ASX News LIVE | ASX Slips as Bull Runs Take a Breather; Bitcoin Rallies

Market close update

Australian stocks fell in afternoon trading, with the ASX 200 ending -0.41% lower at 7,780.2, following overnight declines in US markets.

Investors seem to be pushing back against last week’s dovish sentiment ahead of key inflation data this week. The US Personal Consumption Expenditures data on Friday and Australia’s monthly consumer price indicator on Wednesday will provide insights into the direction of inflation and interest rates.

Tech, real estate, and communications sectors weighed on the market, while energy stocks gained. Fortescue slipped 1.2% as iron ore prices fell. Premier Investments rose 4.4% on strong sales and demerger news.

Seven Group disputed a report recommending against its Boral takeover bid. 29Metals halted a Queensland mine due to weather issues, sending its shares down -25.9%. Mesoblast surged 45.5% after the FDA allowed it to re-submit a license application.

Market movers

Sorry ive been off the air traders, I’ve been doing some company deep dives that will come to readers soon.

In the meantime, here is a great macro update from a trusted trader, Chris Weston.

📽️Trader Insights – what went down in markets.

A visual across equity, crypto, commodities and FX – tight ranges seen in US indices, but some solid moves in crypto, Reddit, Micron, Super Micro and crude

Take a look as we head towards the Asia open #bitcoin $NVDA $RDDT pic.twitter.com/MGp5CVZP6a

— Chris Weston (@ChrisWeston_PS) March 25, 2024

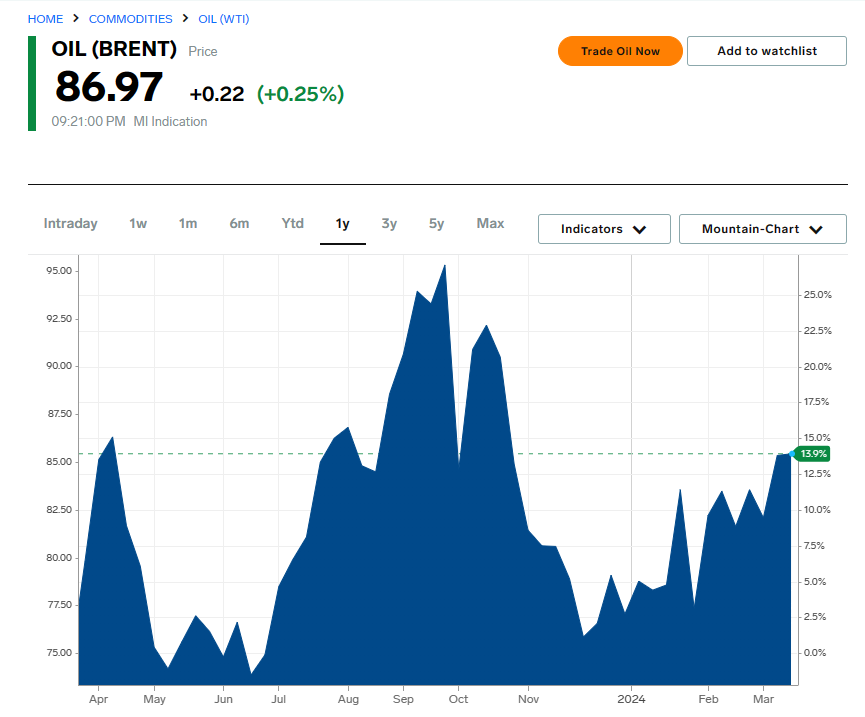

Oil climbs as Russian geopolitics back in focus

With the re-election of Putin in Russia, tensions have once again risen between the West and Russia, this time spilling into Oil Prices.

Multiple strikes by Ukraine on large Russian oil refineries in the past few weeks have surged Russian Urals crude oil prices, which are currently around US$76 per barrel, nearing their October 2023 peak. With the bombings reaching further into Russia, around 12% of Russia’s oil processing is currently impacted.

As a response, Russia has launched its largest aerial bombing of Ukraine’s energy systems since the war began.

On the demand side, China is expected to import a record amount of oil this month, while flows to India decreased as the country pulled out many of its large tankers.

These tankers were supporting the Russians to avoid sanctions on its oil that restricted western shippers from supplying the cude at anything above its sanctioned price cap of $60 per barrel.

These price shifts have meant Brent and WTI crude have seen knock-on effects from these supply-side disruptions and their price has climbed back to October 2023 prices. While still far off their peaks:

Brent Crude’s up +0.25% at US$86.9, while WTI Crude is up +0.34% at US$82.23 per barrel.

Source: Market Insider

Midday market update

The ASX 200 is flat at midday after dipping in morning trading. Modest declines witnessed on Wall Street overnight saw the Australian index retrace gains seen late yesterday this morning.

The big market movers have been in the Energy sector, which is up +1.51% as Oil continues to gain ground amidst a slight fall in the USD and rising oil prices as Russian supply and geopolitical tensions mount.

More on that in the next post, but for now, big gains in oil companies have brought the ASX back to flat, with notable movements by Woodside Energy +1.73%, Santos +1.25% and Beach Energy +5.76%.

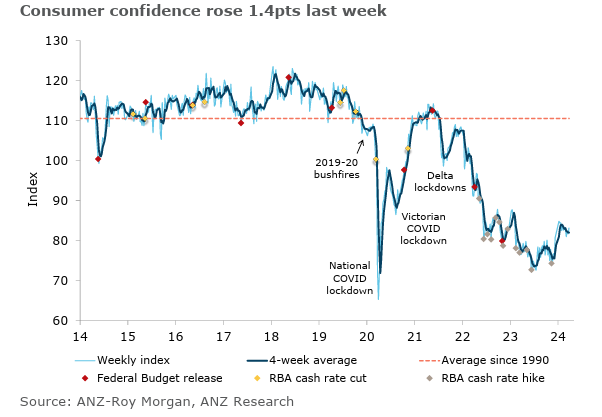

Consumer confidence rises in ANZ–Roy Morgan Index

Australian consumer confidence experienced an uplift last week, buoyed by the RBA shift towards a looser monetary policy stance and better-than-expected labour data.

ANZ economist Madeline Dunk noted that the consumer confidence measure increased by 1.4 points. However, she cautioned that recent progress in managing inflation expectations hit a roadblock, with the series rising 0.3 points to 5.1%.

“Confidence amongst renters lifted 7.1 points to its highest level since early January,” Dunk added.

“Despite this, renters remain the least confident among the three housing cohorts. Confidence is currently 3 points lower for renters compared to households paying off a mortgage.”

While we’ve seen recent gains, lumpy inflationary pressures continue to pose a challenge, as shown by the uptick in inflation expectations.

Its also worth noting the large disparities in confidence levels persist across different housing groups, with renters trailing behind homeowners in terms of overall optimism.

Crown Melbourne Retains Casino License

Crown Melbourne has been deemed suitable to continue operating its Southbank casino despite previously exhibiting ‘egregious governance failures‘, an absence of regulatory standards, and a culture that ‘prioritized profits over public safety‘.

Victorian Gambling and Casino Control Commissioner Fran Thorn acknowledged that Crown had previously demonstrated such concerning practices but stated that the company has now resolved the major problems identified in the royal commission’s investigation.

‘The arrogance of the casino industry has been exposed,’ Thorn declared this morning. ‘We are now in an environment where the scrutiny of the gambling industry and casino operators are higher than ever before.’

She expressed satisfaction that Crown’s systemic failings are now in the past, asserting, ‘In return for an exclusive license, Victorians have the right to know Crown will never again prioritize profits over public safety.’

The decision to allow Crown Melbourne to retain its casino license marks a significant turning point. The company has undergone intense scrutiny and has been pushed to address its past issues to meet the heightened regulatory standards.

It stands in contrast to Star Entertainment’s recent issues with the NSW gambling regulators, which has seen a new chapter as the company saw its CEO and CFO exit yesterday in the hopes of regaining its licence there.

Morning market update

Good morning. Charlie here,

The ASX 200 opened down -0.21% to 7,795.6 as markets saw a quieter day on Wall Street, which remained rangebound for much of the session.

A quieter start to the week has seen little catalysts for further movement, but bullish sentiment remains. As we near the end of the quarter expect rebalancing to occur across equities as funds shift around portfolio weightings.

Investors may also be taking a more cautious stance on the personal consumption expenditures price index— due on Good Friday— which could show higher or lumpy inflation numbers.

Wall Street: S&P 500 -0.31%, Dow -0.41%, Nasdaq -0.27%.

Overseas: FTSE -0.17%, STOXX +0.26%, Nikkei -1.16%, SSE -0.71%.

The Aussie dollar fell +0.33% to US 65.38 cents.

US 10-year bond yields +5bps to 4.25%.

Australian 10-year bond yields +1bps to 4.04%.

Gold rose +0.21% to US$2,173.07, while Silver fell -0.13% to US$24.67.

Bitcoin rose +4.35% to US$70,366, while Ethereum rose +4.58% to US$3,616.

Oil Brent rose +1.46% to US$86.68, while WTI Crude rose +0.05% to US$81.99.

Iron ore rose +0.2% to US$108.40 a tonne.

Key Posts

-

4:40 pm — March 26, 2024

-

3:58 pm — March 26, 2024

-

12:44 pm — March 26, 2024

-

12:37 pm — March 26, 2024

-

11:28 am — March 26, 2024

-

10:50 am — March 26, 2024

-

10:22 am — March 26, 2024

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2024 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988