Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | ASX to Bounce; Lendlease Announce Strategic Shift

Market close update

The ASX 200 closed up +0.79%, trading at 7,788.3 as markets once again closed higher in the runup to a US trading holiday this evening.

Wall Street is closed for Memorial Day tonight, giving markets a local focus as we start the week.

The Aussie benchmark saw 10 of the 11 sectors close in the green today, with only Energy (-0.22%) finishing down as oil prices remain subdued.

Oil has seen a mix of calming geopolitical affairs, weak demand and looming cut extensions from OPEC+ as the main reason for its low prices and could likely remain that way until another geopolitical flare-up spikes prices again.

Back to the ASX Real Estate (+1.80%) was today’s clear leader thanks to huge gains from Lendlease [ASX:LLC] which announced a massive strategic pivot back to Australia.

Shareholders and traders rejoiced at the announced plan to sell its global developments and focus on its historically profitable Australian developments as the global property cycle remains subdued.

Lendlease closed today up by +8% at $6.36 per share, making it the second-best performer on the ASX 200 after Neuren Pharmaceuticals [ASX:NEU], which gained a whopping 15.74% after releasing positive results from its latest Phase 2 drug trials for Pitt Hopkins.

The full details of the trial can be found here.

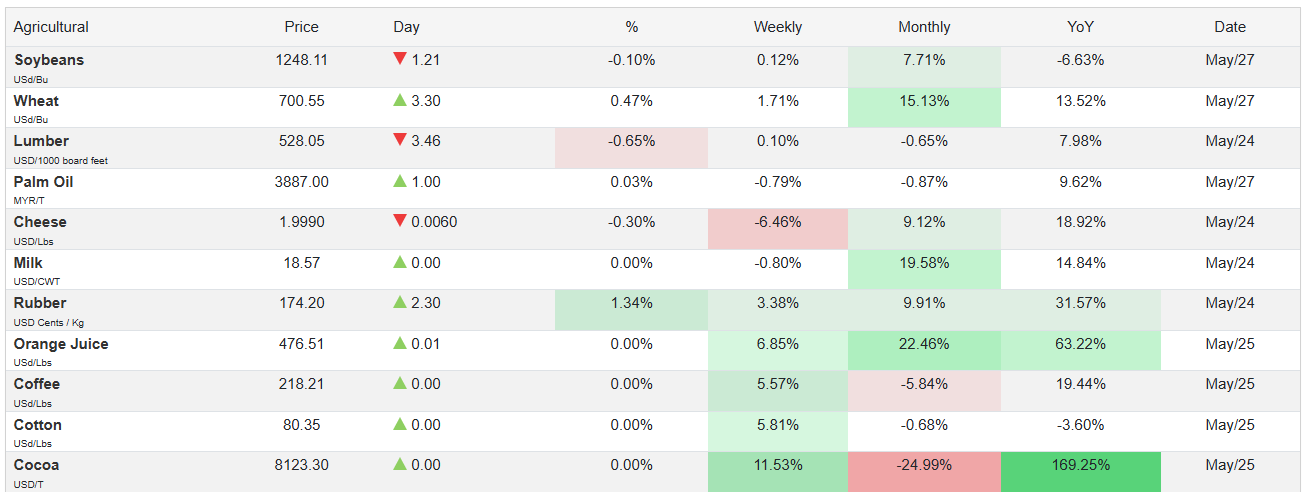

Agriculture commodities begin to rise off bottom

In an early development that has yet to turn into a larger trend, I’ve started to notice Agricultural commodities begin to climb in monthly charts.

Agricultural commodities have seen little change over the past 12 months, while other commodity prices have risen.

But with new developments in fertilizer costs and shipping costs, things are starting to change.

In the past month, we have seen the Containerised Freight Index rise by over 52%.

The index, which tracks the cost of sea shipping, increased by +7.25% yesterday alone and is now up by 178% in the past 12 months.

This is part of what has helped push up these prices, but it’s not the whole story.

We’ll keep track of this trend and dive deeper if things continue.

Source: TradingEconomics

Optus loses court case to keep 2022 cyberattack details secret

Optus will be compelled to disclose the contents of a Deloitte report that investigated the root cause of a major 2022 cyberattack that exposed sensitive customer data.

The Federal Court has dismissed an appeal filed by the telecommunications company seeking to keep the report confidential.

The Federal Court’s ruling paves the way for Slater & Gordon, the law firm spearheading a class-action lawsuit against Optus, to access information from the report.

The class action alleges that Optus failed to adequately safeguard its customers’ personal information.

The hack saw millions of customers’ personal data leaked, including names, email addresses and dates of birth.

The 2022 cyberattack on Optus has already intensified the scrutiny of its data management practices and handling of personal information, but the latest court case will drag all of those painful memories up for a company trying to quickly forget the past.

While the Deloitte forensic investigation report will not be made publicly available, certain details from the report could be disclosed through the class action proceedings.

Strategic Rare Earths Project in Turmoil as Chairman Exits Ahead of Showdown

Nicholas Curtis has resigned as executive chairman of Northern Minerals [ASX:NTU], handing a victory to the China-linked Yuxiao Fund in the battle for control over the strategic rare earths project.

The Singapore-registered fund holds a 9.98% stake in the Northern Minerals and had been pushing to oust Curtis at an upcoming extraordinary general meeting (EGM).

The resignation also comes as Northern Minerals remains under investigation by the Foreign Investment Review Board (FIRB).

Last year, Yuxiao Fund signed a cooperation agreement with Chinese conglomerates China Northern and Shenghe Resources, which have strong ties to Communist Party officials, raising concerns at Northern Minerals.

Tensions escalated after Treasurer Jim Chalmers, acting on FIRB advice, blocked Yuxiao from increasing its stake in Northern Minerals from 9.81% to 19.9% last year, as the government began highlighting the strategic importance of rare earths projects and concerns over potential foreign influence.

Shares of NTU are down by -5.3% in trading this afternoon at 3.6 cents per share.

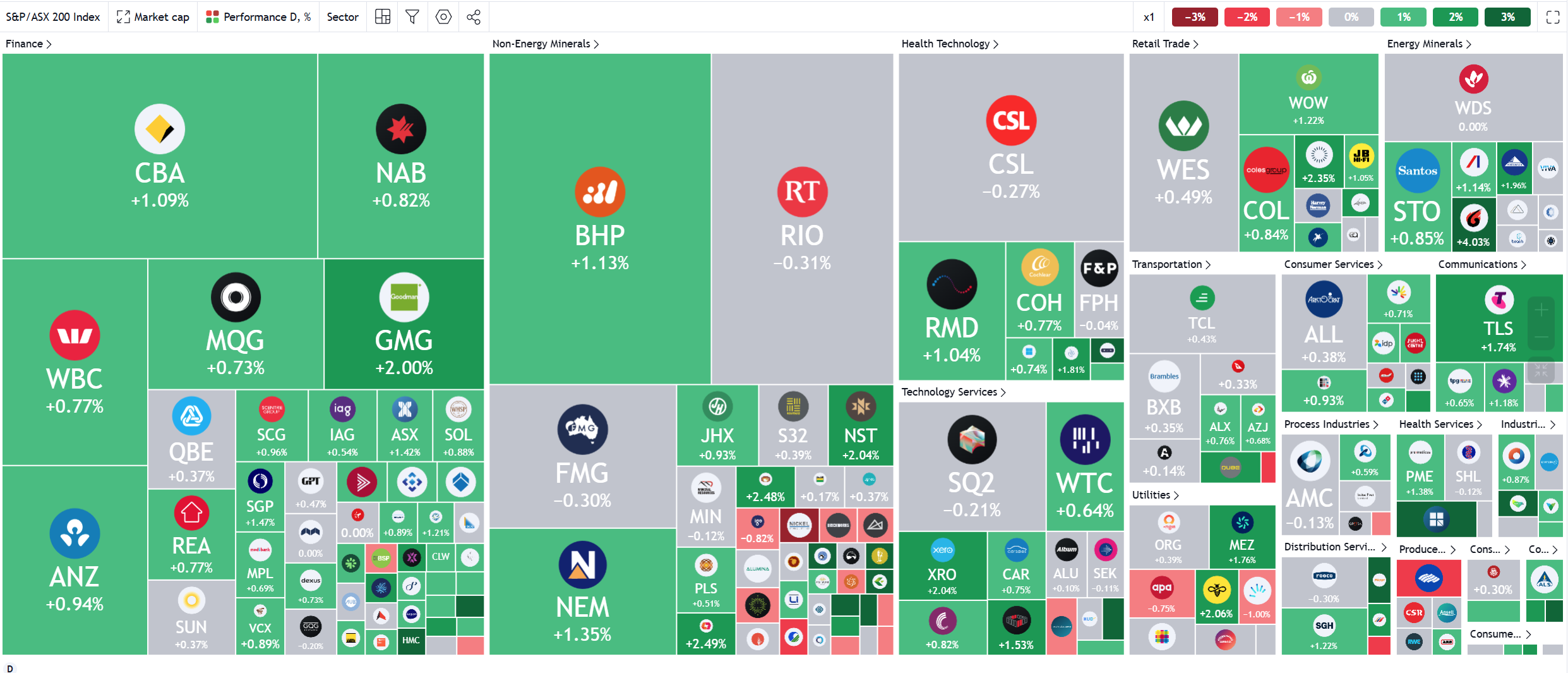

Midday market update

The ASX 200 is up by +0.72% at midday, trading at 7,783.2 as the market recovers from a sell-off at the end of last week when commodity prices fell back from fresh highs.

Real estate (+1.61%) and Staples (+1.20%) were this morning’s biggest gainers. However, today’s rally is fairly broad, with 10 of the 11 sectors up at midday.

Only Utilities is down at this point, falling just -0.17% as APA Group -0.7% and AGL Energy -0.95% underperform.

The big market mover so far today has been Lendlease, which is up by +8.83% as it announces a huge $4.5 billion strategic pivot to focus on Australia and return value to shareholders.

Goodman Group is also helping lift today, up by +2.05% at midday, trading at $34.36 per share.

Today’s heatmap isn’t interactive due to issues at TradingView.

Source: TradingView.com

HMC Capital completes raise

HMC Capital [ASX:HMC] announced it has completed its $100 million institutional placement today with around 15.4 million new fully paid ordinary shares issued at $6.50 per share.

The share purchase plan will be used to fund the acquisition of 100% of Payton Captial and any drawn debt around the deal.

HMC shares resumed from their trading halt today and are trading up by 5.72% at $7.32 per share so far today.

Short sharp commodity update

Here is a brief commodity update from the Research head at Westpac IQ Robert Rennie for this week.

With prices correcting across many of the major commodities after record runs in the past fortnight, things are quiet for now.

So what are some of the narratives across markets, here’s a good breakdown.

Industrial #Commodity #narratives 27/05/24:

– Brent up 0.9% Friday with OPEC meeting confirmed June 2 online

– ADNOC briefs press that it will reach 5mbpd capacity by end 2025 ahead of 2027 goal – currently producing at 2/3 capacity

– Tengiz field in Kazakhstan will boost… pic.twitter.com/ayjQpG9FBE— Robert Rennie (@Robert__Rennie) May 26, 2024

Neuren Pharmaceuticals jumps on Phase 2 trial results

Neuren Pharmaceuticals [ASX:NEU] shares are up by +7.35% to $22.03 in trading this morning as the company released its latest results from its Phase 2 trials.

The trial was for its new treatment for children with Pitt Hopkins syndrome which is a genetic disorder that affects a wide range of cognitive functions.

The drug known as NNZ-2591 completed the limited phase 2 trial, with only 16 subjects aged 3-17 but showed statistically significant improvements across all scores.

In a presentation released today, Neuren said that the treatment proved safe and improved outcomes across all scored benchmarks.

The full results can be seen here.

Shares are now trading near the top of its 52-week range, up by +61.2% in the past 12 months.

Lendlease major focus for today

Infrastructure giant Lendlease [ASX:LLC] is today’s clear focus for the market as the company announces the largest strategic shift in more than two decades.

The strategy update, which you can read in full here, has been expected for some time with various reductions and simplifications outlined since last year.

However, the full extent of those changes has been laid out today with a big push to simplify its organisational structure and bring down costs.

Lendlease will book a $1.48 billion writedown as the company ends overseas developments in its construction business, freeing up $4.5 billion for local growth and shareholders.

The company said it was targeting a lower risk business and strengthening its balance sheet with a reduction in gearing target range to 5-15% anticipated by the end of FY26.

That’s down from the prior 10-20% and will set up the company for a $500 million share buyback as the company intends to return value to shareholders.

Lendlease Chairman Michael Ullmer said:

‘We recognise that our security price performance and securityholder returns have been poor as we have faced structural challenges and a prolonged market downturn. We need to take significant action at an accelerated pace to deliver value for our securityholders, capital partners and customers.’

Shares of Lendlease are this morning’s top performer, with its shares up by +8.64%, trading at $6.41 per share.

Morning market update

The ASX 200 opened up +0.62% to 7,775.7 as the Australian benchmark bounced after a strong US tech rally finished up last week.

The previous sell-off came as stronger than expected US Purchasing Managers Index (PMI) hinted that business activity was still strong in America, pushing back expectations of cuts.

But soon after, more data points calmed the markets and Nvidia’s huge earnings then charged the Nasdaq to close at a new all-time high.

The ASX will start the week without support as the US and European holidays will mean those markets are closed this evening. Few catalysts are around for markets, so we will be looking domestically for market-moving news.

The biggest shift will likely be from Australia’s monthly inflation figures, which are due on Wednesday. Estimates are for around 3.4% but any shift from this will be telling.

Wall Street: S&P 500 +0.70%, Dow flat, Nasdaq +1.10%.

Overseas: FTSE -0.26%, STOXX flat, Nikkei +0.22%, SSE -0.88%.

The Aussie dollar flat +0.02% to US 66.29 cents.

US 10-year bond yields -1bps to 4.46% now down -20bps for the month.

Australian 10-year bond +3bps to 4.28% down -23bps for the month.

Gold rose +0.11% to US$2,336.65, while Silver rose +0.52% to US$30.50.

Bitcoin fell -0.85% to US$68,607, while Ethereum rose +2.65% to US$3,847.

Oil Brent flat at US$82.14, while WTI Crude rose +0.14% to US$77.83.

Iron ore rose +0.8% to US$120.40 a tonne.

Key Posts

-

4:41 pm — May 27, 2024

-

4:32 pm — May 27, 2024

-

3:29 pm — May 27, 2024

-

3:13 pm — May 27, 2024

-

12:16 pm — May 27, 2024

-

11:55 am — May 27, 2024

-

11:49 am — May 27, 2024

-

11:39 am — May 27, 2024

-

11:23 am — May 27, 2024

-

10:44 am — May 27, 2024

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2024 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988