Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | ASX to Fall as Bond Yields Climb; BHP Bid For Anglo Fails

New Predictor Service

Here’s a new service for all you traders looking into your crystal ball for tomorrow’s big trades.

Here’s the 100% foolproof method of telling the future. Tarot cards!

Yes, you can use the power of digital divination to see where your favourite stock is going next.

Click here to ask the divine graces a question and see where markets will go next.

Alternatively you can check back here tomorrow for all the latest big news moving the ASX.

Until then have a great evening!

Market close update

With just one day left of trading before the month’s end, the ASX 200 looks to be heading for its second consecutive month of decline after falling seven of the past eight sessions.

The ASX 200 fell by -0.60% to close at 7,619.7 today as the spectre of re-acceleration inflation raised its head yesterday with the April CPI print.

Monthly headline inflation came in at 3.6% yesterday, well above the consensus estimate of 3.4%.

This higher print has reignited debates over the RBA’s next move and the potential of another rate rise being on the cards.

With so much concern in the market, my own guess is that all the RBA will need to do is a touch of jawboning and hawkish rhetoric to ease pressures, but things remain uncertain.

The money market is pricing a 20% chance of a hike between now and the end of the year after the results, pushing back expectations of cuts till February 2025 according to the RBA rate tracker.

On the ASX, 6 of the 11 sectors closed in the red today, with Materials (-1.97%) the worst performer, while Discretionary (+0.63%) was the top dog today.

Meanwhile, in individual performances, Catapult Group International was the top performer on the wider ASX, gaining +9.68%, while Chalice Mining fell sharply today, down by -11.17% to close at $1.59.

Australia the inflation outlier

In a day of bearish news, what’s one more negative story?

This one comes from economics correspondent Michael Read from the AFR.

Deutsche Bank’s latest comparison of core inflation across peer economies has Australia standing as the lone outlier where core inflation has accelerated since December.

With April’s monthly CPI coming in at 3.6%, 0.2% higher than consensus estimates, the spectre of re-accelerating inflation is back.

Its also worth noting that the latest Headline CPI data also included suppressed prices across several segments as the government’s first cost of living subsidies started to come through.

What does this mean for the RBA’s next meeting? Will raises be seriously brought back to the table?

The RBA has shown patience in the past with bumpy monthly figures, but when does patience become inaction?

Deutsche Bank: "As the chart below shows, Australia is also the only country in our sample of peer economies where core inflation has accelerated (by 0.1ppts) since December. Across six other peer economies, core inflation has fallen by an average of 0.7ppts since December." pic.twitter.com/tKjVwSEYLW

— Michael Read (@michael_read_) May 30, 2024

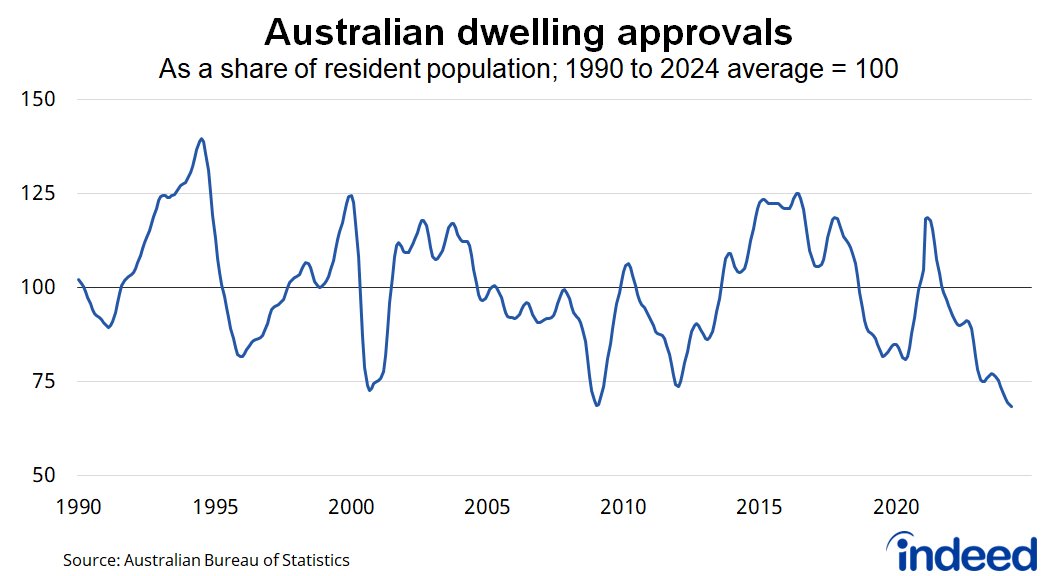

Building approvals show construction sector still in hibernation

The latest data from April shows building approvals in Australia are still at historic lows.

For a more detailed breakdown, we again go to IFM Economist Alex Joiner for a regional breakdown that once again shows things are not looking great.

Source: IFM Investors – Alex Joiner

Here’s what that looks like if we look at two decades of approvals as a share of residents. This means that accounting for population growth, the number of dwelling approvals is around 32% below its average.

Source: Indeed – Callam Pickering

The only upside of this news is that it will likely give the RBA space to allow slightly higher inflation numbers for now, although the next major statements from the RBA will be huge for where market sentiment goes next.

Attention aspiring traders

For those who want to learn more about the ins and outs of trading and leveraging AI, we have a special announcement.

For today, we have only opened up a massive 71% discount for our latest AI Trading Masterclass and Subscription to Small-Cap Systems.

This class will teach you the ins and outs of trading and a special invitation to trade with Callum Newman as he puts his algorithm to work in the small-cap sector.

You will receive vetted system-based high-conviction trade ideas directly via email so you can begin your own trading journey.

The offer has a no-obligation 30-day trial period, so you can see if it works for you.

Click here to learn about how AI can give you the signals to accumulate in the quick-moving small-cap market.

BHP calls it quit over bid for Anglo American

Top news today is the failed bid by BHP [ASX:BHP] for UK rival Anglo American.

The $75 billion bid was seen as a large play by the mining giant for Anglo’s copper assets as well as neighbouring Queensland coal assets.

The deal had hoped to unlock $12 billion in synergies for BHP but had laid a tall order for Anglo, requiring them to sell off its South African diamond, manganese, nickel and potash businesses.

Anglo instead wanted BHP to take the whole $23 billion in assets it didn’t want. The impasse came to a head last night when Anglo refused to allow an extension for the bidding process, meaning that according to UK law the deal now has a six-month cooldown before it can occur again, likely killing any chance of a repeat.

In a statement today, BHP said:

‘BHP will not be making a firm offer for Anglo American. BHP is committed to its Capital Allocation Framework and maintains a disciplined approach to mergers and acquisitions.

‘While we believed that our proposal for Anglo American was a compelling opportunity to effectively grow the pie of value for both sets of shareholders, we were unable to reach agreement with Anglo American on our specific views in respect of South African regulatory risk and cost and, despite seeking to engage constructively and numerous requests, we were not able to access from Anglo American key information required to formulate measures to address the excess risk they perceive.

‘We remain of the view that our proposal was the most effective structure to deliver value for Anglo American shareholders, and we are confident that, working together with Anglo American, we could have obtained all required regulatory approvals, including in South Africa.’

As the dust settles after the deal, BHP’s CEO has lobbed accusations that Anglo withheld ‘key information’ that would have allowed BHP to properly asses the risks around the demergers, but it was clear there were large disagreements between the rival boards.

Shares in BHP are down by -1.64% in trading so far today, at $44.42 per share.

Midday market update

The ASX 200 is down by -0.45% at midday, trading at 7,631.4 as the broad market sell-off continues as traders push back their bets on when the RBA may next cut interest rates.

The RBA Rate Tracker has shifted wildly since the latest CPI data, with the chances of a cut going from 10% to now 5% in the next meeting.

Markets are now pricing in a likely cut sometime in early 2025, with similar concerns on Wall Street.

As a response bond yields are climbing again, with the Australian 10-year treasury adding +21bps to 4.47%, while the US 10-y climbed +7bps to 4.62%.

On the ASX 200 only four of the eleven sectors are in the green at noon. Leading today are Industrials (+0.37%), while mining was this morning’s laggard, down by -1.43%.

Fortescue saw another day of strong losses, down -2.33% as iron ore prices remain weak, while BHP fell by -1.78% in this morning’s trading after it withdrew its bid from rival Anglo American overnight. Rio Tinto is also down by -1.45% this morning, trading at $128.64 per share.

Bank financials give you a hint

Here is a great piece from our very own Callum Newman on why you should be looking at the Big Four’s financials to decide your position on the markets.

With the risk of re-accelerating inflation raising its head again, fear is spreading.

But looking at the major players we can see why we remain in a structural bull market.

Click the link below to read more.

Bank clues to the bull market https://t.co/JIzCkwaBRQ

— Callum Newman (@CalNewmanFT) May 30, 2024

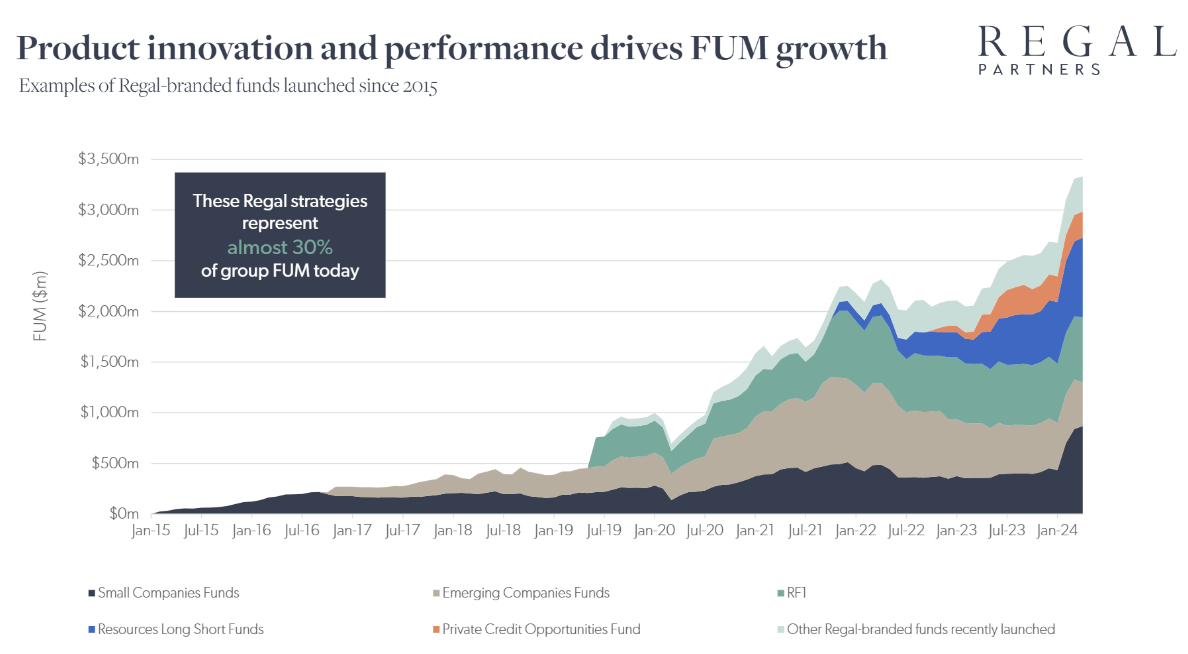

Regal sees $400m of inflows to FUM

Brendan O’Connor, CEO of the fast-growing investment firm Regal Partners [ASX:RPL], announced that the company has secured an impressive $400 million in inflows so far this year.

Since its merger with VGI Partners in mid-2022, Regal Partners has embarked on an acquisition spree, recently bringing PM Capital and Taurus Funds Management into its fold.

Here’s what that growth looks like since 2015:

Source: Regal Partners

Looking ahead, O’Connor reaffirmed Regal Partners’ ongoing strategy to diversify into alternative asset markets. Highlighting a slide that identified private equity, real estate, and infrastructure as areas where the firm currently lacks presence, O’Connor stated:

‘We continue to monitor a range of opportunities to add additional scale or expertise to the business. This may include smaller bolt-ons as well as larger transactions.’

However, he emphasized that any exploration into new markets must not impede the company’s substantial existing growth trajectory. “But whatever we explore must not hamper our existing runway for growth, which is substantial,” O’Connor cautioned.

Shares in Regal are down by -0.64% to $3.12 in this morning’s trading as part of the wider sell-off.

Morning market update

Good morning. Charlie here,

The ASX 200 opened down -0.71% to 7,611.5 as yesterday’s higher inflation data weighs on the local market. April’s monthly CPI came in at 3.6% yesterday, well above consensus estimates of 3.4%, raising the spectre of a potential rate rise by the RBA.

A similar story is playing out on Wall Street as climbing bond yields weighed down markets there as a new round of hawkish Fed-speak has markets quaking.

In major local news, BHP has abandoned its $75 billion bid for Anglo American after the rival refused to extend the deal window.

The deal now has a six-month cooldown before BHP can approach again, but it remains to be seen if that will occur.

Already, the recriminations have begun with Anglo saying that ‘too much execution risk’ was placed on their company in the deal, while BHP’s CEO claimed that Anglo withheld ‘key information’ in the talks.

In other news, five major Australian beef exporters suspended from exporting meat to China can now resume.

Wall Street: S&P 500 -0.74%, Dow -1.06%, Nasdaq -0.58%.

Overseas: FTSE -0.86%, STOXX -1.33%, Nikkei -0.77%, SSE flat.

The Aussie dollar fell -0.58% to US 66.11 cents.

US 10-year bond yields +6bps to 4.61%.

Australian 10-year bond +20bps to 4.46%.

Gold fell -0.89% to US$2,338.79, while Silver fell -0.12% to US$32.02.

Bitcoin fell -1.08% to US$67,581, while Ethereum fell -1.90% to US$3,766.

Oil Brent is flat at US$83.53, while WTI Crude is flat at US$79.26.

Iron ore rose +0.7% to US$118.55 a tonne.

Key Posts

-

4:39 pm — May 30, 2024

-

4:19 pm — May 30, 2024

-

3:04 pm — May 30, 2024

-

2:51 pm — May 30, 2024

-

2:35 pm — May 30, 2024

-

2:24 pm — May 30, 2024

-

12:30 pm — May 30, 2024

-

12:15 pm — May 30, 2024

-

11:13 am — May 30, 2024

-

10:19 am — May 30, 2024

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2025 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988