Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | ASX to Rise as US Fed Flags Three Rate Cuts; Gold Jumps

Market close update

The ASX 200 closed up +1.12% at 7,782.0 as gold miners and the Big Four banks helped lift the local market as the Fed lifted the markets spirits.

Only two of the eleven sectors finished in the red today, with Utilities -0.59% and Health Care -0.17% underperforming.

Meanwhile, thanks to solid gains amongst the big banks, Financials led the charge today, gaining +1.74%.

Notable shifts on the ASX 200 included Brainchip holdings gaining +16.67% and AFT Pharmaceuticals falling -7.72%.

Other notable market shifts were rare earth miners such as Australian Strategic Minerals which jumped over +20% after it announced a potential $909 million in debt funding commitments from the Biden Administration.

Gold surges after Fed dovish signals

Australian gold stocks basked in the radiant glow of bullion’s meteoric rise, reaching their highest peaks since January 10th.

Spot gold is up 2.12% today, trading at US$2,202.89 an ounce. This golden surge suggests that the sub-index is poised for its best performance since March 4th, should the gains hold.

The catalyst for this gilded ascent came as the US Federal Reserve held interest rates steady while signalling its intention to implement three rate cuts throughout the year.

Leading the charge, the shares of mining titan Northern Star Resources jumped 2.6%, scaling their loftiest summit since March 14th.

Evolution Mining’s stocks followed suit, climbing an impressive 5.7% to attain their highest altitude since January 16th.

Perseus Mining also rose a solid 5% to trade at $2.10 per share.

NAB Maintains November Rate Cut

National Australia Bank [ASX:NAB] is standing firm on its prediction that the Reserve Bank will implement a rate cut in November, despite the unemployment rate declining to 3.7% in February data.

According to Tapas Strickland, NAB’s head of market economics, “Today’s employment data confirms our view that the recent weakness was primarily due to a shift in seasonality, which has now been reversed.”

Strickland added, “Given that Australia only receives a complete picture of inflation, including services inflation, on a quarterly basis, and services inflation remains elevated, we believe it will take a couple more quarters of inflation data before the first potential rate cut.”

NAB stated, “We remain comfortable with our long-held forecast that the first rate cut will occur in November, followed by a gradual cutting cycle bringing rates down to 3.1 percent by the end of 2025.”

Interestingly, the Big Four have been standout gainers today with:

Commonwealth Bank +1.55%

NAB +2.51%

Westpac +1.74%

ANZ +1%.

Midday market update

The ASX 200 is up by +0.52% at 7,735.6 around midday as the market lost some of its early momentum as stronger jobs data pushed out expectations of rate cuts for some as the numbers took many by surprise.

Many had expected the numbers to be strong but not to this extent.

Total hours worked increased by 2.8% in February after falling sharply in January.

The total unemployed fell by 52,000 in February, that’s a 0.4ppts drop to 3.7% from 4.1% the prior month.

Employment was up 116,000 while the participation rate was unchanged after prior big shifts.

The takeaway here is that monthly employment numbers remain too volatile for a clearer image to be made of them.

Like the lumpy inflation we’ve seen in prior monthly figures, it will take a bit more time to get a clearer picture, no doubt the RBA will be more cautious from this, but it’s still too early to tell.

Webjet jumps

Webjet [ASX:WEB] is the market leader on the ASX 200 so far today after the company’s investor presentation day excited the market.

The share price is up by 6.2% trading at $8.46 per share as the company shows healthy signs of growth.

Management noted that WebBeds is on track to achieve total transaction value (TTV) of $4 billion in FY 2024 and then $5 billion in FY 2025. After which, it is targeting TTV of $10 billion in FY 2030 with a 50% EBITDA margin.

The company said it has laid out its ‘Pillars of Growth’ that will help it reach those targets, which involve growing its portfolio to ‘new customers, supply and markets’. Hardly groundbreaking stuff but the company is seeing solid growth.

Unemployment rate falls to six-month low

Australia’s unemployment rate fell to 3.7% in February, defying expectations as the nation added 116,500 jobs, data from the Australian Bureau of Statistics revealed.

The robust employment figures contrast with economists’ consensus forecast of a 40,000 job increase and a 4% unemployment rate.

The strong labour market data underscores the RBA’s challenges in reining in inflation.

Despite moderating price pressures, sticky services inflation prompted the central bank to maintain its stance this week.

After the release, the Australian dollar rallied against major currencies, reflecting investors’ expectations of higher interest rates.

Investors now turn their attention to the upcoming monthly Consumer Price Index (CPI) data on March 27 and retail sales figures the following day, which will further shape the RBA’s policy outlook.

Morning market update

Good morning. Charlie here,

The ASX 200 opened up +0.70% to 7,749.5 this morning as the bulls were let out of the pen following the Fed’s latest signals after leaving rates on hold overnight.

The Federal Reserve said all the usual things you’d expect from a cautious Central Bank. ‘Inflation remained high’…’sticking to the data’…’hopeful signs’ all that.

What investors were really watching was for any details that differed from this ‘say nothing’ approach.

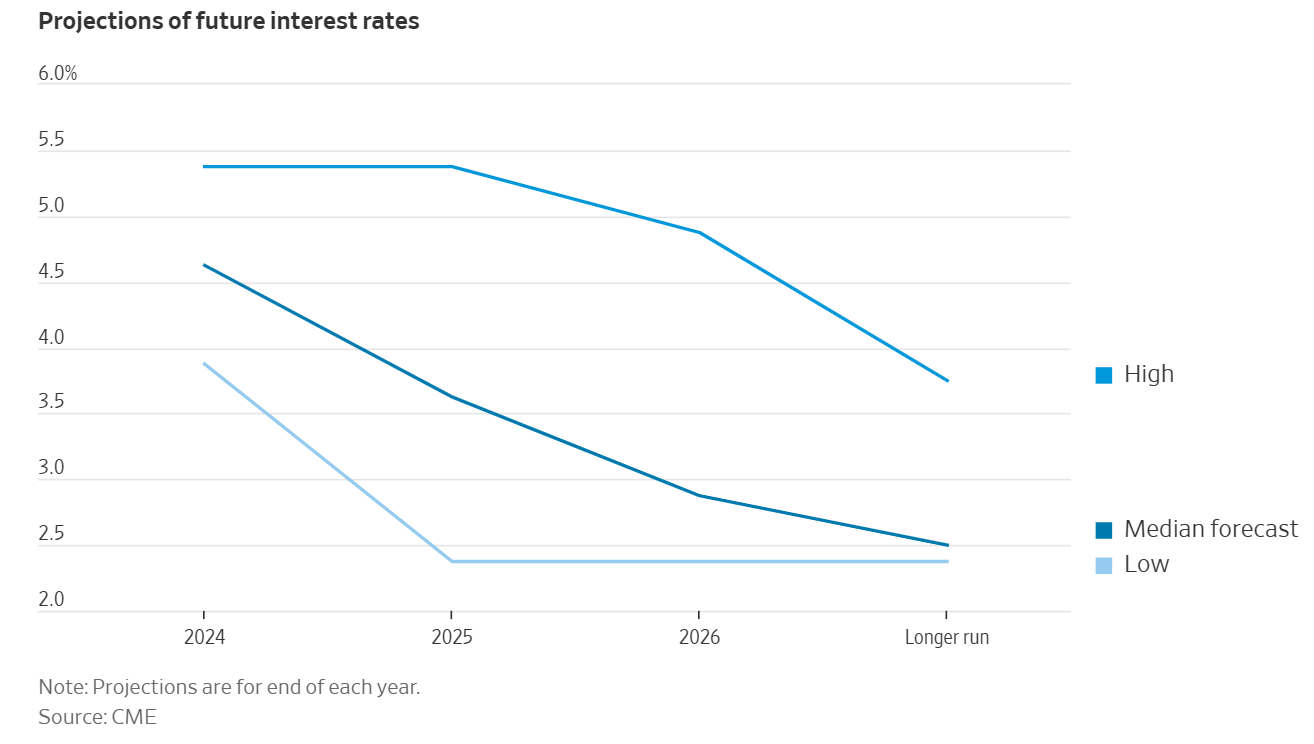

The first smaller surprise to markets (and myself) was the unchanged ‘dot plot’. The Dot plot is a collection of all of the Fed member’s projections of interest rates.

Many were expecting a shift down from potentially three cuts being the average to two. The average was on such a knife edge that it would have only required two members to shift for it to have gone down.

In the end, the Fed kept it steady with three rate cuts flagged for 2024.

The full projections can be found here.

The dots show that the Fed has slightly revised growth forecasts and slightly higher inflation for longer.

Here are the dots cleaned up into an easier-to-read form thanks to CME and WSJ.

Source: The Wall Street Journal

What this means is that officials are less anxious about entrenched inflation than perhaps the market was thinking.

The second surprising extra that especially charged the bulls was an offhand comment by J Powell.

Late in the press conference, Powell was asked about the easing of financial conditions, and he replied in a fairly uncharacteristically bullish way, saying, ‘Ultimately, we do think financial conditions are weighing on the economy,’ and said signs that the labour market is weakening shows the higher rates are working.

The irony here is now that comment will likely be enough for markets to undo much of the desired weakening he hoped for.

The S&P 500 hit a fresh record high as a response, and closer to home, we will expect markets to follow suit here.

Gold also saw strong gains, as lower future interest rates make holding non-interest accruing assets like gold more favourable.

Wall Street: S&P 500 +0.89%, Dow +1.03%, Nasdaq +1.25%.

Overseas: FTSE flat, STOXX -0.15%, Nikkei +0.66%, SSE +0.55%.

The Aussie dollar gained +0.76% to US 65.81 cents.

US 10-year bond yields -2bps to 4.27%.

Australian 10-year bond yields -6bps to 4.02%.

Gold is up +2.38% to US$2,208.5, while Silver is up +3% to US$25.62.

Bitcoin rose 7.6% to US$67,752, while Ethereum rose +8.74% to US$3,506.

Oil Brent fell -1.36% to US$86.19, while WTI Crude fell -2.42% to US$81.45.

Iron ore fell -1.3% to US$105.25 a tonne.

Key Posts

-

4:43 pm — March 21, 2024

-

2:51 pm — March 21, 2024

-

2:44 pm — March 21, 2024

-

12:34 pm — March 21, 2024

-

12:21 pm — March 21, 2024

-

12:15 pm — March 21, 2024

-

10:16 am — March 21, 2024

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2025 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988