Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | ASX to Rise after Booming US Jobs Data; Beach Energy, Ansell, WGX Feature

Market close update

The ASX 200 closed up +0.20% in a fairly rangebound day that saw most sectors gain today, although Energy (-1.24%) and Staples (-0.98%) mega-caps held the benchmark back from wider gains.

Technology (+1.19%) was the top-performing sector today, thanks in large part to stunning gains by Life360 (+16.80%), which has seen further success in the adoption of its family member tracking app for young drivers.

Oil prices dropped through the session today, with Brent falling -1.27%. This brought down the larger oil and gas players, with Santos falling -1% and Woodside Energy down -1.63% at the close.

Beach Energy also had a tough day on the index, falling -15% after reporting quality issues and delays at the commissioning of its Waitsia Plant which is now due to begin production in CY25.

Meanwhile, Iron ore bounced back above US$100 a tonne on renewed speculation that China’s demand may pick up following stimulus and a return from a long weekend in China.

In other individual stock moves, APM Human Services tumbled nearly -30% after warning of weaker profits and a downward revised offer from its largest shareholder, Madison Dearborn Partners, over the weekend.

Gold Fever: China Extends Bullion Buying Spree

China’s insatiable appetite for gold shows no signs of waning as the world’s second-largest economy added to its bullion reserves for the 17th consecutive month in March.

As the tussle between economic superpowers intensifies and geopolitical tensions rise in the Middle East, gold’s safe-haven allure has arguably never been more pronounced.

The latest data from the People’s Bank of China revealed that the nation’s gold holdings rose by 0.2% to 72.74 million ounces last month, marking the smallest increase during this buying binge that started in November 2022.

Gold’s allure has intensified in recent months, with prices scaling record peaks fueled by expectations of lower U.S. interest rates and sustained central bank buying.

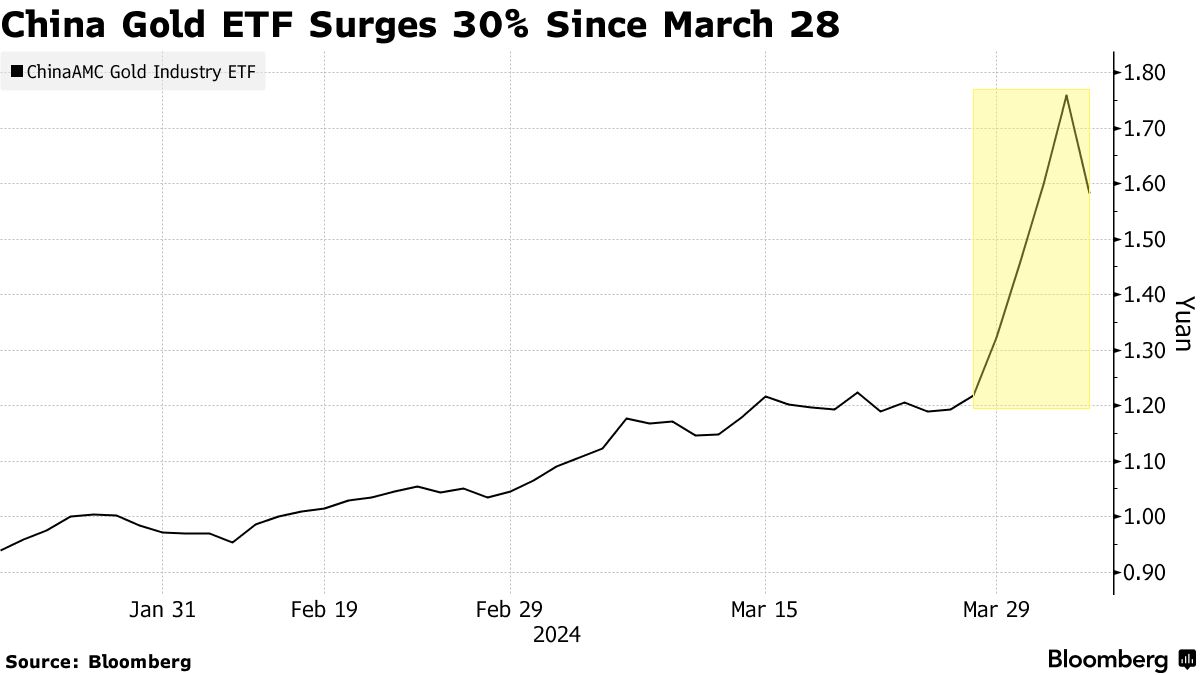

Chinese consumers have also been joining the gold frenzy, with Gold-ETFs surging in recent weeks.

Source: Bloomberg

China, alongside India, has been at the vanguard of this central bank gold-accumulation trend, which has bolstered the precious metal’s strength since 2022.

While the World Gold Council’s February data indicated a 58% month-on-month decline in global central bank gold purchases, partly due to higher sales volumes, China’s unwavering commitment to fortifying its bullion reserves highlights the nation’s strategic thrust toward ‘de-dollering’ its foreign exchange holdings.

If you want to learn how you can take advantage of these movements beyond just buying gold, then CLICK HERE for more information.

Life360

Technology company Life360 [ASX:360] is experiencing a remarkable surge in its stock price today, with shares soaring 17% to reach $14.19.

This rally is being driven by the recently announced financial results for the first quarter of the year, where the company revealed it exceeded market expectations by attracting a record-breaking 4.8 million active users during this period.

This is its second recent surge after the company’s shares jumped in February after the company revealed it intended to add advertising to its free app.

Ansell lines up $974m deal

Ansell [ASX:ANN] shares are currently on halt after the company released news of a planned bid for equipment manufacturer Kimberly-Clark worth $974 million.

The deal is outlined in their most recent investor presentation and also involves a $400 million capital raising.

Market update

The ASX 200 sits up +0.12% this afternoon, trading at 7,782.8 as mega-caps Woodside Energy (-1.57%) and Santos (-0.57%) drag the benchmark down.

Energy stocks and Staples are the main underperformers today with both down slightly over 1% as oil prices fell slightly after a strong run last week.

Tech is the major performing sector this afternoon, up +1.17%. Life360 gained 16.89% today, as well as solid gains from Wisetech Global, +0.97%.

Westgold and Karoroa to merge

Westgold [ASX:WGX] emerged as the suitor to buy Canadian-listed Karora Resources to become a 400,000oz+ producer today.

After failing to buy Gascoyne in 2021 and losing to Ramelius Resources for Musgrave Minerals, WGX has been the lookout for a M&A for some time.

Here is the breakdown of the new gold producer. Interestingly, Westgold beats Ramelius Resources to the gates to break above 300,000oz a year.

Shares in Westgold are up by +1.30% to $2.33 in trading this morning, with the stock now up +57% for the past 12 months.

Elders sees heavy drops

Australian Agribusiness Elders [ASX:ELD] has seen its shares collapse in trading this morning as the company released a trading update that outlined the challenges in agriculture at the moment.

Shares are down by almost -25%, trading at $7.39 as the company said the first-half of the years’s trading has been ‘significantly below expectations‘.

The company blamed these three main drivers for the hard year so far:

- Client sentiment was dampened following the Bureau of Meteorology’s El Niño declaration, negatively impacting the first quarter.

- Lower crop protection prices compared to the same period last year resulted in reduced sales revenue and margins.

- Cattle and sheep prices were significantly below their 10-year averages, particularly hurting the first-quarter performance.

- Trading was sluggish in March due to a delayed start of the winter crop season in the key Western Australia broadacre market.

- Certain key agricultural chemical products experienced margin pressure as prices rose.

The company said that the outlook for FY24 winter crops in most religions had improved, which should push sales into the second half of FY24.

Underlying EBIT is expected to be between $120 million and $140 million for the full year FY24.

Beach Energy shares tanks on issues at Waitsia Plant

Oil and gas company Beach Energy [ASX:BPT] is down by -18% in trading this morning as the company faces trouble at one of its sites.

Beach had already identifited ‘quality issues during pre-commissioning of its systems at the Waitsia Gas Plant‘ but has now advised that further quality issues are emerging as activities progress.

The Waitsia Joint Venture has given its first estimate of pushed back timelines and increased costs due to the issues.

The site is now expecting first gas by early-CY2025 (previously mid-CY2024), with a planned three-month production ramp up thereafter.

Total capital expenditure is now $600-650 million net to Beach (was previously $450-500 million).

Added processing costs due to the delay of first gas target will also be incurred in FY25.

Managing Director and CEO Brett Woods said:

“It is extremely disappointing to be continually encountering quality and execution issues given the late stage of the project. Having to redirect existing onsite labour to remedial works is slowing the progress of pre-commissioning activities, resulting in further delay and cost increases.”

Morning market update

Good morning. Charlie here,

The ASX 200 opened up +0.25% to 7,792.4 as US markets bounced on Friday from surprisingly strong jobs data batting away concerns about a hidden looming recession.

March US payrolls handily beat expectations, with nonfarm payrolls increasing by 303,000 jobs. Economists polled by Reuters had expected 200,000 jobs for the month, so the increase was a hopeful sign for many of real strength in the US economy.

Unemployment fell to 3.8%, while wages also steadily increased in March. The strong jobs data may increase the chance of later rate cuts in the eyes of many, as recent talks of interest rate cuts coming later by the Fed meant Wall St finished the week down.

Major US benchmarks closed down for the week: Russell 2000 down -2.87%, Dow down -2.27%, S&P 500 down -0.95%, Nasdaq down -0.80%.

Also being closely watched by traders are climbing commodity prices. Gold finished last week up 4.8%, its best week since October, pushing the price over US$2,300 per ounce.

Copper prices finished the week up 5.7%, near a two-year high, while geopolitical tensions also pushed up oil prices, with Brent over US$90 per barrel.

Wall Street: S&P 500 +1.11%, Dow +0.80%, Nasdaq +1.24%.

Overseas: FTSE -0.81%, STOXX -1.10%, Nikkei -1.96%, SSE -0.18%.

The Aussie dollar fell -0.08% to US 65.72 cents.

US 10-year bond yields +9bps at 4.40%.

Australian 10-year bond yields flat at 4.18%.

Gold fell -0.75% to US$2,312.39, while Silver fell -0.98% to US$27.17.

Bitcoin rose +0.54% to US$69,348, while Ethereum rose +2.75% to US$3,449.

Oil Brent fell -0.34% to US$90.86, while WTI Crude rose +0.16% to US$86.73.

Iron ore fell -0.9% to US$96.85 a tonne.

Key Posts

-

4:43 pm — April 8, 2024

-

3:51 pm — April 8, 2024

-

2:46 pm — April 8, 2024

-

2:32 pm — April 8, 2024

-

2:24 pm — April 8, 2024

-

11:57 am — April 8, 2024

-

11:52 am — April 8, 2024

-

11:01 am — April 8, 2024

-

10:27 am — April 8, 2024

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2024 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988