Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | ASX to Fall after Large-Scale Attack by Iran Shakes Markets

Market close update

The ASX 200 closed down -0.46% to 7,752.5 today as markets risked-off heavily after the Iranian attacks over the weekend.

Only Energy (+0.38%), Materials (+0.35%) and Staples (flat) were in the green today, while all other sectors were well into the red.

Leading the losses was the interest-rate sensitive Tech which fell -1.75%. The fear for traders was a flight to safety, which would raise the greenback, while Oil prices would spike if the situation in the Middle East deteriorated further.

For now, things seem to be quiet with the US and UN urging restraint and oil prices remaining flat, but we will see as a new day dawns in Israel.

On the Australian benchmark, Ioneer was the top gainer today, up 17.95% after moving forward its Rhyolite Ridge project closer to construction, followed by Droneshield, which released a positive quarterly report.

While, the biggest losses today were seen by Predictive Discovery which fell by -12% after releasing an underwhelming Pre-Feasibility study.

Mortage demand down in US

New data shows that the demand for mortgages in the United States dropped to its lowest level since 1995 in March.

Mortgage demand is now well down from its peak and even lower than the low points after the 2008 financial crisis.

At the same time, the average monthly payment for a new mortgage has risen to nearly $2,800. This means that the typical American household would have to spend about 45% of their income before taxes to make the mortgage payment. After factoring in taxes, the mortgage payment would take up over 60% of their income. And this calculation doesn’t even include additional costs like property taxes, insurance, and maintenance.

In simple terms, mortgages have become much less affordable for the average American due to the combination of high interest rates and high home price

BREAKING: US mortgage demand in March fell to its lowest since 1995, according to Reventure.

Mortgage demand is now 43% below its recent peak and ~16% below the post-2008 lows.

Meanwhile, the average payment on a new mortgage is now nearly $2,800/month.

This means that the… pic.twitter.com/4bkrfLTIHD

— The Kobeissi Letter (@KobeissiLetter) April 13, 2024

Droneshield jumps on positive quarterly

Counterdrone’s small-cap DroneShield [ASX:DRO] is up +13.45% in trading so far today, following the release of its latest quarterly report.

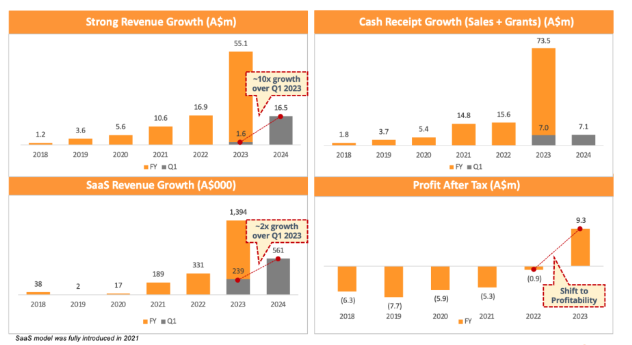

The company said its 1Q24 revenues were $16.4 million up 10x vs Q123

1Q24 customer casTh receipts were the highest ever at $7.1 million.

1Q24 SaaS revenues doubled to $561k vs 239k in Q1233.

Source: Droneshield

The company thinks the current geopolitical outlook gives further credence to their growth, saying:

‘Small drones continue to be used extensively in virtually every conflict around the world today, taking advantage of their low cost, ease of use, and versatility. They are used to deliver explosive payloads, battle reconnaissance, directing artillery strikes, and more.

Outside of the military applications, drones are used to deliver contraband into prisons, disrupt airports, conduct terrorist attacks, disrupt critical infrastructure and shipping, and conduct corporate espionage. This is expected to continue to rapidly rise, as the drone technology continues to improve.’

Gold Road confirms rumours

Gold Road Resources [ASX:GOR] confirmed speculation today that it is looking at the potential acquisition of Greenstone Gold Mines in Canada.

Orion Resources, based in the US, is conducting the sale process; however, no further details have been provided at this stage.

Gold Road said it has not entered into anything definitive and will only pursue the acquisition ‘if it is in the best interest of shareholders‘.

Midday market update

Escalating tensions in the Middle East sparked fears of a broader regional war, sending shockwaves through global markets. Oil prices remain subdued for now as traders anxiously watch for developments.

For many traders, the threat of spiking oil prices has reignited concerns over inflation and dashing hopes for interest rate relief this year.

The ASX 200 fell -0.51% to 7,748.2 at midday, weighed down by tech stocks extending last week’s losses amid rising bond yields and geopolitical risks.

Interest-rate sensitive tech names led the declines, with WiseTech down -1.18%, Xero dropping -1.84%, and TechnologyOne shedding -1.85%.

Fueling the selloff was Iran’s unprecedented aerial assault on Israel over the weekend, launching over 300 drones and missiles. While Israel’s defence systems intercepted the vast majority, the attack stoked worries of a wider Middle East conflict.

The Australian dollar hovered near two-month lows around US 64.77 cents as the spectre of regional war dented appetite for risk assets like stocks and commodity currencies. The U.S. pledged ‘ironclad’ support for Israel, though President Biden stated opposition to any Israeli retaliation against Iran.

Axios reported an excerpt of Biden’s call with Netanyahu in which he reportedly did not support a counter-attack, saying, ‘You got a win. Take the win‘.

Energy stocks (XEJ +0.38%) provided a bright spot, edging higher as oil prices climbed on supply disruption fears. With minor gains in most stocks, standout gains were seen by Beach Energy (+1.0%) and Karoon Energy (+1.08%).

However, gains were capped by speculation major powers would urge restraint to contain the conflict, with Brent crude initially rising just 0.7% to US$91.05 before paring gains.

Elsewhere, NextDC shares dropped over 5% after emerging from a trading halt, having completed a $1 billion capital raise to fund its data center pipeline.

NextDC shares drop on return from trading halt

Shares of Australian data centre company NextDC [ASX:NXT] are down by -4.73% this morning, trading at $15.92 per share as the company returns to trading after halting its shares last week.

The trading halt came as the company announced a $1 billion capital raise to bring forward its data centre pipeline of projects as it faces ‘unprecedented demand‘.

For a full view of their plans, their latest investor presentation is here.

The raise was successful with the stock trading again today, unfortunately joining the rest of the tech sector as it sold off heavily this morning.

Mr Craig Scroggie, NextDC’s Chief Executive Officer and Managing Director, said:

‘We are delighted with the exceptional level of support from our existing institutional shareholders in this Entitlement Offer.’

‘The raising ensures NextDC is positioned to continue to take advantage of the unprecedented growth in demand for data centre services that we are seeing across the market.’

Gold spikes after Middle East attack

Tensions in the Middle East escalated over the weekend, fueling a surge in safe-haven demand for gold.

The precious metal spiked as much as 1.2% shortly after markets opened today, as Iran launched a major aerial attack against Israel on Saturday evening.

Here, you can see the initial spike after the news was first reported:

Source: TradingView

Despite Iran firing over 300 drones and missiles, Israel’s defensive systems successfully intercepted nearly all incoming projectiles, with no casualties reported.

Nonetheless, this dangerous escalation in the longstanding conflict between the two nations drove investors toward the perceived safety of gold.

This continues a rally that has been underway since mid-February, with bullion now trading just shy of the record highs set last Friday. As geopolitical risks intensify, gold’s status as a crisis hedge has renewed investor interest in the precious metal.

Morning market update

Good morning. Charlie here,

The ASX 200 opened down -0.43% to 7,755.0 as the Saturday attack by Iran continues to reverberate across the Middle East and markets.

The attack was claimed as a retaliatory strike by Iran after the 1 April consulate drone strike by Israel targeting Iranian commanders in Damascus.

Israel officials said Iran launched over 300+ projectiles on Saturday night, including cruise missiles, drones, and ballistic missiles.

Jordanian, UK and US joined Israeli efforts to counter the strike, with a reported 99% of the barrage being intercepted.

This is the first time Iran has directly targeted Israel, and so a response from Israel now is the largest point of concern for watchers as Benjamin Netanyahu holds his weakest control over his cabinet in his political career.

Itamar Ben-Gvir, the ultranationalist national security minister, called for a ‘crushing attack,’ saying:

‘The concepts of containment and proportionality are concepts that passed away on October 7,’ he said, referring to Hamas’s attack on Israel that triggered the war in Gaza. ‘In order to create deterrence in the Middle East, the landlord must go crazy.’

As a response, Oil prices have remained surprisingly subdued. After an initial small spike, they have eased and today sit flat at around US$90.56 per barrel for Brent Crude.

Meanwhile, Gold spiked over the weekend to a new all-time high as a response, briefly touching US$2,431 per ounce before dropping back.

Wall Street: S&P 500 -1.46%, Dow -1.24%, Nasdaq -1.62%.

Overseas: FTSE +0.91%, STOXX -0.23%, Nikkei -1.35%, SSE -0.49%.

The Aussie dollar fell -0.07% to US 64.74 cents.

US 10-year bond yields -6bps to 4.52%.

Australian 10-year bond yields -4bps to 4.21%.

Gold is up +0.71% to US$2,360.97, while Silver rose +0.75% to US$28.17.

Bitcoin rose +0.% to US$65,568, while Ethereum rose +5.17%% to US$3,131.

Oil Brent rose +0.12% to US$90.56, while WTI Crude rose +0.05% to US$85.58.

Iron ore rose +2.71% to US$111.15 a tonne.

Key Posts

-

4:33 pm — April 15, 2024

-

4:24 pm — April 15, 2024

-

2:26 pm — April 15, 2024

-

2:16 pm — April 15, 2024

-

12:05 pm — April 15, 2024

-

11:54 am — April 15, 2024

-

11:46 am — April 15, 2024

-

10:37 am — April 15, 2024

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2025 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988