Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | ASX Opens Weakly after Quiet US Session; Goodman Lifts Guidance

Market close update

The ASX 200 closed just above flat, up +0.14% to 7,804.5 today in a subdued day of trading that followed similar beats to US equities last night.

Seven out of eleven sectors closed in the green today, with Industrials (+0.73%), and Technology (+0.59%) the sector leaders.

Discretionary (-0.36%) fell behind today as JB Hi-Fi (-1.67%) and Harvey Norman (-1.12%) each shaved off some value.

On the ASX 200, Pinnacle Investment Management was the top performer, up +6.68% as its investor presentation yesterday may have struck a new cord on today’s news that competitor Perpetual was selling off part of its business to KKR for $2.18 billion.

Perpetual was the worst performer on the benchmark as a result, falling -7.08% on the news, bringing its market cap to $2.5 billion.

On the wider ASX 300, Chalice Mining was today’s top performer, up nearly 11%.

Goodman Group upgrades EPS guidance

Industrial property mega-cap Goodman Group [ASX:GMG] has seen its shares swing up, then down today with a flurry of activity.

This morning the group announced in an operational update that it had ‘delivered a strong operating performance for third quarter FY24, positioning the business well for the full year and into 2025.’

With this announcement, the company upgraded its earnings per share (EPS) guidance for FY24 to 13%.

Despite this cherry news, Greg Goodman, group CEO, also warned that ‘we expect continued volatility in real estate markets globally.’

Yesterday it was also reported that a $780 million deal in which Rest Super and global investment manager Barings bought a sizable industrial portfolio from Goodman, who was divesting to refocus on data centres.

In afternoon trading today, the company’s shares fell, currently down by -0.76% as CEO Greg Goodman admitted to analysts that ‘China is generally pretty weak,’ noting softness in the company’s leases in Western China.

The major Chinese portfolio is centred in central Beijing, Shanghai, and Shenzhen, and he said that the portfolio was ‘holding up quite well in a market that’s pretty soft,’ however, it seems the comments were enough for some to be concerned.

The company’s shares are up by +72.6% in the past 12 months.

Job listings down, is this a worry?

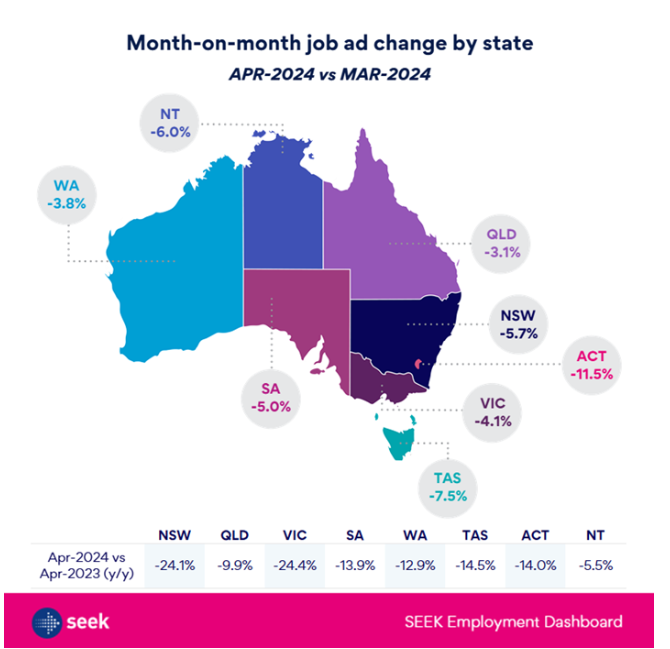

The latest report from job advertising company SEEK shows national job listings are down month-on-month and way down from listings this time last year; lets dig in.

SEEK’s numbers are eye-opening, but it’s also important to remember it’s just one of many independent job listing companies. So what are the figures for April?

National job ads are down -4.7% month-on-month.

National job ads are down -18.6% from April 2023.

Applications per job are up 8.6% month-on-month.

Here’s what that looks like across the country:

Source: Seek

As you can see, the Australian Capital Territory saw the biggest falls in listings since March 2024, but year-on-year saw Victoria and NSW leading the losses, seeing a near -25% reduction in listings.

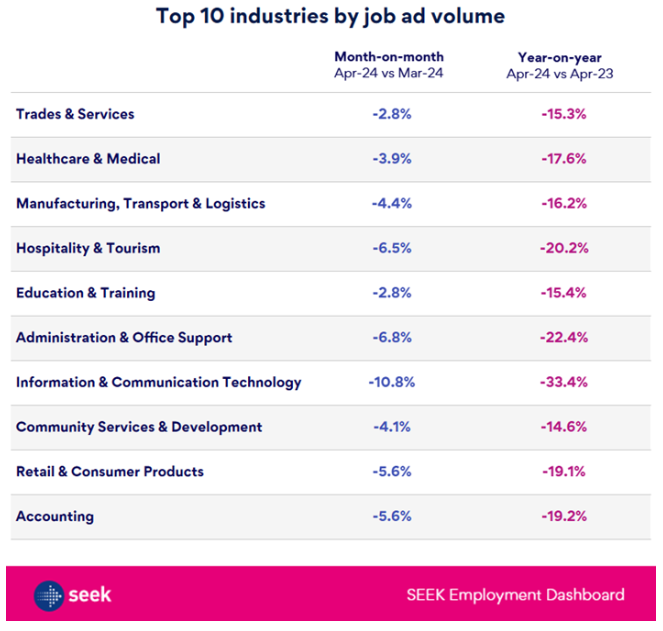

When broken down by top ad listings there were the numbers:

Source: Seek

Source: Seek

While there are some big drops here, remember it’s coming off a hiring boom after the COVID lockdowns.

So, despite fewer job listings and stiffer competition for each role, Australia’s unemployment rate (3.8%) is still near its lowest level in 50 years.

Midday market update

The ASX 200 is trading flat around midday at 7,792.9 as the major Australian benchmark mirrors similar subdued moves on Wall Street last night, which closed around flat for most indices except the Nasdaq, which closed slightly down (-0.10%).

Eight of the eleven sectors remain in the green today, with Energy (+0.58%) and Industrial (+0.55%) sectors ahead.

Only Mining (-0.15%) and Financials (-0.22%) are down at noon, mostly owing to a -0.82% drop by Rio Tinto, and a -1.3% drop by NAB in this morning’s trading.

The big news of today is the confirmed deal of Perpetual by KKR. The $2.175 billion dollar deal will see the asset manager broken up, with its trustee and advice business being sold to the private equity giant KKR.

Perpetual’s stock has sold off on the news, falling by -9.2% in trading so far today.

On the other end of town Fineos Corp. Holdings is up by +9.4%, followed by Chalice Mining up by +9.3% in trading so far.

Leo Lithium exits Mali quagmire

Troubled lithium explorer Leo Lithium [ASX:LLL] announced today that it has signed a memorandum of understanding (MoU) with the Mali Government to settle the long-standing dispute over its Goulamina mine.

The US$60 million settlement with the new Mali government will be paid through a 5% sale of the Goulamina Lithium project to Gangfeng to fund the deal.

Leo brought in Gangfeng to mediate the ongoing spat with the Mali government, which can be better thought of as a shakedown by the Mali government.

It seems the long-running spat with the government was enough to dissuade Leo from continuing with the project, and so today, they also announced the sale of the remaining 40% stake in the mine to Ganfeng for US$342.7 million.

The company said it’s in discussion with the ASX regarding the necessary steps to lift the suspension of the trading halt, which has been in place since last September.

Leo Lithium Managing Director, Simon Hay, commented:

‘After a long period of discussions together with our JV partner Ganfeng, we have signed a MoU with the Mali Government, resolving all outstanding issues concerning the Goulamina Lithium Project.’

‘Despite our best efforts to reach a viable agreement with the Mali Government and considering the increasing risks associated with operating in Mali, the impact of the new 2023 Mining Code and the Company’s financial position for future funding, the Board of Leo Lithium has determined that a sale of the Company’s remaining interest in Goulamina is in the best interests of Leo Lithium shareholders.’

De Grey Mining plans $600m raise

De Grey Mining [ASX:DEG] is in trading half after announcing its plans to bolster its financial resources through a substantial capital raise.

The company aims to secure $600 million from investors through a two-pronged approach.

The first is an institutional placement targeting institutional investors, aiming to raise $344 million. At the same time, De Grey will undertake a retail offer open to individual investors, seeking to garner up to $256 million.

The new shares will be issued for $1.10 each, representing a 13% discount from the company’s last closing price of $1.26.

The company’s shares are down -18.12% in the past 12 months.

For those interested the full presentation of the raise can be found here.

Morning market update

Good morning. Charlie here,

The ASX 200 opened up +0.11% to 7,801.9 this morning in what looks to be a softer day on the markets as US stocks closed flat in an underwhelming session last night.

It seems markets are in a bit of a holding pattern until the next inflation numbers come out or another catalyst for a run emerges.

In stark contrast, European stocks hit record highs last night, with all indices closing well over 1% as traders reacted to a flurry of positive earnings reports.

Swiss banking giant UBS was the major winner on the day, gaining 7.6% as it returned to profit after two quarterly losses.

In Australia, the AFR is reporting that Perpetual has finalised its deal with KKR, which will be broken up as part of the $1.5 billion deal.

Goodman Group upgraded its EPS guidance, and ResMed will be trading ex-dividend today so we’ll keep an eye on those.

Troubled lithium hopeful Leo Lithium announced the signing of a MoU with the Mali government to pay a US$60 million settlement to ‘resolve all outstanding issues.’

The company’s stock has been on a voluntary trading halt since last September as the shakedown from the incoming Mali government has halted operations; more on this later.

Wall Street: S&P 500 +0.13%, Dow flat, Nasdaq -0.10%.

Overseas: FTSE +1.22%, STOXX +1.19%, Nikkei 1.57%, SSE +0.22%.

The Aussie dollar fell -0.48% to US 65.90 cents.

US 10-year bond yields -3bps to 4.46%.

Australian 10-year bond yields -12bps to 4.26%.

Gold fell -0.48% to US$2,315.16, while Silver fell -0.78% to US$27.24.

Bitcoin fell -1.32% to US$62,360, while Ethereum fell -1.68% to US$3,014.

Oil Brent fell -0.22% to US$82.98, while WTI Crude was flat at US$78.39.

Iron ore fell -0.8% to US$118.70 a tonne.

Key Posts

-

4:58 pm — May 8, 2024

-

2:45 pm — May 8, 2024

-

2:17 pm — May 8, 2024

-

12:45 pm — May 8, 2024

-

11:11 am — May 8, 2024

-

11:02 am — May 8, 2024

-

10:06 am — May 8, 2024

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2025 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988