Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | ASX to Fall Ahead of RBA Minutes; Energy Stocks In Focus

Market close update

The ASX 200 closed down by -0.42% at 7,718.2 today as markets slid through the session today.

Bulls may have been hopeful for a more dovish tone from the latest RBA minutes which showed the central bank becoming increasingly more concerned about the state of inflation in Australia.

On the benchmark only energy stocks closed higher on the back of a 2% jump in crude oil prices overnight. Coal producers have also seen strong gains and speculators pile into ASX coal producers as Anglo American battles with an ongoing fire at its Grosvenor coal mine in Queensland.

Woodside closed up +2.94%, Santos +1.18%, Yancoal +1.16%, while Whitehaven Coal jumped +5.41%.

In other major news Liontown Resources has struck a major deal with South Korean battery giant LG Energy Solutions for an extended offtake and funding agreement.

The $379 million funding agreement will fuel the development of Liontown’s Kathleen Valley lithium project in WA.

The other major news today was the resignation of Bendigo and Adelaide Bank CEO Marnie Baker, who was in a leadership position for 6 years of her impressive 35 year innings at the bank.

Liontown Secures $379M Investment from LG Energy Solutions

Struggling lithium developer Liontown Resources [ASX:LTR] has struck a major deal with South Korean battery giant LG Energy Solutions.

The $379 million funding agreement will fuel the development of Liontown’s Kathleen Valley lithium project in WA.

The agreement centers on a five-year convertible note with a conversion price of $1.80 per share, significantly above Liontown’s current trading price of 89¢. If converted immediately, this would give LG an 8% stake in the company.

The deal will also extend LG Energy’s existing 5-year offtake agrement by an additonal 10 years. With Liontown providing 700kt of spodumene concentrate over the first 5 years and 1,500kt over years 6-15.

This strategic partnership highlights the push for lithium outside of China’s control by major consumers, wary of Chinese influence in their markets.

Liontown’s shares are up by +6.18% in trading today, however the stock remains well below its high’s, down -66.8% in the past 12 months.

Superloop Up After Trading Update

ASX telco challenger Superloop [ASX:SLC] is up in trading today after the company released a strong trading update.

Superloop said that thanks to ‘ongoing strong trading performance across the business’ the company is expecting underlying EBITA for FY24 to be at or above the top end of the $51-53 million guidance range.

Final results are expected in late August 2024, but the company said capex remains ‘on track‘ for the $25-27 million range.

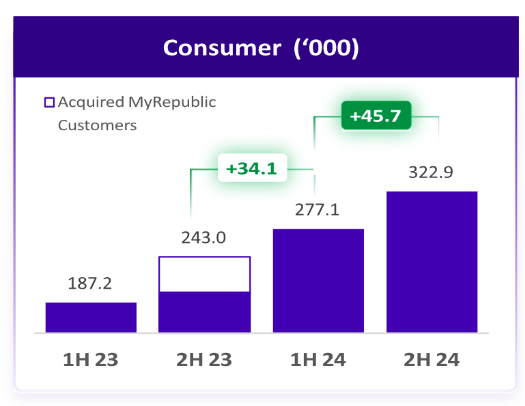

The telco also noted record organic growth in the current half, adding 45,720 new customers.

Source: Superloop

For the full update click here.

Shares are up by +2.25% in trading today at $1.59 per share. That brings its 12-month return at an impressive +174.14%.

ANZ Fined for Breaches of Code

The Banking Code Compliance Committee (BCCC) has sanctioned ANZ for violating the Banking Code of Practice.

From July 2019 to September 2023, ANZ failed to fulfil its Code obligations by “failing to stop or refund fees charged to deceased estates after customers’ deaths“.

BCCC Chair Ian Govey AM emphasized the gravity of these violations. Saying,

“Naming a bank is a sanction that we reserve for the most serious and systemic breaches”.

“The significance of the deficiencies in ANZ’s compliance frameworks was deeply concerning. Its non-compliance warranted such a sanction”.

ANZ identified these issues in early 2022 but took considerable time to address them. “Once aware of the issues, ANZ did not act with sufficient urgency to remediate the affected customers,” Govey noted.

The bank’s remediation program is still ongoing and expected to conclude by July 2024.

The BCCC did acknowledge some positive aspects of ANZ’s remediation efforts, including “reimbursing charges that may already have been refunded“.

Interestingly, the BCCC also found that “another bank” had committed similar breaches.

However, this unnamed bank received only a formal warning for its conduct.

Midday Market Update

Energy gains offset banking losses in this morning’s trading, with the ASX 200 down by -0.17% around midday at 7,737.4.

Real Estate is this morning’s underperformer, down by -1.18%, while energy stocks gained +1.23% in trading so far as oil prices jumped overnight by +2%.

In individual stock movements, Ora Banda Mining is currently the top performer, up by +10%, while Rpmglobal holdings shed nearly -17% so far today after releasing a disappointing trading update, which flagged lower profits than forecasted for FY24.

In other news, this morning, Liontown Resources is in halt pending an offtake/funding deal to spur its struggling Kathleen Valley project.

AFR is reporting (via street talk, so it is not confirmed) that Korean steel manufacturer POSCO could be the other party in the deal.

Meanwhile, the market reacted negatively to the latest RBA minutes (details in previous post), which hinted that the Central Bank could be spurred to raise rates in the August meeting.

Traders are putting a roughly 70% chance of a rate hike before the end of 2024, however we have seen the RBA hold firm with higher figures before so I wouldn’t take those odds to the bank.

RBA Board Minutes ‘narrow path getting narrower’

The Reserve Bank of Australia’s board minutes were released this morning, highlighting growing concerns about inflation.

The Board warned that an unexpected inflation spike could require significantly higher interest rates, potentially impacting employment and economic growth. This caution came as May’s inflation rose to 4% from April’s 3.6%.

While their last decision was another rate hold at 4.35%, the Board signalled its readiness to increase rates if necessary to meet inflation targets.

Here’s what the board said directly about their decision to hold rates:

“Members agreed that the collective data received since the May meeting had not been sufficient to change their assessment that inflation would return to target by 2026, despite some elevated upside risk around the forecast.”

They also noted that the economy appears on track to bring inflation back to the 2-3% target by 2026 while preserving employment gains, but admitted the strategy was looking increasingly risky, saying:

“Members also affirmed their assessment that it was still possible to achieve the Board’s strategy of returning inflation to target in a reasonable timeframe without moving away significantly from full employment, even though this ‘narrow path’ was becoming narrower.

The Board observed less cautious household spending than anticipated, with a falling savings rate indicating tighter budgets.

RBA Governor Michele Bullock stressed the need for vigilance regarding inflation risks, but overall, there wasn’t a clear rhetoric shift that indicated a bias to raise interest rates in their next meeting.

The next RBA decision on August 5-6 will heavily rely on upcoming quarterly inflation data, providing a broader view of inflation trends across the economy.

Ramelius ups stake in rival

Gold miner Ramelius Resources [ASX:RMs] has increased its ownership in ASX-listed Spartan Resources [ASX:SPR], now holding almost 18% of the company.

That’s up from the previous 9% of Spartan shares held by Ramelius.

As of this morning, Ramelius shares are up by +0.80%, trading at $1.89, while Spartan Resources’ stock has seen a larger uptick of +1.6%, trading at 95 cents per share.

Bendigo and Adelaide Bank Announces Leadership Change

Marnie Baker, the long-serving chief executive of Bendigo and Adelaide Bank [ASX:BEN], is set to step down after a 35-year tenure with the bank.

The bank has named Richard Fennell, its current chief customer officer for consumer banking, as her successor.

Fennell, who has held his current position since 2018, will assume the role of CEO and managing director on August 31, 2024. His appointment comes with a fixed annual salary of $1.5 million.

Having joined the bank in 2007, the bank said this morning that ‘Fennell brings extensive experience to the top leadership position’.

His promotion comes as the bank sees an upward trend in the stock performance, with shares rising 17.7% since the beginning of the year to reach $11.33.

Baker’s departure marks the end of an era for the bank, including six years at the helm as chief executive. The new direction appears to be one of favouring new technology to become’ a genuine and compelling alternative to the majors.’

The stock is down nearly -1% in early trading.

ASX Open

The ASX 200 opened down but quickly recovered to flat with it currently trading -0.04% at 7,747.5 as investors await the RBA minutes at 11:30am AEST for some indication of the Central Bank’s next move.

So far, we’ve seen a spike in Energy stocks, which are up +1.29% as Crude oil prices jumped over 2% last night.

In other news we’ll look at today, Bendigo Bank’s long-time CEO has stepped down, and Liontown has halted shares this morning ‘pending an announcement in connection with funding arrangements,’ more on this as it comes through.

Morning Market Update

Good morning. Charlie here,

The ASX 200 is set to fall again today with ASX Futures down by -0.23% this morning as the Aussie benchmark moves out of synch with global markets which were broadly up overnight.

On Wall St, the lagging Magnificent 7 stocks began to catch up with Nvidia, which is seeing lower volumes and choppier trades.

These major stocks were the main drivers, with Apple +2.9%, Amazon +2.1%, and Tesla gaining +6% in after-hours trading.

The ASX morning’s weakness may reverse if the RBA’s upcoming minutes (at 11:30am AEST) show a cautious stance on raising rates; however, considering their prior tone, it will probably say enough to persuade those who think the next meeting is a hike that it’s likely and vice versa.

Despite the morning’s uncertainty, energy stocks will likely see some positive movement today as oil prices rallied +2% overnight to their highest point since April 30.

| Name | Value | % Chg | |

|---|---|---|---|

| Major Indices | |||

| S&P 500 | 5,475.09 | +0.27% |

| Dow Jones | 39,169.52 | +0.13% |

| NASDAQ Comp | 17,879.30 | +0.83% |

| Russell 2000 | 2,030.07 | -0.86% |

| Country Indices | |||

| UK | 8,166.76 | +0.03% |

| Germany | 18,290.66 | +0.30% |

| Japan | 39,631.06 | +0.12% |

| Hong Kong | 17,718.61 | +0.01% |

| Euro | 4,929.99 | +0.73% |

| Name | Value | % Chg | |

|---|---|---|---|

| Commodities (USD) | |||

| Gold | 2,332.23 | +0.31% | |

| Silver | 29.43 | +1.15% | |

| Iron Ore | 109.80 | +3.2% | |

| Copper | 4.413 | +0.51% | |

| WTI Oil | 83.39 | +2.27% | |

| Currency | |||

| AUD/USD | 66.53¢ | -0.38% | |

| Cryptocurrency | |||

| Bitcoin (USD) | 62,925 | +0.29% | |

| Ethereum (USD) | 3,438 | +3.01% | |

Key Posts

-

4:32 pm — July 2, 2024

-

3:49 pm — July 2, 2024

-

2:42 pm — July 2, 2024

-

2:03 pm — July 2, 2024

-

12:55 pm — July 2, 2024

-

12:10 pm — July 2, 2024

-

11:27 am — July 2, 2024

-

10:50 am — July 2, 2024

-

10:23 am — July 2, 2024

-

9:35 am — July 2, 2024

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2024 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988