Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | ASX to Rise as Market Waits for CPI Numbers, Investing Legend Charlie Munger Dies at 99

Market close update

The ASX 200 closed up 0.29% at 7,035.3 today as interest rate-sensitive sectors held up the index after the weaker-than-expected monthly CPI numbers came in at 4.9% in annual terms. The analyst consensus was 5.2%.

Following the morning release of the CPI numbers, Tech, Real Estate and Consumer discretionary stocks rallied, all closing over 1% higher.

Also in interest rate news, the RBNZ kept interest rates on hold today, a move that was widely anticipated.

In ASX material stocks, gold miners were the stand-out success as the spot price of gold hit six-month highs.

Perseus Mining rose 6.7%, Northern Star gained 4.3%, and Newmont was up 5.4%.

Energy stocks were the worst performers today, down 0.8% ahead of the OPEC+ meeting tomorrow where many anticipate further cuts to supply by the cartel, although some grumbling from African members caused the meeting to be delayed, putting sell pressure on oil prices earlier in the week.

Brent is down -0.06% to US$81.63, while WTI Crude is up +0.18% to US$76.55 per barrel.

Top performers on the ASX 200 were Fisher & Paykel Healthcare up 7.87%, while the worst performer today was Graincorp, down -4.82%.

Temple & Webster up after AGM

Online homeware retailer Temple & Webster [ASX:TPW] has seen its shares jump by 16% today.

In the AGM today, the company said that its sales were up 23% from July to November over the prior period.

The company said that it was “supported by the launch of our above-the-line brand campaign in Syd, Mel & Bris which commenced on the 22nd October.”

Management seemed happy with the results. CEO, Mark Coulter, commented:

‘We continue to grow our market share at a time when the overall furniture and homewares market is down, reflecting the resilience of our business model and flexibility of our merchandising strategy. Growing our market share is a key strategic focus, which supports our goal of becoming Australia’s largest retailer of furniture and homewares. Our $30m on-market buyback has bought back 3.9m shares at a total cost of $19.9m to date. Our cash balance remains above $100m which provides significant flexibility to accelerate both organic growth and potentially inorganic opportunities.’

Market update

Softer CPI numbers encouraged trading, sending the ASX 200 up 0.32% to 7,037.5.

In the sectors, inflation-sensitive Tech gained 1.88%, while Health Care was close behind, up 1.69%.

The worst performers were Energy (-0.54%) and Financials (-0.33%).

Top performers on the ASX 200 were Fisher & Paykel Healthcare, up 7.24% after increasing revenue and profit in the first half of 2024.

Gold miners also continued to climb on the strong gold performance, with Bellevue Gold up 5.64%.

Deep Yellow falls on poor MRE upgrade

Uranium miner Deep Yellow [ASX:DYL] disappointed investors with an MRE upgrade today that failed to reach its goals of a life of mine of 30+ years for its Tumas Project.

The Namibian project saw its MRE upgrade by 11% but was lower than some were hoping. DYL’s share price fell by -5.68% today, trading at $1.038 per share.

The company says it expects a Final Investment Decision on the mine by mid-2024 and production to commence mid-2026.

Construction work rose in Australia

The latest data from the Australian Bureau of Statistics showed total construction work rose 1.3% to $64,778 million in the September quarter.

Building word done increased by 0.2% to $34,300 million, while engineering work increased by 2.6% to $30,468 million.

Source: ABS

The biggest contributors by state were Western Australia (+21.3%) and New South Wales (+12.8%), while Tasmania saw the value of construction fall by -3.2% and Victoria by -0.7%.

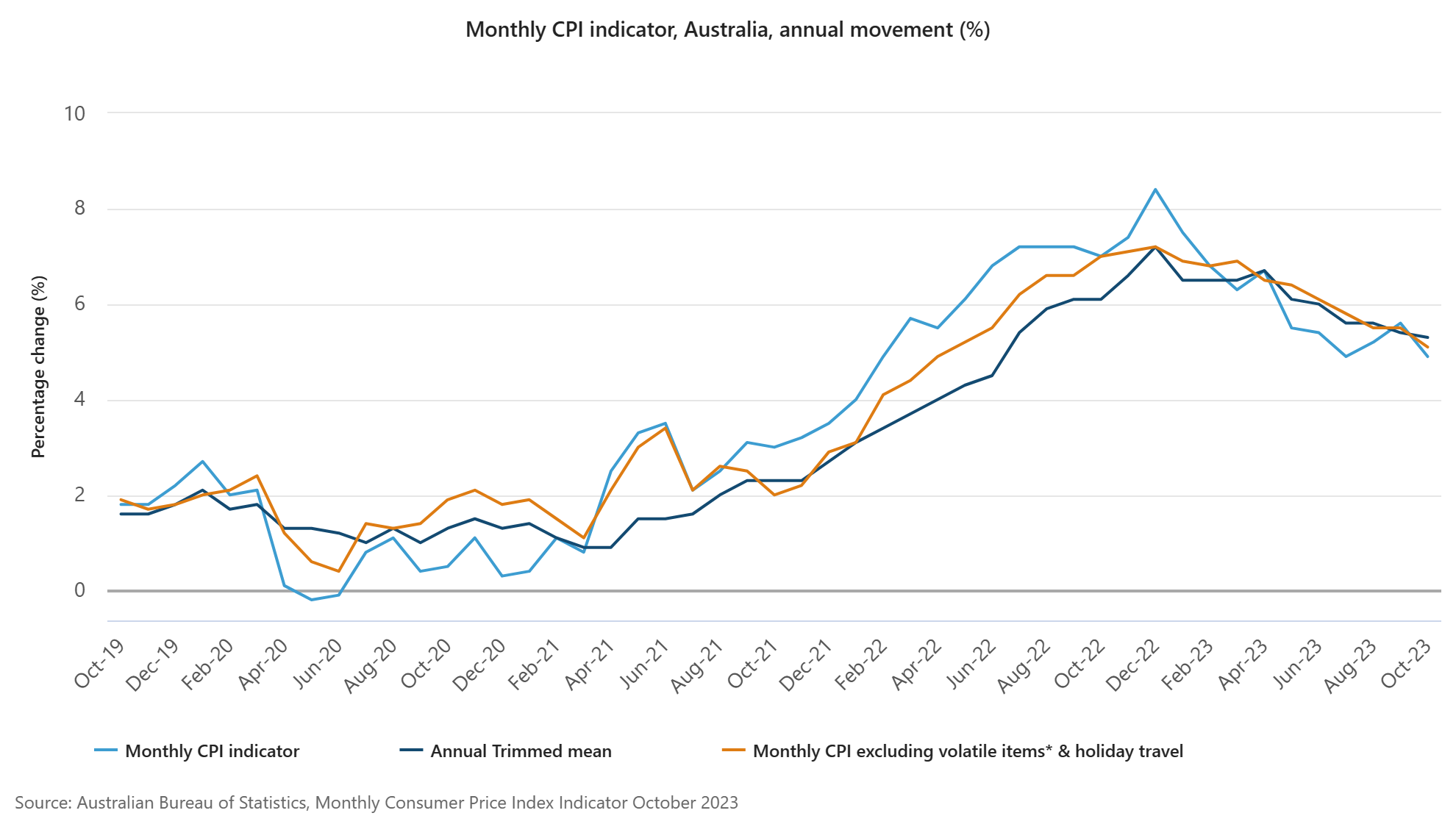

October CPI growth cools

Australia’s Consumer Price Index grew 4.9% in annual terms in October, below the analyst consensus of 5.2%.

The most significant price increases were Housing (+6.1%), Food (+5.3%), and Transport (+5.9%).

Source: ABS

The monthly indicator was down from 5.6% in September, showing progress in the battle against inflation. However, the October report gives only a partial picture as many categories— like services— which are of current concern to inflation numbers, were not surveyed this month.

The RBA will make its next decision on interest rates on December 5th, with most expecting rates to remain on hold.

EML Payments tanks

Global payments operator EML Payments [ASX:EML] has seen its shares fall over 30% this morning as the company announced a statutory loss of $284.8 million.

While the company’s revenue of $254.2 million and underlying EBITA of $37.1 million were both ahead of guidance, investors sold heavily today with the result.

EML said that much of the loss was due to large one-off items, which included $258.9 million related to the acquisition of the PFS Group and Sentenial Group.

For FY24, the company issued guidance of underlying EBITDA of $52-58 million, which would be an increase of 40-56% on FY23.

Charlie Munger passes at 99

Charlie Munger, the investing legend who helped Warren Buffet turn Berkshire Hathaway into an investment titan, has passed away 1 month from his 100th birthday.

Mr Munger was Berkshire’s vice chairman and Buffet’s right-hand man for decades as the two transformed the business from a failed textile manufacturing company into one of the largest companies in the world.

Warren Buffett, who is 93, said today:

“Berkshire Hathaway could not have been built to its present status without Charlie’s inspiration, wisdom and participation.”

While Buffet was known for his reserved nature, often holding his tongue, Charlie was known for his quick and sharp one-liners.

While Berkshire’s leaders were celebrated by its shareholders for generating huge profits, Munger played down the intelligence behind their success, saying:

“I think part of the popularity of Berkshire Hathaway is that we look like people who have found a trick,” he said in 2010. “It’s not brilliance. It’s just avoiding stupidity.”

Morning market update

Good morning all, Charlie here

The ASX 200 opened up 0.10% to 7,022.3 this morning as markets await the all-important monthly CPI numbers due at 11:30 AEST. Also due then are the quarterly construction figures, so we’ll get a better snapshot of Australia’s outlook then.

The Reserve Bank of New Zealand’s interest rate decision is due today, but it will almost certainly be another pause for the economy as it struggles to rekindle growth.

Wall Street finished up but showed some signs of weakness. The S&P 500 rallied back into positive trading in the last 30 minutes of the session.

US Dollar and bond yields continue to sell off on the bet that the Fed has finished raising rates. This should give equities more room to run, but so far, it’s modest.

Amazon announced its biggest Black Friday and Cyber Monday ever as the company extended its deals in a promotional drive to capture price-conscious consumers holding out for deals.

Wall Street: Dow +0.24%, Nasdaq +0.29%, S&P 500 +0.09%

Overseas: FTSE -0.07%, STOXX -0.15%, Nikkei -0.12%, SSE +0.23%

The Aussie dollar gained +0.67% to US 66.50 cents, a four-month high, as the US Dollar Index continues to fall.

US 10-year bond yield -7bps to 4.32%. Australian 10-year bond yields -12bps to 4.45%.

Gold is up +1.27% to US$2,040.96. Silver is up 1.44% to US$25.02.

Bitcoin rose +2.45% to US$37,960. Ethereum rose +1.78% to US$2,053.89.

Oil Brent rose +2.06% to US$81.63, while WTI Crude rose +2.22% to US$76.52.

Iron ore gained +0.20% to US$130.42.

Key Posts

-

4:36 pm — November 29, 2023

-

2:22 pm — November 29, 2023

-

2:16 pm — November 29, 2023

-

12:58 pm — November 29, 2023

-

11:58 am — November 29, 2023

-

11:51 am — November 29, 2023

-

11:43 am — November 29, 2023

-

10:19 am — November 29, 2023

-

10:05 am — November 29, 2023

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2026 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988