Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | ASX Pivots to last Minute Gain; Gold Hits Fresh All-Time High

Market close update

The ASX 200 closed up +0.16% after a last-minute rally saw the index spike to close above the 8k mark at 8,010.5.

An outsized performance by big companies on the ASX who reported earnings today helped lift the ASX into positive territory, with Wisetech, Charter Hall, and Healius all seeing strong gains today.

Thanks to Wisetech’s 17.9% gain today, the technology sector was the star performer, up by 5.3%.

Energy stocks were today’s laggard, with the sector down by -1.85%. Santos‘ earnings disappointed today as its half-year earnings fell, sending its shares down by -4.48%.

Standout performer on the wider benchmark was Humm Group who jumped 35.5% in trading today to close at 70.5 cents after a strong FY24 report that saw revenues increase 21% and NPAT jump 145%.

The price of gold continued to climb throughout today’s session, with the spot gold at a fresh high of US$2,518.23 per ounce.

A 9% Dividend Yield for the Taking

Editor Murry Dawes is always on the lookout for new opportunities within the market…but also threats.

Now that stocks have shrugged off the prior week’s crash, he thinks there is a great spot to pick up a large retail stock paying a gross yield of 9%.

Here’s the story from Murry:

You may be wondering if last week’s crash in Japanese stocks ever happened.

The market has taken it in its stride, and it appears we are back to business as usual.

But the underlying cause of the volatility remains.

The US economy may be slowing faster than many expect as a result of interest rates remaining at a restrictive level for the past few years.

If that is the case investors should consider how they can position themselves to take advantage of opportunities.

In today’s Closing Bell video, I focus on the buy signal in US 10-year bonds.

Past cycles have seen interest rates drop rapidly once the cutting cycle begins. It is not always a bullish outcome for stocks. That’s because something has usually broken as a result of high rates, and the US Fed cuts rapidly to stop an implosion (for example in 2000 and 2007).

Therefore, a more defensive posture is to look for solid dividend yields.

In the video below I show you a $3.6bn retail group that is paying a fully franked 6.3% dividend yield that grosses up to 9%!

I don’t show it to you as a trade but as an example of the type of opportunities that are out there at the moment.

If rates do follow the same path as past cycles and come off the boil rapidly a 9% yield could look spectacular. Especially if a drop in rates ignites the retail sector and revenues grow more rapidly than the current low levels expected.

I also have a look at the possible weekly buy signal in US stocks which would increase the odds there is more upside to come in the short-term.

As I show you in todays video, the volatility last week didn’t cause that much damage to the charts. But the underlying problems with US growth could cause further volatility ahead if data continues to disappoint.

If you want to learn more about the stock market ahead, be sure to stay tuned for Murry’s next major event, which he calls the shakeout.

Click here to save your spot to hear from the guy who picked the August panic in advance.

Breville shares rise on solid report

Kitchen appliance powerhouse Breville [ASX:BRG] has seen its shares rise by +5.3% in trading so far today after the company’s latest FY24 report.

The company saw revenues increase by 3.5% to $1.53 billion from last year, while gross profits rose 7.7% to $556.9 million for the year.

EBITDA saw a 12.5% improvement over FY23, coming in at $245.5 million, while net profit after tax was up 7.5% to $118.5 million.

The company issued a dividend of 33 cents per share fully franked and were confident in the future.

Commenting on the Group’s result, Breville Group CEO, Jim Clayton said:

‘A solid year of performance with a marked strengthening in the second half. The Group delivered 8.0% EBIT growth, slightly above the top end of guidance, against a subdued consumer backdrop, with Gross Profit up 7.7% and Revenue up 3.5%.’

‘Encouraging signs of strengthening in the 2H with double–digit revenue growth in the Americas and EMEA, double–digit growth in Coffee, and an improving performance in our direct countries in the APAC Theatre. Overall, the strength of our new product launches, expansion of new markets and the continuing coffee tailwind supported this top line growth as cost–of–living pressures and mean reversion weighed on the business.’

Including today’s gains, the company has seen its share price rise by 27.5% in the past 12 months, slightly above the sector average.

Santos profits down, dividend up

Energy giant Santos [ASX:STO] has seen its share price plunge around 5% in trading today as the oil and gas producer releases another tough report.

Its half-year report, which you can read in full here, showed its profits falling 17% to US$659 million as revenue from oil and gas fell.

Production for the first six months of 2024 was 44 million barrels of oil equivalent, down 2%, while revenues also fell 9% to US$2.7 billion.

Despite the poor result, the company attempted to assuage shareholders by offering a record interim dividend totalling US$422 million, a 49% increase. That equals US 13 cents per share unfranked.

Managing Director and Chief Executive Officer Kevin Gallagher attempted to paint a different picture, saying:

‘Today’s results demonstrate the capability of Santos to generate strong cash flow from operations, deliver significant progress on major projects and deliver competitive, reliable shareholder returns. The disciplined low-cost operating model underpins our business, and we continue to manage our cost base to be resilient through all scenarios and price cycles.’

The company pointed to project progress, saying the Barossa gas project is earning 80% completion, with first gas on track for Q3 2025.

The company posted no change to the full-year guidance, with expectations of improving oil and gas prices likely baked into their estimates.

Australian mortgage distribution

Here’s the interesting chart for the day.

It shows the distribution of mortgage holders in Australia over the past 10+ years.

With hopes of cuts coming this year dashed by recent rhetoric by the RBA, the question will be, when will the market’s buying pick up next?

Here's a distribution of mortgage rates over the last 10+ years.

To motivate buyers do you suppose the current rate needs to be in the left bubble or simply below the right bubble? pic.twitter.com/7UMLxm5hVB

— Mike Simonsen 🐉 (@mikesimonsen) August 20, 2024

Wisetech soars on higher revenue

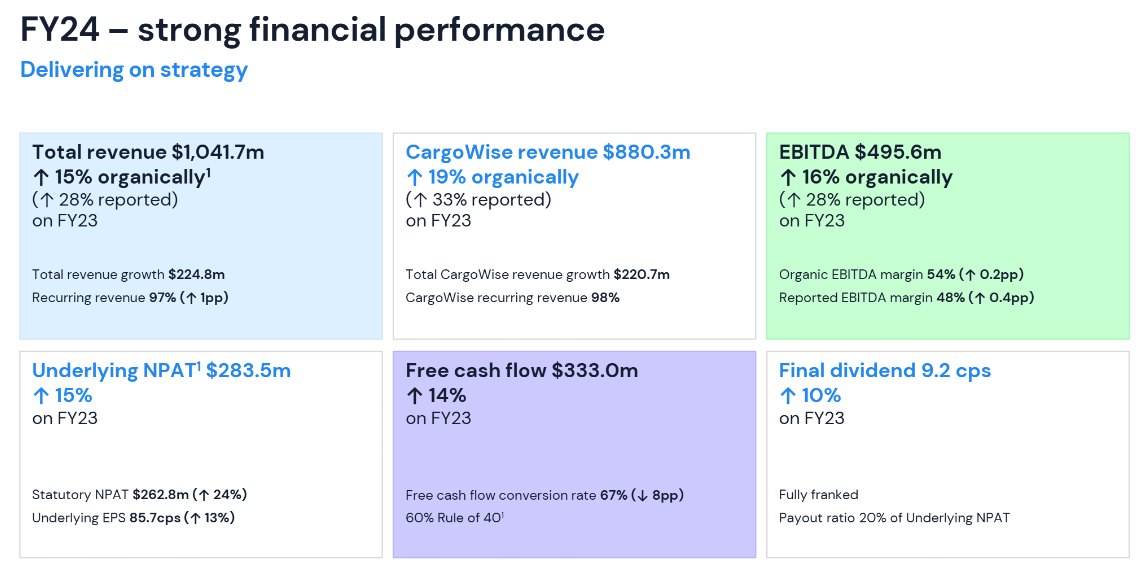

Logistics software giant Wisetech Global [ASX:WTC] has seen its shares jump by +16.7% in trading so far today as the company reported its FY24 results.

The highlights of the performance are below:

Source: Wisetech

The 28% revenue increase landed at the bottom of the guidance range for FY24, but investors were overall happy with the company’s positioning, as earnings and margins came in above expectations.

Earnings before interest, tax, depreciation and amortisation (EBITDA) was $495.6 million, while EBITDA margins were 48%, both above expectations.

WiseTech Founder and CEO, Richard White celebrated the execution of the ‘3P Strategy’ and highlighted some of the big wins, saying:

‘CargoWise’s strong momentum continued throughout the year with the addition of TIBA Tech and Grupo TLA Logistics, as new Large Global Freight Forwarder (LGFF) rollouts, as well as the post year–end signing of Nippon Express, a Top 10 global freight forwarder and Japan’s largest, taking us to 52 large global rollouts, and more than 50% of the Top 25, with the opportunity pipeline across the world’s major economies strengthening.’

For FY25, Wisetech expected a further 33% increase to earnings, coming in between $600-700 million, with margins between 51-52%.

Market update

The ASX 200 is down by -0.10% to 7,989.7, breaking its winning streak seen by most major benchmarks as they quickly recovered from the selloff seen at the start of the month as macro concerns clouded markets.

Its a fairly low volume trading day for the markets as a busy earnings season isn’t enough to seriously shif things around, while some standout earnings by Wisetech Global have helped buoy the ASX 200 from steeper losses after reporting a jump in profits today.

Four of the eleven sectors are in the green, but Wisetech’s outsized performance of over16%, is lifting the tech sector’s performance to +4.81%.

Energy stocks are the largest drag on markets today, with the sector down by -2.52%. Woodside Energy is down by -1.68%, Santos is down a whopping -5.31% after its 1H24 earnings fell and Yancoal a further -5.55% today after its poor reporting results yesterday.

In other major news from reporting today, Charter Hall is up by +14.5% after its reporting today promised a 6% lift in distributions over the coming year.

Scentre Group Reports Profit Jump

Shopping centre property giant Scentre [ASX:SCG] reported a 170% jump in profits in its 1H24 report today.

The Westfield owner holds around $50 billion in assets under management and has seen a solid improvement across its portfolio despite the cost of living challenges.

Statutory profits for the first half of the year were $404 million, up form $149 million in the PCP, while Net operating income grew by 3.5% to a hair over $1 billion for the six months to 30 June 2024.

Scentre Group Chief Executive Officer Elliott Rusanow said:

‘Our focus on creating more reasons for people to visit has seen 320 million customervisitations so far this year. This is an increase of 1.9% or 6 million more visits when compared to the same period last year.’

‘This has provided our business partners with the opportunity to increase their sales through our Westfield destinations, increasing by 2.4% to $13.4 billion in the six months to 30 June 2024 and a record $28.6 billion for the 12 months to 30 June 2024.’

Scentre’s shares are up 1.03% in this morning’s opening, trading at $3.43 per share. That puts the company’s return at 25% for the past 12 months.

Morning Market Update

Good morning. Charlie here.

Global markets broke their winning streak overnight, with ASX 200 Futures pointing to a similar day of pullback on the Aussie share market today.

Major US benchmarks broke their eight-session-long winning streak as traders took profits off the table after the strong rally in the wake of the large drops seen at the start of August.

But volumes were low and confidence seems high in the runup to the next major driver of markets, J Powell’s Jackson Hole speech on Saturday morning AEST.

Expectations of Fed cuts are the major catalyst within the markets, with gold at a fresh all-time high while bond yields continue to ease.

US 10-year Treasuries dropped another 6bps overnight to 3.81% as traders continued to buy into bonds to lock in higher yields before interest rate cuts.

It’s a big day of earnings reports on the ASX today. You can find the full list in the CommSec earnings report here.

Standout names reporting today are Santos, Breville, IAG, Dominoes, Scentre, Lottery Corp, Brambles, and Wisetech.

| Name | Value | % Chg | |

|---|---|---|---|

| Major Indices | |||

| S&P 500 | 5,597 | -0.20% |

| Dow Jones | 40,834 | -0.15% |

| NASDAQ Comp | 17,816 | -0.33% |

| Russell 2000 | 2,142 | -1.17% |

| Country Indices | |||

| UK | 8,273 | -1.00% |

| Germany | 18,357 | -0.35% |

| Euro | 4,857 | -0.28% |

| Japan | 38,062 | +1.80% |

| Hong Kong | 17,511 | -0.33% |

| Name | Value | % Chg | |

|---|---|---|---|

| Commodities (USD) | |||

| Gold | 2,514 | +0.42% | |

| Silver | 29.46 | +0.16% | |

| Iron Ore | 95.95 | +0.56% | |

| Copper | 4.1420 | -0.92% | |

| WTI Oil | 73.16 | -0.68% | |

| Currency | |||

| AUD/USD | 67.46¢ | +0.21% | |

| Cryptocurrency | |||

| Bitcoin (USD) | 59,286 | +0.25% | |

| Ethereum (USD) | 2,584 | -1.31% | |

Key Posts

-

4:37 pm — August 21, 2024

-

4:20 pm — August 21, 2024

-

3:54 pm — August 21, 2024

-

3:26 pm — August 21, 2024

-

3:15 pm — August 21, 2024

-

3:07 pm — August 21, 2024

-

2:53 pm — August 21, 2024

-

10:31 am — August 21, 2024

-

9:29 am — August 21, 2024

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2026 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988