ASX News LIVE | ASX to Fall as Bonds Spike; Supermarkets Face Senate Inquiry

Market close update

The ASX 200 closed down -1.81% to 7,612.5 its worst day of trading since March last year.

All sectors were firmly in the red as compounding fears washed over the market. The session was the fourth consecutive drop on the Australian benchmark as traders derisked in view of a series of unfortunate events.

Firstly, last week, there was the risk of re-accelerating inflation with US CPI data, then followed by the rising tensions in the Middle East with Iran’s attack on Israel and fears of jumping oil prices (which held low).

Now, overnight, we’ve seen hotter-than-expected retail data from the US, showing real strength in the US economy and pushing back expectations on when the Fed will have to cut interest rates.

All of this has pushed the AUD down a further -1.06% through the session today to US 64.19 cents and sent Treasury yields climbing and equities falling.

Only Gold is maintaining its strength at the moment, up by +0.17% to US$2,385.84 per ounce.

Veteran trader describes today as a ‘bloodbath’

It’s been a tough day on the market for sure, but with volumes only 9% over average, describing it as a bloodbath can be a bit overblown.

Here’s his breakdown of the day.

🇦🇺A bit of a bloodbath (sorry a bit dramatic but I guess it sells😉) in the ASX200

We're down 2.1% – the worst day since 10 March 2023 and 3.3 z-score move (for you stats people) – 95% of stocks are lower – volumes 9% above the 30 days average

Value was hit hard in US trade,… pic.twitter.com/8VX8wY3wLd

— Chris Weston (@ChrisWeston_PS) April 16, 2024

Imugene Divests U.S. Manufacturing Facility to Kincell Bio

Biopharmaceutical company, Imugene [ASX:IMU], has announced the sale of its manufacturing facility in North Carolina to Kincell Bio for $6 million. This divestiture is expected to garner significant cost savings for Imugene, with an estimated reduction of $32 million in staff expenses.

According to Imugene’s statement, the transfer of the manufacturing facility and its workforce, coupled with the outsourcing of the Azer-cel process development to Kincell, will result in a 50% reduction in Imugene’s staff.

‘With the transfer of the manufacturing facility and staff and the outsourcing of Azer-cel process development to Kincell, Imugene reduces staff by 50 per cent and extends its cash runway to 2026,’ it said in a statement.

Market update

The ASX 200 is down sharply today, falling -2.14% to 7,586.3.

This would make it the worst day of trading since March 2023 as the broad sell-off continues in the face of rising bonds and concerns of late cuts by the Fed.

Stronger than predicted retail data out of the US highlighted the strength of the US economy and sent equity markets spiraling as traders pushed back their bets of interest rate cuts.

Financials, consumer stocks and mining sectors fell the heaviest so far today, but every sector is well into the red.

USD pushes down AUD

A dollar rally started from the tensions in the Middle East has been supercharged by doubts over how much the Fed is likely to cut rates this year.

The US dollar index which measures the greenback versus a basket of six major currencies, is up 4.65% this year so far.

1.7% of that gain was just in the last week, its biggest weekly gain since September 2022.

That index is now at its highest level since early November and will put pressure on commodity trading which is often through the intermediary USD.

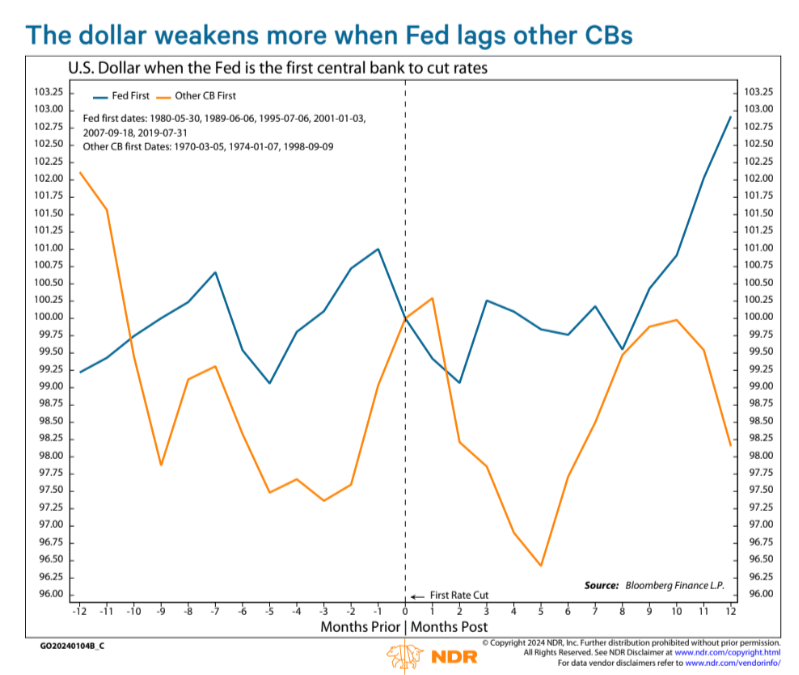

What has really shifted in the past couple of weeks is the expectation of when the Fed will cut rates.

Investors had believed that the Fed would be among the first Central Banks to cut rates, but now we are seeing the European Central Bank and others who look far more likely to cut first.

‘We had a fairly clear path that the Fed would likely be the first actor. The data that we have received really does undermine that,’ said Eric Leve, chief investment officer at wealth and investment management firm Bailard. ‘I can see obvious reasons why the dollar could strengthen further.’

While Ned Davis Research analysts have argued the opposite, pointing to historical data of a lagging Fed shows the potential of a weakening dollar.

Source: Ned Davis Research

Heated first half of Senate Inquiry into Supermarkets

It’s been a charged morning in the Senate as the hearing into suspected price gouging by large supermarkets has seen multiple suspensions amid fractious arguments with Woolworth’s exiting CEO Brad Banducci.

Committee Chair Senator Nick McKim has threatened Mr Banducci with contempt of court multiple times as the pair argue about how Woolworth’s measures its profit margins.

Mr McKim has been trying to argue the return on equity metric shares in their financial reports indicate outsized profits, while Mr Banducci has said he is unaware of the number as the company focuses on return on investment.

‘The focus is, you put a dollar in, what return do you get out,’ Mr Banducci argued.

The next point of contention in the inquiry was around the price-setting process with farmers.

Senator Cadell brought up a text message he had received from a farmer, which showed correspondence from Woolworths.

The text from Woolies simply read, ‘Please align to $24′.

‘What am I meant to read from that? I read it as you will not be purchased from. That’s not market setting, that’s a dictation’, argued Mr Cadell.

Morning market update

Good morning. Charlie here,

The ASX 200 opened down -0.94% to 7,679.8. The Australian benchmark is on track to fall for the fourth consecutive session down as Middle East tensions and US Interest rate cuts play havoc on equities.

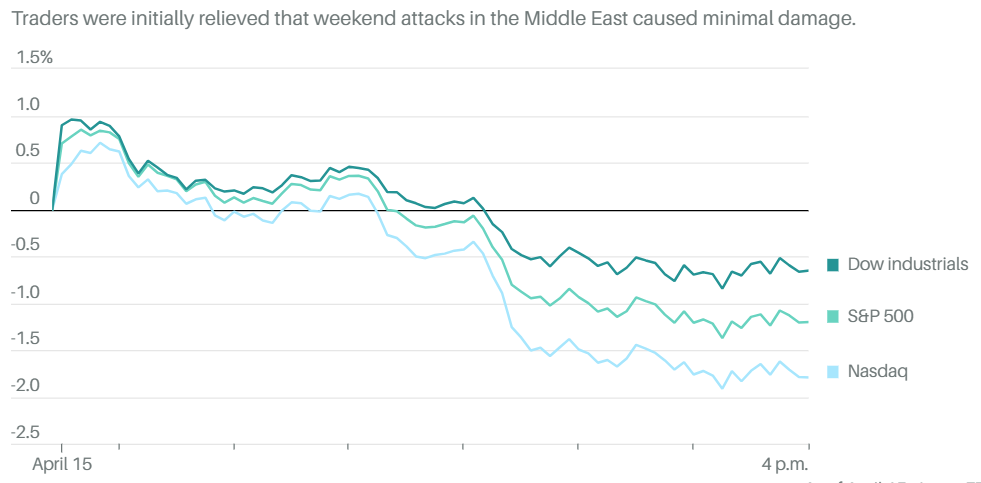

After an initial relief that the Iranian attack had caused minimal damage, US markets fell around midday as retail sales data for March rose more than anticipated, sending Treasury yields higher.

Source: Barrons – FactSet

With the stronger retail data, Wall Street once again felt cuts were coming later than hoped, pushing US 10-year yields to 4.66%, its highest level since 6 November.

‘The Fed has little reason to worry about a recession near-term, keeping their focus squarely on controlling inflation,’ said Bill Adams, chief economist for Comerica Bank.

Meanwhile, on the ASX supermarket CEOs face a Senate hearing in Canberra today to address questions around price gouging.

Wall Street: S&P 500 -1.20%, Dow -0.65%, Nasdaq -1.79%.

Overseas: FTSE -0.38%, STOXX +0.59%, Nikkei -0.74%, SSE +1.26%.

The Aussie dollar fell -0.49% to US 64.42 cents.

US 10-year bond yields +8bps to 4.60%.

Australian 10-year bond yields +4bps to 4.30%.

Gold is up +0.69% to US$2,381.22, while Silver rose +2.32% to US$28.88.

Bitcoin fell -3.63% to US$63,508, while Ethereum fell -1.61%% to US$3,103.

Oil Brent rose +0.34% to US$90.41, while WTI Crude rose +0.53% to US$85.86.

Iron ore fell -0.14% to US$112.05 a tonne.

Key Posts

-

4:20 pm — April 16, 2024

-

4:10 pm — April 16, 2024

-

2:47 pm — April 16, 2024

-

2:34 pm — April 16, 2024

-

12:29 pm — April 16, 2024

-

12:00 pm — April 16, 2024

-

10:21 am — April 16, 2024

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2024 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988