Investment Ideas From the Edge of the Bell Curve

ASX NEWS LIVE | ASX to Rise as Global Markets Rebound

Market close update

The Australian share market rebounded today, with CBA and Macquarie hitting record highs thanks to a UBS report that advised investors to favour bank stocks over miners.

The ASX 200 rose 0.30% to 8,011.9, led by banks and tech. Energy stocks gained despite oil price concerns. All sectors except mining closed the session higher today.

Meanwhile, Commonwealth Bank climbed 0.6% to $143.77, which is up 28% this year to a new high.

Macquarie rose 1.6% to $227.36, gaining 24% in 2024 to also reach a new record. Westpac and NAB reached seven-year highs.

Materials reversed gains after weak Chinese iron ore import data. BHP fell 0.3%, while Rio Tinto rose 0.3%.

In other major market movements, Life360 (-8.15%) and Steadfast were among the day’s biggest losers, with Steadfast dropping over 10% following allegations of misleading clients.

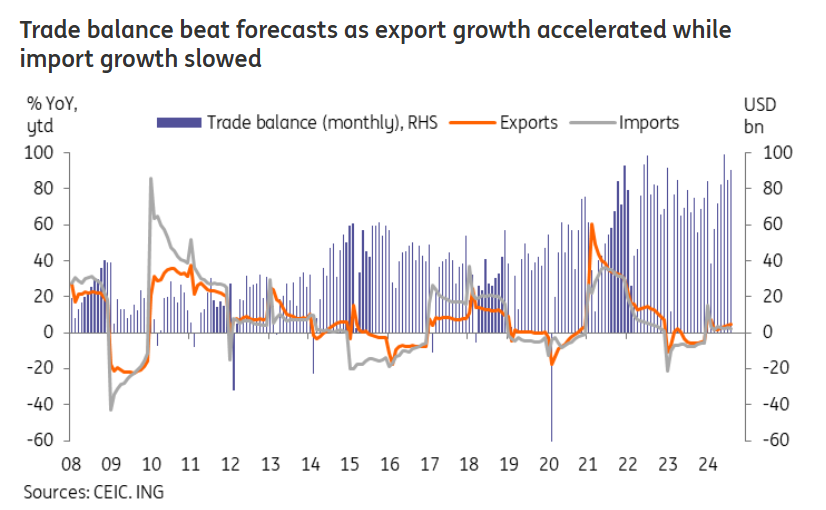

China’s exports surge, hitting 17-month high

China’s exports in US dollar terms grew 8.7% in August, the fastest rate since March last year, as companies ramped up Christmas orders and prepared for possible tariffs in case Donald Trump wins the US election.

China Customs figures showed that exports exceeded expectations for 6.5% growth, with an overall increase of 7% in July.

‘Export values grew year-on-year at the fastest pace in 17 months, with export volumes hitting record highs. We expect exports to remain robust in the near term, supported by the decline in China’s real effective exchange rate,’ said Zichun Huang of Capital Economics.

While these figures are very high, it is important to remember they came from a fairly low base.

Imports, however, grew only 0.5%, underperforming analysts’ forecasts for 2% growth and underscoring weak domestic demand in China.

‘Imports volumes fell last month, but they will probably rebound in the coming months, with strong external demand lifting imports for processing and re-export, and increased fiscal spending boosting industrial commodities demand,’ Huang said.

Trump has promised to increase tariffs if he wins in November. This could also be part of why Chinese exporters are pushing goods out heavily before then, and bracing themselves for another possible trade war.

Source: CEIC

Steadfast plummets after allegations

Strata insurance brokerage company Steadfast [ASX:SDF] is on course for its worst day of trading ever.

Shares in Steadfast are down nearly 12%, erasing the company’s 12 months of share price gains as a scandal hits.

The fall came after a Four Corners ABC report alleged the company had misled clients by sourcing a more expensive insurance policy from a Steadfast-owned firm rather than offering a cheaper option from a rival company.

There were also claims of kickbacks, phantom fees and unfair contracts by the group.

Steadfast denies the allegations, but its share price has tanked since coming out of a trading halt yesterday.

Today, 10 top consumer groups are demanding a formal inquiry into the strata management industry more broadly, with Treasurer Jim Chalmers recommending either the ACCC or the Productivity Commission conduct it, saying:

‘This action is necessary to safeguard the interests of millions of Australians currently living in strata-titled properties and to protect the interests of future strata owners.’

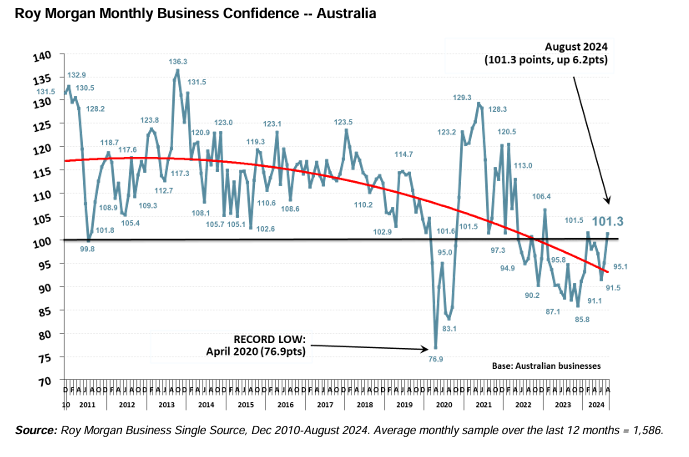

Roy Morgan Business Confidence jumps 6.2pts

The Roy Morgan business confidence survey had some more positive signs than the consumer one earlier today.

Business confidence rose 6.2pts to 101.3 for August.

This could be attributed to the Stage 3 tax cuts or expectations that interest rate cuts are coming sooner, rather than later.

Now a majority (56.4%), up 7.1% of businesses, expect there will be ‘good times ahead‘ for the Australian economy in the next year, compared to only 41.7% expecting bad.

Looking longer-term, businesses are still generally pessimistic for the next five years, with 56.2% (down 4.7%) expecting worse times, compared to 29.1% expecting good.

With today’s bump business confidence now sits 9.9pts below the long-term average of 111.2.

Source: Roy Morgan

Latest Fat Tail Daily Video

Here’s the latest from the new Fat Tail Daily video series.

Publisher James ‘Woody’ Woodburn will be sitting down with our Fat Tail Daily editors daily to discuss the key trends and offer unique insights into market movements.

If you have any thoughts about the length, format, or topics you would like discussed, send us an email at support@fattail.com.au with the subject header: ‘Fat Tail Daily Video Feedback’.

Thanks, and enjoy today’s discussion with Australian Gold Report Editor, Brian Chu.

In 1989, Brian left Hong Kong to escape the prospect of Chinese rule.

Today, he reflects on his 35 years in Australia, the good and the bad.

He believes that while the country is going down the wrong path, it’s possible to turn this around.

Going back to the basics of financial responsibility, valuing family values and avoiding instant gratification.

Midday market update

The ASX 200 is up by +0.68% to 8,042.7 around noon as global markets recovered from last weeks heavy selling.

Overnight Wall St closed over a percent higher as traders upped their bets of double cuts potentially coming in September’s FOMC meeting by the Federal Reserve.

On the Aussie share market, financials (+1.17%) are the top sector, while all 11 sectors are green today.

The gains from financials have seen Commbank and Macquarie both hit new record highs as a report from UBS recommended banking stocks over miners, saying the former is more likely to hold their value in the coming months.

Commodity prices also lifted overnight, with spot gold prices climbing over US$2,500 an ounce and helping local gold producers.

Iron ore futures climbed from their 22-month low yesterday, gaining 1% to US$91.35 per tonne. Helping lift BHP by 0.4% in trading so far today.

Commbank and Macquarie climb to record highs

All the major banks are up today with Commonwealth Bank [ASX:CBA] and Macquarie Group [ASX:MQG] climbing to new record highs.

The moves come as UBS wrote a report that said investors should choose bank stocks over miners.

The reasoning, according to the note, was that banks ‘are more likely to hold their valuations.’

With commodity prices regaining ground today we’ve also seen gains from the major miners, but many remain sceptical about China’s recovery.

APRA proposes new bank rules to withstand crises

The Australian Prudential Regulation Authority (APRA) has introduced plans to overhaul banks’ capital framework, focusing on changing hybrid instruments.

The initiative aims to help capital flow during crises and streamline bank resolution processes.

This is because these hybrid instruments are very complex and can take time to resolve. Time is something banks lack in crises.

The proposal involves phasing out AT1 capital instruments (hybrid bonds) in favour of more reliable capital forms while maintaining overall capital requirements.

Large international banks would replace AT1 with a mix of Tier 2 and Common Equity Tier 1 capital, while smaller banks would substitute AT1 entirely with Tier 2 capital.

APRA Chairman John Lonsdale stressed the importance of these measures in protecting depositors and ensuring financial stability, saying:

‘The purpose of AT1 is to stabilise a bank so that it can continue to operate as a going concern during a period of stress, and support resolution with the capital that is needed to prevent a disorderly failure.’

‘Unfortunately, international experience has shown that AT1 does not fulfil this function in a crisis situation due to the complexity of using it, the potential for legal challenges and the risk of causing contagion. These risks are heightened in the Australian context due to the unusually high proportion of AT1 held by retail investors.’

Super Retail Group faces strikes at warehouses

Super Retail Group [ASX:SUL] the retail conglomerate known for running Rebel Sport, Macpac, and Supercheap Auto is facing strikes today.

The company has seen warehouse strikes from 100 of its Victorian workers over job security and pay.

The group has also faced media scrutiny after allegations of an inappropriate relationship between the CEO and a senior executive that also involved company funds.

Super Retail has denied these claims and is heading to court over the allegations.

UWU National Secretary Tim Kennedy referenced the recent scandal in a press statement:

‘This is a company that can’t afford more bad press. It can afford, however, to pay workers fairly.’

‘Workers at SRG are asking for a cost-of-living pay increase and respect: a fair day’s pay for a fair day’s work, and for everyone who is working the same job, to receive the same pay.’

‘This is an opportunity for the CEO to do the right thing by those who helped make SRG’s billions possible.’

Qantas offers 10-year bond with yield near 6%

Australia’s flagship airline, Qantas [ASX:QAN], has introduced a 10-year fixed-rate bond today.

The offer is scheduled to close around noon today.

While the total bond size remains undisclosed, investor interest has been strong so far, with bids already reaching $1.1 billion.

The indicative bond yield ranges from 6.035% to 6.085%, representing a margin of 210 to 215 basis points over swaps.

Moody’s is expected to assign a BAA2 rating to the bond.

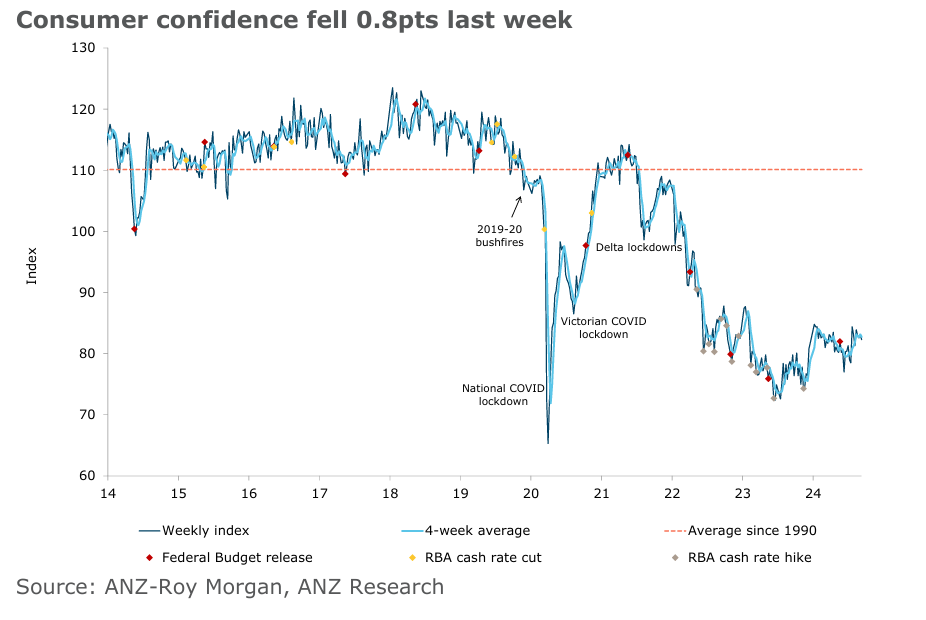

Consumer confidence remains low

The ANZ-Roy Morgan Consumer Confidence survey was released today, showing the widespread pessimism in the Australian market.

Consumer confidence fell by 0.8 points to 82.3 this week. Consumer confidence has now spent a record 84 straight weeks below the 85 mark.

Fewer than one in ten Australians (9%) expect ‘good times’ for the Australian economy over the next 12 months.

Compared to the over one-third (+34%) that expect ‘bad times’ over the same period.

Source: ANZ-Roy Morgan

ANZ Economist Madeline Dunk, commented:

‘The trend in ANZ-Roy Morgan Australian Consumer Confidence has plateaued, with the four-week moving average largely steady since early August. Weekly confidence is currently 2.1pts below the July peak of 84.4pts, which marked a six-month high in the series. The Stage 3 tax cuts and cost-of-living relief do not appear to be progressively boosting households’ confidence.’

‘We are, however, seeing a sustained improvement in inflation expectations which were stable at a 32-month low of 4.6%. Lower petrol prices may be supporting this shift. The result is likely be welcomed by the RBA, with Governor Bullock noting last week that having well-anchored inflation expectations helps to stabilise the economy, support economic growth and create more jobs.’

Morning Market Update

Good morning. Charlie here.

The ASX 200 opened up by +0.57% to 8,033.6 as Wall St rebounded after its worst week this year. It seemed that market’s fears of a wider recession were eased for now however questions remain about the Fed’s next September rates cut.

Bond markets and traders are increasing their bets that it could be a double cut (0.5bps) rather than the usual 0.25bps; however, so far, the Fed has been tight-lipped.

Currently, the market is pricing a 27% chance that the cut will be a double as markets increasingly believe the Fed is too late with its cuts and could cause a recession.

Beyond that, commodity prices improved overnight, helping lift the mining sector this morning, but so far leading the charge are financials, with the big banks the early gainers.

| Name | Value | % Chg | |

|---|---|---|---|

| Major Indices | |||

| S&P 500 | 5,471 | +1.16% |

| Dow Jones | 40,829 | +1.20% |

| NASDAQ Comp | 16,884 | +1.16% |

| Russell 2000 | 2,097 | +0.30% |

| Country Indices | |||

| UK | 8,270 | +1.09% |

| Germany | 18,443 | +0.77% |

| Euro | 4,778 | +0.89% |

| Japan | 36,306 | +0.25% |

| Hong Kong | 17,196 | -1.42% |

| Name | Value | % Chg | |

|---|---|---|---|

| Commodities (USD) | |||

| Gold | 2,506 | +0.38% | |

| Silver | 28.29 | +1.13% | |

| Iron Ore | 92.70 | +1.01% | |

| Copper | 4.0739 | +1.71% | |

| WTI Oil | 68.71 | +1.55% | |

| Currency | |||

| AUD/USD | 66.64¢ | -0.09% | |

| Cryptocurrency | |||

| Bitcoin (USD) | 57,120 | +4.31% | |

| Ethereum (USD) | 2,357 | +2.29% | |

Key Posts

-

4:42 pm — September 10, 2024

-

3:25 pm — September 10, 2024

-

3:05 pm — September 10, 2024

-

2:20 pm — September 10, 2024

-

1:52 pm — September 10, 2024

-

12:44 pm — September 10, 2024

-

12:10 pm — September 10, 2024

-

11:50 am — September 10, 2024

-

11:20 am — September 10, 2024

-

10:58 am — September 10, 2024

-

10:53 am — September 10, 2024

-

10:30 am — September 10, 2024

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2025 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988