Investment Ideas From the Edge of the Bell Curve

ASX News Live | ASX Finishes Down; Lake Resolves Dispute with Lilac, FTX Owes US$3B to Largest Creditors

Oil prices dip to lows last seen in September

Oil prices continue to fall in November, hitting levels not seen since September, on global weakening demand concerns.

The price of West Texas Intermediate crude is down nearly 10% in the past week and down 25% in the past six months.

Source: Financial Times

Future profits are made today

If you could hitch a lift with Marty McFly and travel back in time, what stock would you buy?

The surprising answer to this hypothetical (unfortunately!) question is a US company called Monster Beverage Corp.

It makes energy drinks and was first listed on the stock market in 1995.

Since then, this little-known stock has returned early investors a whopping 260,061%, turning a $10,000 stake into $26 million today.

And all for punting on the growth of caffeinated water!

That’s the interesting thing about the top 10 stocks.

Sure, you’ve your Amazons, NVIDIAs, Apples, and other well-known tech highflyers in there.

But you’ve also companies like Pool Corp [NASDAQ:POOL] — a wholesale distributor of swimming pools — sneaking in too.

Get this…

A $10,000 investment in POOL in 1993 would be worth $6.9 million today. You’d literally be swimming in cash.

And even in the last five years, POOL has generated a return of 207% — three times the return of the S&P 500 over the same time frame.

My point is…

The stock market can be an unbelievable place for wealth creation.

And you don’t need to ride the latest fad, guess the next set of economics numbers, or even front run the Fed’s next moves to do it.

I mean, areas as mundane as fizzy drinks and swimming pools have minted fortunes for some.

But whether you prefer the mundane or the high-tech, the process of finding such gems is pretty much the same.

You think about where the future is heading and then find the best companies best placed to follow it.

Easier said than done, maybe.

But here’s the kicker…

https://www.moneymorning.com.au/20221121/future-profits-are-made-today.html

Life360 enters trading halt, set to announce capital raising

Family safety and location sharing app Life360 (ASX:360) requested a trading halt on Monday pending a capital raise announcement expected before commencement of trading on Wednesday.

In its most recent quarterly, Life360 reported a steep drop in cash and cash equivalents following a string of acquisitions. Cash fell from US$230 million to US$44 million at the end of the September quarter. 360 now counts US$134 million on its books as goodwill.

In a likely reason for the upcoming equity raise, Life360 ended the September quarter with net cash outflows from operating activities of US$55 million.

Liontown Resources: 2022 a breakthrough year for lithium sector

Australian lithium developer Liontown Resources (ASX:LTR) noted in its ESG report released on Monday that 2022 has been a ‘breakthrough year’ for the lithium sector.

The price for all lithium raw materials hit new all-time high, with spodumene concentrate reaching US$7,000 a tonne for SC6 product.

This price is well ahead of the US$1,392 a tonne weighted average price assumed in LTR’s definitive feasibility study.

Liontown thinks the lithium supply shortfall will ‘increase dramatically through 2030’.

Source: Liontown Resources

Lake Resources rises on Lilac dispute resolution

Lithium developer Lake Resources (ASX:LKE) is up 4.5% on Monday after ‘concluding dispute resolution’ with its technology partner Lilac Solutions.

Lake and Lilac have resolved their dispute over performance timelines first flagged in September by entering an amended contract.

The pair have renegotiated a new timeline, ‘which both are confident can be achieved’.

Like the previous contract, LKE has certain buy-back rights if Lilac does not meet the new testing criteria ‘in a timely manner’.

LKE also provided an update on its Kachi lithium project demonstration plant in Argentina operated in conjunction with Lilac and using Lilac’s direct lithium extraction technology

Lake said the Kachi demonstration plant’s performance was ‘in line with expectations.’

New LKE chief executive David Dickson said:

“Lilac has worked extensively with Kachi brine since 2020, generating the data needed for engineering studies. These next steps, along with the strong alignment of our companies, are quite encouraging.”

Bill Ackman: ‘crypto can enable the formation of useful businesses and technologies’

American billionaire hedge fund manager Bill Ackman has changed his mind about the utility of cryptocurrency.

In a long Twitter thread, Ackman said that he has transitioned from a crypto sceptic to a believer in crypto as a facilitator of “useful businesses and technologies that heretofore could not be created.”

“Despite crypto’s ability to facilitate fraud, with the benefit of sensible regulation and oversight, crypto technology’s potential for beneficent societal impact may eventually compare with the impact of the telephone and internet on the economy and society.”

Despite crypto’s ability to facilitate fraud, with the benefit of sensible regulation and oversight, crypto technology’s potential for beneficent societal impact may eventually compare with the impact of the telephone and internet on the economy and society.

— Bill Ackman (@BillAckman) November 20, 2022

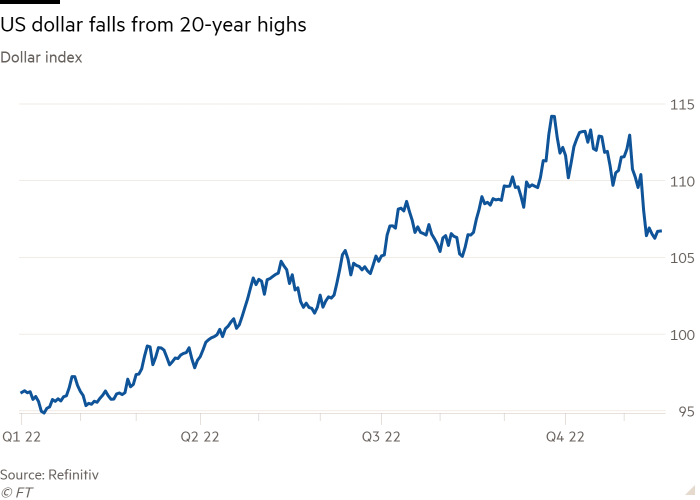

US dollar falls from 20-year high on signs US inflation is easing

The US dollar — on a tear in 2022 — has fallen from its 20-year high in the past fortnight as markets see signs of easing US inflation.

Markets are now betting the US Federal Reserve will begin slowing down its interest rate hikes.

So far this month, the USD has fallen 4% against six peer currencies, on track for its biggest monthly slump since September 2010.

Speaking with the Financial Times, HSBC foreign exchange strategists wrote:

“We expect the US dollar’s powerful climb over the past year to reverse in 2023 as the Fed’s hiking cycle comes to an end. It has peaked.”

Source: Financial Times

FTX owes biggest creditors over US$3 billion as bankruptcy process begins

Collapsed cryptocurrency exchange FTX and its affiliates owe more than US$3 billion to their largest creditors, court filings show.

Over the weekend, FTX filed a list of their 50 largest creditors, with all 50 being customers who are owed at least US$20 million. Two such customers are owed over US$200 million.

In total, FTX and its other businesses has over US$10 billion in liabilities and 1 million creditors.

You can read FTX’s Chapter 11 declaration to the District Court of Delaware here.

In it, the newly appointed CEO John J. Ray — tasked with tidying the mess left by Sam Bankman-Fried and his close associates — stated:

“Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here. From compromised systems integrity and faulty regulatory oversight abroad, to the concentration of control in the hands of a very small group of inexperienced, unsophisticated and potentially compromised individuals, this situation is unprecedented.”

1/ Sharing a Press Release issued early today –

FTX launches strategic review of its global assets. Text below (and link). https://t.co/wxz9MYnXrn

— FTX (@FTX_Official) November 19, 2022

Key Posts

-

1:17 pm — November 21, 2022

-

12:58 pm — November 21, 2022

-

12:42 pm — November 21, 2022

-

10:57 am — November 21, 2022

-

10:31 am — November 21, 2022

-

10:11 am — November 21, 2022

-

9:51 am — November 21, 2022

-

9:38 am — November 21, 2022

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2024 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988