Investment Ideas From the Edge of the Bell Curve

ASX News Live | ASX Ponders RBA Decision; Microsoft Declares Search War

Australia Post delivers stern message: we are at a crossroads

Nothing endures but change.

We were not going to ride horse-and-buggy forever.

And it looks like we’re not going to be penning letters forever, either.

In its half-year update, Australia Post reported flagging revenue and admitted it’s set to report a full year loss for the first time since 2015.

Auspost’s letters segment alone posted a record first-half loss of $189.7 million.

Chief executive Paul Graham was blunt about the state of the letter business:

“Every year it’s costing Australia Post more to deliver fewer letters. We know letters are in an unstoppable decline, thanks largely to digital communications, yet letter costs are rising due to the increasing number of delivery points we service every day. This all contributes to increased losses and is a global issue facing all postal services. We expect annual volumes will decline further, with Australian households receiving less than one letter per week by the end of the decade.”

Here’s Auspost’s bulleted performance for the half year to 31 December 2022 :

- ‘Group revenue $4.69 billion, down 2.4 per cent on same period last year (1H22)

- ‘Group profit before tax $23.6 million, down 88.2 per cent from $199.8 million in 1H22

- ‘Letters revenue $881.9 million, down 5.7 per cent on prior corresponding period

- ‘Letters losses increased to $189.7 million, an increase of 171.5 per cent from 1H22

- ‘Parcels and Services revenue $3.80 billion, down 1.6 per cent on first half last year

- ‘Invested $208.2 million into the business, including in new parcel facilities, fleet and technology’

Auspost chief executive Paul Graham’s outlook was grim:

“We are at a crossroads and the headwinds facing our business have never been stronger. Our Letters business continues to decline, as volumes fall and costs increase. Changing customer behaviours are also impacting our retail network, with continuing digitisation resulting in declining retail transactions at Post Offices. As flagged in our 2022 financial results, Australia Post will report a full year loss this year for the first time since 2015.”

Graham spoke about the crossroads before. Namely, in the most recent annual report:

“We’re at a crossroads in our history as we start to emerge from the impacts of the global pandemic. We’re seeing parcel volumes start to stabilise but the competition intensify. While changing consumer behaviours and an accelerated shift to digital and cashless services is reducing revenue in our Post Offices and our letters service. We must respond to these headwinds and change our course to deliver on what our customers increasingly expect of us in today’s highly competitive marketplace.”

Interestingly, the demise of the letters business was also foreshadowed years ago, by Graham’s predecessor Ahmed Fahour.

In that fateful unprofitable year of 2015, Fahour said Auspost was already dealing with the ‘real decline in our letter volumes’:

“The immediate challenge for our business is clear. We have been carefully managing the real decline in our letter volumes for the past seven years. But we have now reached a tipping point where we can no longer manage that decline, while also maintaining our nationwide networks, service reliability and profitability. We urgently need reform of the regulations that apply to our letters service. A government-commissioned external report last year predicted that — without reform — Australia Post will incur $12.1 billion cumulative losses in letters, and $6.6 billion for the enterprise over the next 10 years. This year we are forecasting a full-year loss for the first time. It is urgent we make changes this year to ensure we can continue to maintain a reliable, accessible postal service for all Australians.”

Nothing endures but change.

Yet, sometimes, the more things change, the more they stay the same.

Auspost: “We are at a crossroads and the headwinds facing our business have never been stronger … As flagged in our 2022 financial results, Australia Post will report a full year loss this year for the first time since 2015."#ausbiz #auspol pic.twitter.com/XVzuabulrX

— Fat Tail Daily (@FatTailDaily) February 8, 2023

ASX ends 0.35% higher

Well, the ASX 200 finished 0.35% higher on Wednesday.

The market chewed over Philip Lowe’s comments yesterday — comments that gave the market some heartburn — and finally digested it.

The financials sector led the way, gaining 0.90%.

Although we’ll see how the banks and lenders fare with bad debts later in the year as Australia approaches the fixed rates cliff.

Around a third of outstanding mortgages in Australia are on fixed rates and two-thirds of these are set to expire in 2023.

A lot of people are about to go from paying low fixed rates set in a ‘rates are unlikely to rise until 2024’ era to paying high variable rates set in the ‘whoops, interest rates will rise sharply to fight inflation’ era.

P.S. In other major news, basketball player Lebron James became the NBA’s all-time leading scorer.

HISTORY.

With this bucket, LeBron James moves past Kareem Abdul-Jabbar to become the NBA’s all-time leading scorer! pic.twitter.com/N6V5RxPe6r

— NBA on TNT (@NBAonTNT) February 8, 2023

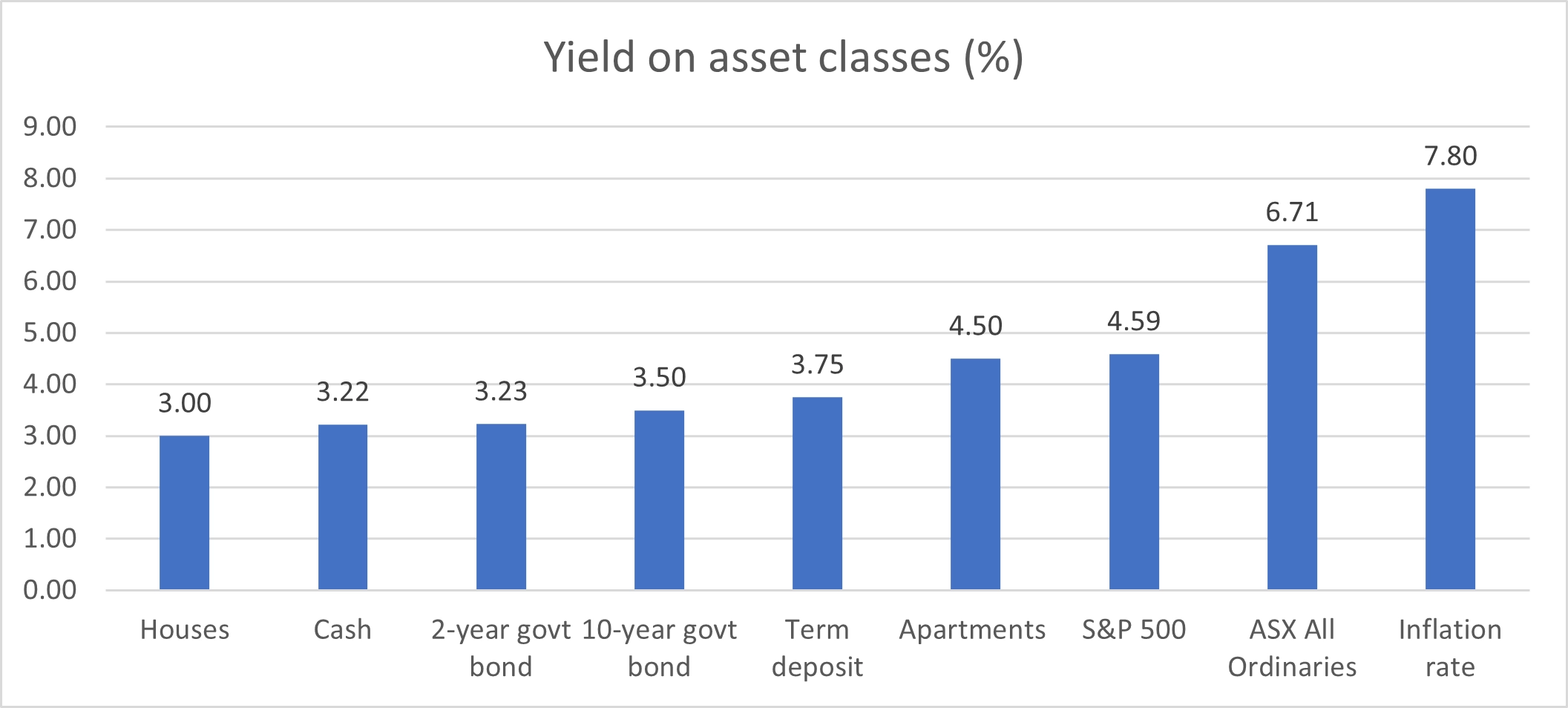

Morningstar: yields of every major Aussie asset class underwater … for now

With inflation high, you don’t want to be holding low-yielding assets whose real returns eat away at your purchasing power.

But the latest data compiled by Morningstar shows all the major Aussie asset classes — cash, bonds, property, and stocks — are underperforming in real terms.

Source: Morningstar

In real terms, all assets are yielding negative returns right now.

That doesn’t make much sense … if you think inflation is set to remain near 7.8% throughout 2023.

But as Morningstar’s James Gruber points out, the current negative yield of major assets tells you ‘most people don’t expect inflation to stay where it is.’

Gruber goes on:

“Otherwise, the pricing and prospective returns of these asset classes wouldn’t make much sense. If inflation was to stay or these levels or rise in 2023, then the yields on all assets would need to rise too, and conversely, their prices would need to fall.

“Given that inflation is expected to fall, then the next big question is: to what level? “From the chart above, it’s reasonable to think that most markets expect inflation to drop back towards 3%. The reason I say this is that if inflation stays above 4%, the pricing for many assets would need to adjust and yields would have to rise.

A nifty little valuation exercise.

Two events have changed energy markets | Selva Freigedo

Every year, British Petroleum (BP) releases its BP Energy Outlook report…and it’s a must-read.

As you may remember, in their 2020 report, BP famously declared that we could have passed ‘peak oil’.

In their recent report, they’ve updated their future scenarios to include the impact of two large events in energy markets last year: the Russia-Ukraine war and the US’s Inflation Reduction Act (IRA).

We’ve talked plenty about the IRA here. In my view, it’s one of the most significant events for the energy transition.

It’s a big deal that the US is looking to bring in clean tech manufacturing closer to home. But as mentioned, the IRA is causing some concern in Europe in that it will shift manufacturing capacity into the US.

But back to BP.

As they wrote in their report:

‘The role of hydrocarbons diminishes as the world transitions to lower carbon energy sources. The share of fossil fuels in primary energy declines from around 80% in 2019 to between 55-20% by 2050.

‘The total consumption of fossil fuels declines in all three scenarios over the outlook. This would be the first time in modern history that there has been a sustained fall in the demand for any fossil fuel.

‘Renewables expand rapidly over the outlook, offsetting the declining role of fossil fuels. The share of renewables in global primary energy increases from around 10% in 2019 to between 35-65% by 2050, driven by the improved cost competitiveness of renewables, together with the increasing prevalence of policies encouraging a shift to low-carbon energy. In all three scenarios, the pace at which renewable energy penetrates the global energy system is quicker than any previous fuel in history.’

In particular, BP sees oil demand ‘plateauing’ in the next decade and then going into decline as less cars on the road are fuelled by oil:

Source: BP Energy Outlook

Remember, this is big oil talking. That they’re even saying this should give some pause for thought.

So, while things may be looking uncertain out there, there’s a big opportunity here…

https://www.moneymorning.com.au/20230208/the-decentralisation-of-global-energy.html

Splitit CEO: BNPL sector set for more pain after Openpay collapse

What do the business strategy books say about this?

Buy now, pay later fintech Splitit (ASX:SPT) chief executive Nandan Sheth thinks the collapse of BNPL peer Openpay (ASX:OPY) is a precursor to more pain.

‘Copycat’ firms, particularly, are at higher risk in Sheth’s view.

The Splitit CEO — who joined the fintech last year — told The Australian that Openpay operated under a flawed business model.

“When you’re lending to subprime consumers with a very high write-off rate – in some cases 300 to 400 basis points of write-offs – and a super-high customer acquisition cost along with marketing costs, your path to profitability is going to be challenged.

“Then there are concerns when it comes to bringing in new capital from new investors, because they may not buy into the long-term story, and when you can’t raise capital and you have got warehouse lines from lenders that have a variety of different covenants – you can very quickly hit a covenant – the lender will come in and propose a restructuring of the company.

“So to be very candid, I’m not surprised that this is happening, I think we will see more consolidation in this space and we’re going to see buy now, pay later players focus on profitability.”

What do the business strategy books say about this? $SPT's Nandan Sheth thinks the collapse of #BNPL peer $OPY is a precursor to more pain.

'Copycat' firms, particularly, are at higher risk in Sheth's view. https://t.co/UrQdCAGAB1

— Fat Tail Daily (@FatTailDaily) February 8, 2023

McLean Roche chief executive Grant Halverson bluntly laid out the state of play in the local BNPL scene:

Afterpay was sold to Block (now worth nothing).

Humm has pulled back from BNPL to concentrate on unsecured lending and scraped its merger with Latitude.

Zebit delisted from ASX, scuttled back to US with $35 million in cash.

Laybuy – plans to delist from ASX and try to keep its cash – now worth $9 million market cap.

Openpay collapses and in hands of receivers.

So, ZIP, Sezzle (operates in USA) Splitit, Payright, Fatfish, and IOUpay remain, in market cap order.

#BNPL $OPY enters receivership.

Who is next? $SPT $SZL $ZIP $IOU $HUM

— Fat Tail Daily (@FatTailDaily) February 6, 2023

What’s the fuss with ChatGPT and its potential for Internet search?

What’s the fuss?

Why does some chatbot threaten to upend search as we know it? What’s the hype?

Techies are giddy about the potential of AI-assisted Internet search. It’s the hot new technological breakthrough that’s taking things further than the latest iPhone upgrade.

The potential baked into the excitement may exceed the reality but it does seem search is set for big changes.

The ChatGPTs of the world are going to use the whole world’s data as one giant Wikipedia and summarise the pertinent sections in tailored responses (and cite sources for the wary).

In Bing’s words, it will ‘look at search results across the web and summarise responses to your specific questions and needs.’

Your questions will have direct answers.

You won’t have to ornament the top of your screen with dozens of tabs seeking to find a whole answer in multiple sort-of-answers.

Bing thinks there will be other benefits, too:

Source: Bing

We announced a new AI-powered Bing search engine and Microsoft Edge browser. Catch the replay here https://t.co/4mtttcO3eI

— Bing (@bing) February 8, 2023

Alphabet is scrambling to get its generative AI chatbot technology out to the public. All of a sudden, Big Tech is duking it out like brash start-ups chasing a new market.

1/ In 2021, we shared next-gen language + conversation capabilities powered by our Language Model for Dialogue Applications (LaMDA). Coming soon: Bard, a new experimental conversational #GoogleAI service powered by LaMDA. https://t.co/cYo6iYdmQ1

— Sundar Pichai (@sundarpichai) February 6, 2023

Microsoft vs Google — who wins the AI war?

Who uses Bing?

People who still prefer taking calls with this, presumably.

Source: Getty Images

But Bing may see a resurgence soon.

Microsoft is adding the popular ChatGPT technology to the Bing search engine. The integration aims to eat away at Google’s predominant market share.

Source: Financial Times

The ChatGPT integration does have the potential to change the way we search.

Instead of sifting through pages of results … and sponsored ads, we could be getting a tailored message in natural language addressing any of our queries head on.

That threatens the whole current ecosystem of Internet search.

Say you download Bing on your phone as an app. With the ChatGPT search feature, you may never have to exit the app when conducting your queries.

Microsoft chief executive Satya Nadella said yesterday at the unveiling event that this technology ‘is going to reshape pretty much every software category’.

Unlike ChatGPT — which can’t synthesise data after 2021 — Bing’s new AI feature will have access to live data, including news stories, train schedules, and product pricing.

‘What’s the cheapest pair of tennis shoes near me?’

‘What’s the top trending story in my city?’

‘Design a quick itinerary for me when I visit Vienna in six months.’

It’s likely Bing’s new search feature could answer these questions with tailored responses without a person ever having to open twenty different tabs.

That would be handy.

P.S. When was the last time anyone joined a waitlist for Bing?

Markets — the morning after

What happened overnight?

Here’s the speed run.

The Reserve Bank of Australia raised its cash rate by 25 basis points to 3.35%.

Australian shares fell sharply when the decision was announced.

How the #ASX reacted to the #RBA's latest 25 basis point rate hike and #Lowe's comments more hikes are coming. $XAO #auspol #ausbiz pic.twitter.com/KCgYQ3cmB1

— Fat Tail Daily (@FatTailDaily) February 7, 2023

It seemed the market was taken aback by the tone of the statement by RBA governor Philip Lowe and his expectation that further increases — plural — will be needed in teh months ahead.

Lowe said it will be ‘some time before inflation is back to target rates’, which is around 2%. In the December quarter, inflation was 7.8% on an annualised basis.

Lowe also admitted that while interest rates act with a lag, they are already starting to have an effect. In his words, ‘Some households … are experiencing a painful squeeze on their budgets due to higher interest rates and the increase in the cost of living.’

But the RBA reiterated to the market that its priority is bringing inflation down, even if that means keeping rates elevated for a while yet.

Lowe’s US counterpart — US Fed chair Jerome Powell also spoke yesterday. His comments ended up sending US stocks higher, however, after Powell said 2023 could be a year of ‘significant declines in inflation.’

But Powell did also say that bringing inflation down to the Fed’s goal of 2% ‘is likely to take quite a bit of time. It’s not going to be, we don’t think, smooth. It’s probably going to be bumpy.’

Like Lowe, Powell reiterated that further rate rises are coming: “So we think we’re going to have to do further [rate] increases, and we think we’ll have to hold policy at a restrictive level for some time.”

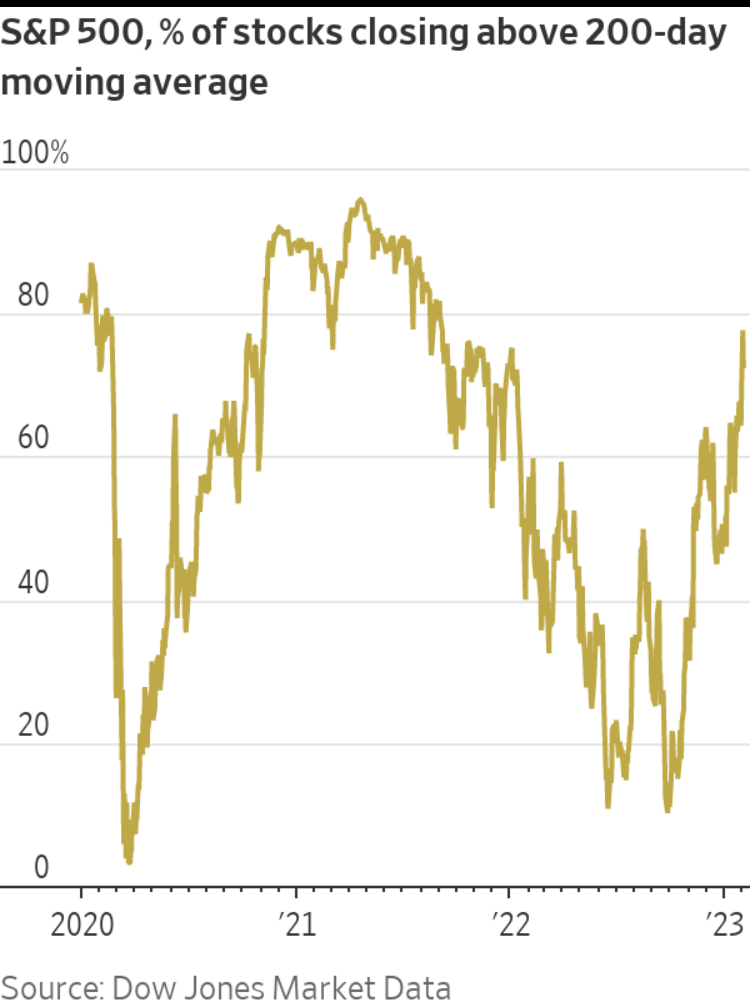

But US markets remain optimistic.

The share of S&P 500 stocks closing above their 200-day moving averages rose to 78%—the highest since September 2021.

Source: WSJ

Good morning, investors

Good morning, investors.

Here’s to another busy day unpacking the markets.

Stocks go up, stocks go down — and in between some interesting things happen.

Let’s discuss them.

Key Posts

-

5:09 pm — February 8, 2023

-

4:32 pm — February 8, 2023

-

3:51 pm — February 8, 2023

-

2:03 pm — February 8, 2023

-

12:54 pm — February 8, 2023

-

12:09 pm — February 8, 2023

-

10:34 am — February 8, 2023

-

10:05 am — February 8, 2023

-

9:59 am — February 8, 2023

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2024 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988