Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | ASX to Break 10-Day Win Streak as Markets Slip Before Powell Speech

Market close update

Australian shares ended their 10-session winning streak today, with the ASX 200 declining -0.04%, 8,023.9.

The downturn today mirrored the negative sentiment on Wall Street, where the Nasdaq saw a -1.7% drop in the overnight session.

On the ASX losses came predominantly from the large mining and energy sectors’ large caps, with both sectors closing well into the red with over 1% losses.

Despite this dip, the benchmark index managed to gain 0.5% over the week.

Six of the eleven sectors managed to close up today, with Telecoms and Healthcare gaining around 0.60%.

Standout performer was Fisher & Paykal Healthcare which gained over 11% after the company upped its guidance for the first half of FY25.

While chicken producer Inghams saw outsized losses, falling nearly 20% after its earnings report today flagged lower volumes for FY25.

Investors were particularly enthused by the stronger-than-anticipated results from software company WiseTech this week, which saw its stock price surge 28.1% for the week, reaching a market valuation of $40.2 billion.

Reasons to consider gold

Major broker Citi released a note today, saying they expect spot gold to reach US$3,000 an ounce by mid-calendar year 2025.

Here was what the note said:

‘While consumption failing to recover in China is a key risk to monitor, we see strong ETF/OTC demand from Western financial inflows supported by expected rate cuts from September, compensating for ex-China demand.’

This Monday, gold touched a record high of US$2,514 an ounce, gaining around 24% over the past six months.

If you need another reason to consider gold, then look no further than US government debt.

The US fiscal situation will literally be worse than Greece in 2025 according to OECD estimates.

US nGDP will need to grow almost 5% alone in order to cover annual net interest expenses.

Fed needs to cut interest rates just for this reason alone.

Got fiat insurance?#Bitcoin https://t.co/NkHhxxu6bp

— André Dragosch, PhD | Bitcoin & Macro ⚡ (@Andre_Dragosch) August 23, 2024

Rex gets more time to find a buyer

The Federal Court has granted an extension request from Rex Airlines’ administrators today, allowing them additional time to secure a suitable buyer for the company.

Justice Cheeseman approved the administrators’ application to extend the convening period until November 25.

With this extension, administrators say they are optimistic that a buyer for the airline will be found within the next two weeks, following the commencement of the sales process earlier this month.

The second creditors’ meeting is still anticipated to take place by the end of September. At this meeting, 4,800 creditors, including 667 former employees, will be informed of the sales process outcome.

Fisher & Paykel shares jump on guidance lift

Fisher & Paykel Healthcare [ASX:FPH] has seen its shares jump by over 10% in trading today after it lifted its profit guidance today.

Managing Director and CEO Lewis Gradon, said:

‘The year to date has begun strongly across all products and regions,’

‘In the Hospital product group, contributions include ongoing change in clinical practice, and a good response to new product introductions. In addition, early indications are that the year to date includes a relatively high hospital census during the period in both the Northern and Southern Hemispheres as Northern Hemisphere seasonal hospitalisations persisted into the beginning of this current financial year and hospitals have returned to more normalised staffing and capacity.’

The full year guidance previously provided in May was for operating revenue to be in the range of approximately $1.9 billion to $2.0 billion and net profit after tax to be in the range of approximately $310 million to $360 million.

While FPH continues to expect full year operating revenue to be in the range of approximately $1.9 billion to $2.0 billion and now expects full-year net profit after tax to be in the range of approximately $320 million to $370 million.

Jumbo shares drop

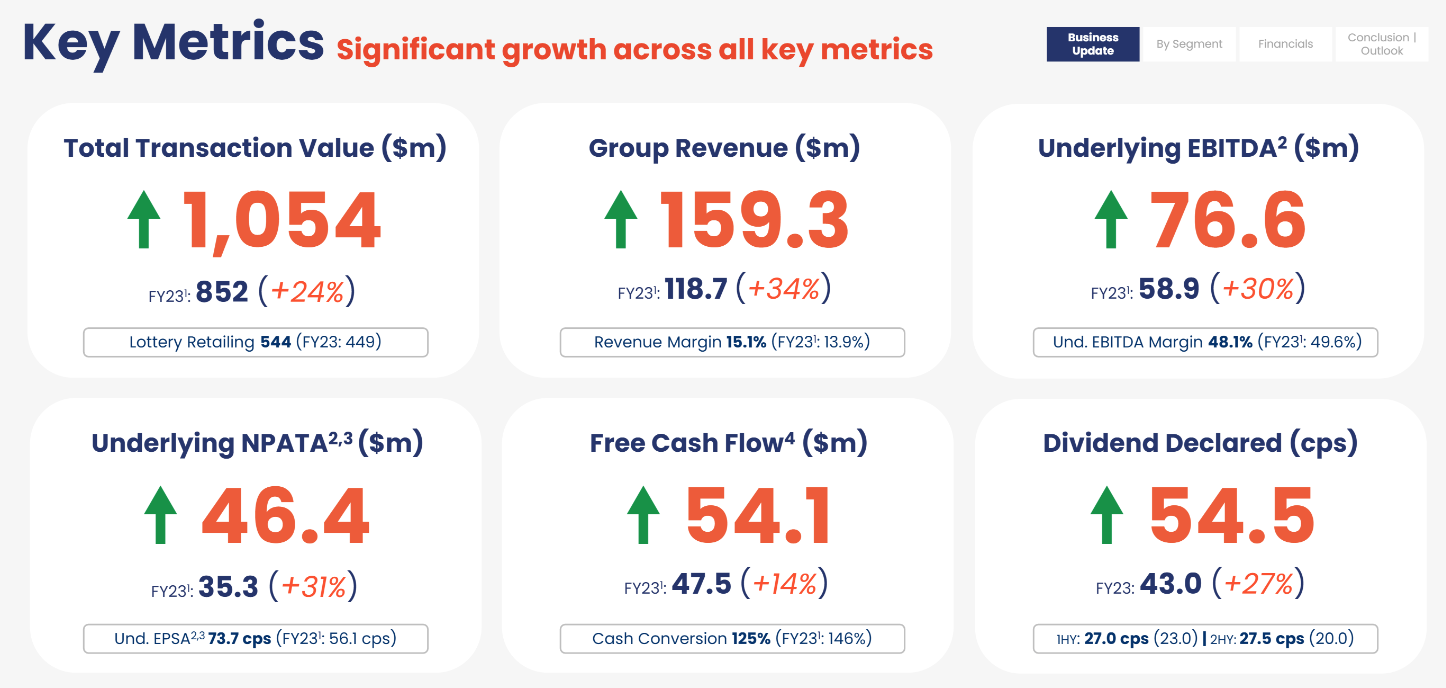

Lottery operator Jumbo Interactive [ASX:JIN] has seen its shares plummet by over 16% in trading today after the company reported its FY24 results.

The drop initially confused many as the company reported a record-breaking fiscal year.

The group’s revenue increased by 34% to $159.3 million, while underlying EBITDA rose 30% to $76.6 million.

Here are the highlights from today’s presentation:

Source: Jumbo Interactive

Despite these positive outcomes, the company’s outlook seemed to be the largest issue with shareholders, as cost-of-living pressures are resulting in fewer lottery tickets sold.

Issues with its Canadian segment also seem to be dragging on the group, with margins there now down to 26.4% from 35% in FY23.

The company declared a dividend of 54.5 cents per share, a 27% increase from last year.

Shares are now down by -16.20%, trading at $13.40 per share, which puts its 12-month return at -10%.

WAM Microcap Fund Continues Market-Beating Streak

Wilson Asset Management’s [ASX:WAM] WAM Microcap Fund has reported a 21.6% investment return for the fiscal year ending June 30, marking its seventh consecutive year of outperforming the ASX Small Ordinaries Accumulation Index.

The fund will distribute a final dividend of 5.25 cents per share, bringing the full-year payout to 10.5 cents.

Its top holdings include Gentrack, SG Fleet Group, Superloop, Tuas Limited, and Capitol Health, spanning sectors from software and telecommunications to fleet management and healthcare.

WAM Capital, the parent company, is currently trading at $1.52 per share and has seen its shares slide nearly 10% in the past 12 months despite the smaller fund’s success.

Midday market update

Australian shares are on track to break their 10-day winning streak after the ASX 200 opened down this morning.

Around midday, the major benchmark is trading 0.37% lower at 7,997.2.

This reversal follows a red session on Wall Street, where the Nasdaq fell 1.7% and other indices retreated.

Traders seem to be taking a cautious approach to the upcoming speech at the Jackson Hole Economic Symposium by US Federal Reserve chairman Jerome Powell, due at midnight tonight AEST.

9 of the 11 sectors are down today, with only Telecoms and Healthcare holding positive so far today as Telstra gains +0.25%, and Fisher & Paykel Healthcare gains +9.78% in the morning’s session.

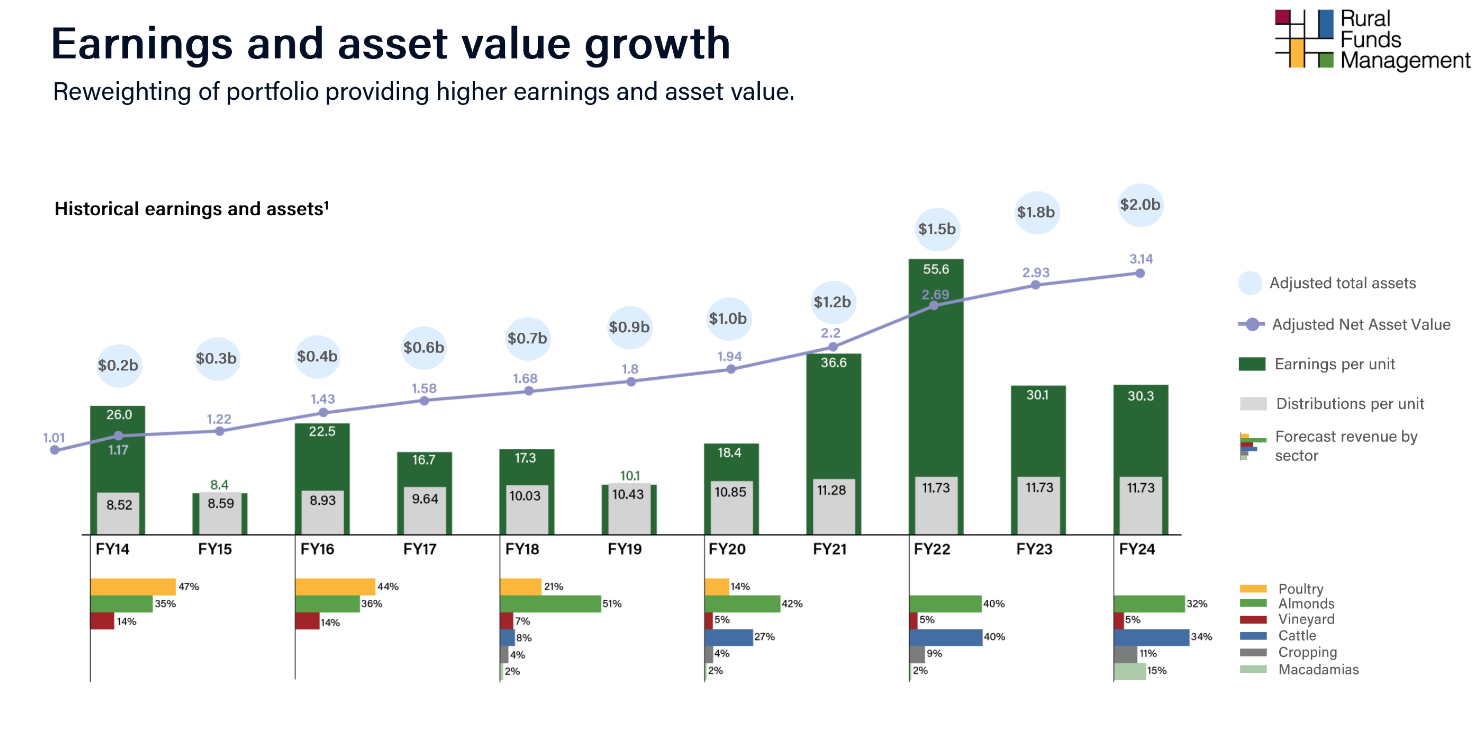

Rural Funds misses earnings guidance

Agricultural REIT Rural Funds [ASX:RFF] reported FY24 results this morning, which can be found here.

The trust’s primary investments are in cattle properties, almond orchards, and macadamia orchards, with key tenants including Olam, Select Harvests, AACo, and The Rohatyn Group.

RFF reported operating earnings below its half-year forecast, delivering adjusted funds from operations (AFFO) of 11 cents per unit, up 2.8%, compared to the 11.2 cents guidance provided in February.

Despite missing this target, RFF said it ‘remains on track’ to complete its 3000-hectare macadamia project, which is expected to reweight its portfolio and drive growth in coming years.

Here is what their portfolio has looked like for the past decade:

Source: RFF

For the upcoming financial year, RFF projects AFFO growth of 3.6% to 11.4 cents per unit and forecasts distributions of 11.73 cents per unit, matching its FY24 payout.

The trust’s manager, David Bryant, announced that the 3000-hectare macadamia developments initiated in 2021 will be substantially completed by the end of this calendar year.

RFM highlighted that the 40-year lease associated with these assets is projected to generate 18% of FY25 total revenue, with the potential for further increases as extra capital is deployed.

Following independent assessments, RFF’s portfolio, valued at $1.2 billion, recorded a $97.3 million valuation gain this year.

Shares are up by +0.48% in trading this morning at $2.10 per share.

Inghams reports: Issues warnings on volumes

Chicken and turkey producer Inghams [ASX:ING] has seen its shares plummet this morning after warning that poultry volumes are expected to decline in the upcoming year.

In its latest financial report, Inghams announced an EBITDA of $47.1 million, a 12.6% increase compared to the previous year. This growth was underpinned by a 2.8% rise in poultry sales volume.

Despite this, and a 68% increase in Net profits of $105.5 million, the company shares are in a downward spiral this morning thanks to its warning.

The company pointed to two main factors: ongoing cost-of-living pressures and a new contract with the Australian supermarket giant Woolworths.

Despite this anticipated decrease in volume, the company foresees potential benefits from reduced costs in fuel and possibly feed.

Inghams said it plans to continue focusing on cost-reduction strategies in procurement and operations, including implementing more automated processes such as leg deboning and waterjet cutters.

Shares are currently down by -16.2%, trading at $3.24 per share.

Morning Market Update

Good morning. Charlie here.

The ASX 200 broke its 10-day winning streak with a pullback on Wall St dragging local markets down as traders take a cautious position before the significant Jackson Hole speech by Jerome Powell on Saturday morning AEST.

Spot gold pulled back from its new highs overnight with prices at US$2,487, while iron ore continues to slowly recover, with prices back to US$96.80 per tonne.

Meanwhile, crude oil bounced off its near six-month low yesterday and continued to climb overnight with prices around US$73 per barrel.

Standout names reporting today are Jumbo Interactive, Paladin Energy, and Inghams, as well as reaction to the after-market earnings yesterday of Telix Pharmaceuticals.

| Name | Value | % Chg | |

|---|---|---|---|

| Major Indices | |||

| S&P 500 | 5,570 | -0.89% |

| Dow Jones | 40,712 | -0.43% |

| NASDAQ Comp | 17,619 | -1.67% |

| Russell 2000 | 2,150 | -0.95% |

| Country Indices | |||

| UK | 8,288 | +0.06% |

| Germany | 18,493 | +0.24% |

| Euro | 4,885 | +0.01% |

| Japan | 38,211 | +0.68% |

| Hong Kong | 17,641 | +1.44% |

| Name | Value | % Chg | |

|---|---|---|---|

| Commodities (USD) | |||

| Gold | 2,487 | -1.03% | |

| Silver | 29.04 | -1.91% | |

| Iron Ore | 97.35 | +0.25% | |

| Copper | 4.1322 | -0.14% | |

| WTI Oil | 73.02 | +1.54% | |

| Currency | |||

| AUD/USD | 67.07¢ | -0.64% | |

| Cryptocurrency | |||

| Bitcoin (USD) | 60,451 | -1.25% | |

| Ethereum (USD) | 2,624 | -0.28% | |

Key Posts

-

4:32 pm — August 23, 2024

-

4:03 pm — August 23, 2024

-

3:41 pm — August 23, 2024

-

3:02 pm — August 23, 2024

-

2:21 pm — August 23, 2024

-

12:30 pm — August 23, 2024

-

11:57 am — August 23, 2024

-

11:02 am — August 23, 2024

-

10:52 am — August 23, 2024

-

10:37 am — August 23, 2024

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2024 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988