Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | ASX Rises, Commodity Weakness Hits Woodside, BHP Fall

Market close update

The Australian sharemarket closed today higher as major banks helped offset any losses seen by energy and mining stocks today.

Weaker commodity prices were the large cause of the drops in those sectors today, with Woodside closing down -3.9%, Santos falling -1.3%, and BHP down by -1.25%.

The Big Four all closed around 1.5% higher, helping lift the ASX 200, which closed up +0.39% in trading today.

Meanwhile, the ASX 200 for the week closed down -0.39% overall after a shaky start to the week amidst concerns of a slowdown of the US and Chinese economy.

In major moves on the wider index, junior explorer Osmond Resources saw its share price jump by nearly +150% in trading today after it announced plans to acquire 80% of a major European rutile, zircon and rare earth project.

The big news moving into next week’s trading will be the August Jobs report for the US, which is due at 10:30 pm AEST tonight.

Expect fireworks on the markets if these numbers fail to live up to their lofty expectations of between 161-165 thousand new jobs for the month and employment falling from last month’s 4.3% to 4.2%.

Bond markets are already positioning to expect disappointing results and the potential for a ‘double cut’ from the Fed this September.

That would mean a 0.5bps cut rather than the anticipated 0.25bps cuts.

We’ll cover that story and any other major news next week, but until then, have a great weekend!

Pacific Smiles CEO resigns after just 8 months

Pacific Smiles [ASX:PSQ] CEO Andrew Vidler has resigned just eight months after taking the position.

The move follows a similar quick exit from its chief financial officer a week ago after shareholders voted against the $327 million takeover bid.

The takeover bid was from private equity group Crescent Capital, who had faced an uphill battle as rival bidder Genesis Capital held 19.9% of the shares voted against them.

Co-founder Dr Alex Abrahams also voted against the deal, saying:

‘[The deal] just crystallises the current loss of shareholder value and excludes them from participating in potential for share price recovery once margin improvement is implemented.’

Today, Dr Abrahams told AFR that he wasn’t surprised by the resignations from top execs, saying:

‘My view is that everyone just wanted to get off the bus.’

Shares in Pacific Smiles are down by nearly 1% today, while the company has still seen a return of 27% in the past 12 months.

First Super Co-Chair Steps Down Amid APRA Allegations

Michael O’Connor, co-chair of First Super, has resigned from the board following accusations by the Australian Prudential Regulation Authority (APRA) of misusing superannuation fund resources to benefit the CFMEU Union (Construction, Forestry, Maritime, Mining and Energy).

APRA has initiated legal proceedings against O’Connor in the Federal Court, alleging multiple breaches of director duties.

The regulator claims that O’Connor, who serves as the national secretary of the CFMEU’s manufacturing division, employed a union worker full-time for the super fund while aware that the individual continued to perform significant work for the CFMEU.

The allegations suggest O’Connor ‘failed to act honestly and in the best interests of First Super’s beneficiaries’.

APRA is seeking to disqualify him from similar roles in the future.

This development comes in the wake of the CFMEU being placed under administration due to corruption allegations and potential links to organized crime.

First Super acknowledged the situation on their website but refrained from further comment due to the legal proceedings.

Whitehaven Coal falls sharply again today

Whitehaven Coal [ASX:WHC] has had a quarter it would probably rather forget.

Its share price is at $5.77, down another -5.5% in trading so far today.

The Australian coal giant has seen its share price fall over 35% in the past three months, since its peak in July after a disappointing earnings report.

The earnings did have some key disappointments. You can see for yourself here.

Revenue fell by -37% since FY23 to $3.8 billion.

EBITDA was down 80% to $798 million.

These low figures were mainly thanks to the low average coal price of A$217 per tonne for its NSW operations and A$271/t for the QLD operations in the June quarter.

They also announced the US$1.08 billion 30% equity sell-down of their Blackwater mine to Nippon Steel and JFE Steel.

Looking ahead, the company has said it expects coal prices to recover thanks to increased demand from India and longer-term supply constraints.

But for those thinking coal could face a turnaround, keeping an eye on these undervalued plays could be worth your time.

Of course, this isn’t advice to invest, and it is certainly not to catch a falling knife.

Employment numbers the next catalyst for markets

At 10:30 PM AEST today, crucial data on the US economy’s cooling rate will be released.

The US August jobs report is eagerly anticipated, as it could be the trigger to shift the Federal Reserve’s September rate decisions.

Economists surveyed by Reuters predict an increase of 160,000 non-farm payroll jobs in August, up from July’s 114,000.

The unemployment rate is expected to slightly decrease to 4.2% from July’s 4.3%.

These figures are key indicators of the labour market’s health and overall economic trends. They will likely define how next week’s market looks both here and in the US.

If job growth falls below expectations and unemployment rises sharply, it may increase the likelihood of the Fed enacting a ‘double cut‘ of interest rates. That’s a 0.5bps cut rather than the expected 0.25bps cut for September.

Conversely, stronger-than-expected job growth could suggest continued economic resilience.

This data release is a focal point for investors, policymakers, and economists worldwide.

Less significant but still important for Australia are our local employment figures, which saw a slight increase in Q2, but are still looking weak.

Here’s the latest chart from IFM Economist Alex Joiner via Twitter.

Employment growth in market sectors picked up a touch in Q2 but is still far weaker than non-market pic.twitter.com/qAOpPVimJi

— Alex Joiner 🇦🇺 (@IFM_Economist) September 6, 2024

Latest Fat Tail Daily Video

Here’s the latest from the new Fat Tail Daily video series.

Publisher James ‘Woody’ Woodburn will be sitting down with our Fat Tail Daily editors daily to discuss the key trends and offer unique insights into market movements.

If you have any thoughts about the length, format, or topics you would like discussed, send us an email at support@fattail.com.au with the subject header: ‘Fat Tail Daily Video Feedback’.

Thanks, and enjoy today’s discussion with me! Alpha Tech Trader Analyst Charlie Ormond.

Midday market update

A sharp rally in bank stocks led the Australian sharemarket to extend its positive day around lunch.

The ASX 200 currently sits up +0.52% at 8,023.5 at midday, with 7 out of the 11 sectors in the green.

The financials sector was the best performing, climbing 1.33% With all the Big Four banks rising.

Commonwealth Bank is up 1.47%, Westpac by 1.42%, ANZ by 1.82% and National Australia Bank by 1.2%.

In commodities, iron ore extended its slump towards US$90 a tonne, with iron ore futures sitting around US$90.95 per tonne.

Oil continues to waiver, while gold edged back above the US$2500 an ounce mark.

The materials sector tracked the Iron ore down, with BHP down 0.8%, Rio Tinto dropping 0.35%, and Fortescue Metals losing 0.2%.

Wall St was mixed overnight, with the Dow Jones slipping 0.5%, the S&P 500 falling 0.3%, and the Nasdaq gaining 0.25%. The markets there remained concerned about how fast the US economy is slowing.

The next major test will be the August jobs report – set for release at 10.30pm Friday AEST.

Oil faces largest loss in nearly a year

Oil is heading for its steepest weekly decline in nearly a year, driven by ongoing worries about weak demand and plentiful supply.

This morning, Brent crude saw a slight uptick, approaching US$73 per barrel. However, it’s still down almost 8% for the week. Meanwhile, West Texas Intermediate hovers slightly above US$69.

This downward trend persists despite OPEC+ postponing a planned production increase by two months.

OPEC announced in a statement that the alliance will delay boosting output by 180,000 barrels daily in October and November, though their overall plan to restore 2.2 million barrels per day over a year remains unchanged.

Since early July, oil prices have been on a downward trajectory, mainly due to demand concerns from major consumers, particularly China.

There have also been some signs of increasing supply from non-OPEC members, however, recent supply disruptions in Libya have somewhat mitigated those price drops.

RBA head Michele Bullock admits more pain ahead

RBA Governor Michele Bullock acknowledged the growing financial strain on Australians in her speech yesterday as the economy slows.

In her speech, named ‘The high cost of inflation’ she noted:

‘Information received through the RBA’s liaison program indicates that more people than usual are seeking support from community organizations, and often for the first time.” Lower-income borrowers and variable-rate mortgage holders are particularly affected.’

With the economy growing at its slowest pace since the 1990s recession, Bullock maintained the necessity of curbing inflation.

‘This is why it is imperative that we return inflation to levels that mean it is in the background again — at which point it will no longer be distorting our economy,’ she said.

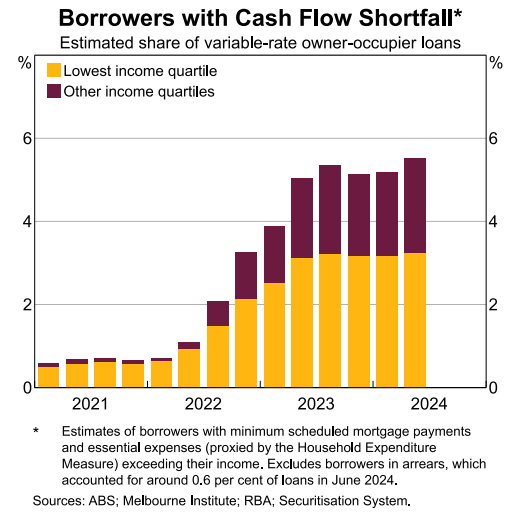

The RBA’s aggressive interest rate hikes have led to a significant economic slowdown and are clearly hurting mortgage holders, who face increasing cash shortfalls.

Source: ABS

Bullock projects inflation could reach the RBA’s 2.5% target by late 2026. However, this comes at a cost. She warned:

‘For owner-occupiers with variable-rate loans… we estimate that around 5 per cent are in a particularly challenging situation.’

Housing costs and market services are one of the factors currently driving inflation. But renters are unlikely to see relief soon. Bullock explains:

‘Year-ended growth in advertised rents is still high, reflecting pressure from a rebound in housing demand and limited supply response.’

While last month’s numbers showed a rebound in new building approvals, with a 10.4% jump month-over-month, the housing market is still looking challenging.

Morning Market Update

Good morning. Charlie here.

The ASX 200 is up by +0.42% in trading so far today as utilities, big banks and real estate hold the market up while big drops were seen in mining and energy.

US markets closed mixed, with tech gains countered by broader weakness as things remain in a holding position for tonight.

Investors await crucial US jobs data due out in the early hours of our Saturday, which may influence the Fed’s rate cut decision this month.

That’s for either a double cut or the usual 0.25bps cut many are expecting.

Oil prices are poised for their biggest weekly loss in a year on concerns of weak demand from China and returning supply. WTI Crude is now trading around US$69 per barrel.

In other news, Tesla plans to launch its self-driving technology in Europe and China in early 2025.

While on the ASX Arcadium Lithium has become one of the first major miners to shut down a lithium operation in Australia.

| Name | Value | % Chg | |

|---|---|---|---|

| Major Indices | |||

| S&P 500 | 5,503 | -0.30% |

| Dow Jones | 40,755 | -0.54% |

| NASDAQ Comp | 17,127 | +0.25% |

| Russell 2000 | 2,132 | -0.61% |

| Country Indices | |||

| UK | 8,241 | -0.34% |

| Germany | 18,576 | -0.08% |

| Euro | 4,815 | -0.68% |

| Japan | 36,650 | -0.03% |

| Hong Kong | 17,444 | +0.39% |

| Name | Value | % Chg | |

|---|---|---|---|

| Commodities (USD) | |||

| Gold | 2,514 | +0.73% | |

| Silver | 28.52 | +1.58% | |

| Iron Ore | 91.15 | +0.20% | |

| Copper | 4.0820 | +0.10% | |

| WTI Oil | 69.34 | +0.28% | |

| Currency | |||

| AUD/USD | 67.35¢ | +0.15% | |

| Cryptocurrency | |||

| Bitcoin (USD) | 56,539 | -2.58% | |

| Ethereum (USD) | 2,391 | -2.76% | |

Key Posts

-

4:34 pm — September 6, 2024

-

4:22 pm — September 6, 2024

-

4:12 pm — September 6, 2024

-

3:42 pm — September 6, 2024

-

3:09 pm — September 6, 2024

-

2:21 pm — September 6, 2024

-

12:48 pm — September 6, 2024

-

12:38 pm — September 6, 2024

-

12:29 pm — September 6, 2024

-

12:06 pm — September 6, 2024

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2025 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988