ASX News LIVE | ASX to Fall as Hot Inflation Report Scuppers Markets

Market close update

The ASX 200 closed down -0.45% to 7,813.6 today as markets sold off in response to the hotter-than-expected inflation data out of the US last night.

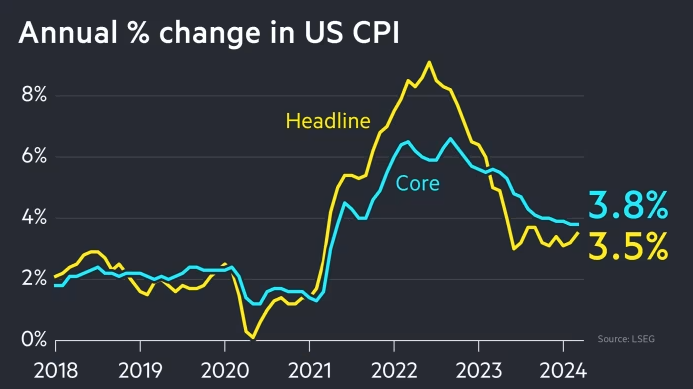

The monthly CPI data showed US core inflation at 3.5% for March on a year-on-year basis. The rise has been blamed on rising fuel and housing costs and is the third month in a row of slightly higher-than-expected numbers.

The rise has paired back bets of interest rate cuts for June and has some reducing their bets of the number of cuts down from 3-2 to one or less.

At the height of market optimism in January, the futures market was pricing in around 175bps of cuts starting in March, but now the shift is expecting considerably less, and starting closer to September.

On the ASX as a response today interest-rate sensitive sectors were down, with Real Estate (-1.80%) the worst performer today.

In individual stocks the best-performing share today was Vulcan Energy Resources up 24.13% as the company announced its first Lithium Chloride produced from its European plant.

Meanwhile, the worst performer on the index today was Wildcat Resources falling -11.81% after mediocre drilling results yesterday met wider macroeconomic fears today.

Dwelling approvals down

The latest monthly data on Australian dwelling permits was released today, showing a -1.9% decrease in approvals month-over-month.

This has been highlighted by some as a cause of real concern as the cost of housing continues to outstrip wages, but Economist Alex Joiner thinks the month’s numbers aren’t as bad as they could have been.

Completions aren't to bad considering high build costs and high rates. It is just that demand is excessive and population growth remains so strong. pic.twitter.com/eeCkso2QeC

— Alex Joiner 🇦🇺 (@IFM_Economist) April 10, 2024

Coles responds to claims of land banking

Coles responded to allegations by Metcash CEO Grant Ramage that the supermarket had been involved in land banking.

This is the process by which individuals or companies buy up large chunks of undeveloped land, intending to profit when nearby land is developed by others.

Here is the response from Coles today:

‘There are many factors which help us determine where we purchase land to build brand new stores, including proximity to new communities and growth corridors, or the need for full-service supermarkets within existing markets.’

‘Due to regulatory and other requirements, it can take several years between purchasing land and beginning construction. Once the store is operational, we generally sell the site to a landlord to allow us to invest in building new stores.’

‘Australia’s supermarket sector is highly competitive. We have an incredibly vibrant independent and specialist sector in Australia. When you go to one of our supermarkets, you will often see an independent bakery, butcher, fruit and vegetable grocer or delicatessen close by, for example, creating competition which ultimately benefits customers.’

Avita Medical tumbles after lower guidance

Regenerative medical company Avita Medical [ASX:AVH] is today’s loss leader after signalling lower 1Q revenue.

In a note today the Avita reaffirmed expectations for full-year revenue 2024 but then said it was likely ‘at the lower end of the previously provided guidance of US$78.5 to US$84.5 million.’

For the March quarter, Avita says it now expects revenue to be in the range of US$11 to 11.3 million, down from the prior guidance of US$14.8 to US$15.6 million.

The downgrade was blamed on ‘slower-than-expected conversion rate of new accounts for our expanded label of full-thickness skin defects [products].‘

Jim Corbett, Chief Executive Officer of AVITA Medical said today:

‘In light of the challenges encountered in the first quarter of 2024, we are intensifying our efforts to drive growth,’

‘While our account conversion rate impacted our quarterly revenue, we remain optimistic for the full year. With the recent launch of PermeaDerm in March and the upcoming launch of RECELL GO, along with our deeper understanding of the VAC processes and timelines, we believe that we will meet the lower end of our previously provided annual revenue guidance range of US$78.5 million to US$84.5 million.’

Midday market update

The ASX 200 is down by -0.58% around midday as benchmarks sell-off after the hotter-than-expected CPI data out of the US last night that showed core inflation for March at 3.5%.

Interest-rate-sensitive sectors like Real Estate (-1.95%) and Tech (-1.53%) sold off heavily on the news this morning, while Energy (+1.08%) and Mining (+0.45%) broadly held onto gains seen yesterday.

Top gainers around midday were Vulcan Energy Resources up 12.94% and Core Lithium +6.45%, while Avita Medical -10% was the biggest faller on the index so far today.

NextDC lines up major raise

NextDC [ASX:NXT] has entered a trading halt as it prepares to raise $1.3 billion at $15.40 per share on a 6.8% discount to its last closing price of $16.52.

In its latest investor presentation, the company says that thanks to ‘unprecedented growth‘ they are accelerating their plans to ‘drive future growth in revenues and earnings.’

Citing AI as the next driving megatrend the company expects adoption to drive future earnings, citing its forward order book hitting record highs.

For a dose of reality I would encourage readers to have a look at Editorial Director Greg Canavan’s recent Livewire article on NextDC to get another side of the story.

You can read that article here.

The company has seen its share price rise by 40.31% in the past 12 months, with it currently trading at $16.71 per share.

Morning market update

Good morning. Charlie here,

The ASX 200 opened down -0.38% to 7,818.4 as a hot monthly CPI print sent US benchmarks down overnight. As we talked about yesterday, the market tends to overfocus on the significance of monthly inflation figures, which tend to be lumpy.

However, the slight rise is enough to put markets on alert to later cuts by the Fed.

The Consumer Price Index (CPI) for March showed a 3.5% year-over-year increase, according to data from the Bureau of Labor Statistics.

That’s up from 3.2% in February and above the consensus forecasts of 3.4%.

Headline inflation rose by 0.4% in March from February, compared with February’s 0.4% gain from January. The stronger pace was blamed on the rising costs of housing and fuel.

Core inflation came in at 3.8% year-over-year in March, up from 3.2% in February.

Source: Financial Times

As a response stocks fell, with the Dow Jones dropping over 400 points to its lowest close in almost two months.

Treasury yields jumped, reflecting bets that the hotter data would delay and reduce future cuts by the Fed.

Shortly after the data release fed-fund futures gave just a 22.9% chance of an interest rate cut in June according to the CME FedWatch Tool.

That’s down from a 56.1% chance just a day ago.

‘A third-straight hotter-than-expected CPI may have been the final nail in the coffin for a June rate cut, but it remains to be seen whether 2024 will turn out to be a two-cut year, or something less,’ wrote Chris Larkin, managing director, trading and investing at Morgan Stanley.

Meanwhile, Fitch downgraded China’s debt outlook, citing economic uncertainty and continued struggles for the Chinese real estate sector.

For Australia, the AUD plummeted overnight falling nearly 2%, while today we will get the latest data on building permits and house approvals.

Wall Street: S&P 500 -0.95%, Dow -1.09%, Nasdaq -0.84%.

Overseas: FTSE +0.33%, STOXX +0.20%, Nikkei -0.48%, SSE -0.70%.

The Aussie dollar plummeted -1.76% to US 65.13 cents.

US 10-year bond yields +18bps to 4.54%.

Australian 10-year bond yields +7bps to 4.24%.

Gold fell -0.84% to US$2,335.03, while Silver fell -1.03% to US$27.88.

Bitcoin rose 1.96% to US$70,447, while Ethereum rose +1.08%% to US$3,536.

Oil Brent rose +1.38% to US$90.65, while WTI Crude rose +0.12% to US$86.31.

Iron ore fell -0.8% to US$106.60 a tonne.

Key Posts

-

4:55 pm — April 11, 2024

-

4:42 pm — April 11, 2024

-

4:24 pm — April 11, 2024

-

2:26 pm — April 11, 2024

-

1:02 pm — April 11, 2024

-

12:35 pm — April 11, 2024

-

10:08 am — April 11, 2024

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2024 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988