Investment Ideas From the Edge of the Bell Curve

ASX News Live | ASX Sinks 1.4%; Retailers Headline with Kogan, City Chic, Adore Beauty Featuring

BWX tumbles 13% on $100 million 1H23 net loss, CEO departs

Beauty and personal care retailer BWX (ASX:BWX) crated on Monday after announcing a huge half-year loss and the departure of its chief executive.

BWX posted a $100.8 million net loss in 1H23, way up on a $5.4 million loss in 1H22. This was largely due to a non-cash impairment charge of $60.8 million related to the carrying value of some assets.

BWX blamed the ‘increased level of demand uncertainty, increased discount rates from higher borrowing costs and more recent economic conditions’, which led to ‘more conservative assumptions’ for valuing the assets on its books.

Still, while the impairment was non-cash in nature, BWX’s 1H23 free cash flow was a negative $37.6 million.

Cash paid to suppliers and employees ($120.4 million) exceeded the cash receipts from customers ($95.9 million).

$BWX made a $100 million loss in 1H23.

Money wasn't the only thing BWX lost, saying goodbye to plenty of senior management, and as of today, its CEO and managing director.

Rory Gration, appointed CEO in March 2022, resigned with immediate effect.#ASX #ausbiz pic.twitter.com/8nUsMUcNza

— Fat Tail Daily (@FatTailDaily) February 27, 2023

Bubs down 12% after $20 million impairment

Infant milk formula producer Bubs Australia (ASX:BUB) is down 12% late on Monday after announcing a $20 million non-cash impairment.

Bubs said that in the process of assessing its impairments of intangible assets for its half-year report, it now expects to impair about $20 million.

The impairment charge relates to the Deloraine Dairy cash generating unit.

Bubs explained:

“The impairment is being driven by the timing of Bubs’ resubmission of its Chinese State Administration for Market Regulation (SAMR) registration application in respect of the three slots for which nomination rights are held by the Australian facility.”

At the end of FY22, Bubs valued the Deloraine Dairy cash generating unit at $31.9 million.

$BUB's Deloraine Dairy cash generating unit was valued at $31.9 million in FY22. pic.twitter.com/rw0krMZzXb

— Fat Tail Daily (@FatTailDaily) February 27, 2023

The next big contrarian opportunity | Ryan Dinse

Despite what happens over the next few months, I just can’t see interest rates staying high for too long.

But here’s the thing…

In the ongoing battle against inflation, central bankers need us all to believe they will.

They need people to act like it’s going to happen — to pull back on spending and hopefully get inflation down — without them having to go as hard as they’re saying.

In short, it’s all just psychology!

And there’s actually a bit of economic game theory at play.

It’s a real-life version of the classic Prisoner’s Dilemma…with all of us as the prisoners!

Let me explain what I mean by this, and how it suggests we could be setting up for a big opportunity down the track…

The Prisoner’s Dilemma is a famous economic thought experiment where two criminals are captured by the police.

They’re each interrogated in separate cells and given a choice.

They each can either stay silent (and hope their mate does too).

Or they can dob in their mate and get a lighter sentence.

The payoff matrix looks like this:

The possible outcomes are:

- A: If A and B each betray the other, they each serve five years in prison.

- B: If A betrays B but B remains silent, A will be set free while B serves 10 years in prison.

- C: If A remains silent but B betrays A, A will serve 10 years in prison and B will be set free.

- D: If A and B both remain silent, they will each serve the lesser charge of two years in prison.

I’ll let you work through the various connotations here…

But the weird conclusion is, the rational thing to do is to betray your partner. Even though if you’d both kept schtum, you’d get the best total outcome (least combined sentence).

How does this relate to markets right now?

Well, as I said before, central bankers want people, businesses, and investors to act like they’re going to go hard on interest rates.

So we’ve all got a choice to make in response.

Believe them and act accordingly.

Or ignore them and act like they won’t go through on their threats.

The basic point I’m making is that everyone’s actions in aggregate effect the eventual outcome.

If we all call their bluff, we probably all lose as we make them increase rates.

But if only a few of us do, we benefit greatly at the expense of those who did ‘what the Fed wanted’.

I think we’re entering that window of opportunity soon.

https://www.moneymorning.com.au/20230227/were-setting-up-for-a-big-contrarian-opportunity.html

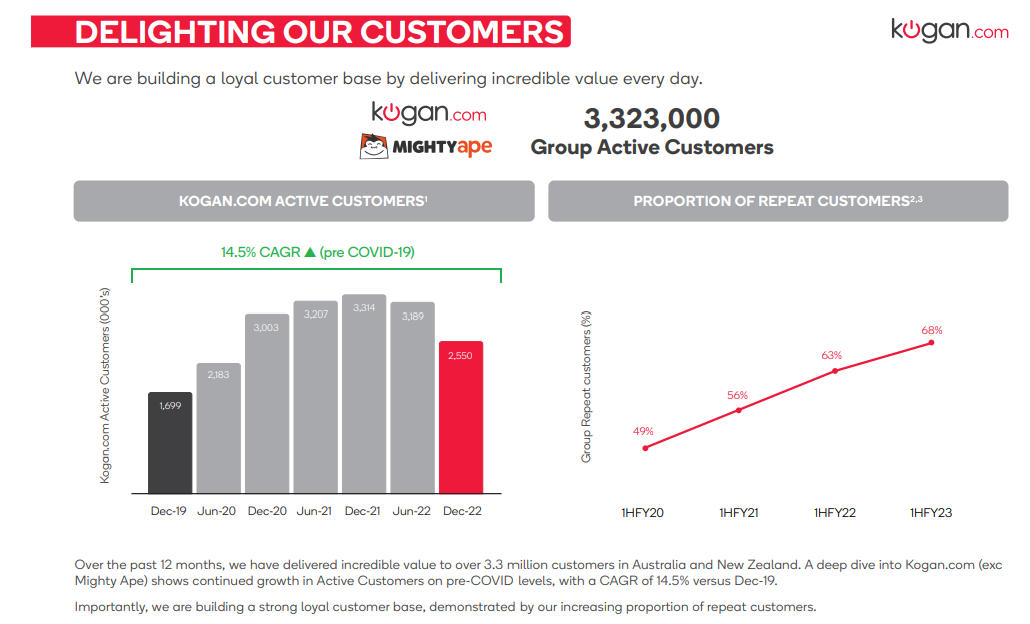

Kogan rises despite doubling net loss in 1H23

Online retailer Kogan (ASX:KGN) said it returned to profitability in January 2023 on an ‘adjusted EBITDA’ basis, the first positive adjusted EBITDA month since July 2022.

On a non-adjusted basis, Kogan’s 1H23 net loss doubled to $23.8 million as 1H23 revenue tumbled 34% to $275.6 million.

Under the heading ‘Positive outlook for 2H23’, Kogan said it expects to ‘gain further efficiencies in operating costs’, describing itself as a ‘dynamic portfolio of businesses’.

But the positive outlook was short on concrete guidance. If anything, the trading update for the month of January was mixed:

- Gross sales were down 33.2% year on year to $68.8 million

- Gross margin up 7.9% to 32.9% year on year (‘reflecting the reduction of excess inventory sold with heavy discounting’)

- Positive ‘adjusted EBITDA’ of $1.5 million

Lake Resources nears 52-week low

Lithium stocks have fallen in recent weeks on softening prices for the white metal and worries of near-term waning demand in the key China market.

Popular lithium juniors like Lake Resources have suffered.

Lake, once trading as high as $2.65 a share in 2022, is now trading below 60 cents. Its 52-week low of 54.5 cents is now in sight.

$LKE is trading below 60 cents and is nearing its 52-week low as #lithium stocks slump on softening prices for the white metal. #ASX #ausbiz pic.twitter.com/cV70OonzyN

— Fat Tail Daily (@FatTailDaily) February 27, 2023

City Chic down 12% as net loss balloons

Women’s apparel retailer City Chic Collective (ASX:CCX) cratered on Monday after swinging to a $27.2 million net loss in the half ended 1 January 2023, having posted a $12.3 million net profit in 1H22.

1H23 sales revenue fell 8% to $168.6 million while City Chic’s global active customer base remained flat at 1.33 million.

Chief executive Phil Ryan said the retailer had a ‘challenging first half across our key markets as consumer demand contracted, particularly in the USA and Europe.’

However, Ryan said in-store sales in Australia were strong, offsetting falling online sales as ‘customers returned to in-store shopping’. Yet even ANZ sales were down 3%, while sales in the Americas were down 14%.

Profit was hit harder than revenues because of margin compression as City Chic continues to struggle to offload excess inventory. City Chic said it had to write down $19.6 million worth of inventory in the half.

Were it not for a $21.5 million injection of debt, City Chic would have ended the half with about $5.8 million in cash and cash equivalents.

CCX provided a grim outlook, too.

Trading in the first seven weeks of 2H23 was 17% down on 2H22. Excess inventory continues to hurt, with the promotional activity needed to clear the inventory remaining ‘elevated as competitors drive deeper clearance activity to drive customer demand.’

$CCX is down 12% after swinging to a $27.2 million net loss in 1H23.

City Chic has burned through a lot of cash recently. #ASX #ausbiz pic.twitter.com/x7ZE8QvasE

— Fat Tail Daily (@FatTailDaily) February 27, 2023

Key takeaways from Buffett’s latest shareholder letter

Last week, Warren Buffett released his latest shareholder letter.

Buffett’s letters are anticipated by corners of the market as eagerly as some anticipate the latest work from George R. R. Martin.

So what did the Oracle of Omaha say? What are the key takeaways?

The letter started with a flex. Since 1965, the overall gain of the per-share market value of Berkshire sits at … 3,787,464% against the S&P 500’s 24,708% at a compounded annual gain of 19.8%.

No wonder his letters are so widely read, with investors parsing his every word for stardust.

In the letter, Buffett again reiterated his mantra that business is his business: ‘Charlie and I are not stock-pickers; we are business-pickers’.

He also admitted that even he makes mistakes. Berkshire’s portfolio isn’t without duds:

“Over the years, I have made many mistakes. Consequently, our extensive collection of businesses currently consists of a few enterprises that have truly extraordinary economics, many that enjoy very good economic characteristics, and a large group that are marginal. Along the way, other businesses in which I have invested have died, their products unwanted by the public. Capitalism has two sides: The system creates an ever-growing pile of losers while concurrently delivering a gusher of improved goods and services. Schumpeter called this phenomenon “creative destruction.””

Buffett also brought out the old hit that Mr Market isn’t always rational and you can buy ‘pieces of wonderful businesses at wonderful prices’.

At the end of the day, however, Buffett admitted that Berkshire owes its success to ‘about a dozen truly good decisions — that would be about one every five years — and a sometimes-forgotten advantage that favours long-term investors such as Berkshire.’

He hammered home that message later in the letter:

“The weeds wither away in significance as the flowers bloom. Over time, it takes just a few winners to work wonders. And, yes, it helps to start early and live into your 90s as well.”

US Fed needs a recession to tame inflation, study finds

A paper presented by economists at the US Monetary Policy Forum over the weekend argued the US Fed will struggle to lower inflation without hurting the US economy and employment.

The paper reviewed past disinflationary episodes in the United States and elsewhere to glean lessons for monetary policy.

A key lesson was one of pain. All 16 of the large policy-induced disinflations in the four advanced economies surveyed were linked to a recession.

In the researchers’ words:

“We find no instance in which a significant central bank-induced disinflation occurred without a recession.”

The researchers concluded that achieving a 2% inflation target will probably entail at least a mild recession.

In response to the paper, member of the board of governors of the US Fed Philip N. Jefferson concurred the ‘argument that policymakers should accept that disinflation is likely to be costly is well reasoned.’

However, Jefferson also said that history ‘can only tell us so much, particularly in situations without historical precedent’.

Jefferson thinks the current situation is different from the paper’s instances of disinflation:

“The current situation is different from past episodes in at least four ways. First, the pandemic created unprecedented disruptions to global supply chains. Second, the pandemic is having a long-lasting effect on labor force participation rates. Third, the credibility of the central bank is higher now than it was in the 1960s and 1970s. Fourth and most importantly, unlike in the late 1960s and 1970s, the Federal Reserve is addressing the outbreak in inflation promptly and forcefully to maintain that credibility and to preserve the “well anchored” property of long-term inflation expectations.

Finally, economic models are important tools but need to be used with careful interpretation and judgment when history does not speak to the current situation. Sound decisionmaking requires that their findings be complemented with additional analytical tools, including careful scrutiny of real-time data.”

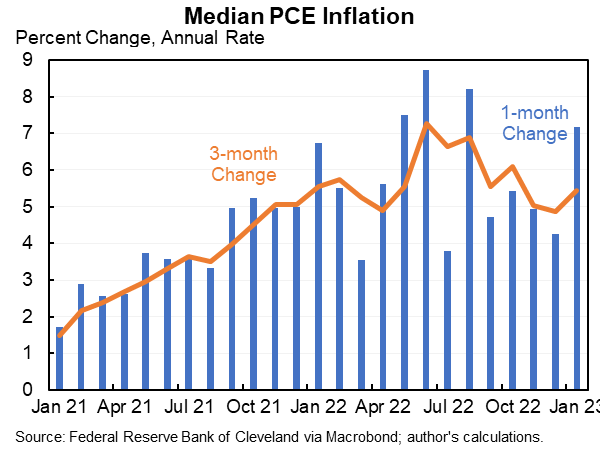

The US economy is ‘very overheated’

The latest core PCE data out of the US disturbed markets and economists alike.

US stocks tumbled last Friday on the release of January’s PCE data, leading to Wall Street’s worst week of the year.

But economists are also perturbed by the latest personal consumption expenditure reading.

Harvard economist Jason Furman thinks the data shows the US economy is ‘very overheated’. For Furman, the US is making ‘little of any progress on inflation’.

That’s bad news for those betting on interest rates coming down any time soon.

The economy is very overheated. We have made little if any progress on inflation. There is little if any reason to expect a large slowdown going forward.

Core PCE at an annual rate:

1 month: 7.1%

3 months: 4.7%

6 months: 5.1%

12 months: 4.7% pic.twitter.com/aCA1341MQd— Jason Furman (@jasonfurman) February 24, 2023

US inflation stubbornly resilient

The US Fed’s preferred inflation gauge — the personal consumption expenditures price index (PCE) — rose a material 5.4% year on year in January.

The core PCE index, which excludes volatile readings from food and energy — rose 4.7%.

Both readings were ahead of consensus forecasts and came in higher than for the 12 months through December 2022.

Source: Jason Furman

Key Posts

-

4:41 pm — February 27, 2023

-

3:45 pm — February 27, 2023

-

3:15 pm — February 27, 2023

-

1:43 pm — February 27, 2023

-

12:37 pm — February 27, 2023

-

12:18 pm — February 27, 2023

-

11:39 am — February 27, 2023

-

10:28 am — February 27, 2023

-

10:05 am — February 27, 2023

-

10:00 am — February 27, 2023

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2025 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988