ASX News LIVE | ASX to Fall as Bond Yields Climb; BHP, Newmont, and ResMed Feature.

Market close update

The ASX 200 closed down -1.32% today to 7,581.5 as hotter-than-expected inflation data in Australia and in the US sent markets down as traders pushed back expectations of cuts.

The first rumblings of possible rate rise even moved into the conversation today as Australian bond yields jumped up +12bps for 10-year Treasury bonds.

As these longer-term interest rates are rising faster than short-term bonds, you get an effect known as the ‘bear steepener’ as markets swing to anticipate rate hikes in the short term.

In the US weaker GDP data for the March quarter raised some concerns of a slowing economy there as the figure came in only at 1.6% for the quarter, below expectations.

In ASX news BHP’s $60 billion takeover bid on Anglo American has been rejected by Anglo’s board, labeling the move as opportunistic. They went on to say.

‘The Board has considered the Proposal with its advisers and concluded that the Proposal significantly undervalues Anglo American and its future prospects.’

While Newmont was today’s best performer, with the stock jumping 13.15% to trade at $65.21 per share on strong quarterly results and elevated gold prices.

Healthcare specialist ResMed also had a strong day, up almost 10% on its third quarter results that showed a healthy growth of margins and 7% revenue growth.

Nick Scali was also up double digits today, gaining over 12% as the company completed a $46 million institutional placement.

Newmont up on strong quarter

The ASX’s largest listed gold miner, Newmont [ASX:NEM] is up by over +13% in this afternoon’s trading as the company reports its quarterly activities.

For Q1 of 2024, the company produced 1.7 million ounces of attributable gold and 489,000 gold equivalent ounces from copper, silver, lead and zine.

The company reported $179 million in income with an adjusted EBITDA of $1.7 billion.

The company also noted that it will divest its Fruta del Norte operations for US$360 million to Lundin Gold as it slims down its portfolio after its acquisition of Newcrest.

For the quarter, the company realised an average gold price of US$2090 per ounce, compared to US$1906 per ounce in the prior quarter.

The company also declared a dividend of US 25 cents per chess share held.

Super Retail drops on looming court case

Allegations have surfaced accusing Super Retail Group [ASX:SUL] CEO Anthony Heraghty and former HR head Jane Kelly of concealing an intimate relationship from the company.

This accusation by former employees is at the centre of a looming workplace dispute headed to court.

The retailer behind brands like Rebel and Supercheap Auto says it expects to be named as a defendant, along with its board, CEO, and other senior leaders, in an imminent legal claim brought by the law firm Harmers Workplace Lawyers.

However, Super Retail maintains the allegations are baseless and states it will defend itself against this action.

The company said it expects the claim to be between $30-50 million.

Australian PPI up again raises fears of inflation

Judo Bank’s chief economic adviser, Warren Hogan, released a stark warning today, saying that the latest PPI figures show that the RBA could continue to raise rates this year.

‘Everything points to the fact that 4.35 percent isn’t the right level for the cash rate,’ he told the AFR today, suggesting that three possible raises could instead be in store for Australians.

So far, he remains an outlier, but more are raising the alarm that the battle with inflation is far from over.

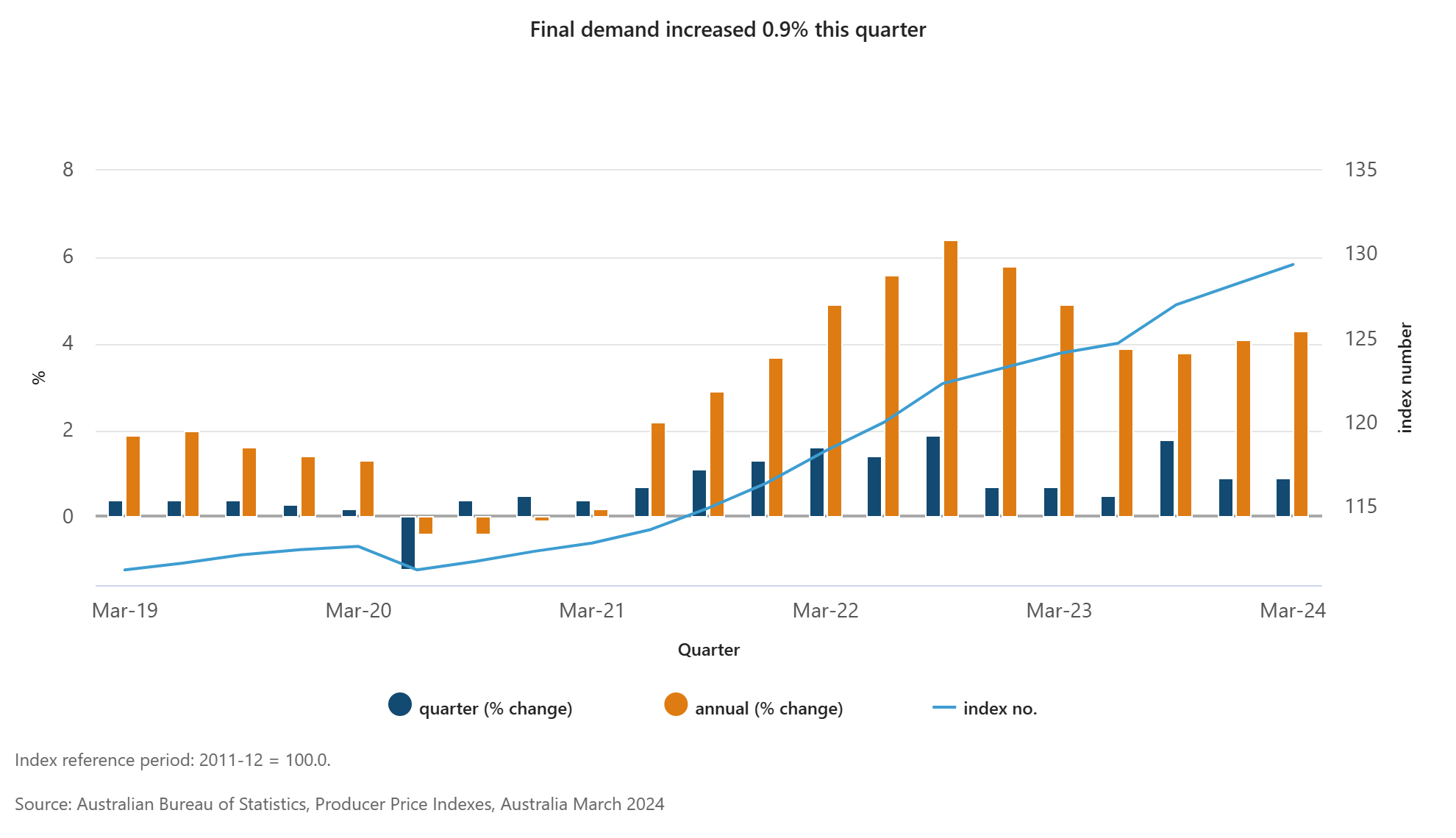

Today’s Producer Price Index (PPI) data for the March period showed the index once again rising.

Source: ABS

The ABS said that rising rents, tertiary education, and construction were the main contributors to the index’s 0.9% rise.

Most of this can probably be attributed to the massive influx of immigration seen in the past 12 months.

Source: ABS

Woolworths fined $1.2 million after admitting to underpaying

Woolworths [ASX:WOW] has been fined $1.2 million after admitting it failed to pay out over $1 million in leave entitlements to over 1,200 employees.

The supermarket self-reported the breach to Victoria’s wage inspector in February 2022 after reviewing its payroll system.

Woolworths admitted that the $1.24 million in underpayments occurred between November 2018 and January 2023.

The fine comes as the company struggles with its PR amidst a heated ongoing inquiry into supermarket price gouging which is targeting Coles and Woolworths.

An interim report will be provided to the Australian Government no later than 31 August 2024.

While the final report is due to be provided no later than 28 February 2025.

Midday market update

The ASX 200 is down -1.37% around midday, trading at 7,578.1 as fears of re-accelerating inflation stoke market fears.

Hotter-than-expected Australian inflation data continues to push bond yields higher (up +13bps today) as traders push back expectations of cuts to early 2025.

Similarly, US stocks fell overnight as the country’s GDP fell below expectations, reaching only 1.6% for the March quarter. While inflation data in the US showed a higher than expected result.

All sectors are down at midday, with Real Estate (-2.22%) and Industrials (-1.92%) the top underperformers.

Big movers today, Newmont has jumped nearly 13% to $65.18 per share on its positive quarterly results.

Healthcare giant ResMed was also up +7.3% to $30.85 per share on rising income and margins in its latest quarterly.

BHP shares fall on Anglo American Bid

Mining giant BHP [ASX:BHP] has seen its shares fall by 4.51% in trading this morning, now trading at $43.19 per share.

The drop comes after the company announced a $56 billion dollar bid for Anglo American, the British multinational mining company.

The rival company is another coal and copper giant and the mega-deal would bring some huge assets under BHPs belt.

Shares in Anglo jumped 16% on the news and the company currently boasts a market value of around $65.6 billion.

Copper is a big target for BHP, with chief executive Mike Henry increasingly vocal about the urgent need for higher copper production to meet the world’s decarbonisation goals.

In a speech to the IEA Critical Minerals and Clean Energy Summit in Paris last year, Mr Henry said about $386bn of ‘growth capital‘ investment into copper could be needed in the next seven years to limit temperatures rises to 1.5C.

That growth capital ‘is over and above sustaining capital,’ he continued.

The proposed deal with Anglo will be subject to a huge amount of scrutiny and oversight but if successful, would plan to spin off Anglo’s South African iron ore and platinum operations and would ‘review’ the diamond business after the deal.

Scott Farquhar Steps Down as Atlassian Co-CEO

Scott Farquhar, the co-founder of Atlassian [NASDAQ:TEAM], has announced his decision to step down as co-chief executive officer of the software giant after more than two decades at the helm.

This move marks a significant milestone for the US$52.6 billion ($79 billion) company, which was founded in Sydney in 2002 and is now listed on the Nasdaq.

The announcement came alongside Atlassian’s third-quarter results released early this morning. Mike Cannon-Brookes, Farquhar’s long-time business partner and co-founder, will take over as the sole CEO of the company.

According to Atlassian, Farquhar’s decision to step down from his co-CEO role is driven by his desire to spend more time with his family and focus on philanthropic endeavours.

Morning market update

Good morning. Charlie here,

The ASX 200 opened down -1.21% to 7,590.2, as bond yields pressed equity markets down and sentiments turned bearish.

Wall Street slipped overnight as GDP data showed signs of a slowdown in economic growth and an uptick in inflation.

Bond yields climbed as a response to an uncomfortable position, with the Australian 10-year Treasury jumping +13bps to 4.53%.

Today, on the Australian benchmark, we will be watching earnings from ResMed and Newmont and more information about BHP’s $56 billion bid for Anglo American.

Wall Street: S&P 500 -0.46%, Dow -0.98%, Nasdaq -0.64%.

Overseas: FTSE +0.48%, STOXX -1.02%, Nikkei flat SSE +0.27%.

The Aussie dollar rose +0.33% to US 65.23 cents.

US 10-year bond yields +6bps to 4.70%.

Australian 10-year bond yields +13bps to 4.53%.

Gold rose +0.57% to US$2,329.39, while Silver rose +0.59% to US$27.35.

Bitcoin fell -0.40% to US$64,292, while Ethereum fell -0.31% to US$3,143.

Oil Brent rose +0.29% to US$89.27, while WTI Crude rose +0.25% to US$83.78.

Iron ore fell -0.87% to US$114.80 a tonne.

Key Posts

-

4:25 pm — April 26, 2024

-

3:29 pm — April 26, 2024

-

3:19 pm — April 26, 2024

-

1:12 pm — April 26, 2024

-

12:44 pm — April 26, 2024

-

12:19 pm — April 26, 2024

-

11:54 am — April 26, 2024

-

11:13 am — April 26, 2024

-

10:47 am — April 26, 2024

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2024 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988