Investment Ideas From the Edge of the Bell Curve

ASX NEWS LIVE | ASX 200 to Fall Ahead of US Fed Interest Rate Decision

Market close update

The ASX 200 closed flat, up only +0.02% following choppy trading throughout the day as markets remain cautious before the big Fed interest rate decision due tomorrow morning (AEST).

Five of the eleven sectors closed up toady, with Utilities the top sector as Origin Energy drove strong returns there, gaining +2.5% to close at $9.80 per share.

Losses among the major miners offset those gains as iron ore futures once again dropped, falling -1.8% to US$90.65 per tonne on the Singapore exchange.

BHP closed the session down -1.3% at $39.12, while Rio Tinto finished down -1.7% at $109.39 per share. Meanwhile, Fortescue closed down by -0.12%, trading at $17.42.

Tensions rising in the Middle East brought moderate gains for the major energy producers today, with Santos gaining +0.14% to close at $7.05.

Karoon Energy was a strong gainer on the news, up +3.2% to $1.52 per share, while Woodside gained +0.3% as it inked a new 10-year supply contract with Japan’s JERA.

Jetstar Faces Legal Action from NZ Consumer Watchdog

New Zealand’s Commerce Commission is set to file charges against Jetstar for alleged violations of the Fair Trading Act.

The commission claims Jetstar misled consumers about their compensation rights for flight delays and cancellations within the airline’s control.

Vanessa Horne, the Commission’s general manager, stated that Jetstar’s communications likely deterred consumers from seeking entitled compensation and that the airline potentially rejected valid claims, saying:

‘The Civil Aviation Act is clear that airlines have a responsibility to reimburse customers for loss caused by cancellations or delays on New Zealand domestic flights that are within the airline’s control,” Ms Horne says. This likely includes delays or cancellations that are due to staffing or mechanical issues.’

The commission alleges that in 2022 and 2023, Jetstar likely made false or misleading statements to consumers regarding their rights under aviation law.

In response, Jetstar apologised on its website, acknowledging errors in assessing compensation claims as operations resumed post-COVID.

The airline stated they are reviewing past claims and contacting affected customers to ensure proper reimbursement.

Harvey Norman faces fresh lawsuit

In a brief afternoon announcement Harvey Norman [ASX:HVN] has confirmed that it has received a class action lawsuit ‘in connection with products with Product Care rights sold by franchisees to customers’.

The statement came in response to a lawsuit filed by Echo Law for selling ‘hundreds of millions of dollars’ of ‘unnecessary and worthless’ extended warranties, the firm claimed.

Harvey Norman has denied these claims, saying it has complied with all relevant laws and will vigorously defend the lawsuit.

Shares are up slightly from this morning, gaining +0.2% to $4.84 per share.

Australian pension funds plan merger

TelstraSuper and Equip Super have entered a merger agreement as the two explore a tie-up that would see the two combine into a $60 billion fund.

Equip Super, established in 1931, manages around $35 billion in assets, while TelstraSuper, the corporate fund for Telstra employees, oversees $26 billion.

Together, they serve a combined membership of 225,000.

The boards of both funds have signed a non-binding memorandum of understanding today. Pending due diligence, the goal is to complete the merger by late next year.

Recently, regulators have encouraged these types of smaller pension fund consolidations as they focus their scrutiny on pension fees and performance.

Australia’s pension system, one of the largest globally, is approaching $4 trillion in assets. Forecasts predict this figure will more than triple by 2048.

RBA considers ‘bank to bank’ digital currency for Australia

The Reserve Bank of Australia (RBA) is exploring the creation of a digital version of the Australian dollar, primarily for use in financial markets.

This initiative, known as Project Acacia, aims to streamline transaction settlements, with the bank claiming it could potentially save billions annually for banks and other financial institutions.

RBA assistant governor Brad Jones stated:

“With the strong endorsement of the [RBA] Payments System Board, I can confirm that the RBA is making a strategic commitment to prioritise its work agenda on wholesale digital money and infrastructure.”

The focus is on a wholesale central bank digital currency (CBDC) rather than a retail version for public use.

The move is partly in response to the rise of cryptocurrencies and blockchain technology in the financial sector.

However, the RBA remains cautious about introducing a retail CBDC, citing concerns about potential bank runs. Jones explained in a recent speech saying:

“The events at Silicon Valley Bank last year offered a cautionary tale over the risk of rapid-fire bank runs in the digital age – one that could be magnified if bank deposits were convertible into [central bank digital currencies] at the touch of a smartphone.”

Despite these reservations, the RBA is expected to continue exploring this technology through various projects and workshops in the coming year.

Woodside signs long-term LNG deal

Woodside Energy [ASX:WDS] is up slightly this afternoon after the energy giant announced the signing of a 10-year LNG supply contract with Japan’s JERA.

The deal will supply JERA with around 0.4 million tonnes of LNG annually, with the contract commencing in April 2026.

Woodside’s shares are up by +0.2% in trading at $24.175 per share this afternoon.

Mark Abbotsford, Woodside’s Executive Vice President and Chief Commercial Officer, commented:

“This LNG offtake agreement is Woodside’s first long-term sale to JERA from our global portfolio and delivers on one of the core elements of our strategic relationship outlined earlier this year.”

“We understand the demand from our customers in the Asian region for reliable energy. LNG continues to be an important energy source for Japan, one which can support the country’s efforts to decarbonize”.

Latest Fat Tail Daily Video

Here’s the latest from the new Fat Tail Daily video series.

Publisher James ‘Woody’ Woodburn is away, so this week, Fat Tail Daily editor Nick Hubble will join us to discuss the key trends and offer unique insights into market movements.

Today, Nick is chatting with Small Cap Investigator Editor Callum Newman.

Callum Newman is currently galivanting around Europe alongside legions of American tourists and thinks things are looking fine.

His anecdotal evidence certainly doesn’t square with the miserable GDP statistics investors are worried about. But should they even be worried to begin with?

PSC Insurance sale gets regulator tick

The sale of PSC Insurance [ASX:PSI] has been given the go-head by Australian and UK regulators today.

The $2.25 billion deal would see the international insurance services provider sold to the UK-based Ardonagh Group.

The deal still requires shareholder approval, with a vote taking place after the General Scheme Meeting on 26 September.

At this time, the board recommends that shareholders vote to accept the deal.

Shares in PSC are up by 32% in the past 12 months.

Midday market update

The ASX 200 is flat around midday, making up from its opening losses to sit down just -0.02% at 8,139.5.

The markets appear to be in a ‘wait and see’ mode as we await the upcoming Federal Reserve interest rate decision, due early tomorrow morning (AEST).

At noon, five of the eleven sectors are in the green, with the bulk of the gains on the major benchmark thanks to gains in Origin Energy (+3.4%), which has pushed the utilities sector up +1.74%.

Energy stocks are also gaining today as a plot by Israel, which saw thousands of pagers explode in Lebanon overnight, appears directly targeted at Hezbollah members.

Some reporting has indicated that this was meant to be executed as a prelude to a larger-scale attack by Israel but was forced to occur earlier.

The move has heightened tensions in the area and raised oil supply concerns, sending WTI crude prices up to US$71 per barrel.

Other notable gainers in trading this morning were Chalice Mining up by 15.35%, and Select Harvests, gaining nearly 7%.

Business failures at highest rate since the pandemic

CreditorWatch, a credit reporting agency, released a report today revealing that business failures in Australia have reached their highest level since January 2021.

The current average business failure rate is 4.95%, having risen 17.3% since January. CreditorWatch projects this rate to climb to 5.20% over the next year.

This surge is attributed to reduced consumer spending, high inflation, and interest rate hikes.

Among industries, Food and Beverage Services faces the highest failure rate at 8.2%, followed by Administrative and Support Services at 5.8%.

In contrast, Agriculture, Forestry and Fishing shows the lowest rate at 3.3%.

The rising failure rate coincides with a significant increase in business payment defaults, which have soared 68.1% year-over-year, reaching unprecedented levels.

This indicates growing financial strain across the business sector, affecting both companies unable to pay bills and those awaiting payments.

CreditorWatch has identified a strong link between B2B payment defaults and future business failures.

The report outlined that a single default raises a company’s risk of closure within 12 months to 28%, while four or more defaults increase this risk to 74%.

CreditorWatch CEO, Patrick Coghlan, says the rising business failure rate shows how urgently businesses need interest rate relief, saying:

“One of the biggest contributing factors to this increase in our business failure rate is the lack of consumer demand.

“This is reflected in the ABS household spending and Westpac Consumer Sentiment numbers.

“Consumers won’t be inclined to open their wallets in any significant way until they get a reduction in their mortgage payments. A couple of rate cuts would also mean that credit becomes more affordable for businesses, and they are able to get back on the growth track as well.”

Is Australia heading for a 1970s-style period of falling living quality and shrinking economy?

In our report called The Decade of Decemation we outline what this could look like and how to position yourself to hold onto your wealth in this kind of environment.

Spartan Resources Jumps on drill progress

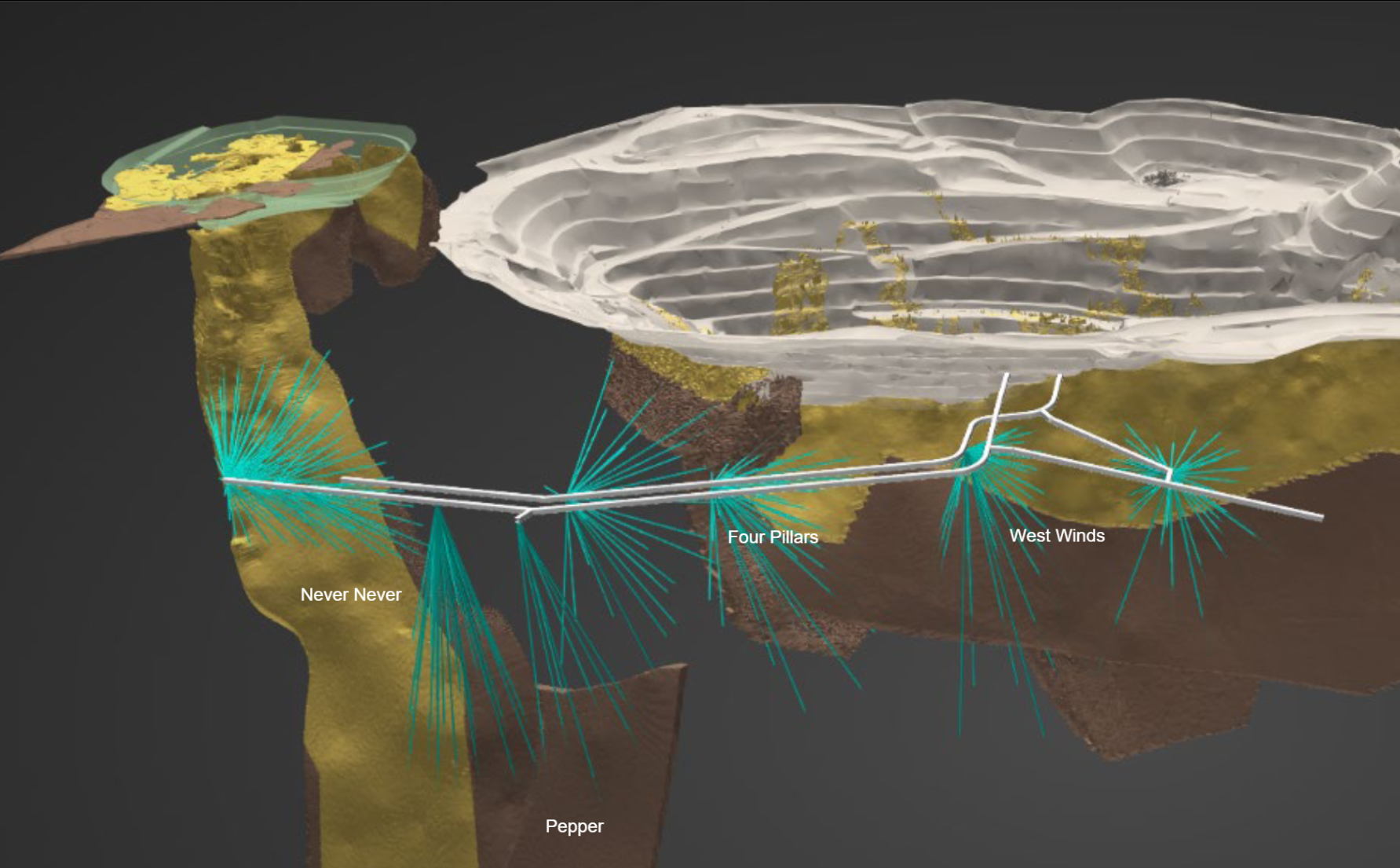

Gold explorer Spartan Resources [ASX:SPR] is up by 5% in trading this morning as it announced the comecncement of exploration drilling.

The drilling is at its 100% owned Dalgaranga Gold Project where work is underway to establish a portal entrance from its previously mined open pit.

You can see the new planned drill in white below:

Source: Spartan

Spartan Interim Executive Chair, Simon Lawson, said:

“The Underground Exploration Drill Drive, named the ‘Juniper Decline’, will establish multiple successive underground drill platforms over the coming months, providing Spartan with the ability to further define and rapidly grow our existing high-grade gold prospects and explore for even more of the same style of high-grade gold shoots.

“The incredible drilling success we have enjoyed in making two significant high-grade discoveries – outlining almost two million ounces of high-grade underground gold in front of our existing processing infrastructure – has all been achieved so far from surface drilling alone.

“The underground platforms will give us even more opportunity to grow our high-grade gold resources quickly and cost-effectively and bring us closer to a number of potential production scenarios that we are working on.”

Oil jumps as Israel plot raises chances of war

At least 11 have been killed and around 4,000 injured in a plot by Israel’s spy agency, which appears to be a prelude to war.

Overnight, Israel detonated thousands of cell phone pagers held by Hezbollah members in a long-term plan that saw Israel’s spy agency inject explosives into Taiwanese-made pagers.

According to the independent Middle East news agency Al Monitor, Israel’s preferred course of action was to detonate the pagers ahead of a full-scale war with Hezbollah.

However, upon suspicions from several members of Lebanon’s Hezbollah, Israel made an 11th-hour decision to detonate the devices early.

The impact has been a renewed concern amid Middle East watchers that a full-scale war is around the corner.

Oil prices are up in response to MidEast supply concerns, which mesh with existing supply shocks.

For example, 12% of crude output from the US Gulf of Mexico is offline after Hurricane Francis hit the area last week.

Further disruptions in Libyan supply have also emerged as rival factions dispute control over its central bank.

Investors have hoped that the Fed’s interest rate cuts tomorrow could revitalize demand from top consuming countries; however, it’s still early days.

Beyond the US, the latest data from China shows oil imports increased last month, with imports now nearing 11 million bpd this month. That’s close to last year’s highest levels.

Latest Fat Tail Daily Video

While I was away, Editorial Director Greg Canavan sat down for an in-depth talk for the latest Fat Tail Daily video series.

Here he’s chatting with FN Arena’s Rudi Filapek-Vandyck about the overall reporting season, the increasingly short-term nature of investing, why investors are crowding into popular large caps, China, commodities, and more.

It’s a great discussion that you don’t want to miss if you are interested in where the market is heading.

Morning Market Update

Good morning. Charlie here, back from a small break. Great timing to return as markets brace for big news.

The ASX 200 is set to fall today, following a weak lead from Wall Street overnight, as markets await the US Federal Reserve’s interest rate decision early Thursday (AEST).

The FedWatch has the current chance of a double-cut (50 basis points) at 64% despite cautious rhetoric from Fed members in the past week and higher retail figures.

For many, the job numbers are a large sign of weakness that is pushing bond markets to raise their bets of a larger cut.

ASX 200 Futures are down 51 points (-0.62%) this morning near 9.30 am AEST after the major benchmark closed at a new all-time high yesterday.

On the ASX today, we’ll be following Woodside after it inked a 10-year LNG contract with Japan’s JERA.

Macquarie Group is considering selling its stake in Wavenet, a UK-based IT services provider valued at around $2.4 billion.

| Name | Value | % Chg | |

|---|---|---|---|

| Major Indices | |||

| S&P 500 | 5,634 | +0.03% |

| Dow Jones | 40,606 | -0.04% |

| NASDAQ Comp | 17,628 | +0.20% |

| Russell 2000 | 2,205 | +0.74% |

| Country Indices | |||

| UK | 8,309 | +0.38% |

| Germany | 18,726 | +0.50% |

| Euro | 4,860 | +0.69% |

| Japan | 36,203 | -1.03% |

| Hong Kong | 17,660 | +1.37% |

| Name | Value | % Chg | |

|---|---|---|---|

| Commodities (USD) | |||

| Gold | 2,572 | -0.44% | |

| Silver | 30.72 | -0.08% | |

| Iron Ore | 92.80 | +0.64% | |

| Copper | 4.218 | +0.13% | |

| WTI Oil | 71.15 | +1.52% | |

| Currency | |||

| AUD/USD | 67.58¢ | +0.11% | |

| Cryptocurrency | |||

| Bitcoin (USD) | 60,107 | +3.47% | |

| Ethereum (USD) | 2,332 | +1.93% | |

Key Posts

-

4:29 pm — September 18, 2024

-

4:00 pm — September 18, 2024

-

3:18 pm — September 18, 2024

-

3:02 pm — September 18, 2024

-

2:33 pm — September 18, 2024

-

2:23 pm — September 18, 2024

-

12:55 pm — September 18, 2024

-

12:28 pm — September 18, 2024

-

12:18 pm — September 18, 2024

-

12:05 pm — September 18, 2024

-

11:33 am — September 18, 2024

-

11:07 am — September 18, 2024

-

9:43 am — September 18, 2024

-

9:28 am — September 18, 2024

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2025 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988