Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | ASX to Fall as Yields Rise; RBA Meets Today with Decision Due Tomorrow

Market close update

The ASX 200 closed down -0.95% at 7,625.9 today. As the mining giants drag down the Australian index.

The major miners all saw drops of over 2% today with BHP down -2.44%, Fortescue down -2.79% and Rio Tinto down -2.18% at close.

The big news for tomorrow will be the conclusion of the RBA’s first two-day policy meeting, during which they will decide on interest rates and offer their latest forecasts for the economy.

At this stage, the bond market is implying a 36% chance the Central Bank will lower the cash rate as early as May this year and has fully priced a drop in August.

Also worth watching are Iron ore and Oil prices. Both commodities have seen big movements today, with Oil prices rising after markets absorbed the impact of US strikes on Iran proxy targets in the Middle East. At this stage, movement is minimal, but it has turned around further losses, with prices up +0.66%.

Iron ore recovered from some of its earlier losses to end the session down -2.25% after China promised to support its ailing economy further, although no details were given.

Appen hits record low on CEO sudden departure

The struggling tech company Appen [ASX:APN] saw its shares drop by -5.26% today to their lowest on record.

The drop comes after the sudden departure of CEO Armughan Ahmad just 12 months after taking the role.

In the release today, the Appen’s Chair Richard Freudenstein said little, commenting:

Armughan has been CEO during a period of great change at Appen. Having overseen a new strategic direction and re-sizing of the business, Armughan has decided to pursue new challenges. We wish him well for the future.

The release also announced that its chief operating officer, Ryan Kolln, will commence in the role of CEO and managing director from today.

Mr Ahmad has been put in the job with the sole job of turning the company around, it seems his sudden and uncommented departure is a bad sign moving foward.

The company has seen its shares fall -58% in 2024 so far.

Aussie dollar tumbles

The Australian dollar dipped below 65 US cents for the first time since November, hitting a low of 64.87 US cents on Monday as investors turned sour on risky assets.

This decline comes after the Aussie dollar has lost 4 US cents since the end of last year.

With the USD rising, pressure has been mounted on miners, as commodity prices tend to drop when the US dollar strengthens.

This inverse rule isn’t always the norm but we have certainly seem some pressure on commodity markets.

Here are some commodity price changes over last year:

- Sugar: +10%

- Coffee: +8%

- Gold: +6%

- US CPI: +3.4%

- Cotton: +1%

- Silver: -3%

- WTI Crude: -5%

- Brent Crude: -6%

- Copper: -7%

- Heating Oil: -8%

- Gasoline: -12%

- Natural Gas: -15%

- Aluminum: -15%

- Wheat: -21%

- Soybeans: -23%

- Zinc: -28%

- Corn: -34%

Fed Chair J Powell 60 minutes interview sheds light on Central Bank’s thinking

Powell’s widely anticipated 60 Minutes interview came and went, with the market gaining some clarity on the Fed’s position.

If you would like the video and full transcript, you can find it here.

The short summary is the Fed expects to make three cuts this year and is approaching with caution.

Powell told CBS’s 60 Minutes that ‘almost all‘ of the Fed’s membership think the Fed will cut rates from their current 23-year high at some point this year.

The interview, which took place a day before the latest round of strong US job data, showed that Mr Powell was largely expecting the robust job numbers.

The latest non-farm payroll figures showed the US economy added 353,000 jobs, that’s nearly double the forecasted amount for January.

As Mr Powell said:

‘The labour market is very, very strong still…So really the kind of pain that I was worried about and so many others were, we haven’t had that. And that’s a really good thing. And, you know, we want that to continue.’

He also noted how ‘historically unusual‘ the current state of the economy is considering the high-interest rates, continuing on to say:

The broader situation is that the economy is strong, the labour market is strong, and inflation is coming down,’ Powell said.

‘My colleagues and I are trying to pick the right point at which to begin to dial back our restrictive policy stance. That time is coming.’

Midday market update

The ASX 200 is down by -1.11% at 7,614.3 at midday.

Most sectors are in the red, but Materials are leading the losses, down -2.31%. Health Care is the only sector gaining today, up +0.15%.

Most major miners are down today with big losses seen by BHP (-2.27%) Fortescue (-2.52%) and Rio Tinto (-2.02%).

Energy producers also sank today with Whitehaven coal down -2.26%, Santos down 0.63%, and Beach Energy falling 1.79%.

Top performer at midday was Pro Medicus up by 4.15% after the company announced the launch of ‘Visage Ease’ for Apple Vision Pro.

Visage is a virtual imaging software that allows for diagnostic imaging and other multimedia capabilities.

Malte Westerhoff, PhD, Visage co-founder and global chief technology officer said today:

‘Visage’s platform of enterprise imaging applications that support the Apple ecosystem are used by many of the world’s largest, most sophisticated healthcare organizations, and also integrated bi- directionally to the most widely used EHR’

‘With Visage Ease VP we can now extend our offering to immersive, spatial imaging which has the potential to open up a number of novel and exciting possibilities within both medical imaging and the wider healthcare space.’

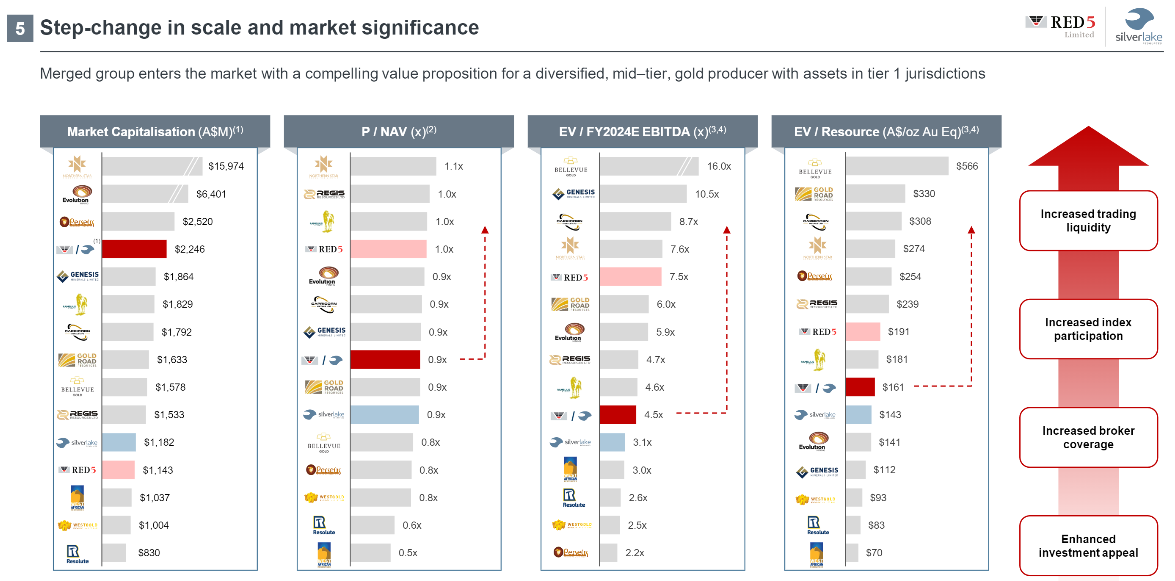

Red 5 and Silver Lake plan merger

Gold miners Silver Lake and Red 5 Ltd have announced plans to merge today, in a deal that will see Red 5 buy 100% of Silver Lake’s shares.

Silver Lake shareholders will receive 3.434 Red 5 shares for each Silver Lake share held, while Red 5 shareholders will remain majority shareholders with a 51.7% stake in the merged company.

The deal is expected to be completed by June, with Luke Tonkin of Silver Lake taking on the chief executive role of the new entity.

The combined company will have over $2.2 billion market cap, a group Mineral Resource of 12.4 Moz and Ore Reserve of 4Moz of gold.

Source: Silverlake

Buy the dip? China sees capital influx as markets face bottom

While we hear every day about China’s struggling economy, many see a silver lining- an opportunity to buy the dip.

In the past four weeks, China has seen a record inflow of around US$21.2 billion into its equity markets.

Is this a smart move for long-term value investors, or another value trap with people catching a falling knife?

The next moves are likely going to be spurred either by more direct action from leaders in Beijing or the devaluation of the yuan.

It’s hard to say, but it is a fair consideration to think things couldn’t get much worse for the ailing 2nd largest economy.

Are investors buying the dip in Chinese Stocks? Over the last 4 weeks, Chinese Equities have seen an inflow of $21.2 billion, the largest in history 🚨 pic.twitter.com/NqwWnB4ypX

— Barchart (@Barchart) February 4, 2024

Big miners drop as USD and China headaches continue

The big miners are leading the fall today as a sharp selloff hits the market.

The ASX 200 is down by 1.23% at 7,604.5 an hour after opening as traders weigh Central Banks’ next moves.

A sharp jump in the US dollar as traders push back expectations of interest rate cuts has reverberated through the equity markets.

The high USD is weighing on commodity prices and miners’ profitability on top of the struggles in the Chinese market. Iron ore prices are down 3.1% to US$126.90 a tonne.

All 11 sectors are in the Red, but mining is the worst hit, with the Materials sector down by -2.15%.

BHP is down -1.89% to $46.71 per share, Fortescue is down -1.95% to $29.15 per share, while Rio Tino is down -1.72% to $129.73 per share.

Click through the top of the chart below to see each company’s share price.

Morning market update

Good morning. Charlie here

The ASX 200 opened down -0.96% at 7,625.2 as the market takes profit before the RBA’s next decision. The Reserve Bank starts its first two-day policy meeting today with a decision tomorrow that will include updated forecasts and a media conference.

The Central Bank is widely expected to keep rates unchanged at 4.35%, with the RBA Rate Tracker putting the market’s bet at a 5% chance of a change.

Meanwhile, the US added 353,000 new jobs in January, almost double the expected 177,000. The strength of the current US economy again raises the question of when the Fed will cut rates.

Oil prices are still down, but many are expecting a reversal as the market digests the US attacks on Iran proxy targets throughout the Middle East.

Despite tensions being high, none of the strikes were into Iran but instead hit Yemen, Iraq, and Syria, so the market’s reaction may be smaller than some expect. Biden says he has no intention of a war.

In stocks, Meta added a further $200 billion to its market cap after beating earnings and offering its first dividend.

Wall Street: Dow +0.35%, Nasdaq +1.74%, S&P 500 +1.07%.

Overseas: FTSE flat, STOXX +0.34%, Nikkei +0.41%, SSE -1.46%

The Aussie dollar fell -0.22% to US 65.12 cents, now down almost 1% in a week.

US 10-year bond yields spiked +14bps to 4.02%.

Australian 10-year bond yields jumped +8bps to 4.09%.

Gold rose +0.05% to US$2,040.85. Silver rose +0.10% to US$22.69.

Bitcoin fell -1.09% to US$42,564, while Ethereum fell -0.48% to US$2,287.

Oil Brent rose +0.44% to US$77.67, while WTI Crude fell -1.90% to US$72.42.

Iron ore fell -4.1% to US$125.60 a tonne.

Key Posts

-

4:56 pm — February 5, 2024

-

3:52 pm — February 5, 2024

-

2:28 pm — February 5, 2024

-

1:56 pm — February 5, 2024

-

12:22 pm — February 5, 2024

-

11:29 am — February 5, 2024

-

11:22 am — February 5, 2024

-

11:11 am — February 5, 2024

-

10:11 am — February 5, 2024

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2024 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988