Investment Ideas From the Edge of the Bell Curve

ASX NEWS LIVE | ASX to Edge Higher; Rightmove rejects REA’s $11b Bid

Market close update

The ASX 200 closed down by -0.3% to 7,987.9, as major losses in tech and banking saw the Australian share market slip from its minor gains this morning.

At close, five of the eleven sectors finished in the green, with the major gains seen in Mining, where lithium players saw double-digit gains sparked by MinRes.

Mineral Resources jumped by +16.5% to $32.28 in trading today after FRIB regulators allowed the sale of its 49% stake in the Onslow Iron haul road for $1.3 billion.

The wider lithium sector rose with it today as many major names bounced off yearly lows as pessimism around lithium supply and demand lingers.

Pulling the ASX down today, the major banks fell ahead of the US CPI data due out this evening AEST.

These key figures will give markets a clearer idea of the state of inflation in the US economy and could shape the size of the Fed’s September rate cut.

Most people anticipate that the figures will show progress against inflation is roughly on track. For now, labour statistics seem to be the bigger worry for many.

Energy stocks also fell today as Brent Crude prices hit a two-and-a-half-year low, slipping below US$70 per barrel.

Newmont to divest key Australian assets for up to $475M

Newmont Corporation [ASX:NEM] is divesting several Australian assets as part of its strategic divesture program.

The company will sell its Telfer operation, 70% stake in the Havieron Gold-Copper Project, and other Paterson region interests to Greatland Gold.

The deal, valued at up to $475 million, is expected to close in Q4, subject to conditions.

The deal includes a $207.5 million cash payment at closing, $167.5 million in Greatland shares, and a potential $100 million deferred cash payment.

Newmont’s CEO, Tom Palmer, said:

‘This initiates our divestiture program announced in February. Greatland’s experienced team will be excellent stewards of these assets.’

He added, ‘We aim to generate at least $2 billion from non-core asset sales, allowing us to focus on Tier 1 assets, reduce debt, and return capital to shareholders.’

Newmont said it remains on track for its 2024 targets but has adjusted its gold and copper production guidance to reflect the sales.

PwC UK forces workers back to the office with Orwellian tracking

In a move that many would consider ‘Orwellian’ PricewaterhouseCoopers (PwC) has issued a notice to its 26,000 UK workers that from January next year they are expected to spend more time in the office… and they will be tracked.

PwC will begin monitoring its employees’ work locations and report the figures to managers each month.

This is the same company that struggled with clear messaging when work locations moved towards ‘hybrid models’ during the pandemic.

Now, it seems they’ve swung the other way. The reason could be that last autumn, it was reported that PwC’s growth was lagging behind its competitors in the previous financial year.

Maybe this is its attempt to try and catch up.

Whatever the reason, its approach has certainly raised some eyebrows among workers.

Latest Fat Tail Daily Video

Here’s the latest from the new Fat Tail Daily video series.

Publisher James ‘Woody’ Woodburn will be sitting down with our Fat Tail Daily editors daily to discuss the key trends and offer unique insights into market movements.

Today, Woody will be chatting with Australian Gold Report, and Diggers and Drillers Editor Brian Chu and James Cooper.

We’re doing something a little different today and we have two editors on the call as they discuss Callum Newman’s latest article.

Callum is in Spain at the moment so we’ve got our two resource titans on to discuss all things lithium.

The lithium sector is in shambles, with some explorer and developer stocks plummeting by 90%.

But could this bloodbath be setting the stage for the next big mining opportunity?

Today, we explore why the current lithium market crash might be the perfect setup for contrarian investors with the long game in mind.

Learn about the cyclical nature of commodities, the future of renewable energy, and why patience could lead to potentially exciting opportunities in the lithium sector.

NextDC falls after $500m capital raise

Major data centre owner and operator NextDC [ASX:NXT] is dragging down the wider technology sector (-1.66%) today.

As of this early afternoon, the major tech player is down by -5.82% after raising around $550 million through the placement of 32.1 million new shares.

Mr Craig Scroggie, CEO & Managing Director, commented on the raise, saying:

‘The strong support for this Placement highlights continued investor confidence in NEXTDC’s growth strategy and long-term vision. As AI continues to drive unprecedented demand for accelerated computing, the need for scalable, high-performance digital infrastructure has never been more vital.’

‘This successful Placement ensures that NEXTDC is well-positioned to meet the growing needs of the cloud and AI ecosystems, while seizing new opportunities in a rapidly evolving market. Our focus remains on maintaining the agility and innovation required to power the next generation of AI-driven technologies that help enterprises harness the digital age.’

For more details on the raise, click here.

After today’s fall, NextDC has now returned 31% in the past 12 months.

Crypto markets hint at Harris debate win

Bitcoin [BTC] traders have reacted to today’s Trump vs Harris debate with apparent concern for Trump’s performance tonight.

Bitcoin prices fell by 1.5% in the first half-hour of the debate before stabilising around US$56,580 per coin.

The fall can be considered a proxy for Trump’s performance as he has recently embraced the cryptocurrency sector and is considered part of the so-called ‘Trump trades’.

These investments would favour a trump win in the upcoming presidential debate.

While we wait for post-debate polls, this one can be seen as a first look at a possible win by the Harris campaign.

Source: TradingView

Midday market update

The ASX 200 is down by -0.35% at 7,983.9 around midday, as gains in mining and real estate were outweighed by losses in tech, banking, and energy stocks.

Financials were down, mirroring similar poor performance in the US as markets await the key CPI data out tonight. The Big Four are all down around 1% lower in trading so far today.

Energy stocks followed oil prices down as Brent crude hit a two-and-a-half-year low, and prices fell below US$70 for the first time since November 2021.

Tech stocks have slightly underperformed so far today. The bulk of the sector’s move seems to be due to data centre owner, and operator NextDC, which slipped 4.1%lower to 17.11 after completing a $550 million equity raise.

The standout performers so far today have been the lithium sector with most major producers up double-digits as Mineral Resources jumped over 20% as regulators allow the sale of its 49% interest in the Onslow Iron haul road.

RBA Deputy speech today: expect higher unemployment

Sarah Hunter, Reserve Bank assistant governor (economic group), spoke at the Barrenjoey Economic Forum in Sydney on the subject of full employment.

Ms Hunter’s core remarks were that the RBA thinks Australia’s labour markets are still above full employment.

That means it thinks there’s still too much employment for the economy’s current strength.

To that end, the RBA expects unemployment to keep rising. Saying it will keep rising ‘until the economy falls back into better balance between supply and demand.’

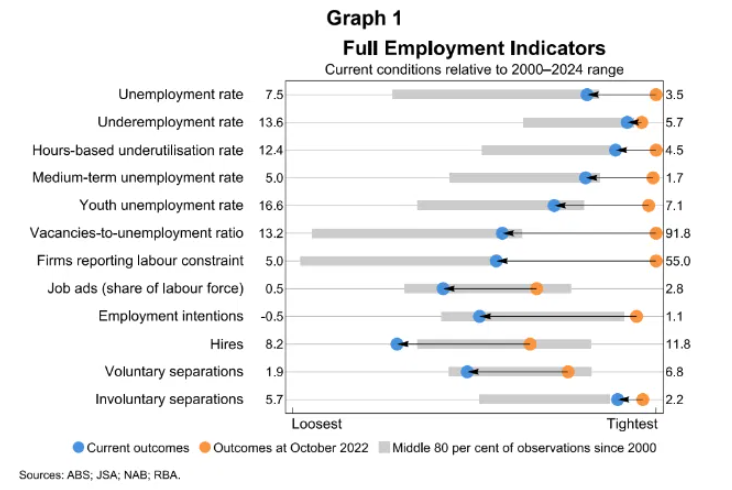

She shared this graphic as one way the RBA judges this balance.

Source: RBA

The graphic compares the latest observation of key labour market indicators (blue dots) with observations of recent extreme labour market tightness from October 2022 (orange dots) and more typical labour market outcomes since the year 2000 (grey bars).

Those blue dots have all moved to the left of the orange dots, but many still sit at the tight end of the grey bars, which show the typical range for each indicator.

ASX Names New Chair Elect

The Australian Securities Exchange (ASX) has appointed David Clarke as its new chair-elect, effective after the October annual general meeting (AGM).

Current chairman Damian Roche will retire at the AGM’s conclusion, ending his 3-year tenure.

This change occurs as ASX faces a lawsuit from Australia’s corporate regulator over alleged ‘misleading’ software upgrade statements.

Mr Clarke, formerly CFO of Mosaic Brands, is said to bring ‘extensive board experience’ to the role.

While his appointment is immediate, shareholders will vote on his election at the 28 October AGM.

Lendlease-Stockland decision pushed back by regulators

The Australian Competition and Consumer Commission (ACCC) announced today that it is delaying its upcoming decision on whether Stockland can buy a dozen master-planned communities from Lendlease.

The ACCC now expects to publish its decision on 26 September 2024.

This two-week extension to the ACCC decision is said to allow the regulator to consider the sale of a Stockland community plan in the NSW region.

Stockland said it will update its FY25 guidance once all approvals have been obtained.

Both Stockland and Lendlease are up slightly in trading this morning.

Rightmove rejects REA

Property giant REA Group [ASX:REA] has seen its bid to acquire its UK counterpart, Rightmove, rejected by its board without reason.

The $11 billion cash and scrip offer would mean Rightmove shareholders would hold approximately 18.6% of the combined group’s shares.

REA is clearly not going to give up after the first rejection, with its comments today, continuing to push the bid, describing it as:

‘The Proposal combines certainty of value, in cash, at a significant premium to recent trading while at the same time giving Rightmove shareholders the opportunity to benefit from the future value creation of the combined business.’

REA Groups is -1.7% lower at $199.04, with its 12-month return at 22%.

Lithium stocks leap this morning

Lithium producers are leading the charge on an otherwise quiet day on the Australian sharemarket this morning.

As of a few minutes ago we’ve seen:

Mineral Resources [ASX:MIN] up by +21.3%

Pilbara Minerals [ASX:PLS] up by +15.7%

Liontown Resources [ASX:LTR] up by +16.6%

Patriot Battery Metals [ASX:PMT] up by +12.6%

That’s just some of the larger market caps; there are plenty of other moves in the sector today.

What’s the catalyst?

Update here: it seems the gains from MinRes have spread to the wider sector after Australia’s Foreign Investment Review Board (FIRB) approved the sale of a 49% interest in the Onslow Iron haul road.

The proceeds from the sale to Morgan Stanley Infrastructure Partners is valued at $1.3 billion.

Morning Market Update

Good morning. Charlie here.

The ASX 200 opened slightly higher, up +0.05% at 8,015.7, as markets seem to be cautious before the US consumer price index (CPI inflation gauge) figures due this evening (AEST).

The Trump vs. Harris debate, scheduled to kick off in just under an hour, will also likely cause many traders to take a ‘wait and see‘ approach.

You can watch the debate live here on YouTube, starting around 11 am AEST.

Meanwhile, overnight Brent Crude slumped to its lowest level in two-and-a-half years, at US$69.57 per barrel.

Oil prices have fallen over 5.5% in the past week as concerns of weak demand and oversupply from OPEC squash prices.

On the ASX today we’ll be watching the reaction to MinRes getting FIRB approval for the sale of its stake in Onslow Iron Haul Road and Rightmove knocking back REA’s $11 billion takeover bid.

| Name | Value | % Chg | |

|---|---|---|---|

| Major Indices | |||

| S&P 500 | 5,495 | +0.45% |

| Dow Jones | 40,736 | -0.23% |

| NASDAQ Comp | 17,025 | +0.84% |

| Russell 2000 | 2,097 | -0.02% |

| Country Indices | |||

| UK | 8,205 | -0.78% |

| Germany | 18,265 | -0.96% |

| Euro | 4,747 | -0.66% |

| Japan | 36,159 | -0.16% |

| Hong Kong | 17,234 | +0.22% |

| Name | Value | % Chg | |

|---|---|---|---|

| Commodities (USD) | |||

| Gold | 2,518 | +0.48% | |

| Silver | 28.42 | +0.26% | |

| Iron Ore | 90.75 | +0.14% | |

| Copper | 4.0425 | -0.20% | |

| WTI Oil | 66.19 | +0.67% | |

| Currency | |||

| AUD/USD | 66.56¢ | -0.10% | |

| Cryptocurrency | |||

| Bitcoin (USD) | 57,557 | +1.11% | |

| Ethereum (USD) | 2,384 | +1.21% | |

Key Posts

-

4:35 pm — September 11, 2024

-

4:08 pm — September 11, 2024

-

3:50 pm — September 11, 2024

-

3:00 pm — September 11, 2024

-

1:40 pm — September 11, 2024

-

1:19 pm — September 11, 2024

-

11:53 am — September 11, 2024

-

11:41 am — September 11, 2024

-

11:27 am — September 11, 2024

-

11:19 am — September 11, 2024

-

11:09 am — September 11, 2024

-

10:39 am — September 11, 2024

-

10:22 am — September 11, 2024

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2025 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988