Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | ASX to Rally with Global Markets as Fed Keeps Rates Steady, Origin takeover bid raised to $19.9b

Market close update

ASX 200 closed up 0.91% today to 6,900.3. A strong rally on the back of the Fed’s decision to keep interest rates on hold at 5.25-2.5%.

Interest rate-sensitive sectors were up the most on the news, with Tech (+3.23%) and Real Estate (+2.36%) the biggest gainers today, mirroring movements seen on Wall Street.

The Big Four banks recovered from losses seen earlier in the week, with all up more than 1.5% today.

Utilities (-3.83%) and Energy (-2.04%) were the worst performers today and the only two sectors in the red at close as oil prices stayed low.

The sectors were brought down by the poor performance of Origin today, which fell -6.4 % to $8.50 after major shareholder AustralianSuper rejected the improved takeover bid offer from North American conglomerate Brookfield and EIG. The offer was described as its ‘best and final offer’, so who knows where things go form here, probably further down.

CSR closed down 1.6% after bouncing higher earlier in the day after posting strong revenue from its building products business, however, as the day went on, concerns about the aluminium business downgrade due to cost pressures brought the company into the red.

Sayona Mining shares jumped after trading near a two-year low earlier in the week as the company announced positive results from its latest drilling campaign at its flagship North American Lithium Project in Quebec, Canada.

Finally the Aussie Dollar was worth mentioning as its surge continued over trading, up 0.48% to US 64.22 cents as traders speculate that US interest rates may have peaked, while the RBA may raise next week.

SSR Mining shares tank as third quarter results dissapoint

SSR Mining [ASX:SSR] has seen its share tumble over 15% today as its third-quarter results pointed towards only making the low end of production guidance for 2024.

That would be production around 700,000/oz, which has disappointed investors who were hoping for more.

The company reported year-to-date gold production of 495,688/oz at the cost of sales of $1,173 and all-in-sustaining costs (ASIC) of $1,516 per ounce.

Rod Antal, Executive Chairman of SSR Mining, said:

‘The third quarter of 2023 featured strong operating and financial results that were well aligned to our forecasts, including record production from Marigold and record throughput at Puna. In addition, first ore from Çakmaktepe Extension was accessed late in the quarter, and the project is on track to deliver initial production of 10,000 to 15,000 ounces in the fourth quarter of 2023 as planned. The results to date continue to put us on track for the lower end of our production guidance in 2023.’

Bravura Solutions woos shareholders

Wealth management software company Bravura Solutions [ASX:BVS] managed to excite investors in its AGM today.

The company highlighted changes in leadership at the general meeting and gave guidance on FY24 earnings.

While revenues were projected to be flat in FY24, earnings were expected to be $10−15 million, up from a -$0.3 million loss in FY23.

In the Chairman’s address, the new company chair, Mathew Quinn, didn’t beat around the bush, saying:

‘FY23 was a year of underperformance and great disappointment for our shareholders, leading to major changes on the board, including my appointment as Chairman in June, and subsequently to changes in the management team with the appointment of Andrew Russell as our new CEO.

The company has already taken swift and decisive action to stem the losses and get back to profitability. Bravura is fundamentally a good business with a very strong base of blue-chip clients, great technology and talented employees, giving us a very strong foundation from which to do this.‘

Investors seem swayed, with the share price up over 15% today.

Suncorp name new banking CEO

Suncorp [ASX:SUN] announced Bruce Rush as the next Banking CEO for the company.

Mr Rush joined the firm in 2021 and previously held the role of executive general manager of home lending.

Suncorp Group CEO Steve Johnson said Bruce was an experienced executive with a deep understanding of the banking industry, he went on to say:

‘Bruce has been a valuable member of Suncorp’s leadership team for many years and has made a significant contribution to the improved performance of the Bank across both its lending and deposit portfolios, amid what have been incredibly competitive market conditions in recent years,’ Mr Johnston said

Rush said he was honoured to be appointed and was proud of the progress they had made so far in the past three years to deliver on their strategic plan to strengthen the Suncorp banking business.

‘We have the full support of the Suncorp Group as the approvals process remains underway, and my focus will be on ensuring the team is equipped to continue delivering on the Bank’s operating plan during this time, and most importantly delivering great customer experiences every day,‘ he finished.

Santos pipeline halted by courts

A federal court has blocked Santos [ASX:STO] from starting work on its 292km pipeline to its Barossa Gas Project in the Timor Sea.

The $5.8 billion Barrosa project has been placed under a temporary injunction sought by Titwi Islanders. In court, Justice Natalie Charlesworth said:

“[Santos] is restrained from undertaking any activity as described in the Barossa gas export pipeline installation environment plan…until 5pm on 13 November,” Justice Charlesworth told the court.

“At the hearing…that time may be extended to the extent necessary for the Court to hear and determine the application for interlocutory relief proper.”

The Tiwi Islands traditional owners sought an injunction on Tuesday night, saying that construction should be paused until Santos assesses new evidence of cultural heritage risks posed by the pipeline.

Origin energy shares down after lukewarm reception to bid raise

North American consortium Brookfield-EIG have come back with a sweetened takeover offer for Australian energy giant Origin.

The new offer is approximately $9.53 per share and was given with the ‘best and final offer‘ line dangling like a deadly hook for the deal.

That’s an 8% increase from the previous offer of %8.81 per share and a 70% premium to the company’s share price a year ago before the offer.

The final price tag would be around US$19.9 billion at the current exchange rate, although that has been volatile in the past few weeks.

As a response, Origin welcomed the news, saying:

‘We are pleased to have agreed with the consortium a significant increase in the cash consideration, reflecting the value of Origin’s assets, people, and the company’s strategic positioning for the energy transition,’ Origin Chairman Scott Perkins said.

However, at this stage, the concerns of Origin aren’t registering for shareholders and investors. All eyes are on majority shareholders AustralianSuper, which holds a near 14% stake in the company and has created a band of large shareholders who have vocally called the previous offers ‘considerably below long-term value‘.

“AustralianSuper believes the ongoing energy transition, as we move toward net zero by 2050, has further enhanced the value of strategic energy transition platforms, such as Origin, whether public or private,” said a spokesperson for the superannuation fund.

Origins stock fell by -5% in this morning’s trading but is currently down -3.90% as investors feel that the needle may not have moved enough for AusSuper to budge in the coming shareholder vote, which will be held on the 23rd of November.

The vote will require a 75% agreement of the total votes

Midday market update

The ASX 200 is up 1.27% at 6,925.1 in a strong recovery tracking gains seen in Wall St after the U.S. kept interest rates on hold overnight.

Interest-rate-sensitive sectors on the ASX benchmark are up significantly, with Tech (+3.21%) and Real Estate (+2.87%) leading the charge at midday.

In tech, the big names are all making big ground today, with Wisetech Global up 3.52%, Xero’s up 4.16%.

In real estate, Goodman Group is up 2.83%, while Scentre Group has gained 2.63%.

All Ords also posted strong gains, up 1.30% at midday. The Aussie Dollar has also made ground, up 0.62% to US 64.31 cents.

Spot Gold’s price has stabilized, now slowly starting to climb at US$1985.01, just up 0.06%.

In company news, Origin is down nearly 5% as the revised offer from Brookfield and EIG of $9.53 per share is considered unlikely to sway majority shareholders like AustralianSuper, who had hinted that they were hoping for a valuation of nearly $12 per share.

CSR shares up after positive 1H24 outlook for buildings

Building products company CSR [ASX:CSR] is up by 5.34% after releasing its first-half results up to 30th September.

The biggest news from the report was the strong building products result, with earnings up 18%, bringing building products revenue to $1.4 billion.

Source: CSR Report 2/11/23

The company also lowered its forecasts for its aluminium business, as its net profits fell in the past two quarters. For the six months to September 30, NPAT came in at $94 million, down 15% from $110 million last year.

Sayona Mining

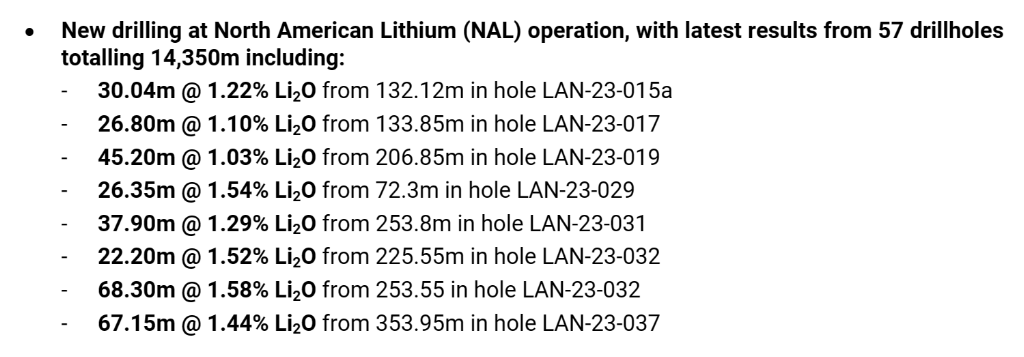

North American lithium producer Sayona Mining ltd [ASX:SYA] announced today that it had identified multiple high-grade lithium intercepts from its recent drilling campaign at the company’s North American Lithium operations that it holds a 75% stake in, shared with Piedmont Lithium [ASX:PLL] in Quebec Canada.

The results from 57 new drill holes have ‘significantly’ increased the potential for a resource upgrade, according to today’s release. Highlights from the drilling were:

Source: SYA Release 2/11/23

Sayona’s Interim CEO, James Brown, commented on the results, saying:

‘These results are hugely significant for NAL, showing the potential for a resource upgrade at North America’s single largest source of hard rock lithium production.’

Shares in the company are up 4.17% this morning, but the company has a long way to go, down 67% in the past 12 months.

Good morning

Good morning all, Charlie here

The ASX 200 opened up +0.40% to 6,865.7, pointing to a strong rally today after the U.S. Fed kept interest rates steady overnight at 5.25-5.5%, where It’s been since July.

The central bank’s assessment of the U.S. economy contained some new adjectives but no new information.

The Fed said that:

Economic activity expanded at a strong pace, rather than solid.

Job gains had moderated, rather than slowed.

Inflation language persisted with inflation remaining elevated.

All major US and European indices were up overnight, with a handful of Asian markets down.

US manufacturing data was also released last night, showing the factory activity came in a 46.7 last month, below the 50-point mark, which is considered contractionary.

New orders and employment figures were also soft, adding to the Fed’s thoughts that it had done enough. The Fed also argued that the high bond yields were helping restrict economic activity, although U.S. 10-year bond yields were down -20bps to 4.73% after the Fed’s decision.

Wall Street: The Dow +0.67%, Nasdaq +1.64%, S&P 500 +1.05%, Russell 2000 +0.45%.

Overseas Markets: FTSE +0.28%, STOXX +0.75%, Nikkei +2.41%, SSE +0.14%

Australian 10-year bond yields fell -10bps to 4.82%.

Gold prices are flat at US$1,983.56 after sliding back from the Aus record prices above 2k AUD. Silver rose +0.67% to US$22.99.

The Aussie dollar is up +1.13%, to US64.07 cents.

Bitcoin is up +2.16% to US$35,287.66 continuing to look strong as we move into the end of the year, currently sitting at a 17-month high.

Oil prices continue their volatility but have fallen sharply. Brent fell -2.92%, while WTI Crude fell -0.12%.

Iron ore is up +0.18% to US$118.91, and Singapore iron ore futures are tracking up +2.02%. Citi Bank said today that iron ore could reach US$130 a tonne by year-end if Chinese stimulus comes through.

So far, China has signaled that it intends to support its ailing infrastructure activity but has yet to show any concrete policy.

Key Posts

-

4:28 pm — November 2, 2023

-

4:03 pm — November 2, 2023

-

3:49 pm — November 2, 2023

-

3:36 pm — November 2, 2023

-

2:00 pm — November 2, 2023

-

12:34 pm — November 2, 2023

-

12:10 pm — November 2, 2023

-

10:43 am — November 2, 2023

-

10:31 am — November 2, 2023

-

10:07 am — November 2, 2023

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2024 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988