Investment Ideas From the Edge of the Bell Curve

ASX News Live | ASX Falls; Piedmont, Latitude, Westpac Feature; Wall Street Reckons with Fed

Are we in a bear market rally or a new bull run?

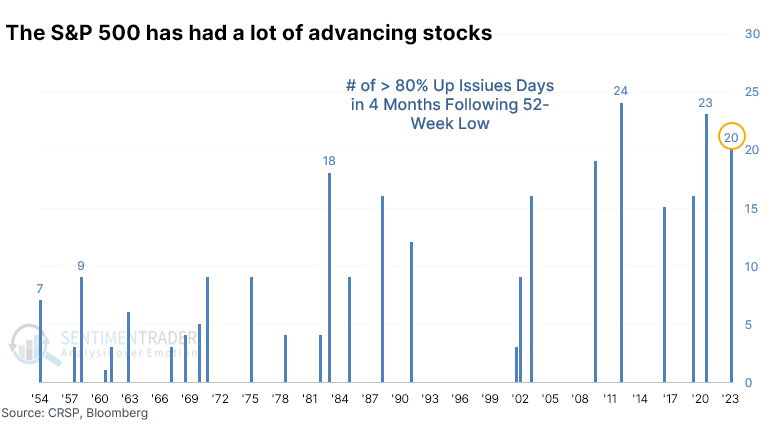

In his latest column, John Authers mentioned data from SentimenTrader showing that in the past four months, there have been 20 days where more than 80% of S&P 500 stocks rose.

According to analysis from SentimenTrader, this has been ‘one of the largest-ever clusters of days with so many rising stocks during the four months following a 52-week low going back to 1950.‘

Authers thinks this suggests a ‘broad, confident, and durable rally’ and raises the probability US equities are ‘at the beginning of a protracted bull-market recovery.’

Source: SentimenTrader

How can that be?

Inflation is proving sticky. Interest rates are rising and will remain high. Correspondingly, bond yields are at levels not seen in years, pushing up the opportunity cost of punting on shares.

How is this conducive for an equities rally?

John Authers cited DataTrek Research co-founder Nicholas Colas, who pointed to earnings resilience as a candidate explanation.

Consensus expectations for S&P 500 earnings growth for 2023 is down on prior years but ‘still as high as 6.9%’.

But will these expectations be thwarted?

Listen to what Cleveland Fed President Loretta Mester said just yesterday. Mester was adamant tight financial conditions will result in growth ‘well below trend this year’.

Further, Cleveland Fed’s business contacts are ‘preparing for a mild recession’.

Tighter financial conditions will result in growth well below trend this year and some cooling off in labor markets, with slower employment growth and an increase in the unemployment rate from its very low level. These developments will help to alleviate price and wage pressures. As a result, I expect to see good progress on inflation this year.

We are operating in an uncertain environment and economic conditions can evolve in unexpected ways. With growth well below trend, it wouldn’t take much of a negative shock to push growth into negative territory for a time. Most of our business contacts are preparing for a mild recession. Similarly, inflation dynamics over this expansion have been influenced in important ways by the pandemic and the war in Ukraine, and we need to be very open to the idea that inflation can evolve differently than we expect. To help me formulate my economic outlook and policy views over the year, I will be looking at a variety of incoming data and collecting economic and financial information from our business, labor market, and community contacts.

That doesn’t sound great for earnings growth.

Authers did note rising interest rates are making cash competitive again as an asset class against equities.

The six-month Treasury bill now yields almost 5%. Pitted against the S&P 500’s dividend yield, cash is no longer trash. In fact, its yielding over 3% more than the S&P 500 dividend yield.

Concerningly, Authers relayed a warning. This century, whenever the spread between cash and dividends got this high, ‘it was followed soon after by an epic stock market crash.’

Westpac Card Tracker: growth in real terms may be slowing

The latest Westpac Card Tracker Index inched higher in February, rising 2 points to 143.2.

The latest reading suggests growth in real, inflation-adjusted terms ‘may be seeing a more pronounced slowing’.

Interestingly, across all domestic non-travel transactions, the share of online sales has fallen back to pre-COVID levels.

The index also saw a continuing softening in retail sales.

Westpac’s retail card index saw a ‘significant weakening in Dec-Jan over and above the usual seasonal fluctuations. The first half of Feb has seen continued softness but with the pace of contraction slowing somewhat.’

Federal Court hands former ASX small-caps darling Getswift record penalty

Getswift belongs in the ASX hall of fame as a classic cautionary tale of hubris and hype.

The now-delisted software company purporting to solve the last-mile delivery problem used to be an ASX darling — with the touted potential usually reserved for US tech stock unicorns.

Getswift listed on the ASX in 2016 at 20 cents per share. By December 2017 it was trading at over $4, raising over $100 million from investors.

But its collapse was as swift as its rise and the company’s management has been in and out of court dealing with accusations of misconduct.

Today, the Federal Court ordered the collapsed company to pay a $15 million civil fine and singled out the directors with fines of their own.

The Federal Court’s fine was the largest ever penalty against a company found breaching continuous disclosure laws.

The Court wrote that Getswift ‘‘became a market darling because it adopted an unlawful public-relations-driven approach to corporate disclosure instigated and driven by those wielding power within the company.’

GetSwift’s former director, CEO and executive chairman, Bane Hunter, was ordered to pay a penalty of $2 million and disqualified from managing corporations for 15 years.

Former director Joel Macdonald was ordered to pay a penalty of $1 million and disqualified for 12 years.

The two penalties are some of the highest dished out against directors for corporate misconduct.

The full judgement by the Court can be read here.

Here’s a little teaser highlighting the eloquent prose of Justice Michael Lee:

In November 2021, Justice Lee handed out a separate 870-page liability judgement against Getswift, which shapes up to be better than any Harvard Business School case study in what not to do as a public company.

If you’re looking for a late summer reading suggestion, how about giving this judgement a go?

Is generative AI coming for coders?

Journalists, lawyers, consultants, content writers and now programmers are on the rumoured chopping block wielded by the evolving generative AI technology popularised by ChatGPT and now Bing.

So far, hot takes about job security threatened by the adoption of AI tech are just that — hot bluster.

But the capabilities of the likes of ChatGPT sure are making a lot of white collar professionals squirm.

Take the latest development in generative AI.

GalileoAI just launched the ‘first AI product that uses natural language [the language you and I speak] to generate user interface designs.’

English really is becoming the hottest programming language.

Today, Generative AI takes a big step and comes to user interface design!@helnzhou and I are excited to announce @Galileo_AI : the first AI product that uses natural language to generate UI designs. It lets you design beyond imagination.

Early access: https://t.co/4KqV1csQ6c pic.twitter.com/LtzSC1kYw3

— Arnaud Benard (@arnaudai) February 8, 2023

ASX BNPL stocks sink on regulation concerns

ASX buy now, pay later stocks are all trading lower on Friday after major news outlets reported that the Australian Securities and Investments Commission recommended BNPL firms be treated like any other regular credit provider.

That would mean more checks on customers, which could slow onboarding and make BNPL less appealing to consumers who preferred not having to divulge much information about their credit history.

- Afterpay-owner Block (ASX:SQ2) is currently down 7.9%

- Sezzle (ASX:SZL) is down 4.1%

- Zip (ASX:ZIP) is down 3.8%

- Laybuy (ASX:LBY) is down 3.1%

- Humm (ASX:HUM) is down 2.5%

In proposed options for regulating the buy now, pay later sector, ASIC came out in support of Option 3 in its submission to Treasury.

Source: ASIC

You can read the full submission here.

ASIC submission on #BNPL mentions that between April 2021 and March 2022, #BNPL users were 'more than twice as likely as credit card holders to have experienced two financial stress indicators in the last 12 months.' https://t.co/h6i05il8Rm$ZIP $SZL #SQ2 $SPT $LBY $OPY pic.twitter.com/RlytEDRJ6m

— Fat Tail Daily (@FatTailDaily) February 17, 2023

Lowe: effect of monetary policies will still be felt ‘well into 2024’

The effects of tightening monetary policies take 18 to 24 months to fully manifest, Philip Lowe told the House of Representatives economics committee. Therefore, the tightening the RBA is doing now will still be felt ‘well into 2024’.

This lag makes the central bank’s job difficult.

How hard does the RBA go here, and for how long?

That’s a key consideration for Lowe and his team and one he flagged in his opening address this morning to the House of Representatives.

Lowe: my advice to bank customers — switch

Asked about the bumper profits the big banks have reaped in recent months, RBA’s Philip Lowe gave a multifaceted answer.

For one, Lowe said it was healthy for the country as a whole to have a strong and profitable banking sector.

That said, the governor acknowledged banks are slow to match the central bank’s cash rate increases with increases on savings rates but quick to hike rates on loans.

One way customers can combat this is switching, Lowe said.

He thinks there are a lot of good deals out there and customers should ‘hunt them out’.

The more customers switch, the more banks will be pressured to raise savings rates faster.

Lowe: $350b of low fixed-rate loans maturing this year

Philip Lowe said in an opening address to the House of Representatives that some households are under ‘very real pressure from high inflation’.

This will only worsen when many low-interest fixed-rate loans mature this year.

Lowe said 880,000 loan facilities with fixed rates are maturing this year, with an outstanding value of $350 billion.

Lowe said holders of these loans will face ‘very significant increases in loan repayments’.

He offered three scenarios on how all this will influence household spending:

“It remains to be seen how these various influences on household spending balance out. There are plausible scenarios in both directions.

“The pool of extra household savings is not evenly spread across the population, being concentrated in households with higher incomes. It is not clear whether households will want to spend these savings in coming months or whether they see them as long-term wealth to be spent gradually over a long period of time.

“It is also possible that the resilience evident in consumer spending on services is because this was the first holiday period for three years that COVID restrictions were not in place. If what we have seen is extra spending as people enjoyed their usual freedoms, a period of belt tightening could follow. But it is also possible that the extra savings and jobs are giving part of the population sufficient confidence to keep spending, just at the same time that others are finding things very difficult. So, it is a complicated picture at present.

“The third uncertainty that I want to highlight is around price and wage expectations. If people expect high inflation to continue, then it is likely to continue, with the higher inflation expectations reflected in wage settlements and firms’ pricing decisions. So, it is important that people expect that the high inflation is only temporary. Currently, inflation expectations remain well anchored and aggregate wage outcomes are not inconsistent with inflation returning to target over time. If either of those things were to change, we would face a much more difficult environment.”

Lowe: households have saved an additional $300b

RBA’s Philip Lowe provided some very interesting data on Australian household finances, savings, and looming mortgage obligations.

Lowe noted that Australian households have saved an additional $300 billion ‘over and above what they normally would do’ since the start of the pandemic.

That’s equivalent to about 20% of annual household disposable income.

At least in the September quarter, households were still saving ‘at a slightly higher rate than before the pandemic’.

RBA’s Philip Lowe fronts House of Representatives Standing Committee on Economics

If you’re keen to watch to a public grilling of RBA governor Philip Lowe, you can watch it live here.

Lowe is currently fielding questions at the House of Representatives Standing Committee on Economics.

Prior to that, Lowe addressed the Committee with a prepared speech, which you can read here.

Lowe cycled through his hits in the address, bringing out pops like ‘we are on a narrow path’ and ‘high inflation hurts people more in the long run than temporary high interest rates’:

“The path here is a narrow one. It is still possible for us here in Australia to navigate this path, especially if inflation and wage expectations remain contained and issues on the supply side continue to be resolved. But it is also possible that we are knocked off that narrow path. Not surprisingly, given the uncertainties, there are a range of views in the community about where the main danger lies. Some are more concerned about the prospect of a sharp rise in unemployment in the near term, while others are more concerned about the prospect of inflation staying too high, which would in time entail even higher interest rates and a sharper rise in unemployment.

“As the central bank, we have a critical mandate to preserve medium-term price stability and we are committed to that objective. If we don’t get on top of inflation and bring it down in a timely way, the end result will be even higher interest rates and more unemployment in the future.”

ASIC could land final blow to BNPL stocks

Buy now, pay later stocks don’t need any more problems. They are knee-deep in them already.

But the Australian Securities and Investments Commission is about to add another one.

Regulation is the sword of Damocles hanging over the sector. Now it’s threatening to plunge down.

In a submission to Treasury, ASIC said BNPL firms should be held to the same lending standards as credit card providers and banks.

The submission, uploaded yesterday, reads:

“Products with similar characteristics and the same purpose and function should be treated the same way in the regulatory framework.

“Uniform regulation under the National Credit Act would bring a more consistent regulatory framework across all buy now, pay later providers and a standardised regime that could be enforced by ASIC.”

Bond yields up … meme stocks up

US 10-year bond yields are at 3.862%, the highest in years.

US Fed officials are tub-thumping that rates will not come down any time soon and will remain at a restrictive level for a while yet.

If CFA students were given just this as context and asked how riskier assets were responding, what the students say, “To the moon (rcoket emoji)!”?

Unlikely.

But meme stocks are mooning. And crypto big boss Bitcoin briefly summitted US$25,000 overnight. The Roundhill MEME ETF is up 32% year to date.

Why?

Many analysts are asking this question. How can we be seeing analogues of the pandemic rally when interest rates are now so much higher?

Bond yields up … meme stocks up.

Why? pic.twitter.com/UMPIsFlvbm

— Fat Tail Daily (@FatTailDaily) February 16, 2023

US inflation won’t be at 2% until at least 2025: Cleveland Fed

US inflation is unlikely to return to 2% until 2025. That’s according to private sector forecasts and the US Fed’s FOMC aggregate of economic projections.

If that prediction comes true, US inflation will have been above 2% for over four years.

But Cleveland Fed President Loretta Mester thinks this could turn out to be optimistic. In her view, inflation could be much more persistent than current consensus implies.

For Mester, the risks to inflation remain on the upside:

“Several private-sector forecasters do not expect inflation to return to 2 percent until sometime next year. According to the median in the December FOMC Summary of Economic Projections, this goal will not be reached until 2025.3 If that comes to pass, it means that inflation will have been above 2 percent for over 4 years, and well above 2 percent for much of that time. Even that forecast could turn out to be optimistic. Some recent research by economists at the Cleveland Fed presents a plausible case, based on a model and historical relationships in the data, that inflation could end up being much more persistent than current projections, despite the actions the FOMC has taken. While this research has not altered my view that there will be material improvement in inflation this year, it does inform my view that the risks to inflation remain on the upside.”

Cleveland Fed President: I would have hiked by 50 basis points in last FOMC meeting

‘Don’t fight the Fed’ is an old market saw. The way meme stocks and Bitcoin are going, the maxim is being ignored.

But if you don’t want to acquiesce to the Fed, at least try to listen to it.

This week several senior Fed officials addressed the public. Their speeches were nuggets of insight.

We’ve already mentioned Dallas Fed president Lorie Logan, whose recent speech was a douche of reality on any interest rate cuts phantasmagoria.

Overnight, Cleveland Fed president Loretta Mester delivered her speech. It was very telling. For one, she was pushing for a 50 basis point hike at the most recent FOMC meeting. And second, she thinks the fed funds rate should be above 5% ‘for some time’:

“At this juncture, the incoming data have not changed my view that we will need to bring the fed funds rate above 5 percent and hold it there for some time to be sufficiently restrictive to ensure that inflation is on a sustainable path back to 2 percent. Indeed, at our meeting two weeks ago, setting aside what financial market participants expected us to do, I saw a compelling economic case for a 50-basis-point increase, which would have brought the top of the target range to 5 percent.”

Read the full speech here.

US stocks finish lower as producer price inflation stronger than expected

US stocks finished lower overnight as investors continue to underestimate the stickiness of inflation.

The move lower suggests markets are growing more accepting of a more aggressive US Fed who wants to tamp down inflation as a first priority.

US supplier prices rose 0.7% in January from the prior month, the US Labor Department announced overnight, the biggest increase since last year. Economists polled by the Wall Street Journal expected a 0.4% rise.

On top of that, jobless–claims data didn’t budge, highlighting the continued strength of the labour market.

Investors should keep a close eye on the labour market as it is a key consideration of the central banks. Dallas Fed President Lorie Logan just this week said returning inflation to the Fed’s 2% target hinges ‘in large part on what happens in the labour market’.

As we covered earlier this week, Logan did a great job of outlining why the current wages growth poses a problem for the Fed’s inflation target. If wages growth remains steady at 5%, productivity must rise to offset any inflationary spillover. But the productivity required to sustain wages growth of that sort is hardly achievable.

“But for 5 percent wage growth to be consistent with 2 percent inflation on a sustained basis, productivity would have to rise at a 3 percent annual rate. Yet output per hour worked grew at an annual rate of only 1 and a quarter percent from 2012 through 2019, and there is little indication it has accelerated meaningfully since then.

“Absent a dramatic rise in productivity, it seems likely that sustainably returning inflation to 2 percent will require substantially lower wage growth. That may take time. Respondents to the Dallas Fed’s Texas Business Outlook Surveys expect more than 5 percent wage growth in 2023, which is down significantly from what they saw in 2022 but still quite elevated. Wage pressures have moderated somewhat in the latest national reports on average hourly earnings and employment costs. I’d need to see a lot more data, though, to be convinced the labor market is no longer overheated.

“To achieve better balance, labor supply will have to increase, or labor demand will have to decrease.”

Key Posts

-

5:19 pm — February 17, 2023

-

3:59 pm — February 17, 2023

-

3:22 pm — February 17, 2023

-

1:40 pm — February 17, 2023

-

1:06 pm — February 17, 2023

-

11:55 am — February 17, 2023

-

11:39 am — February 17, 2023

-

11:26 am — February 17, 2023

-

11:09 am — February 17, 2023

-

10:46 am — February 17, 2023

-

10:30 am — February 17, 2023

-

10:11 am — February 17, 2023

-

9:58 am — February 17, 2023

-

9:49 am — February 17, 2023

-

9:27 am — February 17, 2023

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2024 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988