ASX News LIVE | ASX to Fall; US Fed Holds Interest Rates Hints One More Raise This Year

Market Close Update

ASX 200 closed the day down 1.37%, hitting a 10-week low after Wall Street fell from hawkish rhetoric from the Fed, who forecasted interest rates ‘higher for longer’.

All 11 Sectors finished the day in the red, with Financials and Energy the worst hit for the day, down 1.76% and 1.96%. All Ords were down 1.30% today

The Big Four were all down more than 1.5% today, while a wide swath of Sectors were also hit hard today.

Brainchip fell 11.1% today, compounding on heavy losses after the company was dropped from the ASX200.

Financial services provider Thorn Group gained 2.7% after Bermuda-based Somers revised its offer to $1.17 per share in its buyout offer.

The worst-performing sectors of the ASX 200 today were:

- Energy, down -1.96%

- Financials, down -1.76%

- Health Care, down -1.69%

- Industrials, down -1.60%

- Materials, down -1.25%

ASX 200 nears 10-week low

The ASX 200 has extended its losses, down 1.37% to 7,065.1, putting the index on a path for its worst performance since the 10th of July.

All Ords are down 1.31%, currently, all sectors are well into the red this afternoon.

Energy and Health Care are the hardest hit sectors this afternoon, down 1.84-1.88%.

More details when markets close at 4pm.

Source: TradingView

Market reaction to Fed’s signalling ‘higher-for-longer’

For a market that had a 99% certainty of interest rates holding for the US Fed overnight, there was certainly a large reaction when the Fed gave a hawkish note to its outlook.

The current outlook by the Fed now stands at:

- End of ’23: 5.6% after one more hike

- End of ’24: 5.1%

- End of ’23: 3.9%

This ‘higher-for-longer’ concern should turn out to be a short blip for the markets as cooler heads prevail.

As for the above predictions, a short look at the history of calls made by the Fed will show you that not a huge amount of weight should be given to their longer projections.

Two years ago, when CPI was already above 5%, the Fed was forecasting rate hikes to only 1% by the end of 2023. Even when inflation was staring them right in the face they did not see it coming. Which is why you shouldn't put any weight on their forecasts today or any other day. https://t.co/mJeWXX0Hqp pic.twitter.com/wcZfZBb21T

— Charlie Bilello (@charliebilello) September 20, 2023

Fair Work steps into Chevron LNG workers dispute

After being requested by Chevron, the Fair Work Commission entered the fray as strikes continue by the Offshore Workers Alliance, a collection of unions representing gas workers at the two giant LNG facilities in WA.

Disputes between Chevron and the unions have continued for weeks now as the unions have slowly intensified their industrial action from the initial rolling strikes to a larger scale, refusal of certain jobs, which saw production reduce by a 1/5th last week.

The Fair Work Commission (FWC) recommended an increase in certain allowances for employees as well as the forming of a committee to be established over the next three months that would give staff a clearer pathway to promotion through listing skills required to become eligible for workers.

The FWC also recommended that Chevron should cover employees’ travel and accommodation and should be paid when they attend training.

‘In my view, the parties are close to achieving their desired outcome of registered enterprise agreements to cover the wages and employment conditions,’ Commissioner Bernie Riordan said in a statement.

‘It would be a pity and very frustrating to simply throw out these agreed positions and have the parties return to their respective logs of claims for any future arbitration.’

Both Chevron and the unions have said they will consider the recommendations. The two sides have until Friday morning to decide to accept the FWC solutions.

ASIC sues Australian crypto exchange

The Australian Securities and Investments Commission (ASIC) has begun civil proceedings against Bit Trade — the provider of the Kraken crypto exchange in Australia, after the company allegedly failed to comply with design and distribution obligations (DDO) for one of its trading products.

‘[The]ASIC alleges that Bit Trade’s margin trading product is a credit facility as it offers customers credit for use in the sale and purchase of certain crypto assets on the Kraken exchange. Bit Trade describes this as ‘margin extension’. Customers can receive an extension of credit of up to five times the value of the assets they use as collateral.’

Bit Trade has offered margin trade products to Australians since January 2020, but the ASIC says that since the DDO orders were given in October 2021, at least 1160 Australian customers have lost money on the product.

We are suing Bit Trade, provider of the Kraken crypto exchange in Australia, for allegedly failing to comply with the design and distribution obligations (DDO) for its margin trading product. Since October 2021, customers have lost about $12.95 million https://t.co/MCRYqah0dP pic.twitter.com/zURQ2xDw7M

— ASIC Media (@asicmedia) September 20, 2023

Victoria sees housing shakeup

Victorian Premier Daniel Andrews has announced the biggest shake-up to the state’s housing laws in decades. The new package aims to build 800,000 new homes over the next 10 years, with a focus on cookie-cutter five-storey apartments. The government will also drop permit rules for single dwellings and granny flats and beef up tribunal powers to end disputes.

Other measures in the package include a statewide 7.5% levy on short-stay rentals such as Airbnb and Stayz. Premier Andrews has insisted that the levy is ‘modest’ and will help to fund the construction of new social housing.

The housing package has been met with mixed reactions. Some have welcomed the move to centralise planning decisions, arguing that it will speed up the delivery of new housing. Others have expressed concerns about the quality of the new apartments and the impact of the short-stay rental levy on tourism.

The change comes as criticism has begun to mount on the government for the recent rise in immigration into Australia’s cities, affecting rent and house prices.

AMP Chief Economist and Head of Investment Strategy Shane Oliver has been sounding the alarm for some time. Here is a post from him back on the 15th of September.

Ultra low residential vacancy rates => surging rents. pic.twitter.com/BAbLPqKD45

— Shane Oliver (@ShaneOliverAMP) September 15, 2023

Midday Market Update

The ASX 200 is down 1.01% at 7,091.3 at midday after a tough morning of trading as stocks mirrored losses seen on Wall Street as the market absorbed the Fed’s hawkish rhetoric around holding rates ‘higher for longer’.

At midday, all Sectors were down, but Banking stocks were the worst hit this morning, with the Financial Sector down 1.58% and Health Care close behind, down 1.51%.

In company news, Transurban [ASX:TCL] was blocked by the ACCC for the first time after it attempted to acquire a toll road in Australia. Shares have dropped 2.25%.

The Big Four banks are down between 1−2%. In comparison, financial services provider Thorn Group [ASX:TGA] gained 3.17% by midday after it was announced Bermuda-based Somers put forward a revised $1.17 per share offer for the company after Thron shaved off its asset portfolio to Resimac Group [ASX:RMC] for $16.7 million.

Bank of England interest rate decision today hangs in the balance

Bank of England policymakers will decide today whether to raise interest rates for the 15th consecutive time, but investors and economists are divided on whether they will do so.

Investors have fully priced in one more quarter-point increase this year in the UK central bank’s base rate, which is now 5.25%. However, a drop in inflation to an 18-month low announced on Wednesday has raised questions over whether the BoE will deliver that increase today.

Markets are now braced for a 50% chance of no change in rates, which would be the first lull in a monetary tightening that started at the end of 2021. Prominent economists at Goldman Sachs and Nomura have also reversed calls for a rise, upending near unanimity for an increase in a survey completed earlier this week.

A pause would follow the example of the US Federal Reserve, which on Wednesday kept its base rate steady at a 22-year high.

More likely, according to economists, is a “dovish hike” in the same vein as the European Central Bank, which last week bumped up its base rate while hinting it had reached its peak.

What does this mean for investors?

If the BoE does do a dovish hike, it could lead to a rally in bond prices and a fall in the value of the pound. This is because investors would be reassured that the central bank is not going to be too aggressive in raising interest rates.

However, if the BoE does opt for a more aggressive rate hike, it could lead to a sell-off in bond prices and a rise in the value of the pound. This is because investors would be worried that the central bank is not doing enough to combat inflation.

Overall, the BoE’s decision on interest rates today will be closely watched by investors and economists alike.

NZ Economy shows some strength

The New Zealand economy surprised analysts with a higher-than-expected GDP growth for the September quarter at 0.9% (QoQ), which is almost double the forecasted 0.5% growth.

On an annual basis, the GDP growth was 3.2%. However, a good chunk of this could be attributed to rebuilding damage from disasters that have struck the country throughout the year, including widespread flooding and impacts from Cyclone Gabrielle, which has cost approximately NZ$8.4 billion.

‘Business services was the biggest driver of economic growth this quarter, largely due to computer system design,’ economic and environmental insights general manager Jason Attewell said.

‘Following the impacts of Cyclone Gabrielle, both education and transport, postal, and warehousing grew this quarter after a decline in the March quarter. Agriculture, forestry, and fishing, which was also impacted by extreme weather events, fell in both the March and June quarters.’

According to June’s GDP announcement for the Jan-March quarter, New Zealand fell into a technical recession, with a 0.1% fall in GDP.

However, since then, Stats NZ has revised the last quarter’s GDP to 0% change, meaning the economy wasn’t in recession.

‘The New Zealand economy is doing better than expected,’ Finance Minister Grant Robertson said.

‘It’s continuing to grow, with the latest figures showing no recession in New Zealand earlier this year and that the Government’s actions to build a stronger and more resilient economy contributed to higher than expected growth this quarter.’

The stats may be significant as NZ moves towards its election on the 14th of October, in which both parties are unpopular and the economy has been a central talking point.

ACCC blocks Transurban purchase of EastLink

Transurban, Australia’s largest toll road operator, has been blocked for the first time by regulators from acquiring a toll road in the country.

The Australian Competition and Consumer Commission (ACCC) ruled that Transurban’s bid for Melbourne’s EastLink toll road would “substantially lessen competition” for future toll road concessions in Victoria.

The ACCC’s chairman, Gina Cass-Gottlieb, said that if Transurban acquired EastLink, it would operate every single private-sector controlled toll road in Australia. This would give Transurban a dominant market position and make it difficult for new entrants to compete.

Cass-Gottlieb also said that if Transurban did not acquire EastLink, it would likely be acquired by a potential long-term rival and could be used as a platform to develop the capabilities needed to compete more strongly for other toll road concessions.

The ACCC’s decision is a blow to Transurban, which has been expanding its reach in recent years. The company has acquired a number of toll roads in Australia and overseas, and is currently bidding for a stake in the Sydney NorthConnex toll road.

The decision is also a win for consumers, who could benefit from lower tolls and improved services if there is more competition in the toll road market.

Market Open

- ASX 200 opens down 0.24% at 7,145.9

- $AUD down -0.17% at 64.37 US cents

- ASX futures down -0.32% to 7,171.5

- S&P 500 down -0.94%

- NASDAQ down -1.53%

- DOW down -0.22%

- FTSE up +0.93%

- STOXX flat -0.04%

- SSE down -0.52%

- Bitcoin down -0.39% to $US 27,109.02

- Spot gold down -0.10% to $US 1,929.52

- Iron ore flat -0.03% to $US 122.16

- Brent Crude down -0.33% to $US 93.20pb

All figures shown are from 10:10am AEST

AUD/USD falls back below 64.50 cents after hawkish Fed

The Aussie dollar fell again after the Fed’s tone sent the USD climbing.

The Fed has held interest rates at 5.25-5.5%, which didn’t surprise many in the markets.

But with that call came a raised outlook where the Fed forecasted potential interest rates of 5.1% at the end of 2024, half a percent higher than the previous forecast of 4.6%.

As a response, the AUD tumbled from the previous day’s high of nearly US 65.10 cents to its current US 64.36 cents.

Good Morning

Good morning all,

A busy day in the markets is expected as all the nervous tension is released after the awaited Fed call has come through.

The US Fed has kept rates on pause, as the vast majority of the market expected.

However, the Fed signalled a hawkish tone, forecasting one more rate hike for the year and holding rates higher for longer.

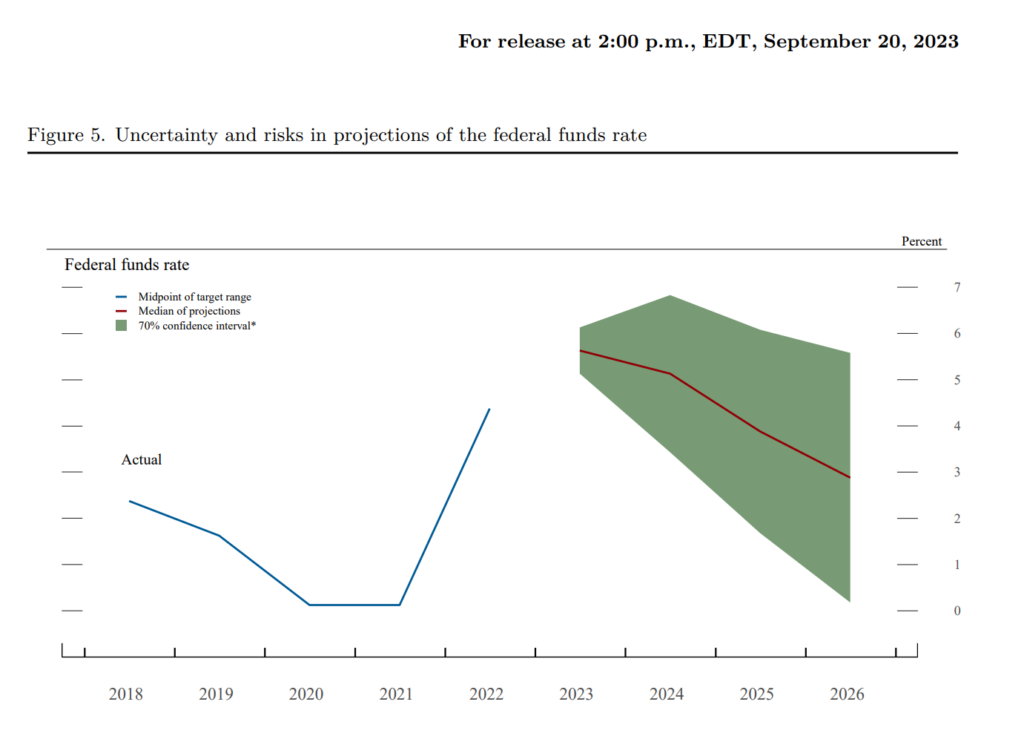

Source: Federal Reserve

The rate projection update above is a departure from the previous outlook from the Fed, which has shited its projected end-of-2024 rate from 4.6% to 5.1%.

As a response, stocks retreated, while bond yields climbed along with the US dollar.

The S&P 500 fell almost 1%, while the Nasdaq Composite fell 1.53% amid a slide in Apple and Tesla.

Key Posts

-

5:11 pm — September 21, 2023

-

3:11 pm — September 21, 2023

-

2:38 pm — September 21, 2023

-

2:19 pm — September 21, 2023

-

1:45 pm — September 21, 2023

-

12:34 pm — September 21, 2023

-

12:12 pm — September 21, 2023

-

11:57 am — September 21, 2023

-

11:47 am — September 21, 2023

-

10:16 am — September 21, 2023

-

10:13 am — September 21, 2023

-

9:53 am — September 21, 2023

-

9:39 am — September 21, 2023

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2024 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988