Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | ASX to Open Down; Oil Jumps to One Year High, Brickworks, Premier, SOL Feature

Have a good evening

Have a great evening and a nice weekend.

We’ll be off here for the long weekend, so enjoy your weekend and enjoy the game!

Michael Burry likely smiling again

Michael Burry from ‘The Big Short’ fame is probably having a great month after once again laying one of his huge bearish bets on the S&P 500 in the past few months.

The S&P 500 is now down -3.58%, which is on track for its worst performance this year. The S&P 500 as a whole is up ~11.5% this year.

The equal-weighted S&P 500 is now officially down 0.2% this year, while the S&P 7, which is made up of the 7 largest stocks, is up 81%.

The ‘higher for longer‘ reality has hit equities hard, and with long-term bond yields continuing to climb, it may be a tough month for equities.

Michael Burry must be really smiling now since the S&P 500 and Nasdaq puts he purchased are likely doing quite well pic.twitter.com/ZjEyzzLZXf

— Barchart (@Barchart) September 27, 2023

Market close update

The ASX finished down slightly at 7,024.8 (-0.08%), with almost all sectors finishing in the red as rising bond yields and yearly high oil prices suppressed equity markets.

Unexpectedly weak consumer retail spending also dragged consumer stocks down, with August retail figures coming in at 0.2% growth, below the 0.3% forecasted and well below the 0.5% seen in July.

US futures point to a positive start in Wall St overnight, which could help other markets, but volatility is expected to remain high as US 10-year treasury bonds reach highs not seen since August 2007.

Source: TradingView (Orange US 10-Year Treasury Bonds, Blue Aus 10-Year Treasury Bonds)

In the ASX, the Energy sector (+2.96%) and Materials (+0.29%) were the only two to finish in the green today as rising Oil prices and tight inventories saw refineries push prices higher across markets.

ASX 200 Sector Top Performance

- Energy, up +2.96%

- Materials, up +0.29%

- Health Care, flat -0.03%

ASX 200 Sector Worst Performance

- Discretionary, down -1.18%

- Utilities, down -0.78%

- Telecommunication, down -0.70%

Retail spending below forecast

August retail sales rose 0.2%, lower than July’s 0.5% increase, reinforcing the case for the RBA to pause rate hikes.

The figures, which are seasonally adjusted, came in below economists’ expectations for a 0.3% gain. The drop in the monthly increase in retail sales has some economists saying the RBA’s recent series of rate rises may be affecting people’s willingness to open their wallets.

This was far below Westpac’s bullish forecast of a 1% increase, which the bank held on the belief that the Women’s World Cup Football would significantly boost spending.

While it looks like the Matildas helped retailers a bit, the boost was still muted.

‘The modest rise in August shows consumers continued to restrain their retail spending,’ said Ben Dorber, head of retail statistics at the Australian Bureau of Statistics.

The RBA is expected to meet next month to discuss monetary policy, with many believing the cash rate will remain on hold for some time.

Bill Evans, Westpac’s chief economist, thought that the latest data means the RBA will likely keep rates on hold until August next year, saying:

‘It is unlikely that the August monthly Inflation Indicator is a game changer. Annual inflation lifted from 4.9% in the year to July to 5.2%, mainly reflecting a 9% lift in petrol prices. A more reliable monthly Indicator than the Trimmed Mean monthly, which excludes volatile items, actually slowed from 5.8% to 5.5%.’

Premier Investments [ASX:PMV] sees profits decline

Premier Investments [ASX:PMV] saw a dip in its share price as it posted FY23 results today, showing a 4.9% drop in NPAT to $271 million despite rising revenue.

The investment company, which focuses on retail brands, owning clothing brands Just Jeans, Jay Jays, Peter Alexander, Dotti, and Jacqui E admitted that cost of living pressures were starting to affect sales.

Sales were down 2% in the six weeks from August to September when compared to last year.

The company said that it would continue its ongoing strategic review to find an ‘optimal future structure’ in a company-wide quest to reign in costs.

John Bryce, Premier Retail’s chief financial officer, is running Premier as interim chief executive and said the retail brands were progressing despite the challenging trading environment, saying:

‘Notwithstanding the challenging macroeconomic environment and the cost-of-living pressures faced by the community, our brands are focused on providing wanted products and value for our customers,’ Mr Bryce said.

The company also announced a concerted shift into the Middle East, with 20 stand-alone stores planned by the end of 2024 and 60 in the region over the next ten years.

Bets on the economy

Editor Callum Newman has been one of the few stalwart positive forecasters this year, and so far, his predictions have come to bear.

As market sentiment turns especially sour, I thought it would be worth sharing his latest thoughts on why the parallels to 2007-8 are unwarranted.

For Callum, the picture is a lot greener, and one of the main reasons for this is US housing.

Why?

Read on below.

https://www.moneymorning.com.au/20230928/why-no-crisis-will-hit-in-2023.html

Oil prices on the march

As fuel prices reach yearly highs, analysts have raised their forecasts for oil prices, with some saying we are likely hitting $100 per barrel.

This will be the first time in more than a year since the energy crisis in 2022, sparked by Russia’s invasion of Ukraine.

The price of Brent Crude has gained approximately 30% since the start of July, trading at US$97.30 per barrel.

Driving the rising prices is the deep cuts in production orchestrated by Saudi Arabia and Russia, who have held sway over OPEC+ members and themselves promised large cuts through until December.

The combined OPEC+ are withholding more than 5 million barrels a day, or the equivalent of 5% of global supplies.

Surprisingly strong demand has also helped raise prices as China’s demand has been higher than many expected, as well as growing demand from Europe as it heads into colder months.

The heavier grades of oil that the Saudis are withholding are especially important for industries as these are usually refined into diesel for trucking, agriculture and heavy industry. Refiners seeking crude for diesel have been locked into bidding wars and have had a large appetite for paying higher premiums because they are also pulling huge profits as inventories are so low.

In another move to tighten the market, Russia has placed a ban on diesel and other fuels in order to help ease rising domestic prices. Some in Europe have accused them of weaponising their reserves. Since then, Russia has lifted the ban on lower-grade diesel bound for Marine industries.

In the ASX 200 today, the Energy Sector is up 2.24%, one of the only sectors to remain in the green today.

Below are some of the standouts:

Brickworks [ASX:BKW] shares tumble amidst falling profits

Building supplies manufacturer Brickworks [ASX:BKW] released its FY23 results today, showing a 54% drop in profits across its Australian and American divisions as it faced ‘challenging conditions’ across both markets.

Australia’s largest brick manufacturer saw its shares drop heavily this morning, recovering slightly with shares currently down by 7.47%, trading at $23.80 per share as investors digested the tough operating environment, which has seen significant falls in new building projects and ballooning costs.

Despite these challenges for the 12 months ending 31 July, Brickworks reported an 8% in revenue to $1,181 million.

Brickworks champions its diversified operations in its annual reports; however, results across its four divisions highlight the challenging year:

- Building Products Australia: EBITDA $100 million, down 13%

- Building Products North America: EBITDA $40 million, down 18%

- Industrial Property: EBITDA $506 million, down 21%

- Investments: EBITDA $159 million, down 12%

Latest Job vacancies data

The Australian Bureau of Statistics Job data shows job vacancies are down -8.9% in the three months to August.

Vacancies are now down five months in a row by 18%, with the percentage of businesses reporting vacancies falling to only 21.7%.

Of these, the highest share of vacancies was seen in public administration, accommodation, food, and manual labour.

Source: ABS

Midday market update

At midday, the ASX 200 has begun to recover after a choppy morning of trading. The XJO is currently up 0.27% at 7,049.2. The index is still down 1.59% for the week so far but Energy stocks are holding up the market today with the Energy Sector up 2.42%

Stapes and Discretionary were the worst performers this morning, both down around 1%.

Woodside Energy gained 2.05%, Santos was up 2.35%, and New Hope Corporation was up 2.83% in this morning’s trading.

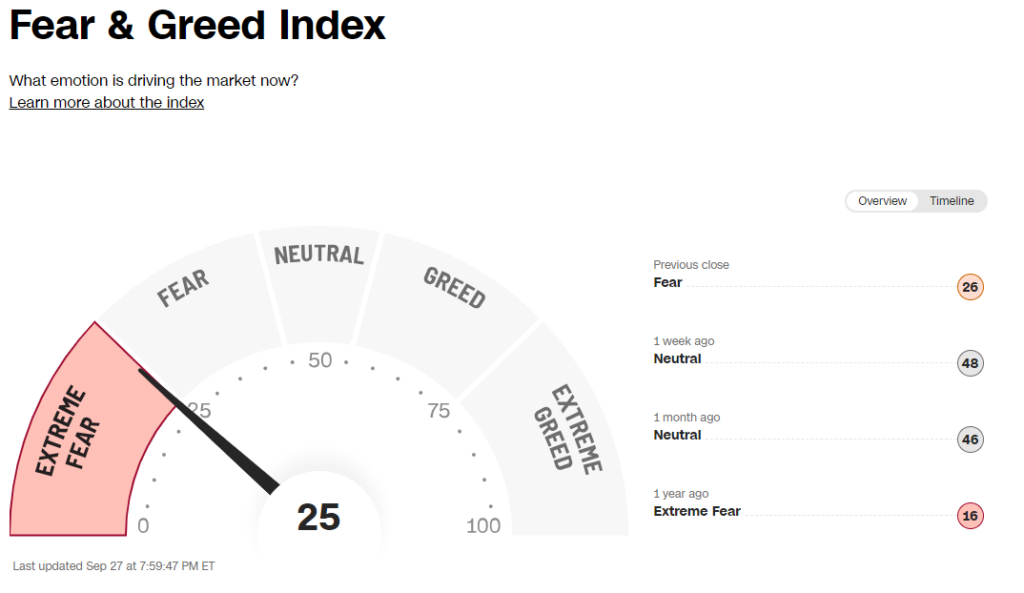

CNN Fear index falls into ‘extreme fear’

The pendulum of market sentiment has again swung, with the Fear & Greed Index plunging to a chilling 25, signalling extreme fear. This dramatic shift from the exuberance of extreme greed observed just two months ago paints a vivid picture of a market landscape dominated by uncertainty and volatility.

This stark transition isn’t merely a momentary panic; it signifies a substantial change in investor sentiment since the Federal Reserve’s rate hike in July. The trajectory of the index has been a steady decent in recent weeks, embodying the growing apprehension and fear gripping the market.

Source: CNN

The plunge in the Fear & Greed Index to 25 is a testament to the speed at which market sentiment can change course. Just a couple of months ago, the prevailing mood was one of unbridled greed as investors chased returns and embraced risk with enthusiasm. Now, fear has taken hold, casting a shadow over the markets and prompting a reassessment of investment strategies.

The resurgence of fear in the market comes after the US Fed’s decision to keep rates on hold in September. The markets widely expected this decision, with the CME FedWatch tool showing the last interest rate call had 99% of market participants expecting a hold. However, the Fed’s outlook scared equity markets as the Fed reasoned that they expected more robust GDP growth and consequentially would expect to keep rates ‘higher for longer’.

The ‘higher for longer’ call has reverberated across markets, with the S&P 500 falling over 5%, putting September on track to be the worst-performing month this year and edging it to its first quarterly loss.

This period of elevated fear and uncertainty prompts contemplation of the factors steering this shift in sentiment.

Looking at previous outlooks or predictions from the Fed should give you some perspective on our current market sentiment and why you should probably worry less about their prognostications.

Below are the Fed’s predictions for inflation (headline and core excluding food and energy) beginning in September 2020.

As a reference, Columns 1 and 2 show the year-over-year inflation that was seen at the time.

Source: Federal Reserve Summary, FOMC

The disparity between their 2023 inflation predictions and our present reality should be a relief. It should highlight why keeping your head in uncertain times and holding a historical perspective will help you not get swept into short-term thinking.

In these turbulent times, the resurgence of fear in the market isn’t just a challenge but also an opportunity. It offers investors a chance to showcase resilience, adaptability, and foresight, navigating the choppy waters with a clear vision and a steady hand, ever watchful of the shifting tides shaping the financial seas.

That’s not to say there isn’t risk in the market presently; indexes are likely underperforming in the coming months and maybe even a more significant correction, as bond yields remain so high.

But individual stocks can still remain great picks if you have the patience and foresight to find them.

Washington H Soul Pattinson [ASX:SOL] profits fall

Washington H Soul Pattinson [ASX:SOL] shares are down by 5.59% this morning after the company released its FY23 results, showing a 9% fall in full-year group profits to $759.3 million.

Chief executive Todd Barlow remained upbeat in today’s statement, saying the company’s investment portfolio ‘performed strongly returning 12.3% when adding back dividends‘.

The total value of the portfolio increased 8.8% to $10.8 billion and highlighted ‘significant repositioning’, with a strong allocation in cash totalling 7% of the portfolio, which is awaiting investment opportunities.

Net cash grew by $613.8 million, primarily through portfolio sales, which were partially applied to reduce short-term borrowings.

SOL offered a final fully franked dividend of 51 cents per share.

Market open update

The morning’s drop in the ASX 200 has recovered to flat in trading as we expect a bumpy day with high oil prices and rising bond yields putting pressure on equity markets.

Oil is recovering from its small selloff, with WTI at yearly highs nearing $94 and Brent continuing to climb as inventory shortages and supply concerns pressuring the refinery market.

- ASX 200 flat 0.07% at 7,035.0

- $AUD flat at 63.60 US cents

- ASX futures up +0.23% to 7,070.5

- S&P 500 flat +0.023%

- NASDAQ up +0.22%

- DOW down -0.20%

- FTSE down -0.43%

- STOXX flat -0.004%

- SSE up +0.16%

- Bitcoin up +0.71% to $US 26,433.20

- Spot gold down -1.29% to $US 1,877.25

- Iron ore down -0.21% to $US 120.93

- Brent Crude up +0.52% to $US 97.05pb

All figures shown are from 11:01am AEST

Good Morning

Good morning investors,

The ASX 200 is likely to fall this morning but could see some recovery throughout the day.

A busy day on the markets as rising oil prices and bond yields put heavy pressure on equities.

WTI Crude reached US$93.82 per barrel – a new yearly high

Brent Crude hit US$96.55 per barrel

The yield on the 10-year traded above 4.6%, the highest since 2007 as oil stockpiles in the US dropped to extraordinarily low levels.

America’s largest US hub fell to its lowest level since July 2022.

Key Posts

-

4:46 pm — September 28, 2023

-

4:40 pm — September 28, 2023

-

4:30 pm — September 28, 2023

-

4:09 pm — September 28, 2023

-

2:45 pm — September 28, 2023

-

2:23 pm — September 28, 2023

-

2:14 pm — September 28, 2023

-

1:28 pm — September 28, 2023

-

1:22 pm — September 28, 2023

-

12:11 pm — September 28, 2023

-

11:56 am — September 28, 2023

-

11:23 am — September 28, 2023

-

11:06 am — September 28, 2023

-

9:55 am — September 28, 2023

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2025 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988