Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | ASX to Rise as Tech Stocks Carry Market, Sayona Cuts Staff

Market close update

The ASX 200 closed up +0.48% at 7,555.4 as the Materials (+1.39%) sector carried the day with strong gains seen by MinRes, who were the top gainers today, up +6.70%.

Meanwhile, the worst-performing sectors today were Technology and Real Estate stocks (-0.40%), which fell in the afternoon after Tesla’s after-hours earnings report saw heavy selling pressure in the Nasdaq’s after-hours trading. The carmaker is currently down by -6.52% in after-hours, so expect fireworks when the US wakes up.

Another notable fall today was Domino’s Pizza, which fell over -30% after revealing that sales in its Asian stores were down nearly 10% in the first half of FY24.

As a consequence, the company pulled its guidance for FY24 and saw one of its worst days trading.

Sayona Mining also saw heavy falls today, down -10% after the lithium miner cut 14 staff at its North American site and saw the exit of its Quebec subsidiary CEO.

The company said it will continue with its operational review until the end of the Q1 CY24.

ACCC inquiry into supermarkets ongoing.

Australia’s consumer watchdog, the Australian Competition and Consumer Commission (ACCC) has said today that its inquiry into alleged supermarket price gouging by the big supermarket chains will take a year to finish.

The ACCC acknowledged that the report is important to Aussies who are struggling with cost of living, with Chair Gina Cass-Gottlieb saying:

“We know grocery prices have become a major concern for the millions of Australians experiencing cost of living pressures.”

“We will use our full range of legal powers to conduct a detailed examination of the supermarket sector, and where we identify problems or opportunities for improvement, we will carefully consider what recommendations we can make to government.”

The last time the ACCC looked at the supermarket sector was in 2008.

Back then it found over 700 restrictive lease agreements that had hampered competition in the space.

Fat Tail Launches Tech Trading Service

In big news today, we are very pleased to announce the launch of our newest service, Alpha Tech Trader.

The service is a tech-focused investing service that will guide investors through the world of investing in AI and tech stocks here and overseas.

The rapid global adoption of AI is something investors see all around them, but finding the right plays is a challenge.

For the real opportunities, we need to look beyond our borders.

This service will launch with 5 ready-to-go AI stocks and guides on how to invest in this rapidly growing space.

We will also be adding new stocks in the coming weeks and launching a trading portfolio on top of the core picks so investors can make money on the way up.

If you’re tired of sitting on the sidelines while the world invests in AI, or you want to invest in AI but not follow the same oversold plays as everyone else then..

Click here to learn how you can join Editor Ryan Dinse in trading the next wave in human history.

$1 Trillion club grows

In the past week, we have seen the addition of a new member into the 1 trillion club.

That is, companies with a market cap of over US$1 trillion dollars.

Meta joined today after once being on this list but previously declining, while Tesla was also once here.

It seems, for now, that the largest players are firmly in the tech space.

Do you think they are likely to be challenged from these positions with the growth of AI?

There are now 6 companies in the US with a market cap over $1 trillion. Meta joined the club today, crossing above $1 trillion for the first time since September 2021. During the 2022 bear market, Meta's market cap plummeted as low as $235 billion, and has since increased 326%. pic.twitter.com/cqny2R8Qof

— Charlie Bilello (@charliebilello) January 25, 2024

Dominoes [ASX:DMP] shares tank as pizza company pulls FY24 guidance

Dominoes [ASX:DMP] might be stress eating some of its pizza this afternoon after a 30% drop in its share price today.

Domino’s Pizza Enterprises has pulled its earnings guidance for FY24 after the sales of the company’s Asian stores dropped sharply in 1H24.

In its announcement today, the company said its Asian sales had fallen 8.9% in the first half of the financial year and that the drop was ‘weighing on the broader business‘.

Meanwhile, trying to remain upbeat, the company said its AU/NZ sales were its best performance in six years and attempted to highlight a raft of new product launches.

They also went on to say:

‘Our Franchisee partners in ANZ and Europe are improving average unit economics but there is more work to do, and this will remain an ongoing focus in all markets into the 2025 Financial Year.’

New Australian tax rates revealed

In the latest news from the government, the promised stage 3 tax cuts have been released. Albeit with tinkering, which pushed the benefits more towards low and middle-income earners.

The government halved the stage 3 tax cuts for the highest earners and used that money to deliver an $804 tax cut for the remainder.

Westpac chief economist Luci Ellis weighed in on cuts and changes today, saying the adjusted package is marginally more stimulatory than the original version.

Ms Ellis is the former RBA Assistant Governor (Economic) and has been seen as a translator for many bureaucratic or government decisions in the past.

Here is what she had to say about the tax cuts today:

“Past research suggests that, on average, these households tend to spend more out of every dollar of extra income than higher-income households do,” she says.

“The changes therefore redistribute more of the tax relief to people who are more likely to spend more of it.”

However, she says that by retaining the 37% bracket, “the system is not flattened out as much as originally planned.”

“This means that more households will still face some fiscal drag,” she says.

“The RBA would therefore not need to do as much in the face of strong income growth, should that emerge.”

“The big-picture issue is that households have been squeezed in recent times by a rapidly rising tax take.

“Real household incomes have been falling. Tax relief in the second half of the year goes some way to reducing the tax drag on household incomes.”

While the governments changes this week alter the distribution of the benefits, she argues “the macroeconomic impact of this – relative to the package as originally announced – is marginal”.

“We do not expect that this will affect the RBA’s view of the inflation outlook or the future path of the cash rate,” she says.

Midday market update

The ASX 200 is up by +0.14% at 7,529.5 around midday, with sectors trading almost evenly up and down today.

The best performers are Materials, up +0.73%, with strong gains by MinRes and the large-cap miners.

The major miners are up by over 1% today as iron ore prices track higher on Chinese stimulus.

Meanwhile, ASX tech stocks fell as Telsa’s earnings miss weighed on our local markets.

The worst-performing sector at midday is Real Estate, down by -0.81% with losses seen by Vincinity Centres (-2.28%) and Landlease Group (-2.22%).

Tesla stocks plunge after hours

Tesla [NASDAQ:TSLA] has seen its shares tank in after-hours trading after the company released underwhelming earnings after closing overnight.

Despite launching its Cybertruck and higher-than-expected vehicle deliveries, the company missed earnings, unable to shake off its poor third quarter.

The EV maker posted $25.1 billion in revenue and $0.71 earnings per share for the fourth quarter, missing analyst expectations of $25.76 billion in revenue.

The company’s report also said it expects the growth rate of its vehicle volume to be ‘notably lower’ in 2024 than te previous year.

Shares in after-hour trading are currently down -6.5% as two back-to-back poor quarters will clearly hang over the company.

Tesla $TSLA dumping in after hours after reporting an earnings miss pic.twitter.com/kv2vjcwBhi

— Barchart (@Barchart) January 24, 2024

January PMIs up across developed countries

America’s manufacturing PMI for January came out today, up +2.4pts to 50.3 from 47.9.

That was above the forecast of 47.9 for the month and a positive sign for manufacturers.

Similar movements are being seen across the developed world as further pandemic supply backlogs clear and future rate cuts ease some concerns.

Some gripes remain, especially around the Red Sea shipping lanes, but falling input prices and lower delivery times are generally improving sentiment.

The Global Shipping Container Index is up 23% this week to a 26-month high, so we will have to track this as the battle with the Houthi’s continues.

Composite PMIs up in January across major developed countries, but still soft

Input prices up slightly, output prices down with both well down from highs

Backlogs remaining down

Overall the PMIs remain consistent with a soft landing and falling inflation. pic.twitter.com/ZH9aXkkEcR— Shane Oliver (@ShaneOliverAMP) January 24, 2024

Fortescue Metals iron ore shipments near record high

Fortescue Metals [ASX:FMG] shares are up by +2.15%, trading at $29 per share today after the company released its December quarterly update.

The mining giant logged near-record iron ore shipments for the first half and kept its full-year forecast unchanged today.

The company continues to ramp up production at its flagship Iron Bridge Project in WA.

Fortescue Metals CEO Dino Otranto said today:

“Demand for Fortescue’s suite of iron ore products remains strong and our entry into the higher grade segment of the market through Iron Bridge has been well received with our second magnetite shipment during the quarter.”

FMG shipped 48.7 million tonnes (Mt) in the December quarter, bringing its first half shipments to 94.6 Mt, that’s the second highest in the company’s history.

However, the company reduced its FY24 shipment forecasts by a million tonnes from Iron Bridge but kept its total shipments unchanged at 192 -197 Mt.

Mineral Resources [ASX:MIN] top mover on ASX 200

On the other side of the lithium coin, we have major producer Mineral Resources [ASX:MIN] as the top mover on the ASX 200 this morning.

To counter the FUD (fear, uncertainty, doubt) seen in smaller lithium explorers, MinRes has released an upbeat quarterly report.

MinRes is up by +6.73% in trading this morning as the company reassured investors that it was still profitable at the current low lithium prices.

Lithium prices have fallen around 90% in the last 12 months, as EV demand and a flagging China add to concerns of oversupply.

The company said its volume and cost guidance remains unchanged for all its operations and showed 72 million tonnes of production for the quarter, up 9% QoQ.

The miner also said its spodumene production at Mt Marion Project had increased by 30% QoQ, and shipments were up a similar amount.

Meanwhile, in the background, MinRes owner billionaire Chris Ellison continues to buy up a growing position in a neighbouring company and recent IPO debutant Kali Metals [ASX:KM1].

When asked about the increasing stake, the response was:

“The MinRes investment in Kali Metals, which has assets in proximity to our Mt Marion and Bald Hill operations, is consistent with previous strategic acquisitions in numerous junior lithium companies with assets in the Goldfields and Pilbara regions. MinRes is confident these investments will deliver shareholder value over time.”

Sayona mining [ASX:SYA] lays off staff and CEO exits

Lithium producers face another tough day with North American miner Sayona Mining [ASX:SYA] in the spotlight today.

The company has begun undertaking an operational review of its North American Lithium (NAL) operation.

The company said today:

“This review of our Québec operations is focusing on reducing our cost base, enhancing productivity and improving Sayona’s ability to continue to produce lithium throughout the market cycle,” said James Brown, Sayona’s interim CEO

That so far has meant 14 staff members have been made redundant at its joint venture operation in Quebec.

Guy Belleau, the CEO of its Quebec subsidiary, has also left the company despite only holding the role for a year.

The company expects the review to be completed by the end of the first quarter of CY24

The share price is down by -5.68% in this morning’s trading, at $0.042 per share.

Morning market update

Good morning. Charlie here

The ASX 200 opened up +0.24% to 7,536.9, following strong earnings beats by technology stocks on Wall Street.

Earnings season in the US is now gathering pace, with tech still showing strength.

Standout earnings:

Netflix +10.7% after a double beat and a huge subscription lift.

ASML +8.85% double beat, new orders hit record high, management say outlook unchanged despite lower EV volumes.

SAP +6.9% double beat, announced ‘AI-restructure’ with plans to lay off 8,000 employees.

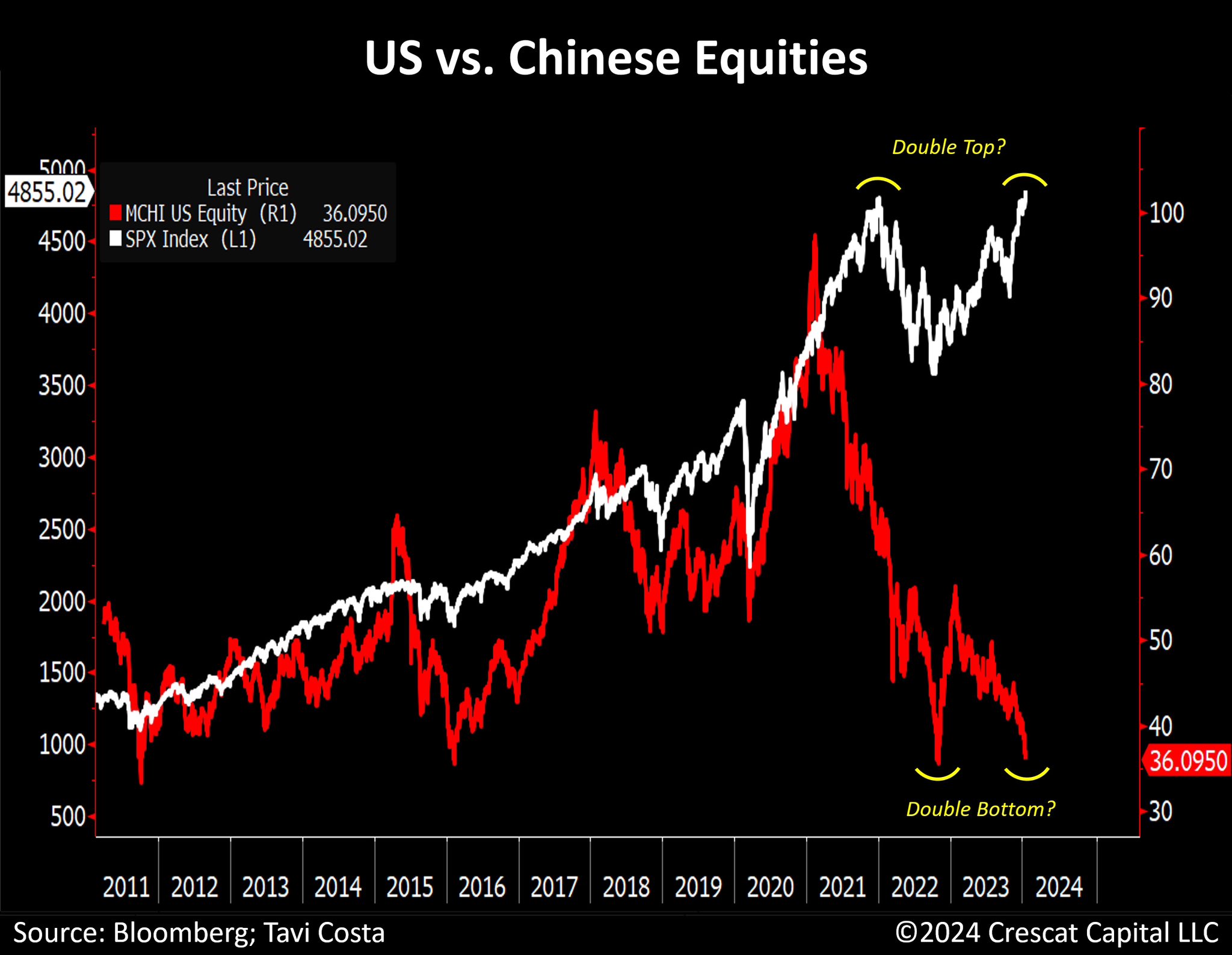

Meanwhile, in China, the ailing stock market hung over sentiment in the country with officials now scrambling to recover confidence after a fortnight of sitting on their hands.

In an unexpected move, after hinting at changing it 2 weeks ago but failing to move, the People’s Bank of China announced the lowering of the reserve requirement ratio (RRR) by 0.5pts in early February.

This allows banks to keep smaller reserve capital, allowing them to lend and is an indirect stimulus move.

With China’s equity markets at multi-decade lows, leaders also tightened restrictions on offshore investment funds and tasked its internally controlled pension funds and local government funds with buying stocks heavily.

The two markets seem on completely different tracks. Here is how it looks since 2011.

Source: Tavi Costa- Crescat Capital

Wall Street: Dow -0.26%, Nasdaq +0.36%, S&P 500 flat.

Overseas: FTSE +0.56%, STOXX +2.20%, Nikkei -0.80%, SSE +1.80%

The Aussie dollar fell -0.07% to US 65.77 cents.

US 10-year bond yields gained +2bps to 4.18%.

Australian 10-year bond yields gained +9bps to 4.28%.

Gold down -0.76% to US$2,014.10. Silver gained +0.90% to US$22.67.

Bitcoin gained +1.0% to US$39,890, while Ethereum fell -0.15% to US$2,223.

Oil Brent rose +1.02% to US$80.36, while WTI Crude rose +1.32% to US$75.35.

Iron ore gained +2.4% to US$135.15 a tonne.

Key Posts

-

4:16 pm — January 25, 2024

-

3:49 pm — January 25, 2024

-

3:30 pm — January 25, 2024

-

3:16 pm — January 25, 2024

-

2:48 pm — January 25, 2024

-

2:25 pm — January 25, 2024

-

12:55 pm — January 25, 2024

-

12:44 pm — January 25, 2024

-

12:22 pm — January 25, 2024

-

12:02 pm — January 25, 2024

-

11:26 am — January 25, 2024

-

10:46 am — January 25, 2024

-

10:14 am — January 25, 2024

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2025 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988