Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | ASX to Fall after Heavy Losses on Wall St; Qantas and Woolworths Feature

Market close update

The ASX 200 closed down by -1.23% to 7,569.9 today after a day of heavy losses from all sectors today as markets anxiously await the Fed’s interest rate decision in the US.

US stocks sold off in a similar fashion last night after overnight data showed labour costs increasing by 1.2% last quarter, above analyst estimates, adding fuel to the fears of rising inflation.

The interest-rate-sensitive Tech stocks were among the worst performing, led by market cap leader WiseTech. Its shares dropped 4.3% to $88.81. NextDC lost 2.9% to $16.20, and TechnologyOne fell 1.5% to $16.

While traders broadly expect US interest rates to remain on hold, watchers will listen to J Powell’s remarks after the decision to gauge the likelihood of cuts this year.

The ASX’s energy sector was also down 2% after oil extended its falls on the prospect a ceasefire in the Middle East. Brent crude traded at $US85.65 a barrel after losing around -2.52% today.

Both Woodside and Santos were down over 2% today as a result.

AVZ Minerals Delisting Looms

In a blow to its investors, AVZ Minerals [ASX:AVZ], the Perth-based lithium explorer, announced plans to delist from the ASX on May 13.

This move could result in one of the biggest wealth wipeouts in Australian stock market history, with over 21,100 shareholders facing the potential loss of their combined $2.8 billion investment.

The company’s shares last traded on the ASX in May 2022 at 78 cents each, leaving shareholders with substantial paper wealth tied up in the now-threatened venture.

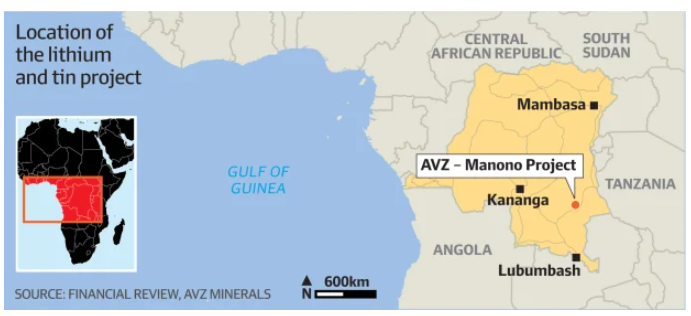

In a statement released last night, the AVZ board cited the failure of the Democratic Republic of Congo (DRC) government to comply with court orders and ongoing legal battles with Chinese and Congolese mining rivals over the control of the Manono tenement, which is believed to be the world’s largest hard rock lithium deposit, located in the resource-rich southwestern region of the DRC.

Source: AVZ Minerals- AFR

“After careful consideration, the AVZ board has resolved not to seek reinstatement on the basis a reinstatement at this time would not be in the best interests of AVZ shareholders,” the board said, acknowledging the gravity of the situation.

As the delisting date approaches, shareholders brace themselves for the potential loss of their investments.

Santos and Woodside fall on easing oil prices

As the steam is slowly coming out of the tense Middle East this week, we’ve seen oil prices come down.

After traders warned of the potential of US$100 per barrel just a month ago, prices today have eased again.

Brent Crude is down -2.54% to US$85.63 per barrel.

WTI Crude is down -0.95% to US$81.15 per barrel in the session today.

As a response on this red day, we’ve seen local oil and gas players, Santos fall -2.08% to $7.54, and Woodside fall -2.30% to $27.58 per share.

That’s the third session of falling oil prices, helped by an industry report pointed to a sharp rebound in the US crude stockpiles.

In the Middle East, hopes of a ceasefire agreement continued to progress as the Israeli government is said to have accepted part of a deal that would see Israeli hostages released for Hamas prisoners.

The tensions in the area are far from over, however, with Netanyahu threatening to send the IDF into Rafah in Southern Gaza ‘regardless of a cease-fire.’

Attempts by the US to walk this back have fallen through, with Israel withdrawing its delegation that was planning to meet with US officials about the Rafah offensive plans after the US abstained from a UN cease-fire vote.

The US, which would historically veto these kinds of votes for Israel, is attempting to use the UN to bring Netanyahu back to the table, but so far, little has swayed the Israeli PM.

UN chief Antonio Guterres warned that an Israeli assault on Rafah would be an ‘unbearable escalation‘ that would be ‘devastating‘ for Palestinians in Gaza and the wider region.

The UN humanitarian body echoed that sentiment today, saying:

‘The simplest truth is that a ground operation in Rafah will be nothing short of a tragedy beyond words. No humanitarian plan can counter that,’ said Martin Griffiths, the UN under-secretary-general for humanitarian affairs.

Midday market update

The ASX 200 is down by -1.19% to 7,572.9 in a heavy sell-off day that mirrors losses seen on Wall Street overnight as traders are wary of the next moves from Central Banks.

All sectors are down at midday, with the interest-rate sensitive Tech sector the worst performer today, down -2.43%.

In individual companies, the top performer at midday is mining explorer WA1 Resources up 9.10% after releasing its latest Luni Assay results.

While the biggest faller around midday is underwear online retailer Step One Clothing, which is down by -9.49%.

Big Four Banks lay down bets for next cuts from the RBA

The Big Four are all singing the same tune after CBA economists revised their forecasts yesterday.

After last week’s stronger-than-expected inflation figures, now the major banks are saying there will be only one rate cut this year, and its likely to come in November rather than September.

Here is what the Big Four are currently predicting:

Source:ABC -Ratecity

ANZ warned today that the risks around the timing of monetary easing had started to lean towards ‘a later start’ given the ongoing strength in non-tradables and services inflation.

So the focus for them is higher domestic price pressures need to ease from the second quarter for the RBA to lower rates in 2024.

The Commonwealth Bank revised its forecast yesterday and now expects one rate cate from the RBA this year, down from as many as three expected earlier this year.

The RBA is meeting next week and is widely expected to keep rates on hold at 4.35%.

‘We think the cash rate will need to remain at a restrictive level for some time yet for the gap between demand and supply to continue to close,’ ANZ wrote in a report to clients.

‘Our forecasts have annual headline and trimmed mean inflation both ending 2024 a touch above the RBA’s 2-3 per cent target band, before falling into the band in 2025.’

Woolworths sells large stake in Endeavour

Woolworths [ASX:WOW] announced this morning that it has agreed to sell a 5% stake in hotel and alcohol store operator Endeavour [ASX:EDV] for $468 million.

The supermarket giant said the trade will be completed via a block trade at $5.22 per share.

After the sale, Woolworths will hold a remaining 4.1% share in Endeavour.

The sale comes after a tough year for Endeavour, which has seen its shares fall -21.70% in the past 12 months as alcohol sales have suffered due to the cost-of-living crisis.

Endeavour, which is known for its portfolio of hotels and drinks chains like Dan Murphy’s and BWS, has seen its shares fall by -5% in trading this morning.

Woolworths said today that it intends to return the sale proceeds to shareholders and will update its financials in August.

Woolworths chief executive Brad Banducci said today:

‘While Woolworths and Endeavour remain important business partners, with a number of long term partnership agreements in place, we no longer believe that a material equity investment in Endeavour is required as Endeavour approaches its three year anniversary as an independent listed company.’

Qantas investigating data privacy issue with mobile app

Qantas [ASX:QAN] is currently investigating reports of a data privacy breach involving their mobile app.

Customers have reported being able to access other passengers’ personal information, including names, boarding passes, frequent flyer details, and flight schedules.

In a statement released this morning, Qantas acknowledged the issue and stated that they are working urgently to resolve the problem.

‘We are investigating reports of an issue impacting the Qantas app this morning,’ said a Qantas spokesperson. ‘We will provide more information as soon as possible.’

Looking at unconfirmed social media comments on the subject, one customer, Josh Withers from Hobart, confirmed seeing another customer’s name, boarding pass, and flight details on his app.

Withers, a frequent flyer for work, expressed concern over the privacy breach, saying, ‘It’s a pretty big concern because it’s the personal details as to the where and when we’re flying.’

Qantas has apologized to its customers for the incident, saying, ‘We sincerely apologize to our customers.’

The airline has not yet confirmed the scale of the issue or the number of customers affected.

Its share price is currently down by -1.10%, trading at $5.83 per share.

Morning market update

Good morning. Charlie here,

The ASX 200 opened down -0.58% to 7,620.0 after a heavy sell-off on Wall Street last night. As US markets await the Fed’s latest rate announcement, the S&P 500 saw its first month of losses this year.

In its worst month since last September, the S&P 500 and other major benchmarks fell last month as traders anticipate hawkish rhetoric out of the Fed following data last month that implied slowing growth and stubborn inflation.

This, combined with five-month high bond yields, has pressured equity markets, which have been looking for a catalyst for further moves higher.

On the earnings front, reporting from Amazon last night did little to help, with strong earnings in its AWS service, implying AI growth; however, the company’s quarterly revenue fell below estimates.

McDonald’s also posted a rare profit miss, and Starbucks also reported a surprise drop in quarterly sales.

Walmart also announced it will shut all of its health clinics in the US over lack of profitability.

In Australia, we’ve seen early reporting this morning on a potential data breach in the Qantas app that is permitting customers to see each other’s full details.

Treasurer Jim Chalmers is also scheduled to speak around lunch today to announce a major overhaul of Australia’s foreign investment system.

Last night he hinted at the reasoning behind the overhaul, citing national security interests, saying to 7:30:

‘We are worried about losing control of supply chains. We’re worried about losing resilience where there is the capacity for interference.’

Wall Street: S&P 500 -1.57%, Dow -1.49%, Nasdaq -2.04%.

Overseas: FTSE flat, STOXX -1.20%, Nikkei +1.24% SSE -0.26%.

The Aussie dollar fell -1.38% to US 64.75 cents.

US 10-year bond yields +7bps to 4.68%.

Australian 10-year bond yields -1bps to 4.48%.

Gold down -1.78% to US$2,291.72, while Silver fell -2.74% to US$26.34.

Bitcoin fell -4.84% to US$60,700, while Ethereum fell -6.16% to US$3,014.

Oil Brent flat at US$87.87, while WTI Crude fell -0.84% to US$81.24.

Iron ore fell -0.54% to US$115.40 a tonne.

Key Posts

-

4:50 pm — May 1, 2024

-

3:54 pm — May 1, 2024

-

3:24 pm — May 1, 2024

-

12:48 pm — May 1, 2024

-

12:26 pm — May 1, 2024

-

10:59 am — May 1, 2024

-

10:42 am — May 1, 2024

-

10:11 am — May 1, 2024

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2025 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988