000 | 2,167 | +1.19% |

| Country Indices | |||

| UK | 8,356 | +0.54% |

| Germany | 18,421 | +0.54% |

| Euro | 4,871 | +0.64% |

| Japan | 37,388 | -1.77% |

| Hong Kong | 17,569 | +0.88% |

| Name | Value | % Chg | |

|---|---|---|---|

| Commodities (USD) | |||

| Gold | 2,504 | -0.06% | |

| Silver | 29.43 | +1.56% | |

| Iron Ore | 95.35 | +0.76% | |

| Copper | 4.1784 | -0.23% | |

| WTI Oil | 73.57 | -1.07% | |

| Currency | |||

| AUD/USD | 67.32¢ | +0.88% | |

| Cryptocurrency | |||

| Bitcoin (USD) | 59,438 | +0.73% | |

| Ethereum (USD) | 2,634 | +0.24% | |

Key Posts

-

4:41 pm — August 20, 2024

-

3:46 pm — August 20, 2024

-

2:45 pm — August 20, 2024

-

12:47 pm — August 20, 2024

-

12:37 pm — August 20, 2024

-

12:25 pm — August 20, 2024

-

11:46 am — August 20, 2024

-

11:39 am — August 20, 2024

-

10:14 am — August 20, 2024

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2026 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988