Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | ASX Slips as Retail Data Disappoints; Consumer Confidence at 2024 Low

Market close update

The ASX 200 closed down by -0.28% to 7,766.7 in a subdued day of trading as US and UK markets remained closed for public holidays.

What was slated to be a day of quiet gains for miners as commodity prices bounced overnight turned into a slightly bearish day on the markets after the latest retail data remained weak.

Ten out of the eleven sectors ended the day in negative territory, with consumer staples being the sole industry group to register gains, primarily driven by the supermarket giants Coles and Woolworths edging higher.

On the ASX, the materials sector finished flat for the day, but gold stocks rallied as the precious metal added 1.5% overnight, reaching US$2,353 per ounce.

Newmont, the market’s largest gold miner, rose 0.3% to $63.55, while West Australian gold player Evolution climbed 0.5% to $3.95, and De Grey Mining advanced 1.8% to $1.13.

Among other metals, the price of copper rose to US$10,204 per tonne, and silver extended its strong gains, reaching US$31.95 per ounce.

The broad move in metal prices helped the diversified commodities group South32 advance 0.8% to $3.91, while copper producer Sandfire Resources remained flat at $9.49 per share.

AI Summit lays warning for execs

Adam Driussi, founder and chief executive of the Woolworths-backed data and technology firm Quantium had some choice words for execs ignoring AI.

‘AI is going to change everyone’s jobs,’ he continued:

‘If I look at executive teams, I think probably in two years time, 30 per cent of the people around the table won’t be sitting here any more – and that’ll be the 30 per cent that don’t embrace AI, and don’t think about how they change their jobs and how they lead their organisations to embrace AI.’

The words were at the ongoing AFR AI Summit which is being held in Sydney.

There were some other notable comments from the Summit however it was notable the lack of experts on the pannels, which were instead largely filled up with local business leaders who were full of idioms and short on details.

Boss Energy Sinks on CEO Share Sale

Shares in South Australian uranium producer Boss Energy [ASX:BOE] are down by -12.08% to $4.69 per share, putting it as one of the worst performers today.

The drop came as it was revealed that CEO and Managing Director Duncan Craib, Chair Wyatt Buck, and Director Bryn Jones have sold a significant portion of their holdings today.

In total the execs sold around $21 million worth of shares on the market today.

While nothing else was announced, that level of insider trading usually bodes well for shareholder confidence, often seen as a classic early bearish signal.

Country Road execs face bullying and sexual harassment claims

Allegations of sexual harassment and bullying by some senior executives have surfaced at the prominent fashion retail chain Country Road.

These allegations have triggered an ongoing investigation commissioned by the company’s owner, South African-based Woolworths Holdings Limited, which is unrelated to Australia’s Woolworths Group.

In response, Country Road has acknowledged that ‘some team members’ have provided the company with ‘feedback‘ regarding ‘handling of their complaints.’

According to the statement today, The Country Road Group said it takes any complaint of harassment, including sexual harassment, very seriously and has a zero-tolerance policy for matters of this nature.

The company said an independent review is in its final stages and can be expected in June.

Elixir Energy sees 328% rise in contingent resources

Elixir Energy Ltd [ASX:EXR], a Queensland-focused gas exploration and development junior, has announced a remarkable 328% increase in its contingent resources for the Grandis Gas Project.

The contingent resources now stand at 1,297 billion cubic feet, a significant uplift driven by the drilling results from the Daydream 2 appraisal well.

It’s worth noting that the current analysis focused solely on the data related to the gas-bearing sandstones in the Permian section of the project.

The project’s coal resources, which are set to undergo stimulation and production testing later this year, were not included in this assessment.

Managing director Neil Young said the company will continue appraisal work and will hope to gain another upgrade.

‘We are naturally delighted with the ongoing material build-up of the very significant contingent resources in our exceptionally well-located Project Grandis,’ he said.

‘As our appraisal program resumes in the next month or so, the success case should deliver yet more substantial increases.’

Downer EDI Secures Lucrative $600 Million Contract

Engineering group Downer EDI [ASX:DOW] has announced a significant contract win in the water and sewerage sector.

The company has secured a deal valued at an estimated $600 million to provide water and sewerage services in south-east Queensland.

With this addition, the engineering group now extends its services to over 13 million Australians and highlights the company’s recent success at securing major infrastructure projects.

The company’s shares are up by 36% in the past 12 months and are currently trading at $4.86 per share.

Midday market update

The ASX 200 has slipped into negative territory, down by -0.18% to 7,774.4 as soft retail data combined with the latest 2024 low consumer confidence weighted on most sectors.

Seven of the elven sectors were down as few other drivers were there to prop up the market after the disappointing print.

Source: Market Index

Overnight, we did see commodity prices bounce, with oil, gold, silver, and platinum rising enough to bolster the mining sector, which is up by +0.29% at noon.

Major market mover today is Strike Energy, which is up by nearly 10% on improving gas prices, followed by gaming studio Playside studio, which is up by +8.89% as it raises its FY24 guidance.

On the ASX 200, the biggest faller today was Boss Energy, down by nearly -10% as its CEO sells around $21m in stock today.

Issues remain with the usual Tradingview live sector heatmap, so I will post a snapshot until the technical issues are resolved.

Source: TradingView

Adding evidence to consumer pain

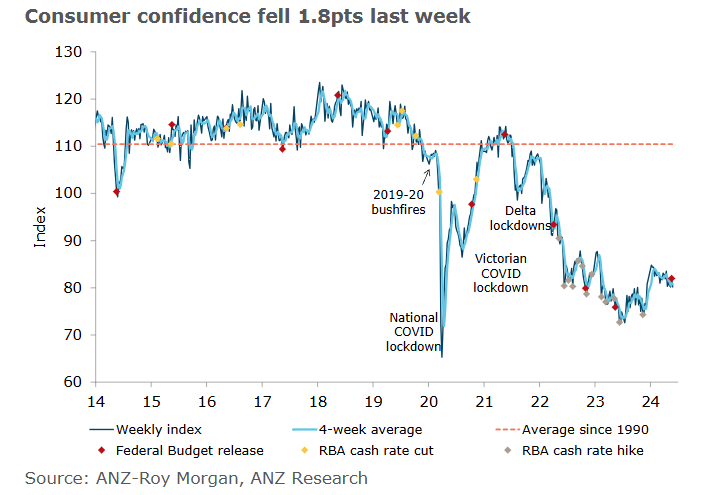

If today’s weak retail data wasn’t enough to depress retailers, the latest ANZ-Roy Morgan Australian Consumer Confidence Index may tip them over.

Consumer confidence fell back -1.8 points to 80.2pts last week while short-term economic confidence nose-dived -5.4pts, its largest weekly fall since February 2023.

The drops put us at a low point for 2024 consumer confidence and short-term economic expectations.

Households were also more wary about their 12-month outlook for their finances, with the subindex down -4.1pts.

There is not much we can pull from these numbers that isn’t a dim view for retailers and household expectations moving forward.

With no US and UK trading overnight this combined with the latest retail trading data is probably enough to send markets retreating for the rest of the session today.

ASX 200 rises on retail data then slips again

The ASX 200 is trading just below flat as the latest retail data sparks some hope before traders cautiously pull back in some sectors.

You can see the 11:30 am bump from the latest retail data which we will get to next.

Source: Market Index

Retail details

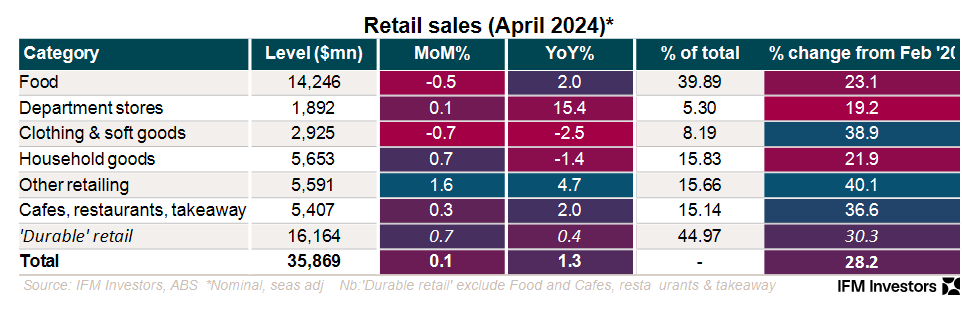

Monthly retail data on its first pass appeared positive, giving markets a small bump.

April data seasonally adjusted showed a 0.01% rise month-on-month.

That’s 1.3% higher compared to April 2023. So on face value, traders quickly reacted to this headline without diving deeper.

Remember April 2023 was an especially dim period for retailers so any move up from that low baseline is to be expected.

If we break it down by sector (thanks to tables from IFM Investors and Alex Joiner), we get a better picture.

Source: Alex Joiner – IFM Investors

In reality, it was another soft print for retailers, highlighting the financial stress households are currently experiencing as they manage higher-for-longer interest rates.

These figures reveal consumer pessimism. While pockets have seen some spending increases, most of that is found in baby boomers who have paid off their mortgages and are living off their past asset gains.

Tower [ASX:TWR] returns to profit in H1FY24

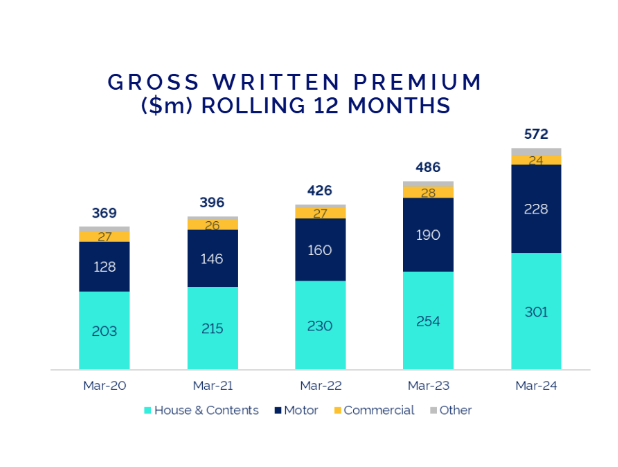

Tower Insurance [ASX:TWR] shares are on the move as the company released its financial results for the first half of FY24.

The New Zealand insurer posted an underlying net profit after tax of NZ$36.6 million (AU$33.8 million) and a reported profit of NZ$36 million (AU$33.3 million).

This marks a significant turnaround from the NZ$5.1 million loss recorded during the same period last year.

The attributed its turnaround to improved claims management, premium growth, and operational efficiencies driven by ‘digital transformation initiatives‘.

These rather vauge factors have helped reverse the losses incurred in the previous period, which were exacerbated by catastrophic weather events.

Tower’s CEO, Blair Turnbull, expressed satisfaction with the strong results, stating, ‘Tower has delivered a strong result this half, driven by improved claims, digitization and operational performance, and positive customer experiences.’

Looking ahead, Tower expects its underlying net profit after tax for FY24 to exceed NZ$35 million (AU$32.3 million).

The company also expects Gross Written Premium growth of between 10-15%. Here’s how those premiums have grown in the past four years:

Source: Tower

Tower declared a dividend of 3 New Zealand cents (2.8 Australian cents) per share.

In trading so far this morning its shares are up by +2.70% to 76 cents.

Morning market update

Good morning. Charlie here,

The ASX 200 opened up +0.16% to 7,801.1 as local markets are expected to have a slow morning until April’s Retail data is released at 11:30 am this morning for Australia. That and a lift in commodity prices are the two likely drivers for today’s trades.

Copper, gold, silver, platinum, and oil all saw solid lifts overnight, suggesting that the commodity market is on the edge of a wider cyclical uptrend.

Oil is the odd one out here, but its price has risen overnight as markets anticipate extended supply cuts at the upcoming OPEC+ meeting on Sunday.

US and UK markets were closed overnight for public holidays, leaving local markets to go it alone today.

Remaining overnight markets were lifted after stimulus announcements from China pointed towards its young chip industry and European Central Bank gave clear signals that its ready to begin cutting rates.

April retail data is due out at 11:30 a.m. this morning and will likely be the larger catalyst for movement today, so stay tuned.

Wall Street: S&P 500 closed, Dow closed, Nasdaq closed.

Overseas: FTSE closed, STOXX +0.47%, Nikkei +0.66%, SSE +1.14%.

The Aussie dollar rose +0.39% to US 66.56 cents.

US 10-year bond yields flat at 4.46%.

Australian 10-year bond -4bps to 4.26%.

Gold rose +0.64% to US$2,352.28, while Silver rose +3.68% to US$31.64.

Bitcoin rose +1.38% to US$69,299, while Ethereum rose +1.63% to US$3,880.

Oil Brent rose +1.12% to US$83.04, while WTI Crude rose +1.03% to US$78.52.

Iron ore fell -1.3% to US$119.25 a tonne.

Key Posts

-

4:54 pm — May 28, 2024

-

3:54 pm — May 28, 2024

-

3:08 pm — May 28, 2024

-

2:56 pm — May 28, 2024

-

2:17 pm — May 28, 2024

-

2:12 pm — May 28, 2024

-

12:19 pm — May 28, 2024

-

12:09 pm — May 28, 2024

-

11:56 am — May 28, 2024

-

10:31 am — May 28, 2024

-

10:10 am — May 28, 2024

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2025 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988