Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | ASX to Fall Ahead of Inflation Data; Silver, Copper, and Nickel Climb

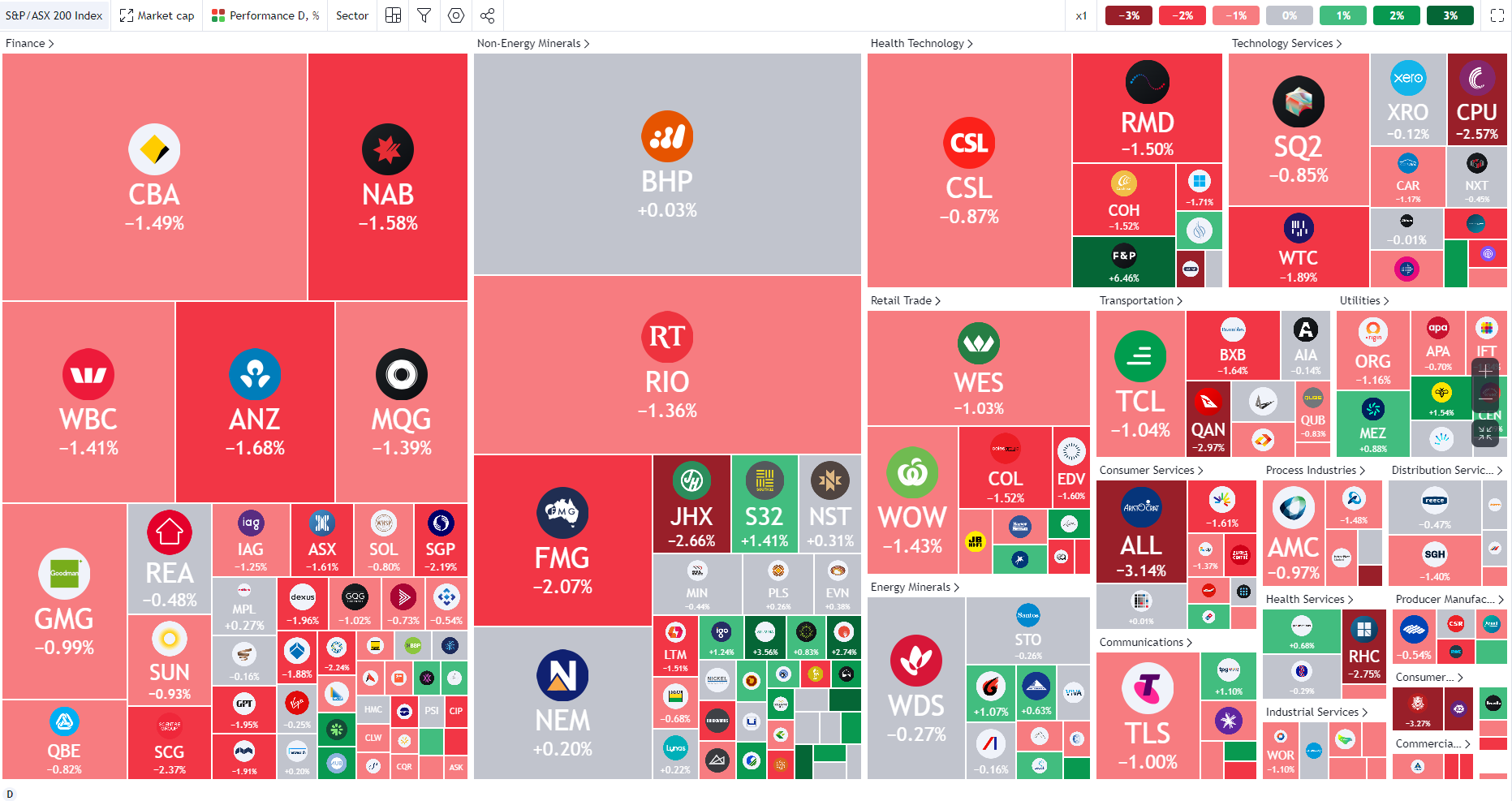

Market close update

The ASX 200 closed down by -1.30% to 7,665.6 in a day of heavy selling action as the latest April CPI print came in hotter than expected at 3.6%, well above analyst’s consensus of 3.4%.

With the hotter numbers, many traders have once again pushed back their expectations of rate cuts from the RBA, and so markets retreated today.

All 11 sectors closed down, with Staples the worst off today, falling by -2.08%.

Shares in mining were fairly mixed today, with the major iron ore producers falling after a drop in iron ore futures on the Singapore exchange sending the mega caps down.

Fortescue fell by 3.6%, Rio Tino closed out down 1.5%, while BHP finished around flat at +0.03% before a trading halt as it asked for an extension to its Anglo-American takeover bid deadline.

Major Insurance company IAG fell by -3.1% after revealing it was now defending a second lawsuit, this time in front of the Victorian Supreme Court, over alleged mispricing of loyalty discounts on home insurance policies.

Droneshield was today’s standout performer, up by 9.18% to $1.07 per share.

Time to invest in Junior Mining Stocks?

Here’s a great interview from our own Callum Newman, who is talking with father-son duo Robin and Hedley Widdup about opportunities within Junior miners.

As we see commodity prices within copper, zinc, silver, and gold climb higher, it could be a great time to consider some mining juniors in your portfolio.

For the more seasoned resource sector players there are also some great actionable insights here.

Pundits all shift guesses for next cuts

The surprise upside of today’s CPI numbers has brought every economist and banker out of the woodwork to warn about shifting tides at the RBA.

April’s monthly CPI figures came in at 3.6%, above the hoped 3.5% and widely expected 3.4%.

Now, those same people who guessed 3.4% are turning around with new bets.

David Bassanese, the chief economist at Betashares, now anticipates a single rate cut this year instead of the two previously forecasted, with the expected rate cut occurring in December.

‘Today’s inflation result suggests interest rates will likely remain at their current restrictive levels for an extended period, with little relief expected before Christmas.’

Bassanese cautioned about a ‘simmering risk‘ that the RBA might feel compelled to raise rates further to curb inflation in areas sensitive to demand, such as discretionary consumer goods and services.

He’s now saying that there is a minimum 40 per cent chance of a rate hike this year ‘if the disinflationary process fails to resume soon.‘

Similar warnings were heard by ING head Robert Carnell, who said today that he’s only ‘one bad inflation report away’ from changing his cash rate forecasts to a raise.

Meanwhile, Judo Bank economist Warren Hogan also thought that the uptick this month could tip the RBA into a possible raise next month, saying:

‘These results will test the RBA’s patience,’ Hogan said. ‘Inflation is not falling back to target with signs that inflation’s underlying ‘pulse’ might be picking up in 2024.’

‘The RBA was very close to hiking the rate earlier this month. This number could tip them over to raising rates at their next meeting on 18 June.’

Midday market update

The ASX 200 is down by -0.93% at midday, trading at 7,694.3 as this morning’s hotter-than-expected inflation data sent markets even further down today and bolstered expectations that the cash rate will remain unchanged for several months longer.

The Australian April CPI indicator rose 3.6% year-on-year, up from 3.5% in March and exceeding economists’ expectations of 3.4%.

Prior to the print, money markets implied a 16% chance that the Reserve Bank would raise the cash rate to 4.6% by September.

They are now fully pricing in a rate cut in August 2025. Bond yields increased, with the three-year rate rising two basis points to 4.07%, and the 10-year return adding four basis points to 4.39%.

Australian three-year futures, which are sensitive to the cash rate, dropped 12 basis points.

The Australian dollar strengthened in response while shares extended losses. Before the CPI print, only the energy sector remained positive, buoyed by the overnight higher oil prices. However, as we hit noon, all sectors are in the red.

Source: TradingView

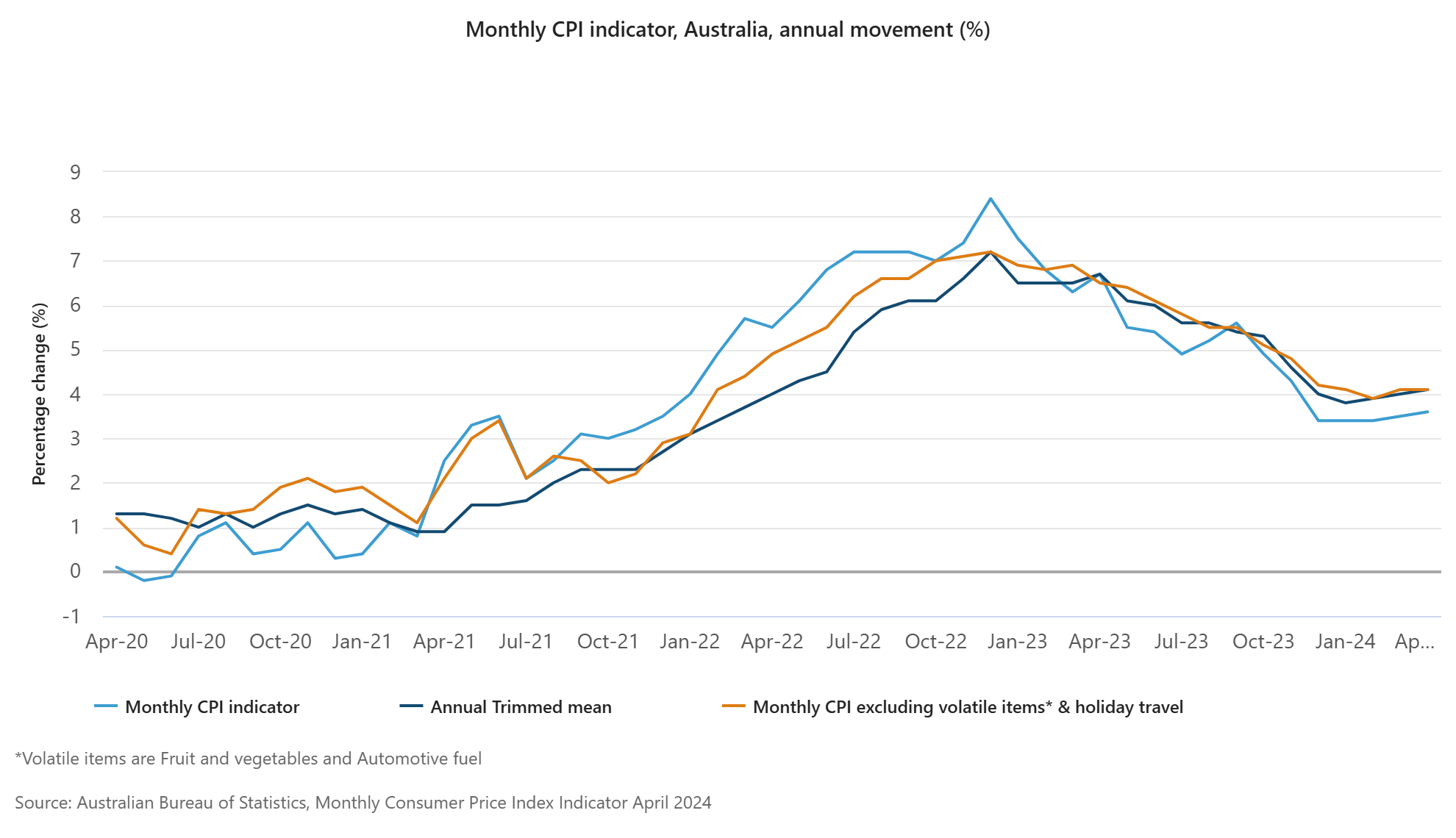

Inflation data comes in hotter then expected

Australia’s Consumer Price Index (CPI) for April came in hotter than expected today sending the ASX lower, down by -1% as early traders sell down after the print.

The ABS’s monthly CPI indicator rose to 3.6% in the 12 months to April, well above the expected 3.4%.

The move comes after a 3.5% rise in March, which also raised similar concerns about re-accelerating inflation.

Source: ABS

Here’s a breakdown by the ABS of the various price shifts:

Food products rose an average of (+4.2%), Bread and cereal products (+5.1%) and Non-alcoholic beverages (+2.8%) also contributed to the rise. Meat and seafood products recorded a partially offsetting fall (-0.6%) due to large price falls for Lamb and goat over the last 12 months (-12.5%).

New dwelling prices rose 4.9% in the 12 months to April, maintaining a consistent annual price growth of around 5% for the past nine months. The increase in New dwelling prices reflects builders continuing to pass on higher costs for labour and materials.

Rental prices increased 7.5% in the 12 months to April, down from 7.7% in March, which continues to reflect strong demand for rental properties and tight rental markets.

Automotive fuel prices rose 7.4% in the 12 months to April, down from a rise of 8.1% to March. The rise was driven by higher wholesale fuel prices.

In monthly terms, Automotive fuel prices rose 2.2% in April, the third consecutive monthly rise.

Health costs rose 6.1% in the 12 months to April, up from 4.1% in the 12 months to March.

Medical and hospital services is the main contributor to the rise, with a 7.3% annual rise in April following a 4.6% rise in March. The added strength this month reflects a rise in health insurance premiums which increased on 1 April.

Nvidia leads the charge on the Nasdaq

In a remarkable surge, Nvidia [NASDAQ:NVDA], the pioneering AI chipmaker, is nearing an astonishing milestone – dethroning Apple as the second most valuable company on Wall Street’s hallowed grounds.

This market favourite’s meteoric rise has propelled its market capitalization to an eye-watering $2.81 trillion in US dollars after the company’s shares rose another 7.1% to an all-time high of $1,140.59 overnight.

The move came after Nvidia’s latest quarterly results which beat EPS estimates by nearly 10% and gave a robust forecast for June-quarter revenue.

Nvidia also announced a 10-for-1 stock split, which some analysts anticipate will further spark retail investor enthusiasm and could be the prelude to an eventual addition to the Dow Jones Index.

IAG faces lawsuit

Insurance Australia Group (IAG) [ASX:IAG] is trading down in the early hours of today’s session after the company revealed it faces a class-action lawsuit in the Victorian Supreme Court.

The suit alleges that IAG is engaging in ‘unfair tactics and misleading conduct’ by using a pricing algorithm that targeted and raised prices for loyal customers.

This is not the first major suit for the troubled insurance giant. In August 2023, ASIC began proceedings against subsidiaries for misleading customers about discounts they receive.

Shares of IAG are down by 1.6% in early trading but are up by over 20% in the past 12 months, we’ll see if it can defend these two cases without bleeding its share price in the near future.

Morning market update

Good morning. Charlie here,

The ASX 200 opened down -0.43% to 7,733.5 as almost all major markets and benchmarks closed down overnight.

Only the Nasdaq was spared from the falls, reaching a new all-time high on the back of Nvidia’s earnings.

The S&P 500 closed flat after a last-minute snap-back from a day of trading lower. All other major Asian and European markets closed down.

Oil, silver, copper, and nickel continued their march higher. Oil, which has been flat for a month, has risen due to heightened tensions in the Middle East and expectations around the upcoming OPEC+ meeting.

OPEC members, plus Russia, Malaysia, Mexico, Sudan, Oman and the Stans, will meet on Sunday to discuss extending their supply cuts.

Here is the breakdown of the countries involved in OPEC and the ‘plus’ states.

Source: IEA

Expectations are for the cuts to be extended for at least another three months and oil prices are up over US$1 in anticipation of the move.

In Australia today, the all-important CPI data is due at 11:30 a.m. Some of the major banks, like NAB, have said they expect a slightly improved result in April compared to March.

‘The April monthly CPI indicator for Australia is expected to dip to 3.4 per cent year-over-year from 3.5 per cent previously, with NAB’s views in line with consensus.’

Traders should expect positive moves in the Energy sector and likely sell-offs in some of the major Iron ore producers as futures take another tumble on the Singapore exchange.

Wall Street: S&P 500 flat, Dow -0.55%, Nasdaq +0.59%.

Overseas: FTSE -0.76%, STOXX -0.57%, Nikkei -0.11%, SSE -0.46%.

The Aussie dollar fell -0.11% to US 66.49 cents.

US 10-year bond yields +8bps to 4.54%.

Australian 10-year bond +7bps to 4.35%.

Gold rose +0.35% to US$2,360.64, while Silver rose +1.33% to US$32.06.

Bitcoin fell -1.47% to US$68,341, while Ethereum fell -1.16% to US$3,842.

Oil Brent rose +1.81% to US$84.60, while WTI Crude rose +0.54% to US$80.26.

Iron ore fell -1.2% to US$117.90 a tonne.

Key Posts

-

4:33 pm — May 29, 2024

-

2:15 pm — May 29, 2024

-

2:09 pm — May 29, 2024

-

12:03 pm — May 29, 2024

-

11:47 am — May 29, 2024

-

11:00 am — May 29, 2024

-

10:35 am — May 29, 2024

-

10:19 am — May 29, 2024

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2025 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988