Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | ASX to Fall; Iron Ore and Copper Surge

Market close update

The ASX 200 closed down -0.85% today, closing out at 7,814.4 with a 1.2% gain over the week.

Today only the Mining sector avoided the sell-off as the Materials sector closed up +0.4% while the Tech sector was today’s laggard, down by -3.05%.

The major minors closed up as commodity prices saw strong gains over the week, with Copper being the standout gainer, gaining 12% in the past month alone as supply crunches face the market.

Iron ore futures also saw gains overnight, up over 2% as Chinese officials met in an attempt to support the struggling property market.

In their latest change, Beijing officials have lowered the mortgage rate floor for homebuyers. The PBoC has now set the minimum down-payment ratio for first-home buyers to just 15% and cut it to 25% for second-home buyers.

The big drop in tech was fairly widespread, but the full brunt of the pressure on the benchmark was felt from the drop of the mega-caps Wisetech falling -3.64% to $98.05, and Xero falling by -5.12% today to close the week at $125.81.

In company news, regional player Bendigo Bank reported falling cash profit for the 10 months to April 30. Profits fell 2.3% to $464 million.

Despite this, the share price gained 8.2% to $10.73 as traders had expected worse and cheered signs of improvement as its profit margins rose.

Meanwhile, the suspension of Star Entertainment’s Queensland casino licences was lengthened until December 2024. Shares lost 2.2% to 45 cents per share.

Westpac’s chief economist says government and RBA ‘running a fine’

Westpac’s Chief Economist and former RBA Assistant Governor, Luci Ellis believes the Reserve Bank of Australia and the federal government are treading cautiously in their efforts to control inflation.

In a note today, Ellis stated that while households face financial pressures, recent wage and labour market data do not indicate increasing inflationary risks down the line.

Despite this she still had some choice words about the budget, saying:

‘The government is walking that fine line between providing support and services to a household sector under pressure and avoiding adding to that pressure by boosting inflation and possibly interest rates.’

She noted that while much post-budget commentary focused on inflationary impacts, measures like rent assistance and energy bill relief could genuinely reduce households’ cost of living and help anchor inflation expectations.

According to Ellis, some economic slack may emerge, at which point the RBA could consider cutting rates and the government could increase fiscal support without significantly stoking inflation, as it might currently.

She acknowledged the risks to this strategy but said neither the RBA nor the government is pursuing a reckless policy approach, but it was close, saying:

‘There are risks to this strategy, and both the RBA and the government will need to walk a fine line. But neither of them is pursuing the policy equivalent of running with scissors.’

Skycity reaches agreement with AUSTRAC

Kiwi casino operator SkyCity Entertainment [ASX:SKC] has reached an agreement with AUSTRAC to pay a $67 million fine for breaches around customer identification and monitoring rules.

Today Skycity acknowledged that it needed to ‘do better‘ to meet the expectations of regulators and said the process is ‘already underway’.

The rules are in place to dampen money laundering through casinos which has been a particular focus of regulators in recent years, with similar scrutiny on Star Entertainment which is in the middle of an inquiry.

‘AUSTRAC took this action out of concern that SkyCity’s conduct meant that a range of high-risk practices, behaviours and customer relationships were allowed to continue unchecked for many years,’ AUSTRAC’s chief executive, Brendan Thomas said.

Skycity’s shares are up by +0.66% in trading this afternoon, trading at $1.53 per share.

ANZ flags employment concerns for Australia

ANZ’s economics team has provided its weekly macro report analysis on the recent employment data and the federal budget.

Looking at the recent employment figures, they note the unemployment rate rose to 4.1% in April from 3.9% in March, while the underutilization rate increased from 10.3% to 10.7%.

Significantly, overall hours worked have declined by 15 million over the past year, representing a 0.8% decrease compared to last year’s levels. This is despite population growth and increased employment over the same period.

ANZ economists said this was a confirmation of a softening labour market, citing the pattern of stronger part-time but weaker full-time job growth, the rising unemployment rate, falling yearly hours worked, and moderating yearly wage growth.

They put a large stress on the yearly decline in hours worked being especially noteworthy, even though positive yearly growth is expected next month due to base effects.

Historically, larger year-over-year drops in hours worked have preceded economic downturns over the past 25 years, which they view as a concerning signal amid the current economic climate.

China’s recovery still in question

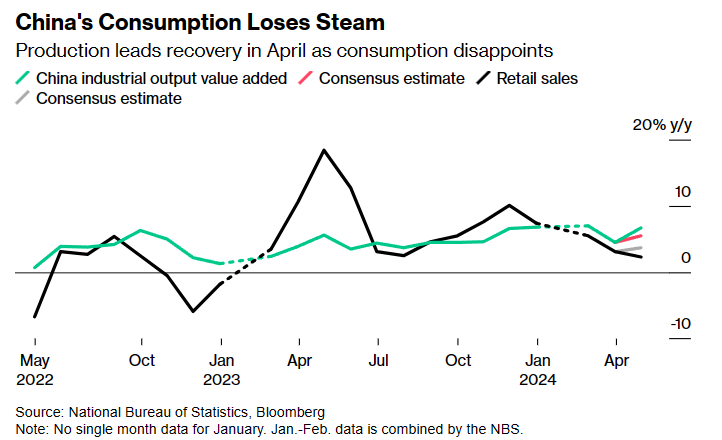

China’s economic recovery remains uneven, with consumer spending unexpectedly slowing in April while industrial production accelerated, according to latest data from the National Bureau of Statistics.

Retail sales grew 2.3%, missing forecasts of 3.7% growth. However, industrial output rose 6.7%, faster than the 5.5% estimated, boosted by strong exports and manufacturing.

Source: Bloomberg

The property crisis continues to weigh on domestic demand, though fixed-asset investment grew 4.2% in the first four months. Property investment declined 9.8%.

Iron Ore Futures jumped over 2% last night as the further stimulus is expected for the ailing property sector but so far nothing is concrete.

To support growth, China is rolling out 1 trillion yuan in special sovereign bonds to fund infrastructure and considering a plan for local governments to buy unsold homes. Monetary easing is also expected to aid bond purchases by banks.

However, risks remain, including tensions with the US and EU over China’s clean energy push, leading to new tariffs on Chinese electric vehicles by the Biden administration.

Midday market update

The ASX 200 is down by -0.62% as we pass lunchtime, trading at 7,832.6. Every sector except mining is down at this time, while higher commodity prices and new fervour thanks to the latest Federal budget have meant the major miners and smaller rare earth and lithium players are up so far today.

It seems moving the major miners is news of a meeting of Chinese officials, aimed at tackling the countries ailing property market.

BHP is up nearly 1% at $44.98 per share, while Fortescue is up nearly 2% with the rising Iron ore futures. Rio Tinto has gained 0.90%.

In the Rare Earths segment, we’ve seen strong gains by Talga group, up 8.09% and Arafura gaining 5%.

Top performers so far today is lithium hopeful Vulcan Energy Resources, up by over 15%, followed by Canadian lithium explorer Patriot Battery Metals, up by 12%.

Bendigo Bank Flags Profit Decline

Bendigo Bank [ASX:BEN], the large regional lender, has signalled a potential dip in its profits for the current financial year.

According to the bank’s update today, its cash profit for the 10-month period ending April 30 has declined by 2.3%, reaching $464 million.

Despite the profit slippage, Bendigo Bank reported that its credit expenses remain at low levels, indicating a stable lending environment.

Additionally, the bank’s net interest margin, a key metric that measures the profitability of its lending operations after accounting for revenue-sharing arrangements, stands at 1.87%

In the note today the company said:

‘At our half year results in February we reiterated our commitment to managing the business for long term value. We have continued our focus on disciplined growth and prudent management of our costs. The margin considerations we outlined in February have helped support a year-to-date margin of 1.87% post revenue share.’

Shares in the Bank are up by +4.03% in trading this morning at $10.32 per share. The company is holding an investor day on 23 May, so expect movement around that.

Lendlease Forms Asia Pacific Life Sciences Real Estate JV

Lendlease [ASX:LLC] is establishing a new 50/50 joint venture with Warburg Pincus, focusing on the growing life sciences real estate sector in Asia Pacific.

As part of its simplification efforts, Lendlease will transfer its life sciences construction, development, and investments in Asia to the new platform.

The deal, valued at $147 million, is expected to net Lendlease around A$66 million. Combining Lendlease’s regional experience with Warburg Pincus’s focus in scaling platforms, the JV aims to become a leading integrated life sciences real estate business.

Lendlease’s CEO Tony Lombardo highlighted the JV’s potential, calling it ‘well-positioned‘ in the region while realizing value from Lendlease’s existing operations.

Lendlease’s shares are down slightly this morning as markets are down, with its share price -1.44% at $6.15 per share.

Star Entertainment’s licence suspension extended

The Queensland government has ordered an extension of the licence suspension for Star Entertainment’s [ASX:SGR] casinos in Gold Coast and Brisbane.

Originally set to last until May 2024, the suspension will now remain in effect until December 2024.

This gives regulators extra time to evaluate the findings from the second Bell inquiry, which investigated the operations of Star’s Sydney casino.

The company’s share price is now down nearly -60% in the last 12 months as the company has seen leadership changes and further inquiries shake out concerned shareholders over the embattled casino’s next direction.

Morning market update

Good morning. Charlie here,

The ASX 200 opened down -0.22% to 7,864.3 this morning, following a quiet day on Wall Street which saw stocks close slightly lower.

Yesterday, Australia’s market recorded its best day of the year after data from the Bureau of Statistics showed headline unemployment rate rose to 4.1% in April, from a revised 3.9% in March.

While in the US, yesterday’s post-CPI and retail data rally was dampened overnight as markets retreated slightly.

Before the fall the Dow Jones managed to hit 40,000 points for the first time in history.

Equities are likely to have a quieter day today, but looking towards commodities, we can see a bit of movement.

Copper continued to surge, up another 2% overnight to its highest level since April 2022.

Meanwhile, Iron ore saw an unexpected rally on the futures markets on reporting that Chinese officials are meeting today to try to resolve the country’s struggling property market.

Wall Street: S&P 500 -0.21%, Dow flat, Nasdaq -0.26%.

Overseas: FTSE flat, STOXX -0.56%, Nikkei +1.39%, SSE flat.

The Aussie dollar rose -0.28% to US 66.79 cents.

US 10-year bond yields +3bps to 4.37%.

Australian 10-year bond -10bps to 4.22%.

Gold fell -0.55% to US$2,378.04, while Silver fell -0.16% to US$29.68.

Bitcoin fell -1.97% to US$65,341, while Ethereum fell -3.12% to US$2,946.

Oil Brent is up +0.20% to US$83.44, while WTI Crude is up +0.16% to US$79.36.

Iron ore spiked +2.6% to US$116.15 a tonne.

Key Posts

-

4:43 pm — May 17, 2024

-

4:14 pm — May 17, 2024

-

3:38 pm — May 17, 2024

-

3:00 pm — May 17, 2024

-

2:29 pm — May 17, 2024

-

1:27 pm — May 17, 2024

-

11:08 am — May 17, 2024

-

10:57 am — May 17, 2024

-

10:28 am — May 17, 2024

-

10:19 am — May 17, 2024

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2025 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988