Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | ASX to Fall; Super Retail Appoints Chair; Apple Hits Record High after AI Deal

Iron Ore Prices Continue to Fall with China

The iron ore market is bracing for further declines as prices teeter on the brink of falling below $US100 per tonne.

Traders are growing increasingly pessimistic about the prospects of a recovery in China’s property market despite ongoing efforts by the Chinese government to rescue the struggling sector.

In the spot market, iron ore prices dropped 4% to $US104 per tonne overnight, marking the lowest level since April 5.

The sell-off has taken a toll on mining giants, with BHP shares falling 6% over the past three weeks. Rio Tinto and Fortescue have been hit even harder, with their stocks declining 11% and 15% each.

The downward trend continued today, with all three companies’ shares falling more than 1%.

This latest downturn comes despite China’s introduction of a stimulus package in May aimed at encouraging home buyers. While the rescue measures initially provided some support to iron ore prices, strategists now believe that they have fallen short of what is needed to boost steel demand and revive the property market.

As a result, the iron ore market is expected to remain under pressure in the near term, with the potential for prices to dip below the psychologically important $US100 per tonne level.

Macquarie Upgrades Woodside

Investment bank Macquarie has recently upgraded its rating for oil and gas company Woodside [ASX:WDS] to ‘outperform.’

Macquarie analysts said today that they believe the market is currently overestimating the risks associated with commodities, projects, and climate change in relation to Woodside’s valuation.

Since September last year, Woodside’s shares have experienced a decline of -29%, now trading at an implied oil price of $US56 per barrel. This puts Woodside at a substantial discount compared to its peers in the United States.

Given Woodside’s stock’s recent performance, Macquarie sees an attractive upside potential of 18% and a healthy dividend yield of 6%. The broker has set a target price of $32 for Woodside shares.

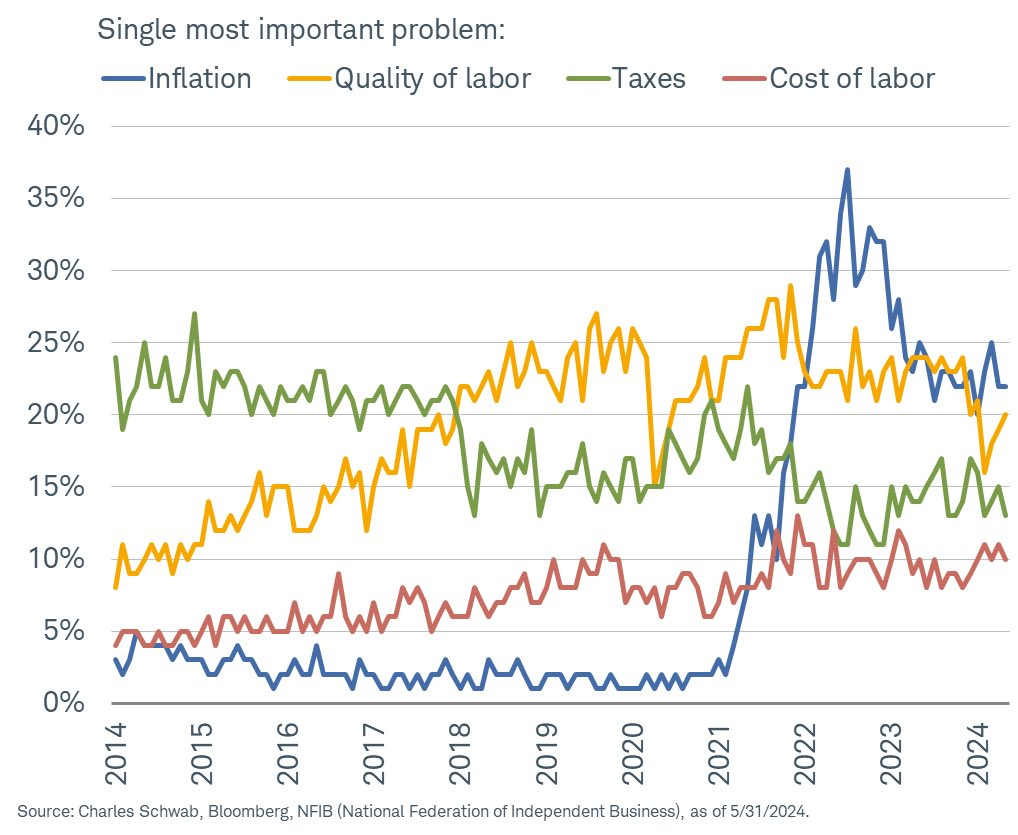

Inflation remains top of business concerns

As of May, inflation remains the primary concern for small businesses in the US.

Similar responses have been seen in Australia, where the cost-of-living crisis has pushed consumers to close their wallets and increased the strain on businesses to maintain their loan interest.

However, the quality of labour, which ranks as the second most pressing issue, has been increasingly gaining prominence, according to the National Federation of Independent Businesses (NFIB) where the chart comes from.

Source: NFIB 2024

Midday market update

The ASX continued its downward trend at midday, with the ASX 200 dropping -0.61% to 7707.9.

Nearly all sectors experienced a broad sell-off as investors remained cautious ahead of the upcoming US Federal Reserve interest rate decision scheduled for tomorrow.

This follows yesterday’s significant 1.3% fall, the biggest daily drop in six weeks, as traders prepared for the Fed to resist immediate rate cuts during its policy meeting this week.

Despite a slight recovery in iron ore prices from yesterday’s sharp decline, which was driven by concerns over demand in China, the materials sector was among the worst-performing sectors.

Major players in the sector, such as BHP, Rio Tinto, and Fortescue Metal, saw losses of -1%, -1.51%, and -1.3%, respectively.

Technology stocks, which are sensitive to interest rate changes, also face falls today. WiseTech fell -2.1%, and NextDC dropped -1.3%.

In the United States, banking stocks led the Dow Jones lower during the overnight trading session.

However, the Nasdaq and S&P 500 managed to rise, supported by a 7.3% surge in Apple shares.

The optimism surrounding Apple’s plans to enhance its devices with OpenAI’s artificial intelligence capabilities drove the company’s stock to close at $US207.15, just below its peak of $US207.16, pushing its market cap to US$3.18 trillion.

Super Retail Group Appoints New Chairwoman

Super Retail Group [ASX:SUL], the company behind well-known Australian brands such as Supercheap Auto, rebel, BCF, and Macpac, has announced the appointment of Judith Swales as its new chairwoman.

Swales, who currently serves as the chief executive officer of Fonterra’s global markets division, will succeed Sally Pitkin, who previously indicated her intention to step down from the position at the company’s 2024 annual general meeting.

Prior to her current position at Fonterra, Swales held the position of managing director at Heinz Australia and has also served on the boards of Virgin Australia and Dulux Group.

Chair-elect Judith Swales said toady:

“It’s an honour to be appointed Chair of such a great Australian company. Super Retail Group has proven a remarkable success story in its two decades as a listed company and I am confident about the Group’s prospects for long-term growth.

I’m determined to build on Sally’s leadership and to work closely with my fellow Board directors, our CEO Anthony Heraghty and his management team in the interests of all shareholders.”

Shares in Super Retail are down by -0.38% in this morning’s trading, but have gained over 17% in the past 12 months.

WeWork CEO David Tolley Steps Down

WeWork, once considered the most valuable US startup, has recently emerged from bankruptcy after facing substantial losses due to expensive leases and a slump in demand driven by the pandemic.

The company’s outgoing CEO, David Tolley, who joined WeWork in February last year and took on the top job in October, has stepped down from his position.

During his tenure as CEO, Tolley successfully reduced the company’s expenses by more than 30%, amounting to approximately $US12 billion. This was achieved through downsizing WeWork’s real estate portfolio, renegotiating leases, and withdrawing from dozens of unprofitable locations.

Despite this, WeWork filed for bankruptcy protection in November, and its restructuring plan was approved by a judge late last month, allowing the company to eliminate $US4 billion in debt.

As WeWork emerges from bankruptcy, Tolley will be replaced by John Santora, a veteran in the commercial real estate industry who recently served as the Tri-State chairman at Cushman & Wakefield.

It is unlikely that the company will be able to phoenix itself in an ongoing weak commercial real estate market, but its an interesting saga to watch in the world of big startups.

Morning market update

Good morning. Charlie here,

The ASX 200 opened down again this morning, falling -0.32% to 7,730.3 after yesterday’s heaviest fall in two months.

The ASX has largely tracked sideways for the past four months, range-bound as prices of commodities and bond yields jump around thanks to macro moves in the US.

Hotter-than-expected US unemployment data once again pushed trader’s bets of interest rate cuts arriving later for the US, and Australia will probably follow suit in being late to cuts.

All eyes are on the Fed’s FOMC meeting decision at 4am (AEST) on Thursday. The decision is broadly expected to be another hold, but the meeting will release its dot-plot forecasts, giving markets some indication of the Fed’s thinking moving forward.

On Wall Street, markets closed slightly up for the S&P500 and Nasdaq, which hit fresh highs. The biggest news in the market is Apple’s (+7.26%) partnership with OpenAI, which will bring AI onto its iPhones.

Wall Street: S&P 500 +0.27%, Dow -0.31%, Nasdaq +0.88%.

Overseas: FTSE -0.98%, STOXX -1.02%, Nikkei +0.25%, SSE -0.76%.

The Aussie dollar -0.03% to US 66.08 cents.

US 10-year bond yields -6bps to 4.40%.

Australian 10-year bond +8bps to 4.29%.

Gold +0.24% to US$2,315.75, Silver -1.32% to US$29.32.

Bitcoin -2.95% to US$67,360, Ethereum -4.5% to US$3,497.

Oil Brent +0.74% to US$82.23, WTI Crude +0.33% to US$78.16.

Iron ore fell -1.8% to US$104.20 a tonne.

Key Posts

-

3:24 pm — June 12, 2024

-

2:29 pm — June 12, 2024

-

12:45 pm — June 12, 2024

-

12:23 pm — June 12, 2024

-

11:15 am — June 12, 2024

-

11:10 am — June 12, 2024

-

10:11 am — June 12, 2024

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2025 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988