Investment Ideas From the Edge of the Bell Curve

ASX News Live | ASX Closes 2% Lower; BHP, Pointsbet, Zip, Sandfire Sink

Afterpay rival Klarna sees 1H22 losses quadruple

Big BNPL player Klarna — rival to Afterpay and Affirm — saw its first-half losses quadruple as the fintech struggles with rising costs, bad debts, and a plummeting valuation.

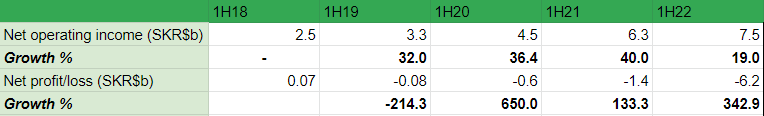

Overnight, Sweden-based Klarna reported a net loss of SKR6.2 billion (US$581 million) for 1H22, up from a SKR1.4 billion loss in 1H21.

While total income rose 19% YoY to SKR7.5 billion and gross merchandise volume rose 21% to US$41 billion, net losses ballooned over 340%.

Growth no longer highly prioritised

Addressing Klarna’s shareholders, CEO Sebastian Siemiatkowski said the market’s mood has changed. Profitability is in, growth at all costs is out.

“We’ve had a few years now where growth has been really heavily prioritized by investors. Now, understandably, they want to see profitability. We’ve had to make some tough decisions, ensuring we have the right people, in the right place, focused on business priorities that will accelerate us back to profitability while supporting consumers and retailers through a more difficult economic period. We needed to take immediate and pre-emptive action, which I think was misunderstood at the time, but now sadly we have seen many other companies follow suit.”

One of the measures Klarna took was to reduce the number of “Klarnauts” by 10%.

Another was to retrench its lending largesse.

“Similarly we’ve said we will tighten our approach to credit losses – these are an investment in growth, and we will lend a little less sometimes, especially to new consumers, supporting them to make the right decisions for them and for Klarna in changing economic circumstances. You won’t see the impact of this on our financials in this report yet – we have a very agile balance sheet, especially in comparison to traditional banks due to the short-term nature of our products, but even for Klarna it takes a little while for the impact of decisions to flow through.”

Jeremy Grantham: ‘super bubble’ yet to burst

Co-founder of Boston asset manager GMO Jeremy Grantham warned the ‘super bubble’ he foresaw is yet to pop.

In a note titled Entering the Super Bubble’s Final Act published on Wednesday, Grantham said the recent rally to mid-August was a quintessential bear market bounce.

Historically myopic investors risk being sucked in just as the bear returns with a vengeance.

Only a few market events in an investor’s career really matter, and among the most important of all are superbubbles. These superbubbles are events unlike any others: while there are only a few in history for investors to study, they have clear features in common.

One of those features is the bear market rally after the initial derating stage of the decline but before the economy has clearly begun to deteriorate, as it always has when superbubbles burst. This in all three previous cases recovered over half the market’s initial losses, luring unwary investors back just in time for the market to turn down again, only more viciously, and the economy to weaken. This summer’s rally has so far perfectly fit the pattern.

For Grantham, the super bubble he wants lanced is no ordinary effervescence.

The asset manager thinks the current supper bubble is a mixture of all three major asset classes — housing, equities, and bonds.

And that bodes poorly:

Previous superbubbles saw a much worse subsequent economic outlook if they combined multiple asset classes: housing and stocks, as in Japan in 1989 or globally in 2006; or if they combined an inflation surge and rate shock with a stock bubble, as in 1973 in the U.S. and elsewhere. The current superbubble features the most dangerous mix of these factors in modern times: all three major asset classes – housing, stocks, and bonds – were critically historically overvalued at the end of last year. Now we are seeing an inflation surge and rate shock as in the early 1970s as well. And to make matters worse, we have a commodity and energy surge (as painfully seen in 1972 and in 2007) and these commodity shocks have always cast a long growth-suppressing shadow.

Given all these negative factors, it is unsurprising that consumer and business confidence measures are testing historic lows. And in the tech sector, the leading edge of the U.S. (and global) economy, hiring is slowing, layoffs are rising, and CEOs are increasingly bracing for recession. Recently, we have seen a bear market rally. It has so far played out exactly in line with its three historical precedents, the bear market rallies that marked the middle phase of deflating superbubbles. If the bear market has already ended, the parallels with the three other U.S. superbubbles – so far so strangely in line – would be completely broken. This is always possible. Each cycle is different, and each government response is unpredictable. But these few epic events seem to act according to their very own rules, in their own play, which has apparently just paused between the third and final act. If history repeats, the play will once again be a Tragedy. We must hope this time for a minor one.

MoneyMe and Atomos among stocks hitting 52-week lows on Thursday

With the Aussie stock market sharply lower on Thursday, it’s no surprise that some stocks are hitting their 52-week lows:

- Personal loan lender MoneyMe, down 75% over the past 12 months

- Video equipment manufacturer Atomos, down 85% over the past 12 months

- Chemicals manufacturer and processor DGL, down 30% over the past 12 months

- Gold miner Evolution Mining, down 45% over the past 12 months

- Fellow gold miner Ramelius Resources, down 50% over the past 12 months

- Fintech Raiz Invest, down 65% over the past 12 months

- Personal lender Harmoney, down 60% over the past 12 months

- Biotech Immutep, down 50% over the past 12 months

- Battery tech materials developer PPK, down 90% over the past 12 months

ASX #stocks hitting their 52-week lows on Thursday:

– $MME, down 75% over the past 12 months

– $AMS, down 85%

– $DGL, down 30%

– $EVN, down 45%

– $RMS, down 50%

– $RZI, down 65%

– $HMY, down 60%

– $IMM, down 50%

– $PPK, down 90%— Fat Tail Daily (@FatTailDaily) September 1, 2022

iCandy up 20% on revenue jump

Mobile games maker iCandy Interactive (ASX:ICI) is currently up over 20% after releasing its latest half-year results.

iCandy proclaimed 1H22 was its best firs half ever.

Revenue rose 1,600% on 1H21 to $15.7 million, as EBITDA reached profitability, hitting $4.4 million.

The big revenue jump came after ICI consolidated its February 2022 acquisition of Lemon Sky Studios. ICI said Lemon Sky was the main driver of the revenue and has secured a demand pipeline “of more than 3 years for its work.”

iCandy’s EBITDA profitability excluded the acquisition cost.

Net profit for the period came in at $230,000, following a net loss of $1.2 million in 1H21.

The total acquisition price was $50,874,199. $18,329,400 was settled in cash and $32,544,799 settled via shares.

More parties join the nuclear bandwagon as spotlight on uranium intensifies

The discussions around nuclear energy and its role in abating the current crisis are growing every day.

Last week it was Japan and Germany, this week it is Switzerland and California…

A handful of Swisse politicians are pushing the leaders to take a leaf from Germany’s book. They suggest that to keep the lights on in their nation over the coming winter, five of their nuclear reactors must be brought back online.

For now, all these advocates can do is gather petitions. But, with 100,000 signatures, they will have the ability to initiate a referendum on the matter. Getting those signatures won’t be too hard, though, in my opinion, because the alternative — energy shortages — certainly won’t be popular.

Meanwhile, in California, a new bill was put forward late last Sunday. While it will certainly face an uphill battle, this bill proposes to keep the state’s last nuclear power plant open past its planned closure in 2025.

What is fascinating about this bill is where it has come from. Because this wasn’t some political play from a Republican in a Democrat stronghold. It was actually put forward by a Democrat who argues that nuclear power must be kept alive as gas-burning plants shut down.

The point, though, for investors like yourself, is that nuclear energy is back in a big way…

https://www.moneymorning.com.au/20220901/more-parties-join-the-nuclear-bandwagon-as-the-spotlight-on-uranium-intensifies.html

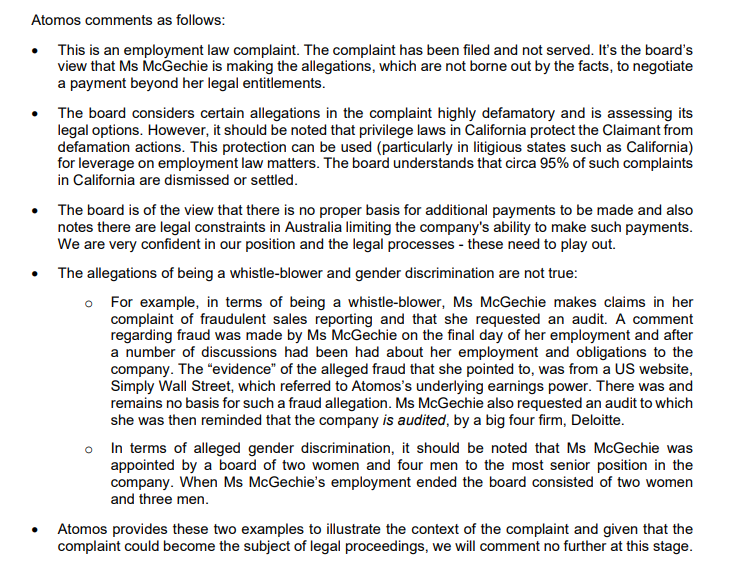

Atomos down 21%, ‘disappointed’ about AFR coverage

Video equipment manufacturer Atomos (ASX:AMS) is down over 20% on Thursday following its response to an article from the Australian Financial Review regarding Atomos’s former CEO, Estelle McGechie.

In an article published on Wednesday, AFR journalist Michael Roddan wrote:

‘Estelle McGechie, the former CEO of Atomos who the company said in April was sacked “primarily because she has not yet relocated to Australia”, has alleged, rather, that she was wrongfully terminated because she “dared to speak up about rampant illegal conduct at Atomos”.

‘The Silicon Valley-based McGechie, a former Apple developer who was appointed Atomos CEO in September 2021, has alleged Atomos engaged variously in “securities fraud and revenue manipulation”, “falsely reporting material sales forecast information”, “channel stuffing” (shipping excessive stock to distributors to artificially boost short-term sales figures), and “insider trading”.’

Ex-CEO alleges ‘rampant illegality’ at Ellerston, Regal-backed Atomos https://t.co/BxavVogqAp

— Michael Roddan (@MichaelRoddan) August 31, 2022

Early this morning, Atomos released a response, expressing its disappointment and announcing it has made a formal complaint.

“Atomos is disappointed that the AFR has published an article where it has chosen to misreport an employment complaint by former CEO, Estelle McGechie, as the company being involved in ‘rampant illegality’. Atomos provided relevant context to the AFR ahead of publication deadline which the journalist, Michael Roddan, chose not to include in the article. Atomos has made a formal complaint to the AFR.”

Moneyme sinks 25% on institutional placement

Digital fintech MoneyMe (ASX:MME) is currently down nearly 25% after completing a $20 million institutional placement.

The personal loans lender issued around 40 million new shares at 50 cents a share, representing a 28% discount to the last closing price on Monday, 29th August.

The market promptly sheared MME’s share price to pretty much the placement issue price, with MME shares currently exchanging hands for around 52 cents a share.

Clayton Howes, MoneyMe’s CEO, commented:

“Capitalising the business in a challenging environment to fund asset growth and support debt facilities is important and a good step for the business.”

June US total oil demand above pre-Covid June 2019, highest since 2006

Recession fears and high energy prices leading to ‘demand destruction’ are yet to show up in the data.

Bloomberg energy journalist Javier Blas reported that according to the latest data, US total oil demand in June was above pre-Covid June 2019 levels.

Not only that, US oil demand was the highest for the month since 2006.

OIL MARKET: According to the new monthly data, US total oil demand in June was 20.772m b/d ( (that's ~740,000 b/d higher than implied by the weekly data). June 2022 was above pre-covid June 2019, and the highest for the month since 2006 | #OOTT 2/3 pic.twitter.com/1GLNeDmPJP

— Javier Blas (@JavierBlas) August 31, 2022

ASX plummets 2% on market open, dragged lower by ex-dividend BHP

The ASX 200 is currently down 2% in early market trade on Thursday, dragged sharply lower by mining giant BHP (ASX:BHP), who is trading ex-dividend.

Bookmaker Pointsbet (ASX:PBH) continued where it left off yesterday and is down a further 6% currently after reporting widening net losses in its FY22 results.

Battery tech stock Novonix (ASX:NVX) is down over 5%. Novonix released its FY22 results yesterday, showing a 61% rise in revenue to $8.4 million but net losses rising nearly 300% to $71.4 million.

Oil prices continue to slide on recession fears

Oil prices fell almost 8% in the past two days, leading to a third straight monthly decline.

Are recession fears trumping supply concerns?

Brent crude, the widely followed price, fell 12% in August to US$96.49 a barrel.

S&P 500 ends lower overnight, drops 4.2% in August

The benchmark US S&P 500 fell overnight, a fourth straight day of declines as investors brace for resolute action from the Federal Reserve.

The major US stock indexes ended August with losses between 4% and 5%, the worst monthly performance since June.

S&P 500 closed 0.8% lower overnight, bringing its August loss to 4.2%.

The Dow Jones Industrial Average fell 0.9%, dropping 4.1% last month.

And the tech-heavy Nasdaq fell 0.6%, sliding 4.6% in August.

The Nasdaq $QQQ sold off 85 bps in the last ten minutes of trading to turn a green day red. Was up 30 bps on the day at 3:50 PM ET, finished down 58 bps by 4 PM. A lot of selling in the final 10 minutes of August trading.

— Bespoke (@bespokeinvest) August 31, 2022

Key Posts

-

4:18 pm — September 1, 2022

-

2:45 pm — September 1, 2022

-

2:21 pm — September 1, 2022

-

12:03 pm — September 1, 2022

-

11:43 am — September 1, 2022

-

11:07 am — September 1, 2022

-

10:39 am — September 1, 2022

-

10:30 am — September 1, 2022

-

10:17 am — September 1, 2022

-

9:55 am — September 1, 2022

-

9:42 am — September 1, 2022

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2025 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988