Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | ASX to Gain Today as Hopes of ‘Immaculate Disinflation’ Spread

Market close update

Investors on Wall Street positively pre-empted the US Fed’s decision on interest rates due tonight, propelling stocks higher today.

Meanwhile, in Australia, the ASX 200 closed the session down -0.10% at 7695.8 as the Reserve Bank of Australia’s decision to keep interest rates unchanged did little to excite investors this afternoon.

Only Energy (+0.60%) and Telecoms (+0.29%) finished the day up significantly, while Discretionary stocks closed flat while the remaining eight sectors were down.

Tech and Utilities saw underperformance today in the run-up to the Fed’s decision tonight.

In individual stocks news today:

Packaging giant Amcor experienced a 3.6% drop, making it one of the biggest laggards of the day. This decline came after the company’s chief executive, Ronald Delia, announced his retirement due to health reasons.

Lithium producer Mineral Resources, saw a slight dip of 0.54% as the miner entered into a farm-in agreement with Lord Resources to expand a project in WA through a partnership.

Gold miner Perseus Mining suffered a 3.85% decline after sweetening its takeover offer for the Tanzanian explorer OreCorp as the bidding war intensified. Consequently, OreCorp’s shares rose 2.7%.

Sonic Healthcare, a diagnostics company, retreated 0.5% following its plans to acquire the Swiss-based Dr Risch laboratory group for $202 million in a combined share and cash deal.

Midday market update

The ASX 200 is up by only +0.23% around midday at 7,720.9 after falling back to near flat an hour ago.

The index is still on track for its third day of gains as Central Banks like the RBA softened rhetoric about raising rates yesterday, and economists project continued disinflation.

The RBA rate tracker shows markets have fully priced in first-rate cuts to come in September and an 80% chance in August, although these are still moving targets at this stage.

On the index, eight sectors are up, with Energy +1.05%, leading the charge as further Ukrainian attacks on Russian oil refineries continue to push up prices. In the past two weeks, Russia has seen six explosions at oil refineries as the Ukrainians show off their long-range capabilities and attempt to disrupt Russia’s ability to wage war in Ukraine.

Utilities and Staples were the biggest fallers around midday with both down -0.3%.

In individual company news, South32 has seen its share price drop by -2.75% as the company pulled its manganese output guidance due to damage caused by cyclone Megan at the Groote Eylandt port in NA.

Amcor CEO retires

Packaging giant Amcor [ASX:AMC] chief executive Ronald Delia announced his retirement today for health reasons.

Peter Konieczny, currently chief commercial officer, will act as the interim boss.

Mr Delia said today:

‘I have complete confidence in the strength and capabilities of Amcor’s leadership team, and Peter will do an outstanding job as interim CEO during the transition period’.

The company has begun a ‘full internal and external search‘ for its new CEO.

Shares are down by -4.5% in this morning’s trading at $13.79 per share.

Crypto fresh sell-off

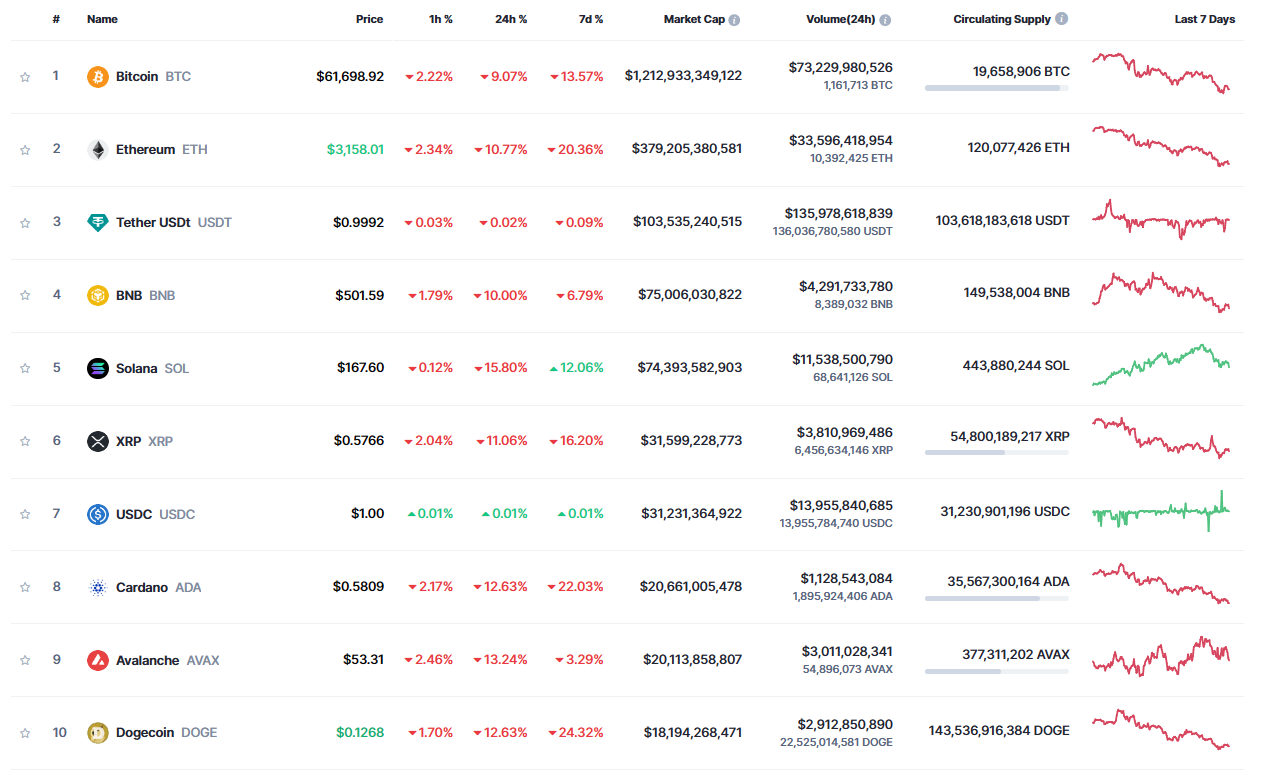

A heavy sell-off from the major cryptocurrencies has many of the major coins down double-digits in the past week.

Bitcoin is down -9.2% in the past 24 hrs at US$61,608, while Ethereum is down -10.5% at US$3,164.

Source: Coinmarketcap.com

Supply issues were blamed for the selling pressure as ETF funds continued to battle over the future institutionalisation of the once-spurned asset class. Big moves by the large players have sent volumes and volatility up in recent weeks.

According to our own crypto insider Ryan Dinse, a $1 billion fund blew up on a bad MSTR/BTC arbitrage play, which caused the first big sell-off.

After that, we had a bit of a cascade of selling. Then yesterday, the GBTC ETF (an old Grayscale fund that has a lot of BTC and was converted to an ETF but with much higher fees than others) had its second-biggest outflow.

Inflows into the other nine were OK, and the day finished about neutral overall but the stalled momentum in inflows — which were averaging around US$500 million (or 11x BTC new supply issuance) per day — also caused some more ‘panic’ selling.

Overnight, Michael Saylor (of Microstrategy) used a fresh round of convertible bond money to scoop up another 9245 BTC. Also, overnight, Blackrock quietly launched an Institutional Digital Assets fund seeded with US$100m of ETH.

Morning market update

Good morning. Charlie here,

The ASX 200 rose +0.32% to 7,727.5 this morning following bullish sentiment after Wall Street closed its session with a strong trading day.

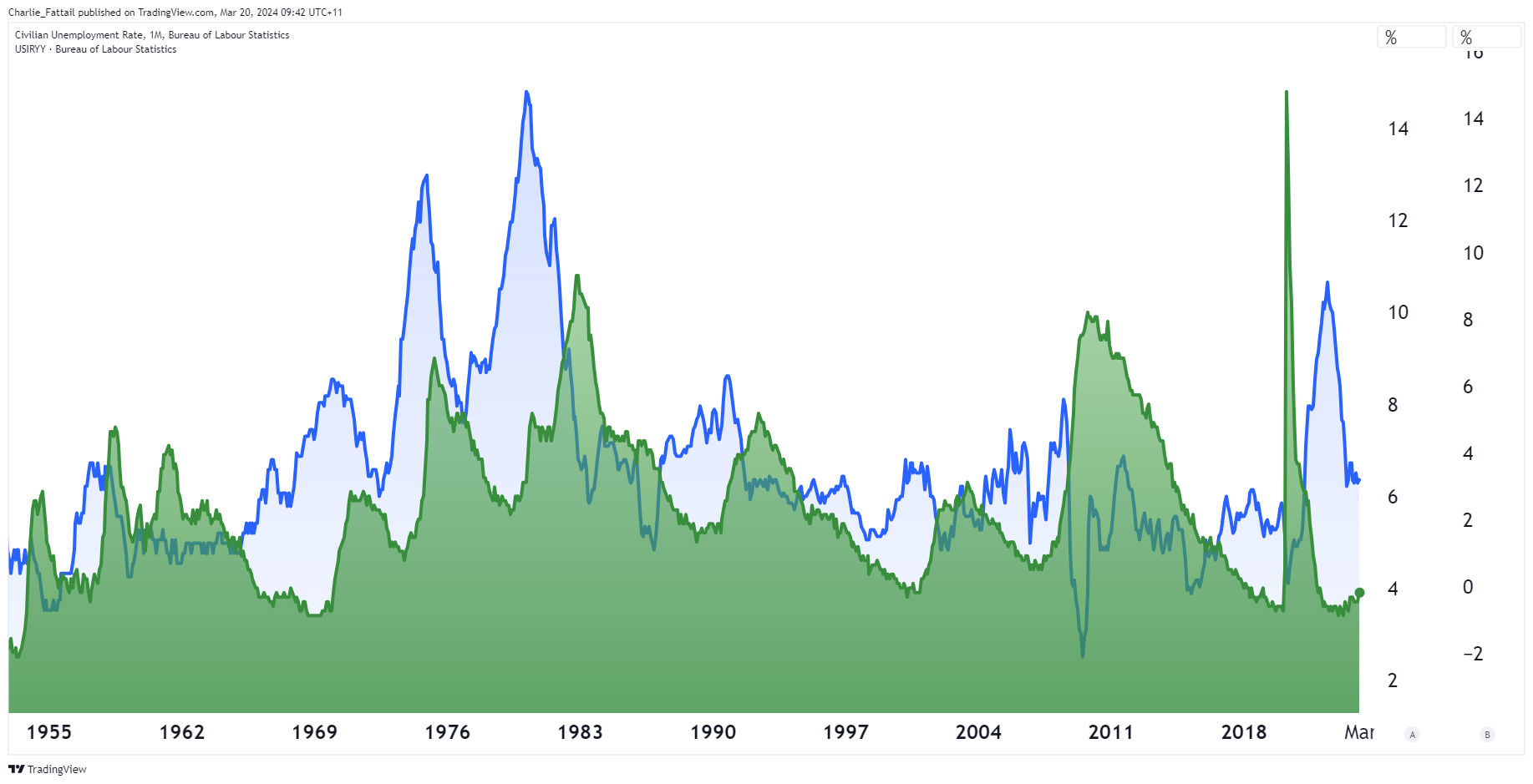

The RBA kept rates on hold yesterday in a move that was widely anticipated and shifted little. Economists and Central Bankers alike are now forecasting ‘immaculate disinflation’, easing inflation without a sharp rise in unemployment.

Time to celebrate or time to be fearful? Hard one to pick.

A look at history shows that prior inflation battles, like the ones in the 1970s and 80s, saw unemployment spike violently as inflation was falling, so some risks remain, especially in Australia, where consumer sentiment and consumption are so low.

Source: TradingView (inflation in blue vs unemployment green)

Still, equities continue their bullish trend after a couple of weeks of hesitation, with the S&P500 touching fresh highs overnight as markets brace for the FOMC meeting tomorrow.

Policymakers are expected to release a statement at 5am AEDT on Thursday alongside economic projections. Shifts in these ‘dot-plot’ projections of Fed members could shake markets if any shifts occur. Just two fed members shifting out their interest rate cut projections will shift the averages and push algorithmic traders into changing positions.

Yesterday the Bank of Japan ended its era of negative interest rates, in a shift from ultra-loose monetary policy that started over a decade ago.

The move had been a radical one at the time but had staved off deflationary threats to the country’s economy. Preceding the move were historic wage raises by Japan’s biggest unions, which the country’s central banks hope will be the stimulus cushion to ease the shift.

The reason foreign markets like the ASX watch the BoJ changes so carefully is because despite Japan’s economy failing to excite and hit the headlines, Japan remains the world’s biggest creditor nation for 33 years in a row.

With external assets of roughly US$3.2 trillion, this money has lived in markets like the ASX and Wall Street due to the negative interest rates in Japan. So, changes here could be significant for markets moving forward.

For now, little has changed on the market side, as UBS economist Masamichi Adachi remarked:

‘Markets still reacted in a dovish way because they do not believe that inflation will stabilise in Japan and that the BoJ will be able to raise rates.’

Wall Street: S&P 500 +0.56%, Dow +0.83%, Nasdaq +0.39%.

Overseas: FTSE +0.20%, STOXX +0.50%, Nikkei +0.66%, SSE -0.72%.

The Aussie dollar fell -0.42% to US 65.31 cents.

US 10-year bond yields -3bps to 4.29%.

Australian 10-year bond yields -3bps to 4.07%.

Gold is down -0.16% to US$2,158.23, while Silver is down -0.61% to US$24.91.

Bitcoin fell -8.60% to US$62,016, while Ethereum fell -10% to US$3,176.

Oil Brent rose +0.36% to US$87.20, while WTI Crude +0.88% to US$83.45.

Iron ore rebounded for the second straight session, up +3.2% to US$107.20 a tonne.

Key Posts

-

5:14 pm — March 20, 2024

-

1:10 pm — March 20, 2024

-

10:43 am — March 20, 2024

-

10:38 am — March 20, 2024

-

10:22 am — March 20, 2024

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2024 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988