Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | ASX Hits Record High Following Wall Street’s New Records

Market close update

The ASX 200 reached a new peak of 0.61% at 7,745.6 points today, with the primary index gaining for its sixth rise in seven sessions amid expectations that central banks might shift towards lowering interest rates this year.

Around midday, the index had declined slightly, with advancements in the technology (+2%) and resources (+1.87%) sectors being counterbalanced by declines in healthcare (-1.52%) and Telecoms (-0.66%).

Lithium mining companies experienced a surge as futures for the battery metal in China continued to rebound over the week. Pilbara Minerals saw a 3.3% increase, and IGO Ltd rose by 2.48%.

In other big moves, the mobile tracking application Life360 saw a remarkable 38.8% increase due to significant growth in users and sales. The app, popular among parents for monitoring their children’s whereabouts, reported over 61 million monthly active users in 2023. That’s up over 30% YoY.

Meanwhile, in the US the S&P 500 and Nasdaq indices achieved new closing highs.

Following the release of inflation data, bond yields fell, while Bitcoin increased to reach US$61,473, setting a new high in Australian dollars. Gold’s value also rose over the session to US$2,04 an ounce.

Housing update from Shane Oliver

It has been some time since we’ve checked in with Twitter’s (X’s) busiest Australian Economist AMP, Shane Oliver.

Here’s his latest breakdown of Australian house prices.

Are we in for a rush of demand as rate cuts are more likely, or will supply issues persist?

Do both point to higher prices in the future?

Shane certainly points in that direction, although rising unemployment remains the spectre on the sidelines.

CoreLogic data shows faster home price grth.The hit from hi rates to home buyer capacity to pay points to lower prices & rate cuts are normally needed for higher prices…but the chronic supply shortfall still dominates helped by talk of rate cuts ahead. Key threat is higher unemp pic.twitter.com/KN27oML7ZY

— Shane Oliver (@ShaneOliverAMP) February 29, 2024

Midday market update

The ASX 200 hit a fresh record high of 7733.2 today before dropping back down slightly. It is currently up +0.23% at 7,716.0, bringing its return in the past 12 months to 6.35%.

The move comes after the markets moved up expectations of rate cuts this year due to continued softening inflation numbers out of the US.

On the Aussie benchmark, eight of the eleven sectors are in the green today, with top-performing Technology, up 1.76%, followed by Materials, up 1.1%.

The worst performing sector is Healthcare, down -1.42% as giants CSL (-1.52%) and Cochlear (-4.04%) fell.

The standout gainer today was previously covered Life360, up nearly 33%.

Meanwhile, Boss Energy (-5.58%) and Ampol (-5.18%) lag behind the rest of the ASX as oil prices and profit-taking hit the energy sectors.

Life360 goes vertical today on sales jump

Life360 [ASX:360], a family tracking app based in San Francisco, is narrowing its losses and has announced plans to launch advertising in its free app. The company’s net loss for the year ending December 31st, 2023 was $28.2 million, down from $91.6 million the year before.

Revenue increased by 33% to $305 million in 2023, and the company achieved positive adjusted EBITDA of $20.6 million, exceeding its guidance of $12 million to $16 million. Life360 offers both free and paid versions of its app, and the new advertising program will allow advertisers to reach its 20 million daily active users.

Life360’s CEO, Chris Hulls, said the company is committed to balancing financial responsibility with investment for growth.

“We made significant progress towards profitability by reducing our net loss and achieving positive adjusted EBITDA and operating cash flow for the full year,” Hulls said.

Life360 is forecasting revenue of $365 million to $375 million in 2024, with adjusted EBITDA of $30 million to $35 million.

While the company did not post a dividend investors were elated with the results today, sending shares up over 30%.

Life’s shares are now up by over 120% in the past 12 months, currently at $10.64 per share.

Syrah Resources Jumps 10%

Troubled minerals company Syrah Resources [ASX:SYA] has seen its shares jump by 10.5% in trading this morning.

The move comes after the producer announced a binding offtake agreement to deliver graphite from its Mozambique mine to South Korean battery giant Posco Future M.

The deal involves up to 2kt per month (24kt a year) following commissioning, with the potential to increase to 5kt per month from the second year onward.

The deal will last for six years, and the price will be negotiated on a quarterly basis.

Like many battery mineral producers, Syrah has been hit hard by the slump in critical mineral prices in the past 12 months.

With the slump in demand from China, Syrah has seen its share price slide around -70% in the past year and is currently the second most shorted stock on the ASX, with 17% of its stock shorted.

Morning market update

Good morning. Charlie here,

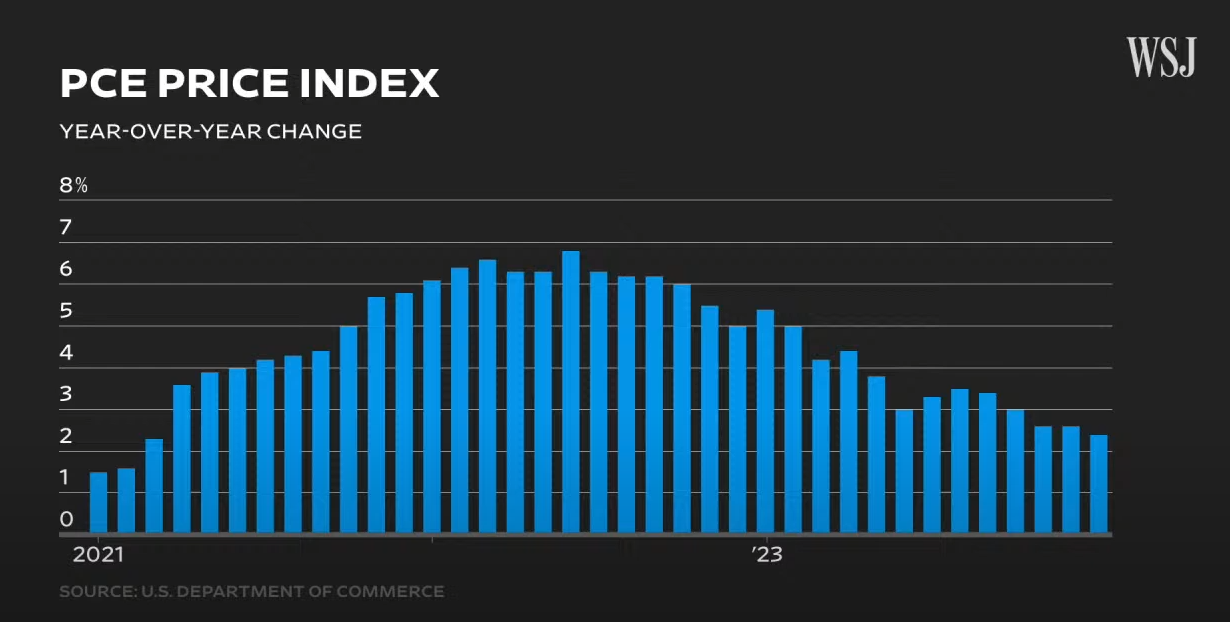

The ASX 200 opened up +0.41% to 7,730 after the market’s standoff posture came to an end after US PCE inflation data was released last night.

Personal Consumption Expenditures Price Index, or PCE for short, is the Fed’s favoured metric for tracking inflation, so the market takes the number with a certain amount of sanctity.

The PCE, excluding food and energy costs, increased 0.4% for the month and 2.8% from a year ago, as expected.

Headline PCE, including those volatile food and energy costs, increased 0.3% monthly and 2.4% on a 12-month basis, also in line.

Source: WallStreet Journal

Personal income rose 1%, well above the expected 0.3%; however, spending decreased 0.1%, compared to the expected 0.2% gain.

This is really the biggest news of the data. A 0.4–0.5% increase would be considered a big shift up, a 1% move in huge.

Digging deeper into the numbers, most of that increase wasn’t simply from people making more money; the biggest mover was transfer payments, i.e, government spending.

So income was only up 0.4%, while government programs were up 2.6%. So it seems the big ticket item was social security payments, which were up 3.5%.

You could argue that it looks like classic government spending in the run-up to an election: spend big, make the people who take the majority of social security (elderly) happy and stay in power.

But it can also be seen as targeted spending to support a cohort that hasn’t seen increases in the prior 4 quarters and doesn’t spend money in an inflationary fashion.

Overall, the PCE numbers looked positive for slowing inflation and will likely give traders more confidence that the Fed will cut rates this year.

Wall Street: S&P 500 +0.52%, Dow +0.12%, Nasdaq +0.90%.

Overseas: FTSE flat, STOXX -0.12%, Nikkei -0.11%, SSE +1.94%.

The Aussie dollar rose +0.02% to US 64.97 cents.

US 10-year bond yields -1bps to 4.22%.

Australian 10-year bond yields -5bps to 4.11%.

Gold is up +0.43% to US$2,043.38, while Silver is up +0.91% to US$22.67.

Bitcoin fell -1.69% to US$61,399, while Ethereum fell -0.66% to US$3,348.

Oil Brent flat at US$83.62, while WTI Crude fell -0.33% to US$78.28.

Iron ore fell +0.6% to US$116.70 a tonne.

Key Posts

-

4:27 pm — March 1, 2024

-

12:55 pm — March 1, 2024

-

12:50 pm — March 1, 2024

-

11:23 am — March 1, 2024

-

11:13 am — March 1, 2024

-

10:28 am — March 1, 2024

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2026 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988