Investment Ideas From the Edge of the Bell Curve

ASX News Live | ASX Edges Higher; Fisher & Paykel, Mad Paws, Whitehaven, Liontown, City Chic Feature

Netflix subscriber growth smashes expectations … but revenue only slightly better than forecast

While Netflix gained 70% more subscribers than it expected, revenue was only ‘slightly above our beginning-of-quarter projection’.

But that beginning-of-quarter projection rested on Netflix thinking it’ll gain a net 4.5 million subscribers, not the actual 7.7 million.

Despite a huge subscriber beat, revenue barely budged beyond Netflix’s forecast.

Why?

While $NFLX gained 70% more subscribers than it expected, revenue was only 'slightly above our beginning-of-quarter projection'.

Despite a huge subscriber beat, revenue barely budged beyond Netflix's forecast.

Why? #Netflix

— Fat Tail Daily (@FatTailDaily) January 20, 2023

Netflix subscriber beat highlights unique challenge for analysts

Did you watch Harry and Meghan’s documentary on Netflix? Or what about the Addams Family spinoff Wednesday or the whodunit film Glass Onion?

If yes, did you enjoy any of them? How much? Do you think others enjoyed them as well as you? Enough to renew their Netflix subscription or open an account with the streamer for the first time?

These questions may seem random but they might just be the types of questions Wall Street analysts have to consider when forecasting the key metric for the streaming giant — subscriber growth.

Regarding subscribers, Netflix smashed Wall Street’s expectations for the December quarter. The company added 7.7 million subscribers against the expected 4.6 million.

In a big way, that was driven by the success of original content like Wednesday and Glass Onion. Addressing investors in a shareholder letter, Netflix wrote:

“Wednesday was our third most popular series ever, Harry & Meghan our second most popular documentary series, Troll our most popular non-English film, and Glass Onion: A Knives Out Mystery our fourth most popular film.”

But how can analysts quantify in advance the potential success of Netflix’s original content?

Source: Netflix

Netflix’s subscriber growth even surprised the streaming giant itself.

“Our content slate outperformed even our high expectations,” stated Netflix in a letter to investors.

So how can analysts do better when Netflix has troves of internal data to make more accurate guesses than analysts?

And will subscriber growth disappoint next quarter given the historic performance of Harry & Megan, Wednesday, Glass Onion, and Troll?

Ioneer continues to fall on permitting violation update

Ioneer — developing a lithium-boron project in Nevada — is down a further 6% on Friday after sinking yesterday on a permitting violation update.

INR shares are currently down 21% this week.

The permit breach relates to Ioneer’s drilling program in November 2022 at its Rhyolite Ridge project in Nevada.

The permit issued to Ioneer did not allow the ‘placement and storage of drill program-related equipment’ along an area adjacent to Rhyolite Ridge.

INR managing director Bernard Rowe stated:

“We take full responsibility for the breach and sincerely regret the inadvertent noncompliance with the permit. Since day one, Ioneer has instructed our staff and contractors about the need to observe all permit conditions. We are investigating exactly how this failure occurred, and we will take action to assure total compliance in the future.”

Ioneer did not state whether it incurred a fine or whether the breach will delay its development of Rhyolite.

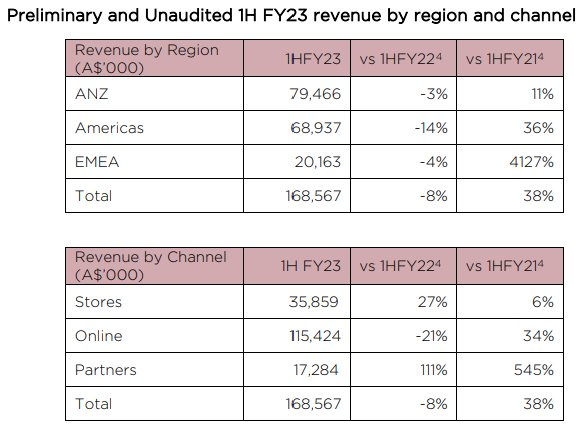

City Chic expects underlying EBITDA loss of ~$4 million in 1H23

Women’s apparel retailer City Chic Collective — down 85% over the past 12 months — is expecting to make an underlying EBITDA loss in the 26 weeks to January 2023 of $2.5-$4 million.

Sales for 1H23 are expected to be down 8% to $168.6 million on 1H22 but up 38% on FY21.

Heavy promotional activity shrunk CCX’s gross margin, with City Chic arguing this was needed to stimulate demand.

Further, City Chic is dealing with higher fulfilment costs, increasing the cost of doing business as a percentage of sales compared to 1H22.

Lower sales and gross margins, coupled with higher fulfilment costs, will push the retailer into a first half underlying EBITDA loss.

City Chic expects to hold $163-164 million worth of inventory at the end of 1H23, below the range guided at its AGM, which was expected to be in the range of $168-174 million.

Who will fill a shortfall of American oil production?

The decline of US shale oil is a looming threat to the global economy.

After saving us from a worse outcome post-2008, it seems as though waning production could tip the scales the other way in 2023.

I do see challenges on the horizon for investors. Oil, though, for my money, may be the biggest of them all.

After all, if the US begins to bow out as a major producer, it could leave the market in the hands of the OPEC cartel once more.

That is unless investment picks up in other areas…

The reason that US shale oil is heading toward decline is clearly due to a lack of capital. As oil industry experts told the Financial Times:

‘“We produced too much oil and competed with Opec,” says Pioneer boss Sheffield. “We actually lowered the price by $20 to $30 per barrel over the past 10 years to the detriment of losing our entire investor base.”

‘The shift, says Sheffield, has been from an industry that spent 100 per cent of its cash flow on growing production to one that only reinvests 40 to 50 per cent, with the aim of growing between 0 and 5 per cent.

‘After a decade of deep shale losses, investors are enjoying the new model — and wary of making more risky bets on a sector with a bad record and an uncertain future in a decarbonising world.’

This is exactly the issue that our resident commodities expert, James Cooper, has been warning people about. There is a severe lack of reinvestment from mining and energy companies in new projects.

Shale oil, though, may be the biggest example yet. Because while it isn’t a dead industry yet, it likely will be if investor appetites don’t begin to shift.

The problem is that it’s hard to imagine that changing anytime soon.

The US oil companies have given shareholders a taste of share buybacks and dividend payouts, things that are hard to take back. And so, while the profits will keep investors happy in the short term, it will come at the cost of shale’s growth long term.

All of which begs the question, who will fill a shortfall of American oil production?

Well, the answer might just be India.

https://www.moneymorning.com.au/20230120/as-one-oil-major-declines-another-rises.html

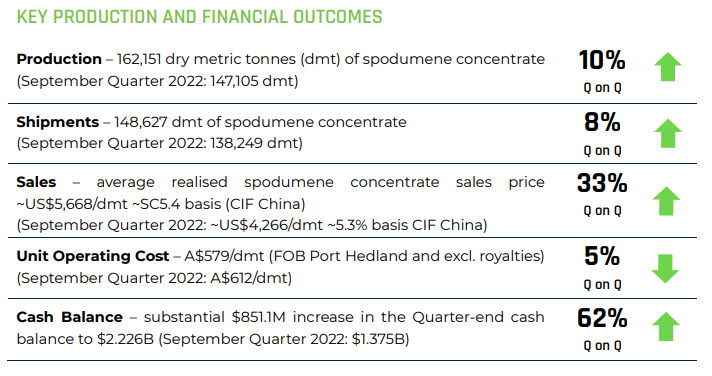

Pilbara Minerals up 9% on ‘substantial’ cash balance increase of $851m

Australian lithium producer Pilbara Minerals is making the most of the strong lithium market.

Strong sales and much higher lithium prices saw PLS close the December quarter with a cash balance of $2.2 billion.

That’s a whopping $851 million increase quarter over quarter alone.

Pilbara raked in $1.1 billion from selling spodumene concentrate during the quarter but only dished out $185.5 million on operating costs and $73.1 million on capital costs.

Source: Pilbara Minerals

Pilbara shipped 148,627 dmt of spodumene concentrate during the quarter at an average selling price of US$5,668/dmt, equivalent to a SC6.0 price of US$6,273/dmt.

Showing why Pilbara is basically printing cash at the moment is its unit operating cost, which was US$380/dmt excluding royalties and freight.

While these operating costs rose 5% quarter on quarter, sales rose 33% quarter on quarter.

Even when you include freight and royalties, Pilbara’s unit operating costs were still US$768/dmt.

On freight and royalties, Pilbara explained:

“Royalty costs include a 5% state government royalty on the FOB selling price, a 1% native title royalty on the FOB selling price, and a 5% private royalty on the FOB selling price which is applied to a part of the resource/reserve acquired following the Altura Lithium Operation acquisition.”

On costs generally, Pilbara commented:

“Costs for the Quarter continued to be impacted by labour shortages in the WA mining sector, supply chain disruptions and general inflationary cost pressures, as well as an elevated mining strip ratio as the Company continues to undertake substantial investment in mining activities. Unit operating costs for the Quarter were lower compared to the September Quarter 2022 and benefited from economies of scale from improved production, lower maintenance costs with one less shutdown during the Quarter, lower fuel costs following reinstatement by the Australian Government’s temporary reduction in diesel fuel tax credits, but offset by higher labour costs and the effects of general inflationary pressures.”

Liontown’s revised mining plan escalates Kathleen Valley capital cost to $895m

While Liontown’s revised mining plan is expected to boost near-term throughput capacity by 0.5Mtpa, it will cost more.

Liontown admitted the revised plan will impact the capital estimate for the Kathleen Valley project.

Kathleen Valley’s estimated capital cost to first production rose to $895 million, which includes a $40 million contingency fund.

Liontown explained it is facing rising cost pressures ‘as is being seen across the industry’:

“As is being seen across the industry, Liontown has experienced substantial escalation in rates across all site-based labour-intensive contracts with some tenders experiencing price increases greater than 30%. In addition to market-wide price escalation, a reduction in both productivity rates of, and the number of contractors willing to bid, has also been evident impacting tendered package prices.

The combination of optimisation, additional scope and cost escalation has resulted in Kathleen Valley’s estimated capital cost to first production from the process plant increasing to $895m inclusive of $40m in contingency.”

Liontown’s Definitive Feasibility Study — published in November 2021 — estimated initial project capital costs to be $473 million.

In June 2022, LTR passed its Final Investment Decision for Kathleen Valley. But that included a cost revision. Estimated initial project capital costs now sat at $545 million.

Addressing the cost escalation today, Liontown managing director and CEO Tony Ottaviano said:

“The updated capital estimates provided today incorporate these important changes as well as the macro reality of rapidly changing pricing and cost assumptions. Our team continues to do a fantastic job in working to mitigate these forces and maintain cost control and discipline across the organisation. However, we need to be realistic about what we can and can’t control – with the overriding objective of meeting our schedule while maintaining the highest possible standards of safety for our people.”

Liontown Resources down 7% on Kathleen Valley project update

Australian lithium developer Liontown Resources (ASX:LTR) has made ‘rapid progress across all aspects’ of its Western Australia project.

Liontown said it was on schedule to deliver first production from the Kathleen Valley process plant ‘by the middle of next year’.

This aim will be supported by ‘prudent investments’, including a 60% increase in on-site accommodation capacity.

Liontown also plans to expand its initial plant throughput capacity from 2.5Mtpa to 3Mtpa.

LTR’s November 2021 Definitive Feasibility Study discussed initial plant throughput of 2.5Mtpa, increasing to 4Mtpa in the sixth year of operations.

But after ‘debottlenecking and optimising’ the engineering design, the lithium developer thinks it can now boost its near term production by 0.5Mtpa.

The day ahead and the day that was

US stocks ended lower overnight, in a likely response to stronger than expected labour market data.

The Dow fell enough to now be in the red for the nascent year.

New applications for unemployment benefits in the US declined to the lowest level since September. That worried investors as the US Federal Reserve is likely to see the labour data as corroboration to keep raising interest rates.

Key Posts

-

5:25 pm — January 20, 2023

-

4:12 pm — January 20, 2023

-

3:42 pm — January 20, 2023

-

1:13 pm — January 20, 2023

-

12:58 pm — January 20, 2023

-

11:44 am — January 20, 2023

-

10:42 am — January 20, 2023

-

10:34 am — January 20, 2023

-

10:14 am — January 20, 2023

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2025 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988