Investment Ideas From the Edge of the Bell Curve

ASX News Live | ASX Ends 1.95% Lower as Markets Reassess Fight Against Inflation

Most shorted ASX stocks — Flight Centre and Betmakers top list

On 23 of August, ASIC released its latest data on the most shorted ASX stocks.

Flight Centre again topped the list, with short interest of over 15%.

Rounding out the top ten:

- Betmakers, with 12.8% short interest

- De Grey Mining, with 11% short interest

- Block, with 10.7% short interest

- Nanosonics, with 10.5% short interest

- Lake Resources, with 10.1% short interest

- Zip, with 9.7% short interest

- Inghams, with 8.4% short interest

- Regis Resources, with 8.3% short interest

- Megaport, with 7.8% short interest

Most shorted #ASX stocks this time 5 years ago, August 29, 2018:

– $JBH, 19% short interest

– $SYR, 18.5%

– $GXY (now $AKE via merger), 18%

– $DMP, 13.6%

– $ORE (now $AKE via merger), 13.6%

– $MTS, 12.6%

– $ING, 12.4%

– $MYR, 11.3%

– $HVN, 10%

– $IFL, 9.3%

– $CSR, 8.7% https://t.co/SOeHynBNiI— Fat Tail Daily (@FatTailDaily) August 29, 2022

Adore Beauty ends 10.6% lower on FY22 results

Online beauty retailer Adore Beauty (ASX:ABY) closed 10.6% lower on Monday following the release of its FY22 results.

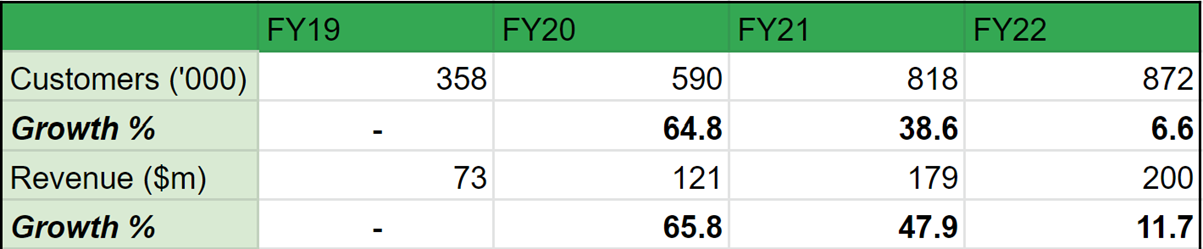

- Revenue up 11% to $200 million

- Gross profit margin unchanged at 33.3%

- EBITDA down 30% to $5.3 million

- Active customers up 7% to 872,000

- Returning customers rose 31% (absolute total withheld)

- Returning customers largest contributor to growth, accounting for 70% of all revenues (up from 62% in FY21 and 56% in FY20)

In a worrying sign for the retailer, active customers rose only 7% for the year.

If we input ABY’s historical figures into a spreadsheet, we’ll see that both customer growth and revenue growth slowing down since FY19.

ASX closes 1.95% lower — Information Technology sector down 4.38%, Lake Resources falls

The ASX 200 ended well down on Monday, falling 1.95%.

The Information Technology sector was hardest hit, falling 4.38%.

Lake Resources recorded the steepest fall of individual ASX 200 stocks, ending the day 10% lower. Does this presage more volatile trading ahead for this junior lithium stock?

$LKE closed 10% lower on Monday, ending the day at $1.06 a share.

The #lithium stock is down 30% since rebounding to $1.60 in August 11.

— Fat Tail Daily (@FatTailDaily) August 29, 2022

Other big fallers included City Chic Collective (down 9.6%), Megaport (down 9.1%) and Zip (down 8.9%).

Women’s apparel retailer City Chic is down 28% in the past 5 days after sales growth came in below expectations and inventories continue to rise disproportionately to sales.

Investors ramp up bets against US stock market

Is the recent rally over?

Investors seem to think so, if you look at the recent short positions.

Net short positions against the benchmark S&P 500 have steadily risen in recent months, hitting a two-year high overnight.

A2 Milk: NZ$150 million share buyback ‘most appropriate form of capital management at this time’

Bitcoin below US$20,000

Bitcoin is currently trading below US$20,000, down about 17% in the past month.

The price of bitcoin was hovering around US$24,500 in mid-August before sliding below US$20,000.

BTC was trading as low as US$19,500 at one point overnight, a level last reached in mid-July.

ASX down 2% but A2 Milk, Lovisa, and McMillan Shakespeare buck trend

Yes, it’s a dour day for the ASX on Monday.

Following steep falls on Wall Street on Friday, the ASX 200 is currently down almost 2% while the All Ords is down 2.1%.

Yet not all stocks were in the red.

Some even thrived.

Salary packaging provider McMillan Shakespeare is up 11.4% at the moment after FY22 statutory NPAT rose 15% to $70.3 million. McMillan also announced a 10% off-market share buyback.

Infant formula stock A2 Milk is currently up 9% after an improvement in revenue and profit in FY22 and a share buyback announcement.

Jewellery retailer Lovisa is up 5% after revenue rose 59.3% to $458.7 million, with a final dividend of 37 cents a share, 30% franked.

And small cap gold and copper miner Dart Mining (ASX:DTM) is up a considerable 30% on big volume and no news. Could be one for the traders.

One market doesn’t believe Jerome Powell — should you?

US$125 billion per minute…

That’s how much Fed Chairman Jerome Powell’s 10-minute speech cost investors on Friday.

As he spoke from the annual meeting at Jackson Hole, Wyoming, all major US markets tanked.

The blue-chip S&P 500 fell 3.4%.

The tech-focused Nasdaq fell 4%.

Bitcoin [BTC] fell a whopping 9%…

The market finally believed Powell was serious about raising interest rates.

But one particular market is still sceptical that Powell will actually follow through.

If it’s right, then this is all just tough talk…

https://www.moneymorning.com.au/20220829/one-market-doesnt-believe-powellshould-you.html

Jerome Powell: the US Fed is drawing on three important lessons

In his speech at the Jackson Hole summit, US Fed chair Jerome Powell outlined three lessons the central bank is following as it attempts to tame inflation.

One, central banks “can and should take responsibility for delivering low and stable inflation.”

Powell said the Fed’s responsibility to oversee price stability is “unconditional”.

This may make some reassess their view of the Fed’s willingness to drive down inflation. How far can a central bank go when stable inflation is its unconditional responsibility?

Jerome #Powell: "Our responsibility to deliver price stability is unconditional."

What is a central bank willing to do when stable #inflation is its unconditional responsibility?

— Fat Tail Daily (@FatTailDaily) August 29, 2022

Two, inflation expectations play an important part in setting the path of inflation over time.

Currently, the public’s long-term inflation expectations remain “well anchored”. But Powell cautioned against complacency, as inflation has already run “well above our goal for some time.”

If the public’s expectations become unmoored, inflation can become a self-fulfilling prophecy.

“During the 1970s, as inflation climbed, the anticipation of high inflation became entrenched in the economic decision making of households and businesses. The more inflation rose, the more people came to expect it to remain high, and they built that belief into wage and pricing decisions. As former Chairman Paul Volcker put it at the height of the Great Inflation in 1979, “Inflation feeds in part on itself, so part of the job of returning to a more stable and more productive economy must be to break the grip of inflationary expectations.”

Here, Powell touched on the concept of rational inattention.

“When inflation is persistently high, households and businesses must pay close attention and incorporate inflation into their economic decisions. When inflation is low and stable, they are freer to focus their attention elsewhere. Former Chairman Alan Greenspan put it this way: ‘For all practical purposes, price stability means that expected changes in the average price level are small enough and gradual enough that they do not materially enter business and household financial decisions.'”

Three, when taming inflation, central banks must not waver. Powell’s third lesson was that “we must keep at it until the job is done.”

“History shows that the employment costs of bringing down inflation are likely to increase with delay, as high inflation becomes more entrenched in wage and price setting. The successful Volcker disinflation in the early 1980s followed multiple failed attempts to lower inflation over the previous 15 years. A lengthy period of very restrictive monetary policy was ultimately needed to stem the high inflation and start the process of getting inflation down to the low and stable levels that were the norm until the spring of last year. Our aim is to avoid that outcome by acting with resolve now.”

Unpacking Jerome Powell’s Jackson Hole summit speech

US Federal Reserve’s Jerome Powell had a key message during his Jackson Hole summit speech: the Fed will fight to drive inflation down.

“The Federal Open Market Committee’s (FOMC) overarching focus right now is to bring inflation back down to our 2 percent goal. Price stability is the responsibility of the Federal Reserve and serves as the bedrock of our economy. Without price stability, the economy does not work for anyone. In particular, without price stability, we will not achieve a sustained period of strong labor market conditions that benefit all. The burdens of high inflation fall heaviest on those who are least able to bear them.”

Powell admitted that restoring price stability will require using tools at the Fed’s disposal “forcefully”.

This will take time. Powell warned that the historical record “cautions strongly against prematurely loosening policy.”

The latest projections show the median federal funds rate running slightly below 4% at the end of 2023.

Powell said reducing inflation will require a “sustained period of below-trend growth” which will inevitably “bring some pain to households and businesses.”

The Fed chair also flagged that “another unusually large” interest rate increase could be on the cards at the Fed’s next meeting in September.

ASX opens 1.9% down but A2 Milk surges

The S&P/ASX 200 is currently down 1.80% as bearish sentiment returns following hawkish comments from the US Federal Reserve chair Jerome Powell.

US stocks closed sharply down on Friday following Powell’s speech at the Jackson Hole summit, where the central banker reaffirmed the Fed’s firm stance on stamping out inflation — even if it crimps economic growth.

The worst performing stocks at market open:

- Pinnacle Investment, down 9%

- Life360, down 9%

- Block, down 7%

- NEXTDC, down 6.6%

- Megaport, down 5.8%

The lone top performing stock at market open was A2 Milk, up 8%. The infant formula product producer saw FY22 net profit rise and announced a share buyback.

Key Posts

-

4:53 pm — July 6, 2023

-

5:24 pm — August 29, 2022

-

4:59 pm — August 29, 2022

-

4:37 pm — August 29, 2022

-

4:24 pm — August 29, 2022

-

4:16 pm — August 29, 2022

-

2:39 pm — August 29, 2022

-

1:52 pm — August 29, 2022

-

12:11 pm — August 29, 2022

-

12:05 pm — August 29, 2022

-

11:27 am — August 29, 2022

-

10:27 am — August 29, 2022

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2026 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988