Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | ASX Set for Modest Gains; Earnings Season: Coles, Ampol, IGO, Origin Report

Market close update

The ASX 200 closed up +0.35% to 7,664.1 today, inching up as markets await the US Federal Reserve’s next interest rate meeting, which starts tonight and is broadly expected to keep rates on hold.

Speeches out of J Powell will likely be the more significant mover of markets over the next week, as well as quarterly results from Amazon and Apple, which are also due.

On the Australian benchmark, eight of the eleven sectors finished in the green today, with Discretionary (+0.79%) and Real Estate (+0.79%) as the top performers today.

In other big news, BHP said it has offered a US$25.7 billion settlement to the Brazilian government for the Samarco dam disaster. Vale and BHP jointly offered the repayment, which is on top of a deal that was struck back in 2016 for victims.

The top performer on the ASX today was Serko, which jumped 18.88% after renewing its deal with Bookings.com.

Pointsbet Holdings suffered the worst losses on the wider benchmark, falling 38.55% today as the stock began trading ex-capital return after completing the sale of its US operations last week.

Worley Drops as largest shareholder sells

Engineering group Worley Limited [ASX:WOR] has confirmed its largest shareholder, the Dubai-based infrastructure group Sidara (formerly Dar Group), sold 19% of its shares in an underwritten block trade.

Worley shares have recovered slightly from their morning drop to now being down nearly -8% to trade at $15 per share.

Worley’s Chief Executive Officer, Chris Ashton, said:

‘We appreciate the support of continuing shareholders who have invested more in our future and welcome the new shareholders who will join our register following Sidara’s block trade.’

Bonza passengers face chaos as flights cancelled after repossession

Budget airline Bonza’s passengers are stranded today as the company’s planes faced repossession by the company’s former investment partner.

The trouble began for the company when one of Bonza’s aircraft, which had been designated to fly from Australia, was grounded for weeks at Gold Coast Airport as speculation swirled over unpaid leases.

This morning, their prior investor, AIP Capital, moved to take possession of the remaining three planes in Australia, leaving passengers unsure of what to do next.

In a statement the company said today:

‘Bonza has temporarily suspended services due to be operated today as discussions are currently underway regarding the ongoing viability of the business.’

IGO shares up as company says its turned a corner

IGO’s [ASX:IGO] quarterly earnings plunged into the red for the first time in over a decade due to the battery metal price crunch. However, the miner led by Ivan Vella believes it has turned a corner.

Investors seem to agree, with the share price up +4.75% in trading so far today, at $7.72 per share.

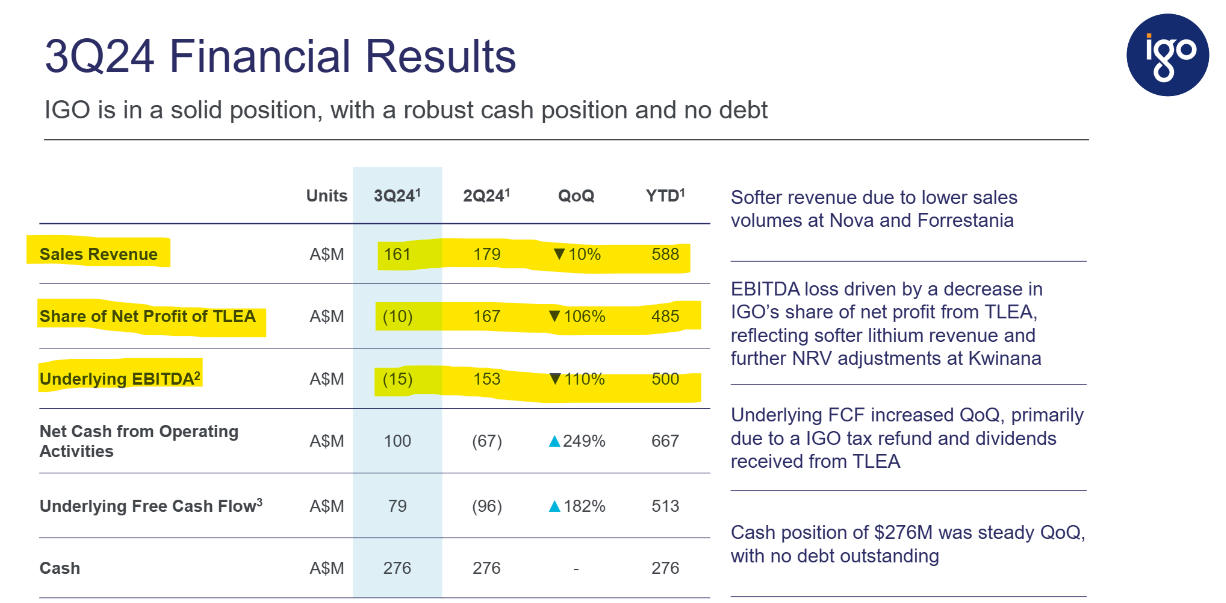

For the three months ended March 31, IGO reported a 10% quarter-on-quarter decline in sales revenue to $160.8 million.

This reflects a substantial 78% drop in sales revenue from the Greenbushes Lithium Mine due to lower sales volumes (down 34% to 183,000 tonnes) and weak lithium prices. Additionally, lower nickel sales volumes at Nova and Forrestania weighed on its top line.

IGO is also set to halt operations at the once-hyped Cosmos nickel mine near Leinster, drawing a line under its ill-fated $1.3 billion acquisition of Western Areas.

IGO’s underlying EBITDA plummeted 110% quarter-on-quarter to a loss of $15 million. Management attributed this to lower spodumene sales and prices at Greenbushes.

IGO’s CEO, Ivan Vella, acknowledged that it was a tough quarter, saying:

‘IGO’s March Quarter results reflect a period in which nickel and lithium markets remained subdued, while sales were also lower compared to the prior quarter. Whilst this resulted in IGO recording a small EBITDA loss of $15M, our balance sheet remains strong with $276 million cash on hand and no debt.’

‘At Greenbushes, production and sales were lower as expected, as the site teams worked to manage production and inventory levels in response to the lower offtake requirements by shareholders. Realised SC6.0 spodumene pricing was also lower quarter on quarter following the amendment in price setting frequency from January 2024, however it has been encouraging to see spodumene prices improving this calendar year.’

Source: IGO

Midday market update

The ASX 200 is up by +0.17% around midday, trading at 7,650.4 as a subdued day of trading is expected to continue through the afternoon as markets await the Fed’s interest rate decision and probably more importantly, the post-meeting speeches by Jay Powell that will give some indication of future moves by the Fed.

According to the CME Fedwatch Tool, some are betting that no cuts will come until 2025 now, as the market pushes back bets.

Meanwhile, for Australia, the Commonwealth Bank has come out as the latest bank to push back the timing of RBA rate cuts to just one cut in November, saying:

‘We have pencilled in one 25 basis point rate cut in each quarter over 2025,‘ said CBA’s head of Australian economics Gareth Aird. ‘Such an outcome would see the end‑2025 cash rate at 3.1 per cent (compared with our previous call of 2.85 per cent).‘

Meanwhile, investors are currently pricing in a 44% chance of a cash rate rise to 4.6% by August.

On the benchmark at midday eight of the eleven sectors are up today, with Mining ahead, up +0.57%, followed by Health care, up +0.41%.

Falling behind at noon is Industrials, down -0.48% as energy and chemical services company Worley is down by -7.24%.

The top performer on the wider benchmark at lunch is Serko up 19.23% on the back a five-year partnership renewal with Booking.com.

Pointsbet Holdings, down a whopping -36.75% as the stock trades ex-capital return, has posted the top losses so far today.

This means the rights to capital return for investors are locked in, and new investors will not receive any if they buy shares now.

Coles sustains sales momentum

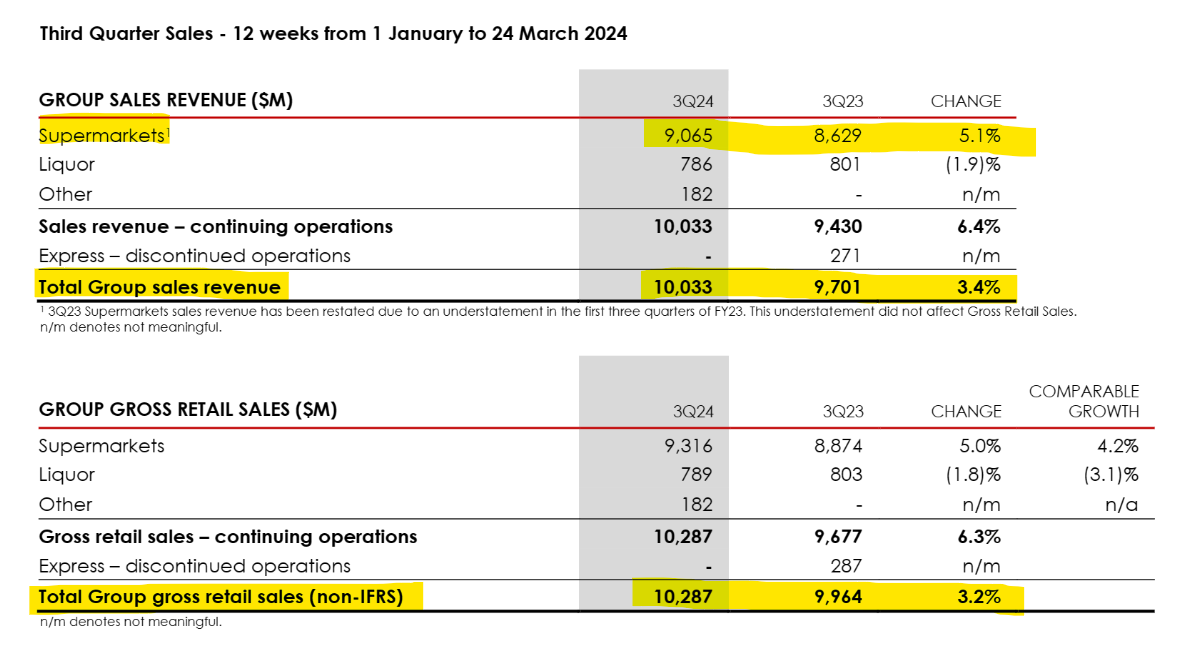

Supermarket giant, Coles Group [ASX:COL] reported robust sales growth for the three-month period ending March 31.

The company’s sales revenue from continuing operations surged 6.4% to $10.03 billion during the quarter.

At the heart of this performance lies a 5.1% increase in supermarket sales, which reached $9.07 billion, offsetting a 1.9% decline in liquor sales.

Coles Group’s CEO, Leah Weckert, attributed the solid results to the company’s effective trade strategies, saying:

‘We have delivered another solid sales result across our supermarkets this quarter reflecting strong execution of our trade plans and our continued focus on delivering great value and great quality alongside improved availability.’

She also noted a significant uptick in customer engagement with its digital platforms and loyalty programs.

While the company anticipates subdued discretionary spending in the liquor segment, it stated that the early part of the fourth quarter’s sales performance has been broadly consistent with the third quarter.

However, Coles these results will likely spur further grumbling as the supermarket faces allegations of price gouging, with multiple inquiries into the major supermarket chains currently underway.

Here are the quarterly results:

Source: Coles

Bapcor new CEO out the door before start date

Automotive parts supplier Bapcor [ASX:BAP] shares are halted after the company announced the sudden departure of incoming CEO Paul Dumbrell.

Mr Dumbrell who was confirmed in the role at the start of February has ‘made a personal decision not to join the company,‘ Bapcor announced today.

The unexpected move comes just two days before his planned start date and has some shareholders concerned about future prospects or hidden rocks ahead for the company.

Shares in the company are down -12.95% for the past 12 months, trading at $5.78 before the trading halt.

March Bernhall will remain as interim CEO and Managing Director while the company restarts the executive search.

Origin Energy’s Gas Revenue Dips Amid Oil Price Decline

Origin Energy [ASX:ORG], reported a 16% drop in gas revenue for the fiscal year 2024 to date, compared to the same period last year. This decline has been blamed on lower oil prices and contract prices.

Despite the drop in gas revenue, Origin Energy’s LNG revenue increased 7% in the three months leading up to March. This growth was driven by stronger volumes and prices.

The company’s gas production also increased 4% year over year, fueled by a rise in active wells and effective well and field optimisation activities.

However, this growth was partially offset by an unplanned production turndown that occurred in November last year.

Origin Energy witnessed a 13% decrease in gas sales volumes in its energy markets division, primarily due to warmer weather conditions.

Looking ahead, Origin Energy expressed its intention to expand its renewable energy business, diversifying its energy portfolio.

Chief executive Frank Calabria said:

‘We continue to progress large-scale batteries under development at Eraring and Mortlake power stations, and recently announced our first storage offtake agreement from the Supernode battery in Queensland, taking Origin’s storage portfolio to around 1 GW of capacity once these batteries come online.’

Source: Origin Energy

Morning market update

Good morning. Charlie here,

The ASX 200 opened up +0.09% to 7,644.2, as markets are expected to make modest movements ahead of the US Federal Reserve rate decision meeting this week.

The meeting is widely expected to be of little consequence, with most expecting the Fed to hold rates again.

Bond yields have eased slightly from their meteoric rise, down around -5bps, which has given equities some space to move.

However, markets remain in limbo as some expect more Hawkish rhetoric from J Powell in response to March figures showing inflation running hot.

Tesla (+15%) has jumped again as Elon Musk finishes a successful trip to China, where he cleared regulatory hurdles that have hindered self-driving software (known as FSD).

The key part of the agreement was with Chinese tech giant Baidu for the use of its data collection on Chinese public roads.

The rapid swing in fortunes for the Tesla stock has wiped US$ 6 billion from short sellers in just four trading sessions.

Meanwhile in China, industrial profits fell again in March, with another slower quarter in March, the spectre of a slow recovery again hangs over the mainland.

Japan’s stock market will reopen after a volatile holiday yesterday in which the Yen slumped past 160 against the dollar before sharply reversing, leading some to speculate on intervention from the BoJ. So far, all seems quiet.

Wall Street: S&P 500 +0.32%, Dow +0.38%, Nasdaq +0.35%.

Overseas: FTSE +0.08%, STOXX -0.51%, Nikkei +0.81 SSE +0.79%.

The Aussie dollar rose +0.43% to US 65.64 cents.

US 10-year bond yields -5bps to 4.61%.

Australian 10-year bond yields -6bps to 4.45%.

Gold down -0.13% to US$2,333.28, while Silver fell -0.52% to US$27.07.

Bitcoin rose +1.52% to US$63,906, while Ethereum fell -1.23% to US$3,219.

Oil Brent rose +0.14% to US$88.52, while WTI Crude rose +0.15% to US$82.75.

Iron ore fell -0.4% to US$117.45 a tonne.

Key Posts

-

4:22 pm — April 30, 2024

-

2:23 pm — April 30, 2024

-

2:07 pm — April 30, 2024

-

1:56 pm — April 30, 2024

-

12:28 pm — April 30, 2024

-

11:19 am — April 30, 2024

-

11:09 am — April 30, 2024

-

10:31 am — April 30, 2024

-

10:09 am — April 30, 2024

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2024 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988