Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | ASX to Bounce; Big Week of Earnings Ahead for Wall St; Citi Downgrades Aus Banks

Central Banks forge their own path

Central Banks around the world are starting to diverge in their monetary policy decisions, a phenomenon known as ‘decorrelation.’

While central banks initially moved in unison to combat inflation by raising interest rates, they are now expected to follow different paths as economic conditions and policy impacts vary across countries.

Many had expected the Fed to give at least 5-6 cuts at the start of the year, but it is now looking increasingly uncertain if even one cut will come.

Why? Interest rate impacts have not been consistent across economies. Australia has experienced a larger impact on household mortgages compared to other markets, despite having the lowest policy rate increase.

This has led to a collapse in household consumption in Australia, while consumption remains robust in the United States.

As a result, central banks will likely follow their own paths as the economic cycle progresses.

This chart – recently featured on Livewire's Signal or Noise is living proof that the #Fed does not always lead an interest rate hiking or cutting cycle. In fact, the #RBA is often late to cut, late to hike, and sometimes, is diametrically opposite to the Fed! pic.twitter.com/hgmOYO3aoB

— Livewire Markets (@LivewireMarkets) April 22, 2024

Star Entertainment back under the spotlight

Star Entertainment Group [ASX:SGR] shares are down by -2.38% as the troubled casino operator is once again in the spotlight.

Shares are trading at 0.41 cents per share as the company faces its second week of inquiry. This second inquiry came after NSW regulators said insufficient changes had been made at the casino’s operations for the company to regain its casino license.

Last month, both the CEO and CFO left the company, saying it was unlikely to regain the license under their leadership.

Now, a top executive at Star says the group is ‘on a journey‘ to change its culture, where the customer has ‘always been right’.

This is a fairly incredulous response for a company that broke money laundering laws ‘innumerable times,’ according to AUSTRAC.

Interestingly, the often misquoted line is actually:

‘The customer is always right in matters of taste.’

As in, if they prefer that pattern or colour, the retailer should not critique or question their preferences. A far cry from, our customers have convinced us to undertake criminal acts.

Midday market update

The ASX 200 is up by nearly 1% around midday, at 7,640.6, as 10 out of the 11 sectors are up today. Only the Energy sector (-1.23%) is down after oil prices fell over the weekend as tensions in the Middle East simmer.

Miners are leading the benchmark today as stocks recover from sharp sell-offs following Israel’s retaliatory strikes on Iran last Friday.

After Iranian officials downplayed the impact of the attacks and it was clear that no nuclear facilities had been targeted, traders regained their composure over the weekend.

In individual stock moves today, South32 is up +6.43% after releasing its latest quarterly report. The company said that it’s not expecting Australian manganese production to come back online until Q3 of 2025 as it continues to tally the full extent of the damage after Cyclone Megan disrupted its Groote Eylandt operations in NT.

Cettire is down by -5.3% after it was revealed that one of the stock’s largest stakes, LHC Capital, sold out of the luxury online retailer.

Droneshield is down by -17.8% after announcing the completion of its $100 million capital raise.

China leaves rates on hold

In its latest Central Bank announcement, the Peoples Bank of China has left its one and five-year loan rates unchanged for a second meeting in a row as the country grapples with its lurching economy. The loan prime rates (LPR) remained at their 1-year (+3.45%) and 5-year (3.95%) levels.

Australians and the RBA have closely watched this decision as any hint of looser monetary policy would be stimulatory for Australia. The RBA said in its March press conference that current forecasts have strongly considered the effects of a weaker Chinese economy.

China accounts for one-third of Australian exports and employs roughly 20% of Australia’s workforce in trade-related jobs.

While today’s move was largely expected, economists will be watching closely for hints of another round of stimulus from Chinese officials, which could boost demand for the Aussie dollar.

Droneshield falls heavily as company raises $100m

Counter-drone company Droneshield [ASX:DRO] has fallen nearly -20% in this morning’s trading as the company completed its $100 million equity raise.

The stock has seen a nearly 200% growth in the past 12 months had originally set its goals to a $70 million raise and a share purchase plan of a further $5 million.

But seeing strong demand over the weekend, brokers have upsized the raise top $100 million.

The raise’s issue price is 80 cents, representing a 19% discount to the five-day volume weighted average price of 99 cents.

Here is a copy of the investor presentation.

Gold’ sky high price in focus

Gold’s rise to new all-time highs of over US$2,400 has captivated markets which have seen their volatility rise as geopolitical risk and uncertain Fed cuts play havoc on equities.

It’s not unusual to see gold rise in times of geopolitical risk, so the jump in prices around the back-and-forth between Israel and Iran was to be expected. However, this rally has been with us for the past six months.

Some would point to Hammas’s October 7th attack as the spurr of this half-year rally; however, that’s only one part of the picture.

Consumers, facing uncertain markets have rushed towards gold as security in these times.

India is typically viewed as the largest personal buyers of gold, with jewellery and gold bars common purchases, but now Chinese consumers have sought the security of the shiny metal.

In the past year, China’s demand for gold jewellery has risen 10%, while India’s has fallen 6%. At the same time, Chinese demand for investment-grade gold has jumped 28%.

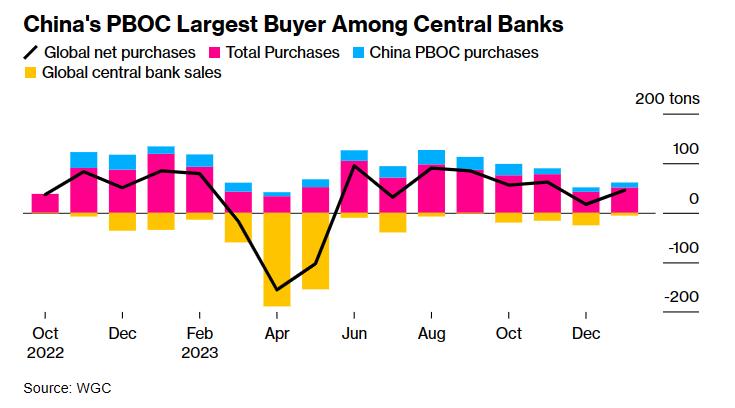

It’s not just Chinese consumers who are buying heavily. The Chinese Central Bank has also been on a buying spree for the past 17 months.

Source: Bloomberg

The heavy purchases from this and other Central Banks is expected to continue through this year, while the demand by Chinese consumers appears robust.

Chinese consumers have typically been the heaviest buyers whenever gold prices drop, usually providing a strong floor to the prices during times of weakness. Instead we’ve seen sustained demand by the Chinese that has caused continued price disparity between theirs and other precious metal exchanges.

This could be a signal that this rally could continue.

Morning market update

Good morning. Charlie here, hope you had a great weekend.

The ASX 200 opened up +1.22% top 7,659.3, breaking from Wall Street, which closed mostly down last week as markets sold off heavily on news of Israel’s retaliatory strike on Iran.

Now that the dust has settled, it appears that the strike was limited so as not to spark further conflagration, but markets are still on edge.

US equities finished their third week down as traders struggled to shake off the hawkish Fed’s new cut expectations. Nasdaq -5.5%, S&P 500 -3.05%, and Russell 2000 -2.77%, Dow was flat for the week.

Around 178 of the S&P 500 companies or around 40% of the index’s market cap, are expected to post earnings results this week.

The biggest expectations are around four of the Magnificant 7 stocks, Microsoft, Meta, Alphabet (Google), and Tesla, which are expected to report.

Of them, only Tesla is expected to post a poor result, so many are hoping it could be the catalyst to turn around the stalled bull run that began at the start of this year.

On the ASX, Cettire’s most prominent backer, LHC Capital, has sold its stake in the online platform, warning that share sales by its founder and CEO are ‘red flags’.

Air New Zealand cut its full-year guidance, blaming deteriorating economic and operational conditions. While Citi Bank downgraded all major Australian banks.

Wall Street: S&P 500 -0.88%, Dow +0.56%, Nasdaq -2.05%.

Overseas: FTSE +0.24%, STOXX -0.37%, Nikkei -2.66%, SSE -0.30%.

The Aussie dollar rose +0.13% to US 64.21 cents.

US 10-year bond yields -1bps to 4.62%.

Australian 10-year bond yields +3bps to 4.30%.

Gold fell -0.25% to US$2,386.41, while Silver fell -0.40% to US$28.57.

Bitcoin rose +0.1% to US$64,944, while Ethereum fell -0.1% to US$3,148.

Oil Brent fell -0.32% to US$87.01, while WTI Crude fell -1.52% to US$81.88.

Iron ore fell -0.04% to US$110.85 a tonne.

Key Posts

-

4:04 pm — April 22, 2024

-

3:36 pm — April 22, 2024

-

1:07 pm — April 22, 2024

-

11:32 am — April 22, 2024

-

11:02 am — April 22, 2024

-

10:53 am — April 22, 2024

-

10:15 am — April 22, 2024

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2024 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988