Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | ASX to Rise along with Iron Ore Prices, CBA Posts $2.5b Quarter Profit, Telstra Affirms Guidance

Market close update

The ASX 200 closed up 0.83% today, breaking 7,006.7. Most sectors were in the green this afternoon with only Telecoms (-0.79%) and Utilities (-1.11%) down at the bell.

Telecoms were dragged down by drops in Telstra (-2.03%), which failed to wow investors with its latest strategy of new Intercity fibre routes and middling results despite strong tailwinds that include picking up customers following the Optus outages last week.

In Utilities Origin (-3.19%) and Mercury NZ (-3.88%) both saw heavy losses today. For Origin, the deathblow of the deal seems near, with AusSuper increasing its stake in the company to 16.5% in the run-up to the shareholder vote to decide the fate of the takeover deal.

The biggest gainers today were within Energy (+2.54%), which recovered along with oil prices that had previously fallen as oil dropped with concerns about global macroeconomics. Woodside Energy gained +2.55%, while Santos gained +2.54%. Beach Energy and Paladin Energy also had strong gains with both rising over 5%.

Iron Ore futures eased throughout the session today as property-sector stimulus in China was balanced out by weaker demand seen for steel. On the Singapore Exchange, the December prices saw a -0.55% drop to US$127.45.

AustralianSuper increases stake in Origin Energy to 16.5%

Origin’s largest majority shareholder AusSuper, has further increased its stake in the energy giant, hitting 16.5%.

The purchase comes after Origin’s stock price sees a sizable downturn after signs of the buyout offer by North American conglomerate Brookfield-EIG looks to be hanging by a thread.

Origin fell by 3.2% to $8.50 at close today, offering AusSuper a great buying opportunity to pick up more stocks before the crucial vote on the offer coming later this month.

OFX Group sees heavy losses

OFX Group [ASX:OFX] is among one of the worst performers today as the online international payments company struggled to wow investors in its 1HFY24 results.

Shares in OFX are down by -12%, trading at $1.35 per share as the company continues to slide. OFX are down nearly -50% in 2023.

The company saw its underlying EBITDA rise 1.6% to $31.8 million, with a notable 84% increase in its recurring revenue.

The company failed to hit growth targets in its North American revenue, which the company blamed on lower corporate confidence driving down the ATVs.

Despite this, the company said it had an optimistic outlook and expected the second half of the year to be stronger than the first. It pointed to growing momentum in the business domain, with B2B revenue up 6.8% and expanding margins.

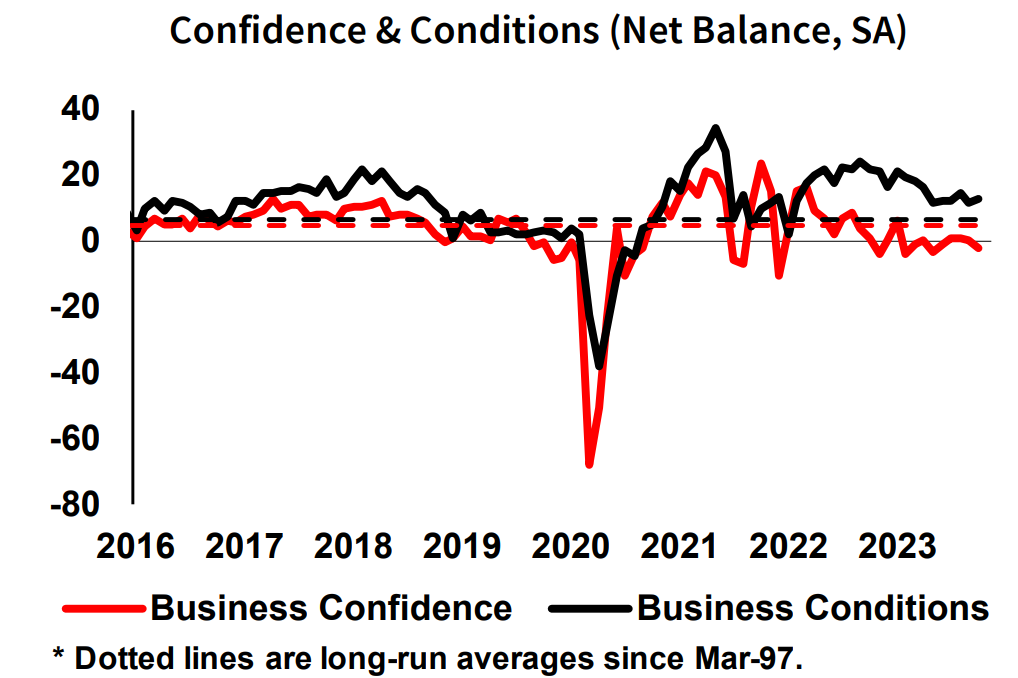

Business confidence fell but higher than consumers

Businesses seem to be a bit more cheery than consumers, with the NAB’s business survey out today.

In the survey, business conditions held through October even as confidence slipped slightly following the RBA’s rate rise.

The NAB survey showed its index of business conditions rose 1 point to +13 in October. In contrast, confidence fell 2 points to -2, which is now into negative sentiment territory.

Source: NAB

NAB’s Chief Economist Alan Oster gave a good overview of the results today, noting that:

‘Business conditions remain healthy, picking up in October and still well above average. Businesses clearly remain cautious about the outlook for the economy despite the resilience we are seeing.‘

Under conditions, he noted that there is still a high level of consumer demand for services, although forward orders fell 2 points to 0.

The survey did note some easing in cost pressures from the high levels seen in the last month. For now, inflation appears to be sticky within the market but is moving in the right direction.

‘Inflation had been persistent through the middle of the year and the survey suggests this remained the case heading into Q4 [the fourth quarter’ said Mr Oster.

‘We still expect to see gradual moderation over time but it will be a protracted process, especially given the resilience of domestic demand thus far.’

Consumer confidence sinks to lows seen in COVID and GFC

The latest Westpac-Melbourne Institute consumer confidence index shows sentiment fell -2.6% to 79.9 points in November.

That’s around levels not seen since the pandemic as the latest round of interest rate rises weigh on households.

Any score below 100 is considered pessimistic by the index, which has seen a sharp drop during this year.

Source: Westpac Economics

Westpac’s Senior Economist, Matthew Hassan commented on today’s result, saying:

‘The RBA’s November rate hike has put renewed pressure on family finances and reignited concerns about both the rising cost of living and the prospect of further rate rises to come,” said Westpac senior economist Matthew Hassan.’

‘Previous months had been showing some tentative signs that sentiment was starting to lift out of the deep pessimism that has prevailed since the middle of last year.’

‘That rally looks to have been cut short before it even really began.’

‘Consumers remain wary of the potential for more rises. Responses point to another “penny-pinching” Christmas this year with nearly 40% of consumers planning to spend less on gifts.’

Midday market update

The ASX 200 is up 0.61% to 6,991.4 around midday in a broad-based rally, which has most sectors up in the green except Utilites (-1.49%) and Telecoms (-0.76%).

Both of these sectors are dragged down by the poor performance of Origin (-3.02%) and Telstra (-1.27%).

Origin has faced further selling pressure after AusSuper rejected an eleventh-hour offer by the Bookfield-led consortium to take part in the $20 billion buyout of Origin, which they rejected within hours of receiving.

Telstra has seen selling pressure today despite confirming underlying earnings of $8.2−8.4 billion and total income of $22.8−24.8 billion for FY24.

It appears investors were not impressed by the presentation today by the unveiling of its plans to build five new major Intercity fibre routes.

In the announcement, the company said:

‘As the largest investor in digital infrastructure in Australia we are uniquely positioned to design and deliver this critical infrastructure, which will enable ultrafast connectivity between capital cities. Importantly, we have future-proofed the design and given ourselves the ability to extend this connectivity into regional and remote communities as demand grows and other partnerships arise, which will open up opportunities for regionally based industries and businesses.’

ASX 200 strong opening

A rocketing opening for the ASX 200 up 0.87% in the first minutes of opening today with strong gains through commodity stocks today with gains through oil, and iron ore. Here’s a good overview here.

Across the Forex the Aussie dollar gains across most of our major trading partners as these commodities strengthen.

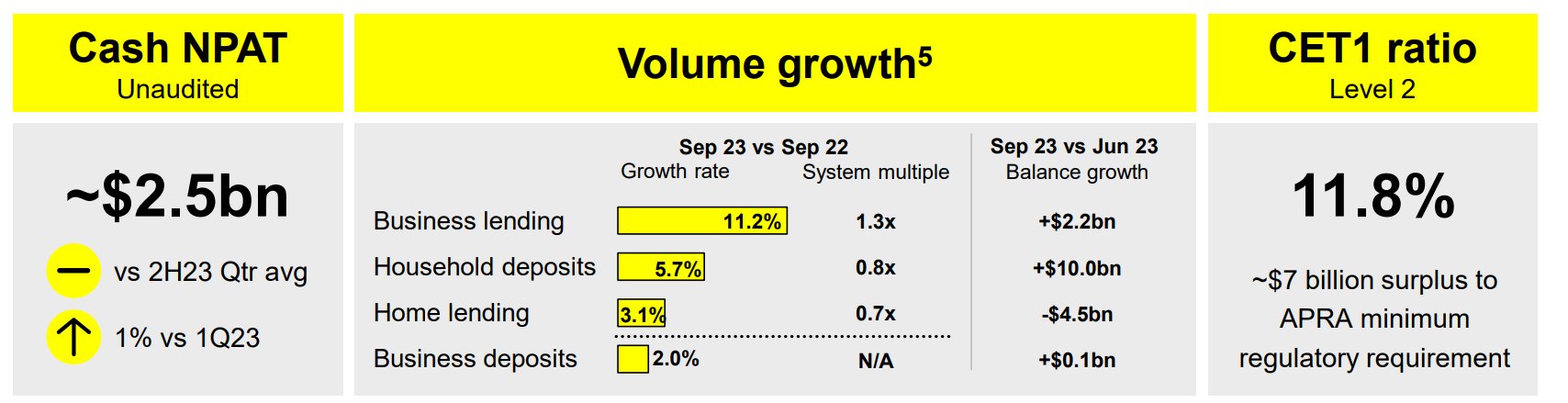

Commonwealth Bank $2.5b first quarter profit

In its latest trading update, Commonwealth Bank [ASX:CBA] said it will continue to focus on customers as it continues its ‘disciplined strategic execution’.

What this actually looks like is flat growth on NPAT while maintaining fairly solid capital positions. Troubled or impaired assets are down to 0.49% -2bps from the prior quarter, while competition heats up within the Big Four in deposits.

CBA had slower growth in home loans and household deposits for the quarter but still managed to pull in an unaudited $2.5 billion in cash profits.

CBA is trading at 17x forward earnings, which puts it around 30-40% more than the other banks, with around zero profit growth and competition heating up so it looks rather expensive at this point.

Source: CBA First Quarter Trading Update

Market morning

Good morning all, Charlie here

The ASX 200 Futures point to a rise this morning after a mixed session on Wall St overnight. Both the US dollar and US bond yields lost early strength in the session to close lower.

Between rising expectations of interest rate hikes and caution before upcoming inflation data, the market lost momentum.

For the Australian market, rising Iron ore prices are likely to lift the benchmarks as a Goldman Sachs report flagged a shortage of iron ore for the rest of the year.

‘Rather than facing a surplus for this year, the iron ore market is now set for a clear deficit,’ Goldman said in its report.

The analysts noted that the size of China’s recent fiscal spending could also be a positive sign.

US 10-year bond yield fell -1bsp -4.64%. Australian 10-year bond yields rose +5bps to 4.67%.

Wall Street: Dow +0.16%, Nasdaq -0.22%, S&P 500 flat

Overseas: FTSE +0.89%, STOXX +0.83%, Nikkei flat, SSE +0.25%

Gold is up +0.40% today, putting its last month at a 1% gain to US$1,946.13. Silver was flat at US$22.31.

The Aussie dollar rose +0.24% to US63.75 cents, gaining with Iron ore prices and the USD weakening.

Bitcoin is down -1.88% to US$36,482.60. Despite the tumble, the trend is still significantly moving upwards. The crypto fear and greed index is currently showing 72, which is considered ‘greed’ levels.

Oil prices are up today but are still down over -10% for the month. Brent rose +1.61% to US$82.72, while WTI Crude rose +1.80% to US$78.56.

Iron ore rose +0.39% to US$128.07, continuing its climb after Goldman Sach’s report of a ‘clear deficit’.

The world’s top steelmaker, Guo Bin, President of state-run China Minerals Resource Group, said that iron ore prices are ‘unreasonable’ at this level.

Key Posts

-

4:47 pm — November 14, 2023

-

4:27 pm — November 14, 2023

-

2:05 pm — November 14, 2023

-

1:55 pm — November 14, 2023

-

1:44 pm — November 14, 2023

-

12:58 pm — November 14, 2023

-

10:16 am — November 14, 2023

-

10:05 am — November 14, 2023

-

9:44 am — November 14, 2023

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2024 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988